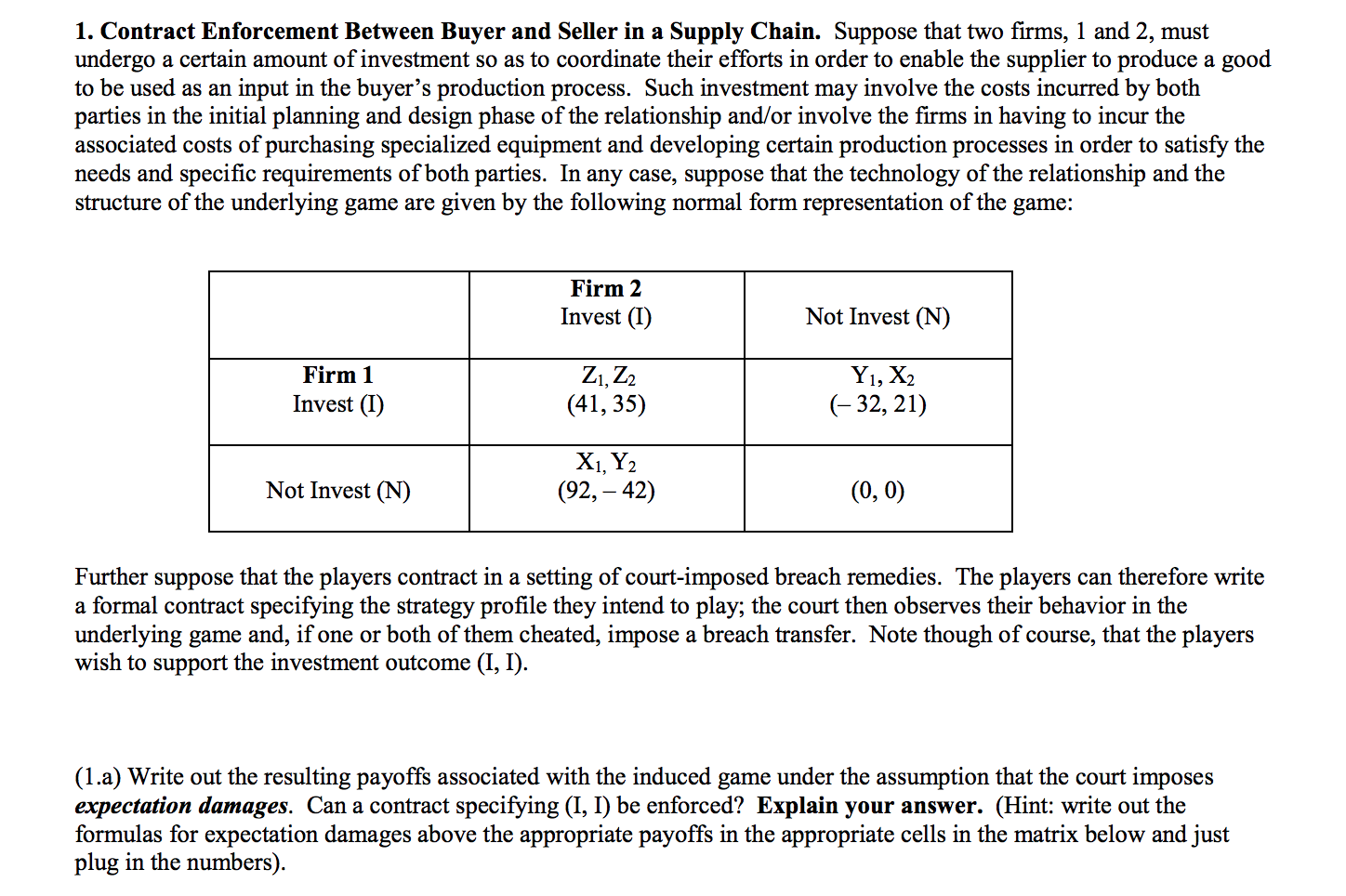

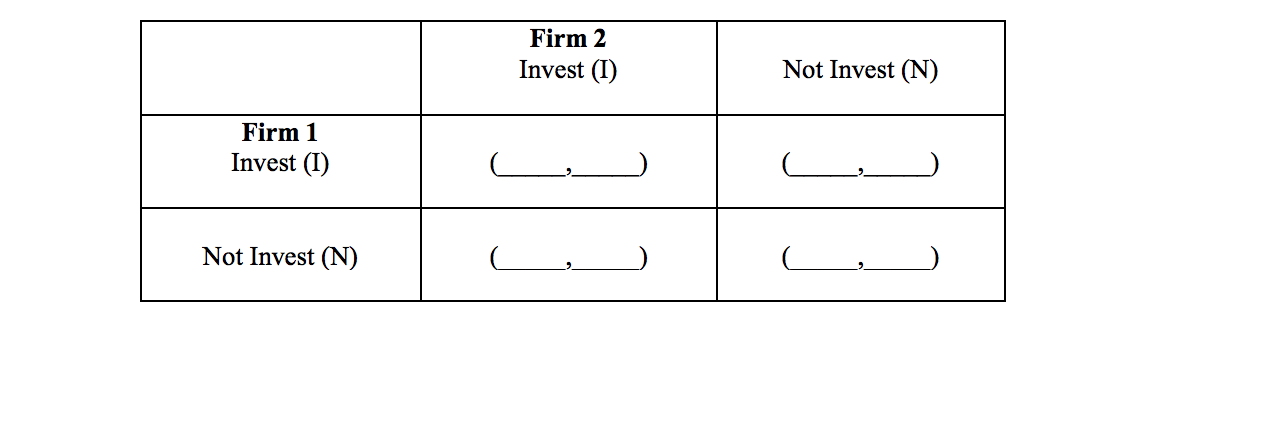

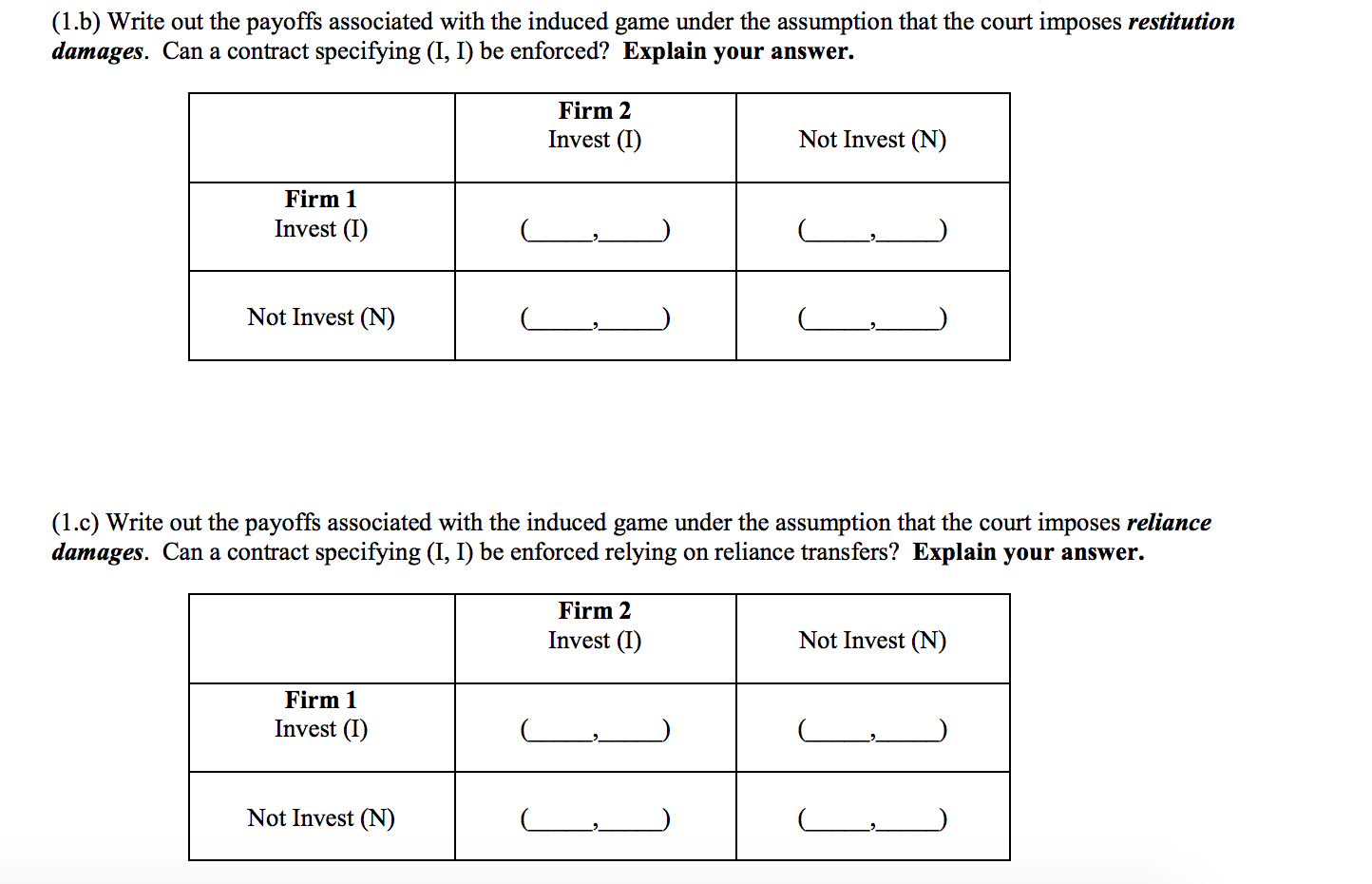

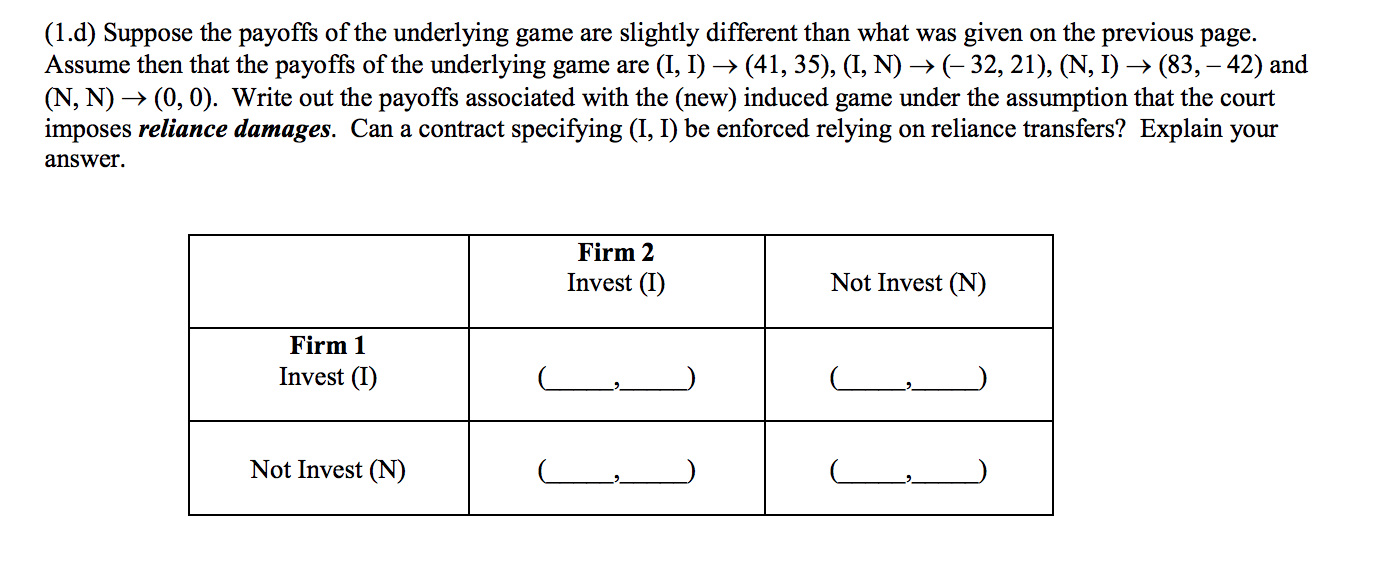

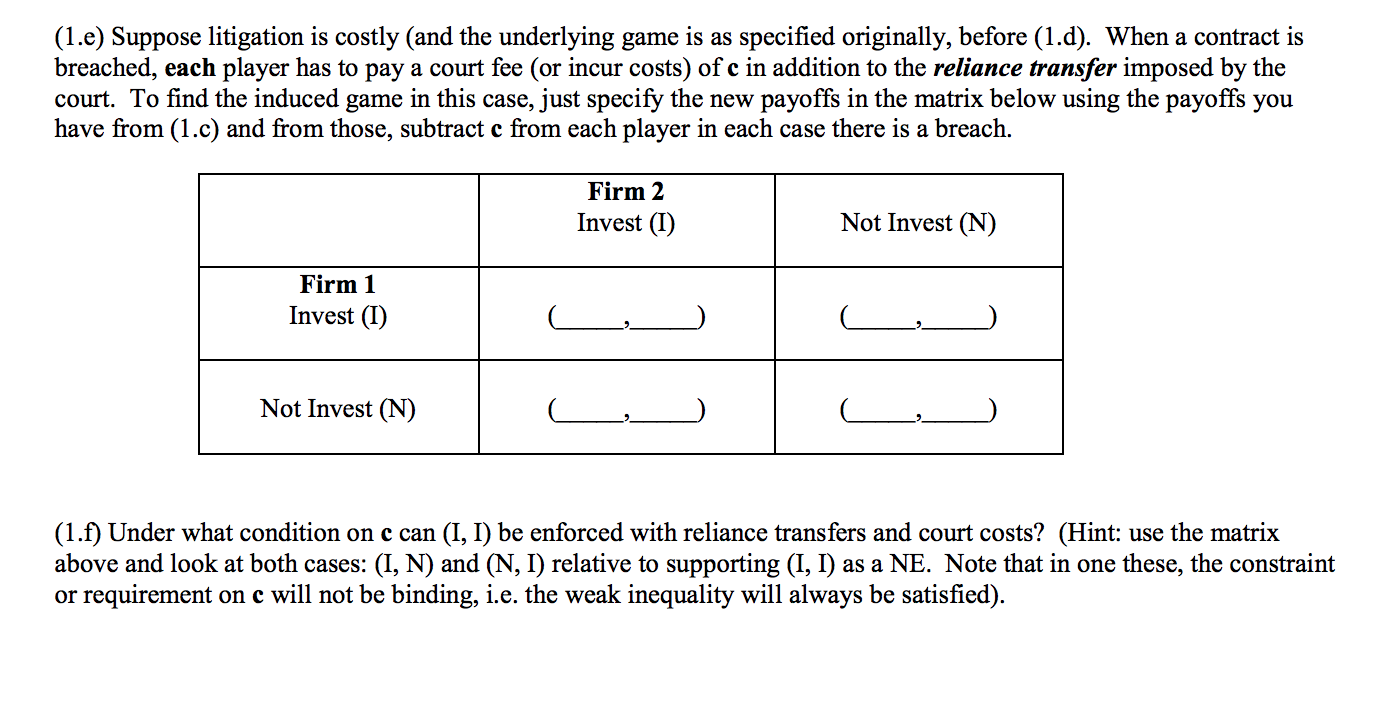

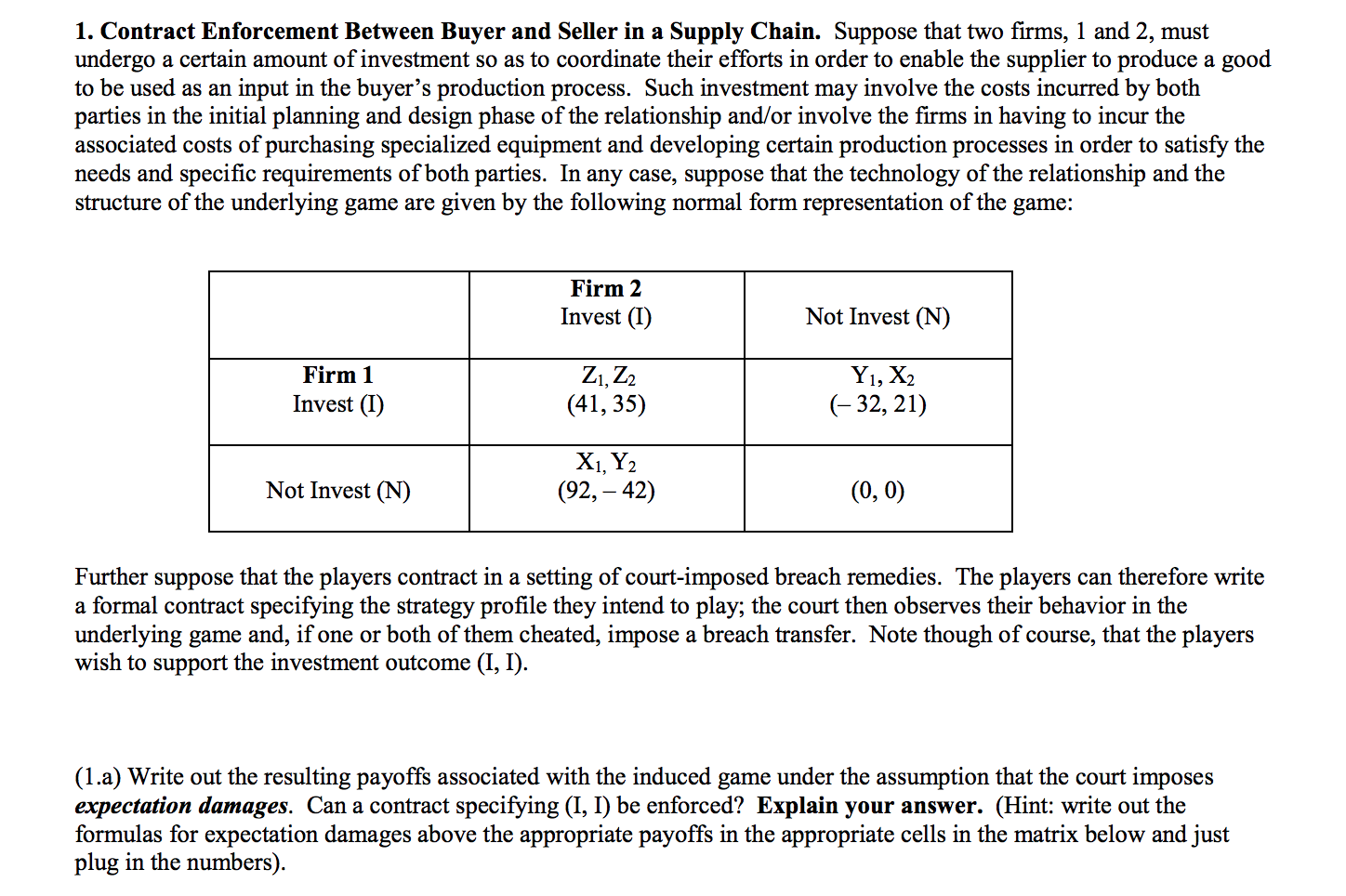

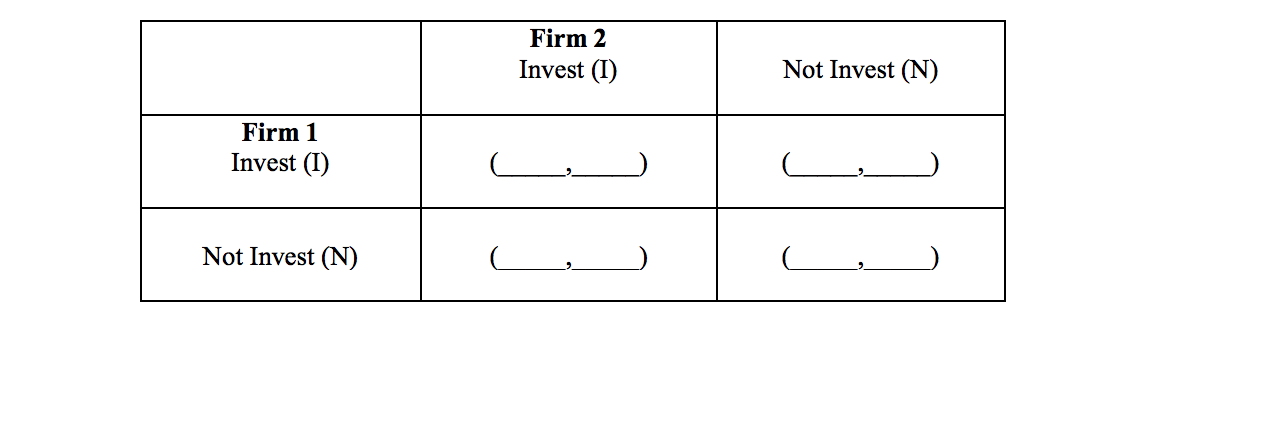

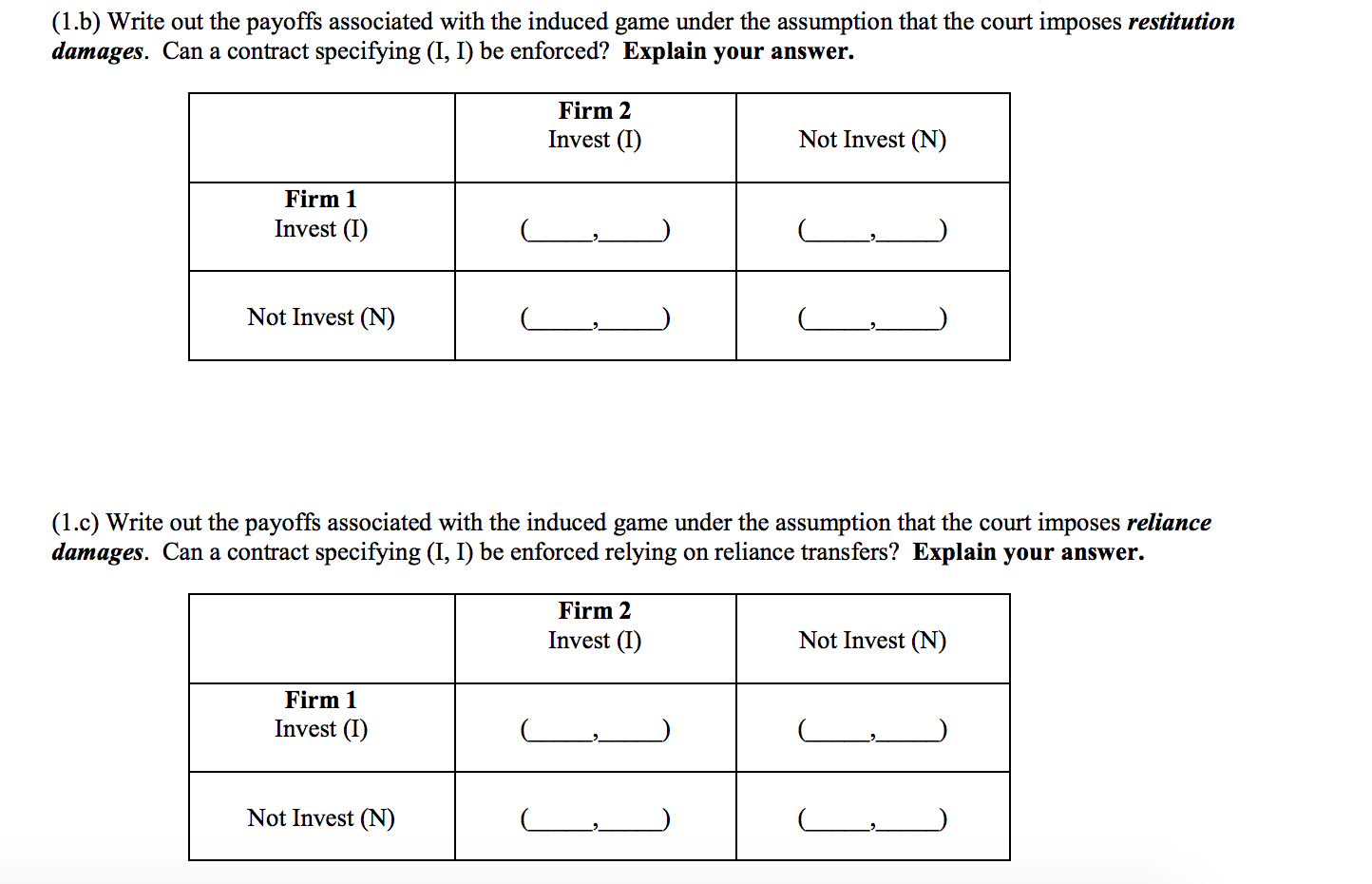

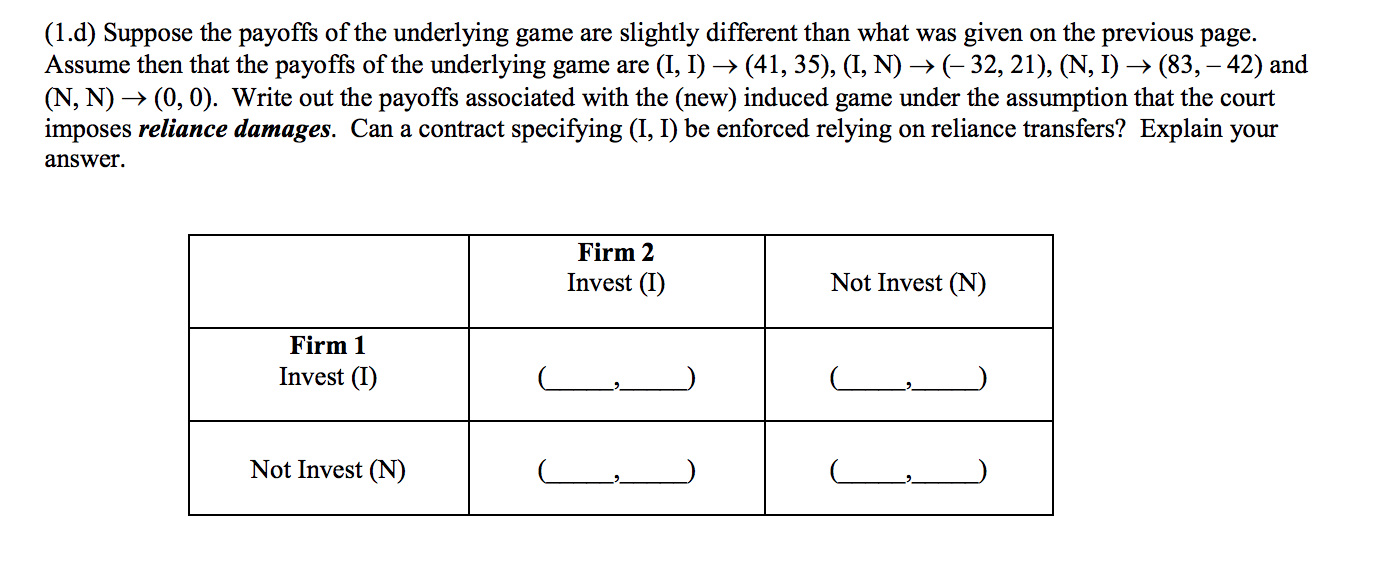

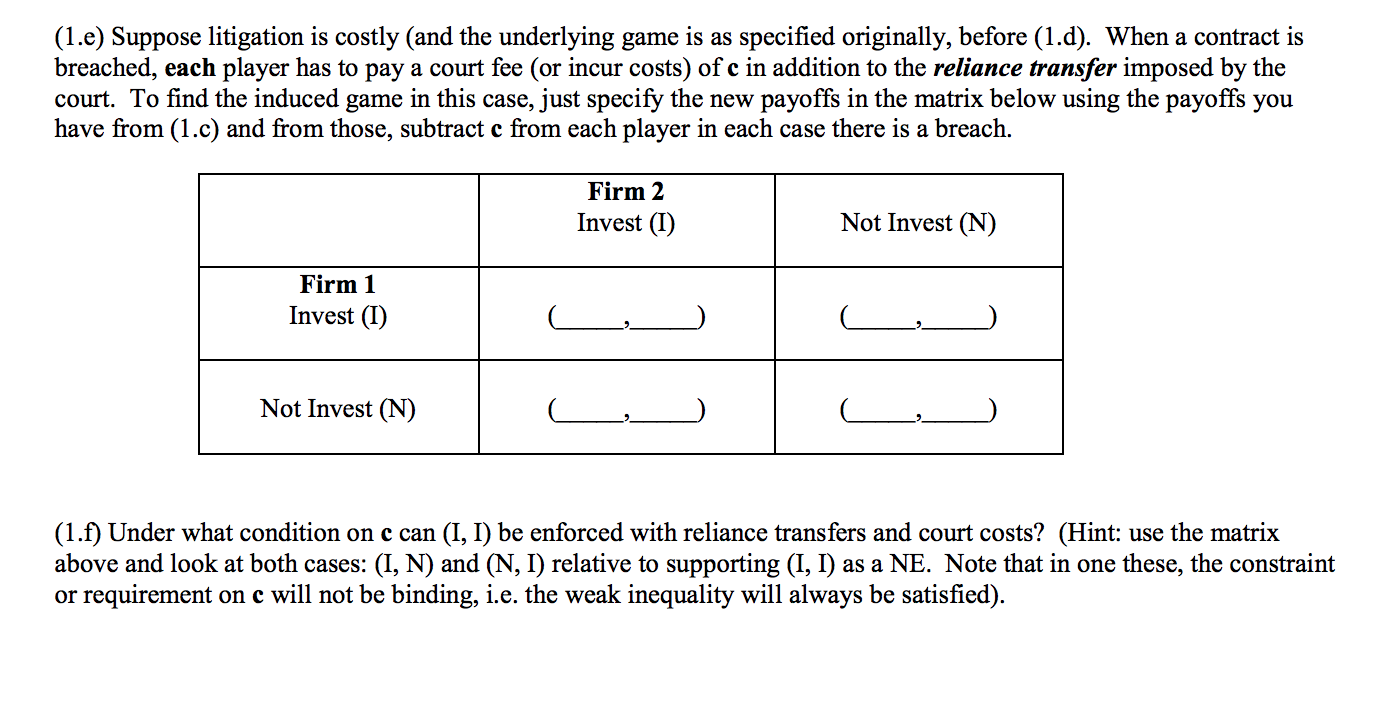

1. Contract Enforcement Between Buyer and Seller in a Supply Chain. Suppose that two firms, 1 and 2, must undergo a certain amount of investment so as to coordinate their efforts in order to enable the supplier to produce a good to be used as an input in the buyer's production process. Such investment may involve the costs incurred by both parties in the initial planning and design phase of the relationship and/or involve the firms in having to incur the associated costs of purchasing specialized equipment and developing certain production processes