Answered step by step

Verified Expert Solution

Question

1 Approved Answer

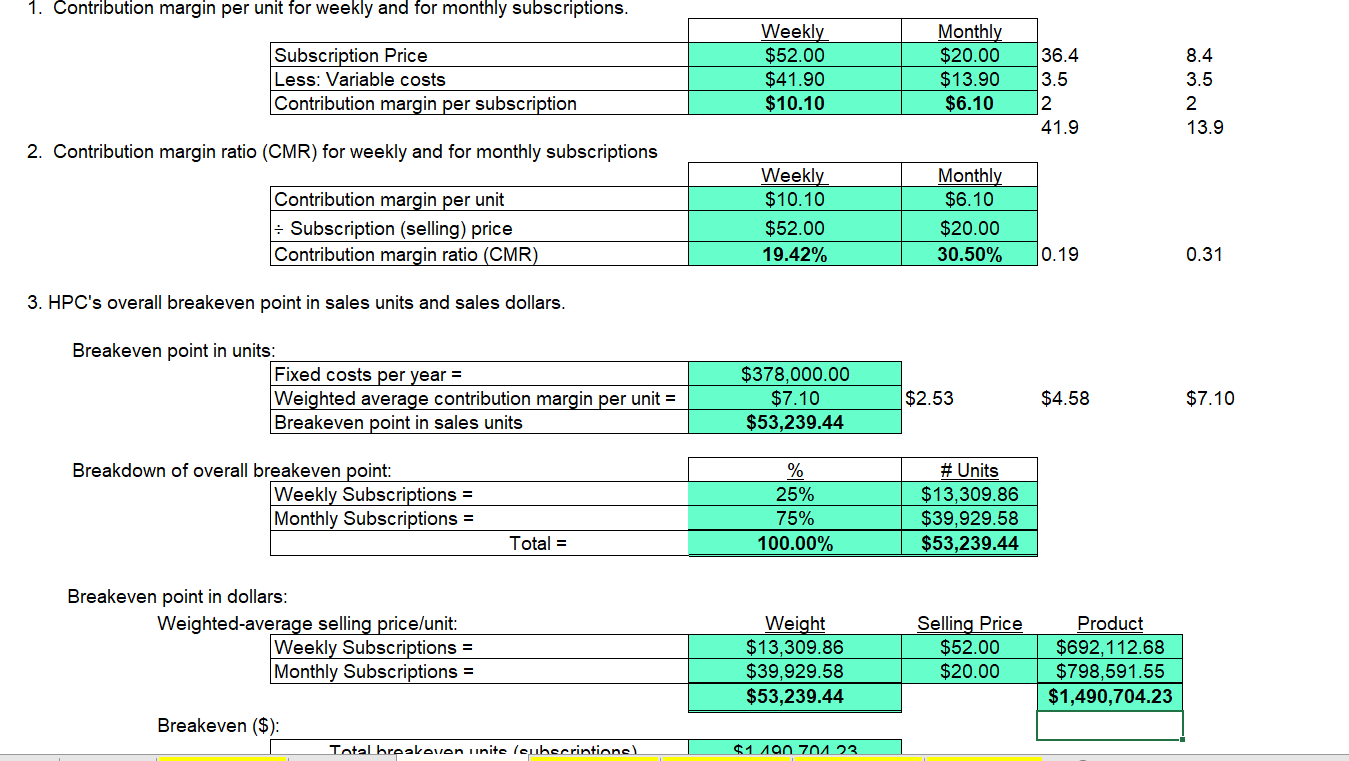

1. Contribution margin per unit for weekly and for monthly subscriptions. Subscription Price Less: Variable costs Contribution margin per subscription 2. Contribution margin ratio