in order to satisfy the needs and specific requirements of both parties. In any case, suppose that the technology of the relationship and the structure of the underlying game are given by the following normal form representation of the game: Firm 2 Invest (1) Not Invest (N) Firm 1 Invest (1) Z1, Z2 (41, 35) Y1, X2 (-32, 21) Not Invest (N) X1, Y2 (92, - 42) (0,0) Further suppose that the players contract in a setting of court-imposed breach remedies. The players can therefore write a formal contract specifying the strategy profile they intend to play; the court then observes their behavior in the underlying game and, if one or both of them cheated, impose a breach transfer. Note though of course, that the players wish to support the investment outcome (I, I). (1.a) Write out the resulting payoffs associated with the induced game under the assumption that the court imposes expectation damages. Can a contract specifying (I, I) be enforced? Explain your answer. (Hint: write out the formulas for expectation damages above the appropriate payoffs in the appropriate cells in the matrix below and just plug in the numbers). Firm 2 Invest (I) Not Invest (N) Firm 1 Invest (1) Not Invest (N) (1.b) Write out the payoffs associated with the induced game under the assumption that the court imposes restitution damages. Can a contract specifying (I, I) be enforced? Explain your answer. Firm 2 Invest (I) Not Invest (N) Firm 1 Invest (I) Not Invest (N) (1.c) Write out the payoffs associated with the induced game under the assumption that the court imposes reliance damages. Can a contract specifying (I, I) be enforced relying on reliance transfers? Explain your answer. Firm 2 Invest (1) Not Invest (N) Firm 1 Invest (1) Not Invest (N) (1.d) Suppose the payoffs of the underlying game are slightly different than what was given on the previous page. Assume then that the payoffs of the underlying game are (I, I) (41, 35), (I, N) + (-32, 