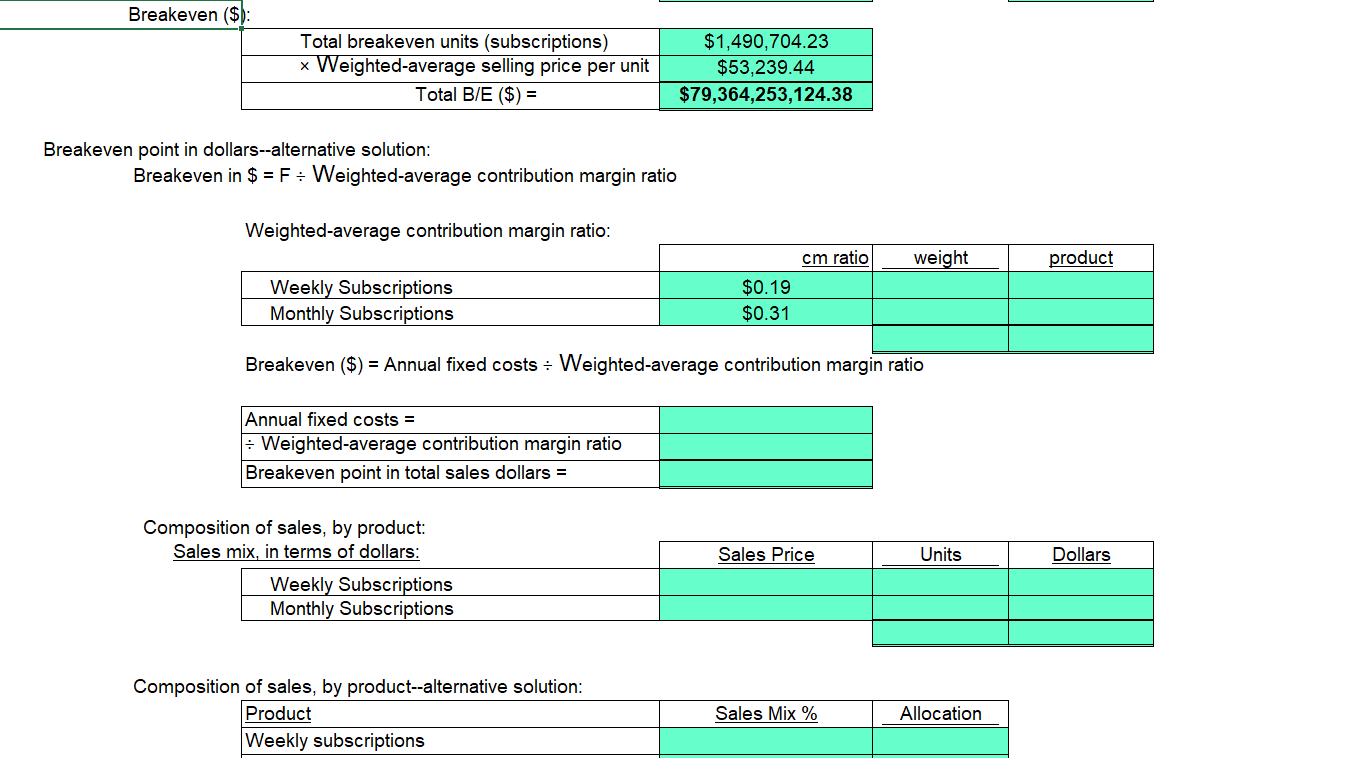

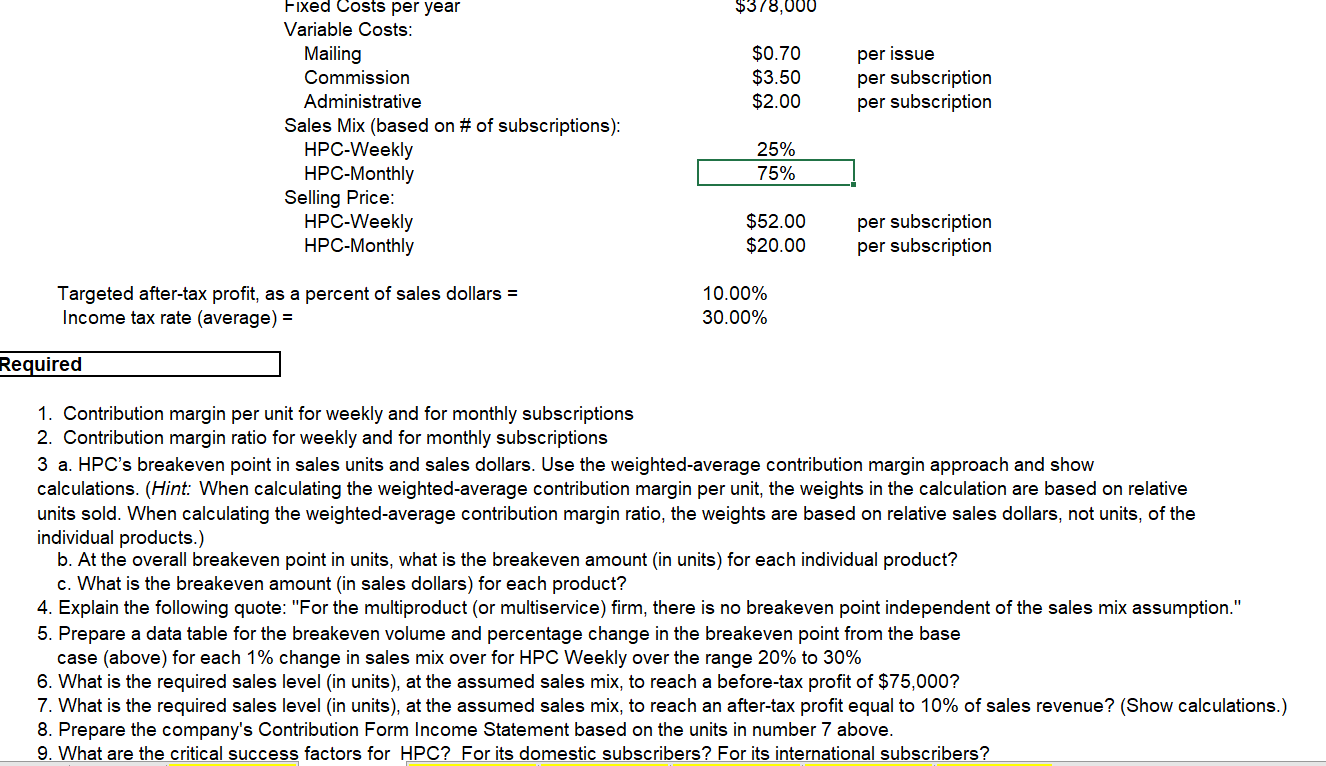

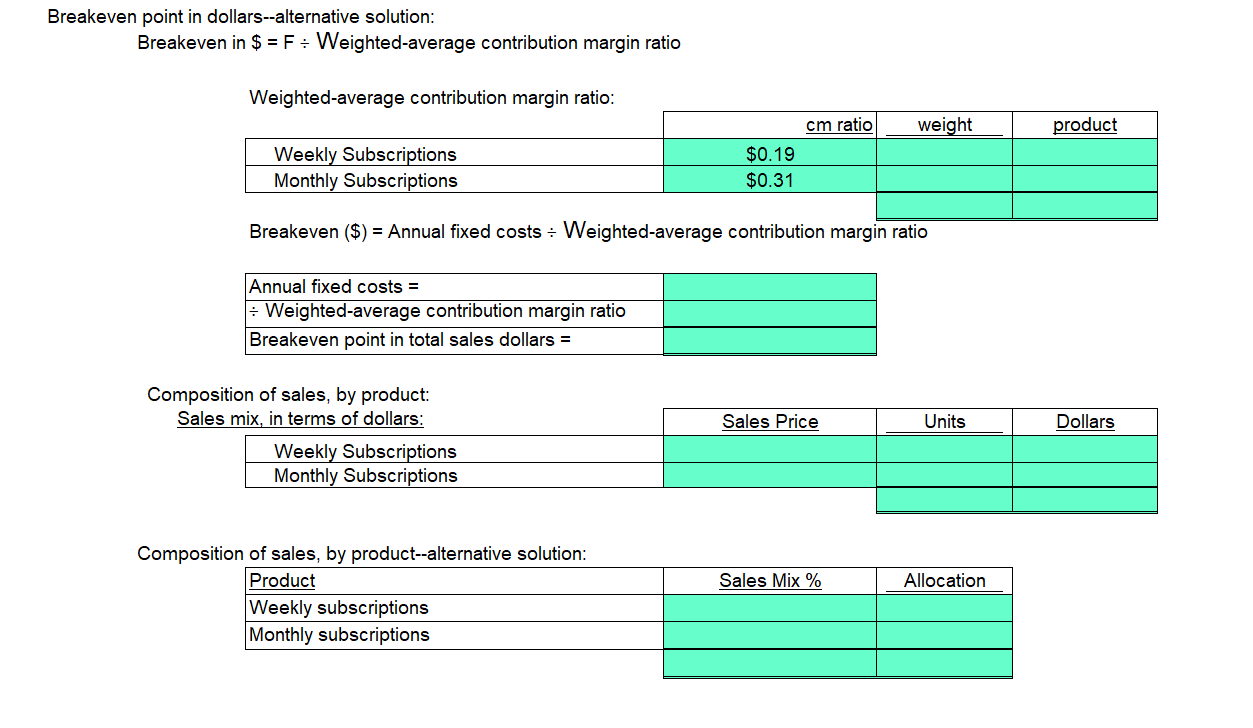

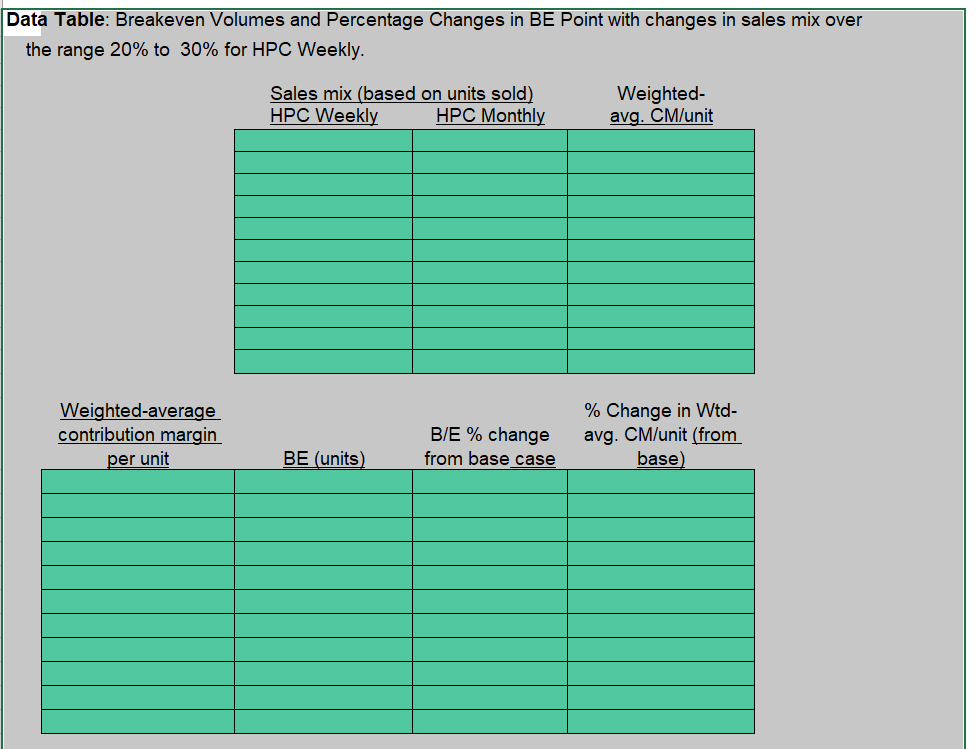

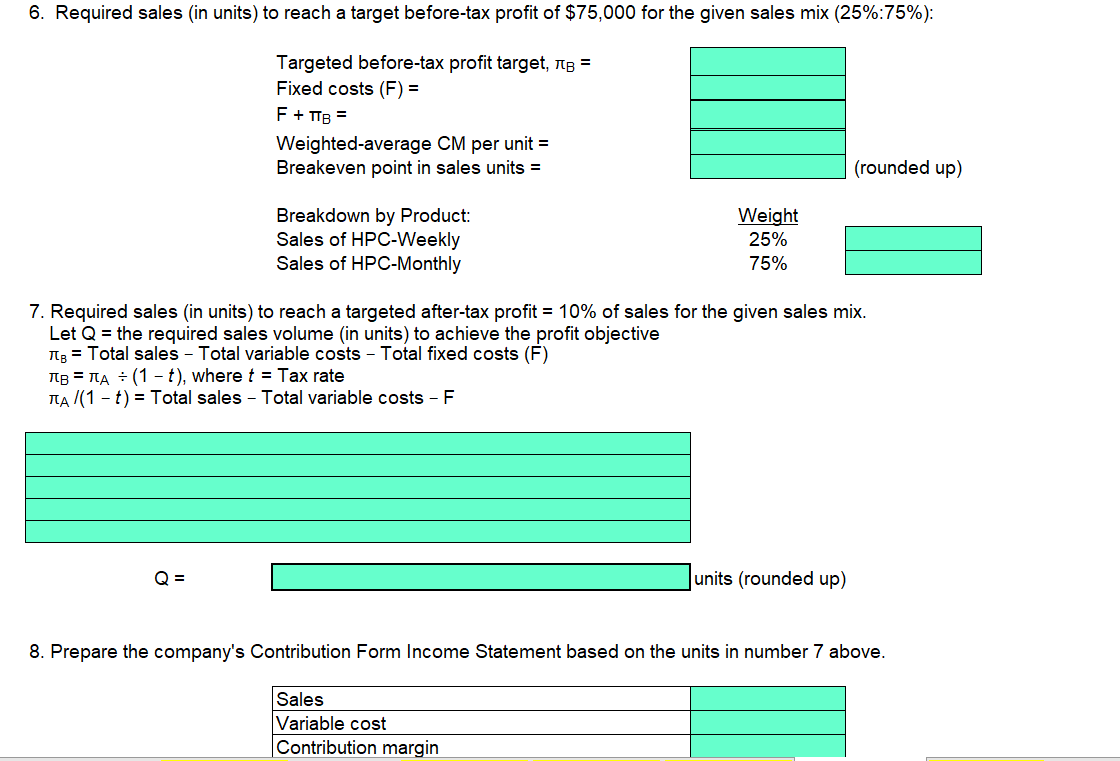

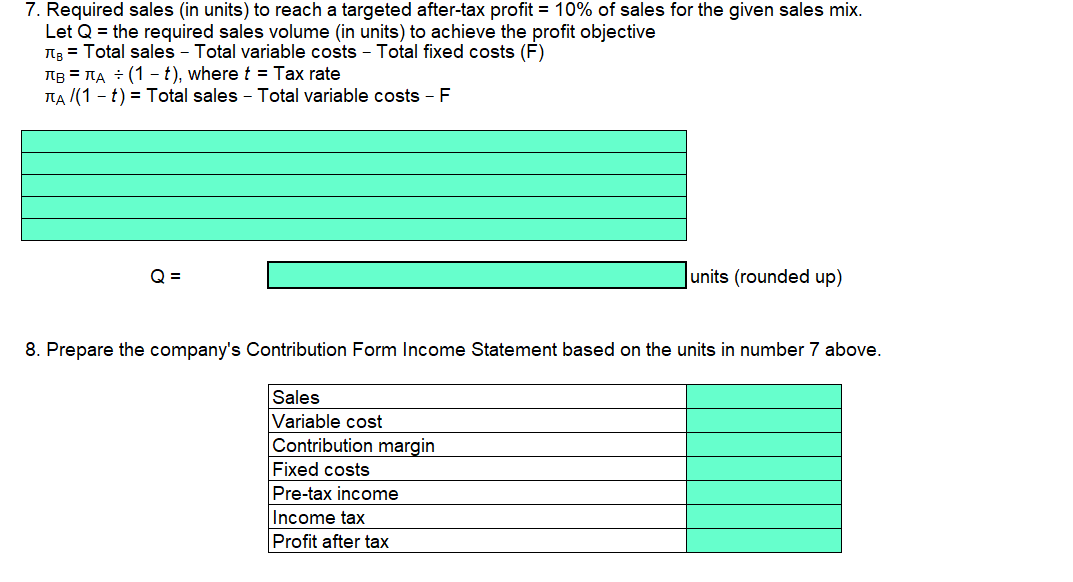

1. Contribution margin per unit for weekly and for monthly subscriptions. Subscription Price Less: Variable costs Contribution margin per subscription 2. Contribution margin ratio (CMR) for weekly and for monthly subscriptions Contribution margin per unit Subscription (selling) price Contribution margin ratio (CMR) 3. HPC's overall breakeven point in sales units and sales dollars. Weekly Monthly $52.00 $20.00 36.4 8.4 $41.90 $13.90 3.5 3.5 $10.10 $6.10 2 2 41.9 13.9 Weekly Monthly $10.10 $6.10 $52.00 $20.00 19.42% 30.50% 0.19 0.31 Breakeven point in units: Fixed costs per year = Weighted average contribution margin per unit Breakeven point in sales units $378,000.00 $7.10 $53,239.44 $2.53 $4.58 $7.10 Breakdown of overall breakeven point: % # Units Weekly Subscriptions Monthly Subscriptions= 25% $13,309.86 75% $39.929.58 Total = 100.00% $53,239.44 Breakeven point in dollars: Weighted-average selling price/unit: Weekly Subscriptions = Monthly Subscriptions= Breakeven ($): Total breakeven unite (subscrintions) Weight $13,309.86 $39,929.58 $53,239.44 Selling Price $52.00 $20.00 Product $692,112.68 $798,591.55 $1,490,704.23 $1 190 701.23. Breakeven ($): Total breakeven units (subscriptions) x Weighted-average selling price per unit Total B/E ($) = Breakeven point in dollars--alternative solution: Breakeven in $ = F + Weighted-average contribution margin ratio Weighted-average contribution margin ratio: $1,490,704.23 $53.239.44 $79,364,253,124.38 Weekly Subscriptions Monthly Subscriptions cm ratio weight product $0.19 $0.31 Breakeven ($) Annual fixed costs Weighted-average contribution margin ratio Annual fixed costs = + Weighted-average contribution margin ratio Breakeven point in total sales dollars = Composition of sales, by product: Sales mix, in terms of dollars: Weekly Subscriptions. Monthly Subscriptions Composition of sales, by product--alternative solution: Product Weekly subscriptions Sales Price Units Dollars Sales Mix % Allocation Fixed Costs per year Variable Costs: 378,000 Mailing $0.70 per issue Commission $3.50 per subscription Administrative $2.00 per subscription Sales Mix (based on # of subscriptions): HPC-Weekly 25% HPC-Monthly 75% Selling Price: HPC-Weekly $52.00 per subscription HPC-Monthly $20.00 per subscription Targeted after-tax profit, as a percent of sales dollars = Income tax rate (average) = 10.00% 30.00% Required 1. Contribution margin per unit