21), (N, I) (83,- 42) and (N, N) (0,0). Write out the payoffs associated with the (new) induced game under the assumption that the court imposes reliance damages. Can a contract specifying (I, I) be enforced relying on reliance transfers? Explain your answer. Firm 2 Invest (I) Not Invest (N) Firm 1 Invest (I) Not Invest (N) C (1.e) Suppose litigation is costly (and the underlying game is as specified originally, before (1.d). When a contract is breached, each player has to pay a court fee (or incur costs) of c in addition to the reliance transfer imposed by the court. To find the induced game in this case, just specify the new payoffs in the matrix below using the payoffs you have from (1.c) and from those, subtract c from each player in each case there is a breach. Firm 2 Invest (I) Not Invest (N) Firm 1 Invest (I) C Not Invest (N) (1.f) Under what condition on c can (I, I) be enforced with reliance transfers and court costs? (Hint: use the matrix above and look at both cases: (I, N) and (N, I) relative to supporting (I, I) as a NE. Note that in one these, the constraint or requirement on c will not be binding, i.e. the weak inequality will always be satisfied). 1. Contract Enforcement Between Buyer and Seller in a Supply Chain. Suppose that two firms, 1 and 2, must undergo a certain amount of investment so as to coordinate their efforts in order to enable the supplier to produce a good to be used as an input in the buyer's production process. Such investment may involve the costs incurred by both parties in the initial planning and design phase of the relationship and/or involve the firms in having to incur the associated costs of purchasing specialized equipment and developing certain production processes in order to satisfy the needs and specific requirements of both parties. In any case, suppose that the technology of the relationship and the structure of the underlying game are given by the following normal