for weekly and for monthly subscriptions 2. Contribution margin ratio for weekly and for monthly subscriptions 3 a. HPC's breakeven point in sales units and sales dollars. Use the weighted-average contribution margin approach and show calculations. (Hint: When calculating the weighted-average contribution margin per unit, the weights in the calculation are based on relative units sold. When calculating the weighted-average contribution margin ratio, the weights are based on relative sales dollars, not units, of the individual products.) b. At the overall breakeven point in units, what is the breakeven amount (in units) for each individual product? c. What is the breakeven amount (in sales dollars) for each product? 4. Explain the following quote: "For the multiproduct (or multiservice) firm, there is no breakeven point independent of the sales mix assumption." 5. Prepare a data table for the breakeven volume and percentage change in the breakeven point from the base case (above) for each 1% change in sales mix over for HPC Weekly over the range 20% to 30% 6. What is the required sales level (in units), at the assumed sales mix, to reach a before-tax profit of $75,000? 7. What is the required sales level (in units), at the assumed sales mix, to reach an after-tax profit equal to 10% of sales revenue? (Show calculations.) 8. Prepare the company's Contribution Form Income Statement based on the units in number 7 above. 9. What are the critical success factors for HPC? For its domestic subscribers? For its international subscribers? Breakeven point in dollars--alternative solution: Breakeven in $ F+ Weighted-average contribution margin ratio Weighted-average contribution margin ratio: Weekly Subscriptions Monthly Subscriptions cm ratio weight product $0.19 $0.31 Breakeven ($) = Annual fixed costs + Weighted-average contribution margin ratio Annual fixed costs = + Weighted-average contribution margin ratio Breakeven point in total sales dollars Composition of sales, by product: Sales mix, in terms of dollars: Weekly Subscriptions Monthly Subscriptions Composition of sales, by product--alternative solution: Product Weekly subscriptions Monthly subscriptions Sales Price Units Dollars Sales Mix % Allocation Requirement 4 Data Table: Breakeven Volumes and Percentage Changes in BE Point with changes in sales mix over the range 20% to 30% for HPC Weekly. Sales mix (based on units sold) HPC Weekly HPC Monthly Weighted- avg. CM/unit Weighted-average contribution margin per unit BE (units) B/E % change from base case % Change in Wtd- avg. CM/unit (from base) 6. Required sales (in units) to reach a target before-tax profit of $75,000 for the given sales mix (25%:75%): Targeted before-tax profit target, = Fixed costs (F) = F + TTB = Weighted-average CM per unit = Breakeven point in sales units = Breakdown by Product: Sales of HPC-Weekly (rounded up) Weight 25% 75% Sales of HPC-Monthly 7. Required sales (in units) to reach a targeted after-tax profit = 10% of sales for the given sales mix. Let Q = the required sales volume (in units) to achieve the profit objective B = Total sales - Total variable costs - Total fixed costs (F) (1), where t = Tax rate A (1) Total sales - Total variable costs - F Q = units (rounded up) 8. Prepare the company's Contribution Form Income Statement based on the units in number 7 above. Sales Variable cost Contribution margin 7. Required sales (in units) to reach a targeted after-tax profit = 10% of sales for the given sales mix. Let Q = the required sales volume (in units) to achieve the profit objective B = Total sales - Total variable costs - Total fixed costs (F) (1 t), where t = Tax rate (1) Total sales - Total variable costs - F Q = units (rounded up) 8. Prepare the company's Contribution Form Income Statement based on the units in number 7 above. Sales Variable cost Contribution margin Fixed costs Pre-tax income Income tax Profit after tax Requirement 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started