form representation of the game: Firm 2 Invest (1) Not Invest (N) Firm 1 Invest (1) Z1, Z2 (41, 35) Y1, X2 (-32, 21) Not Invest (N) X1, Y2 (92, - 42) (0,0) Further suppose that the players contract in a setting of court-imposed breach remedies. The players can therefore write a formal contract specifying the strategy profile they intend to play; the court then observes their behavior in the underlying game and, if one or both of them cheated, impose a breach transfer. Note though of course, that the players wish to support the investment outcome (I, I). (1.a) Write out the resulting payoffs associated with the induced game under the assumption that the court imposes expectation damages. Can a contract specifying (I, I) be enforced? Explain your answer. (Hint: write out the formulas for expectation damages above the appropriate payoffs in the appropriate cells in the matrix below and just plug in the numbers). Firm 2 Invest (I) Not Invest (N) Firm 1 Invest (1) Not Invest (N) (1.b) Write out the payoffs associated with the induced game under the assumption that the court imposes restitution damages. Can a contract specifying (I, I) be enforced? Explain your answer. Firm 2 Invest (I) Not Invest (N) Firm 1 Invest (I) Not Invest (N) (1.c) Write out the payoffs associated with the induced game under the assumption that the court imposes reliance damages. Can a contract specifying (I, I) be enforced relying on reliance transfers? Explain your answer. Firm 2 Invest (1) Not Invest (N) Firm 1 Invest (1) Not Invest (N) (1.d) Suppose the payoffs of the underlying game are slightly different than what was given on the previous page. Assume then that the payoffs of the underlying game are (I, I) (41, 35), (I, N) + (-32, 21), (N, I) (83,- 42) and (N, N) (0,0). Write out the payoffs associated with the (new) induced game under the assumption that the court imposes reliance damages. Can a contract specifying (I, I) be enforced relying on reliance transfers? Explain your answer. Firm 2 Invest (I) Not Invest (N) Firm 1 Invest (I) Not Invest (N) C (1.e) Suppose litigation is costly (and the underlying game is as specified originally, before (1.d). When a contract is breached, each player has to pay a court fee (or incur costs) of c in addition to the reliance transfer imposed by the court. To find the induced game in this case, just specify the new payoffs in the matrix below using the payoffs you have from (1.c) and from those, subtract c from each player in each case there is a breach. Firm 2 Invest (I) Not Invest (N) Firm 1 Invest (I) C Not Invest (N) (1.f) Under what condition on c can (I, I) be enforced with reliance transfers and court costs? (Hint: use the matrix above and look at both cases: (I, N) and (N, I) relative to supporting (I, I) as a NE. Note that in one these, the constraint or requirement on c will not be binding, i.e. the weak inequality will always be satisfied)