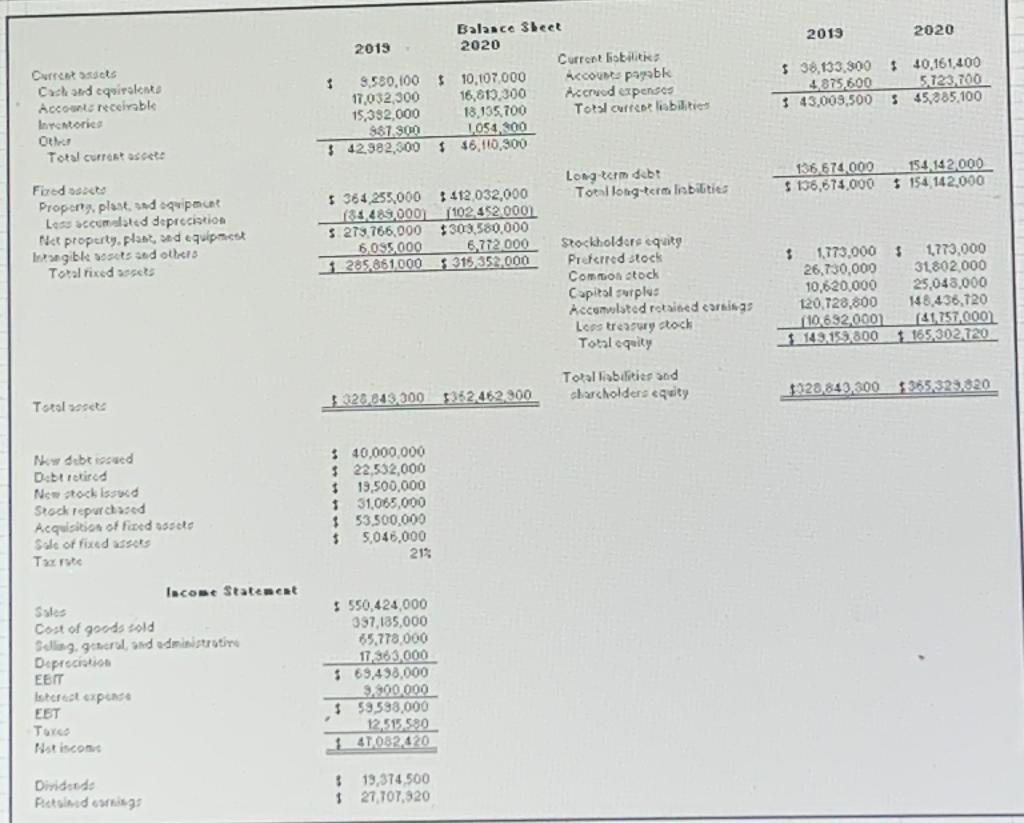

Question

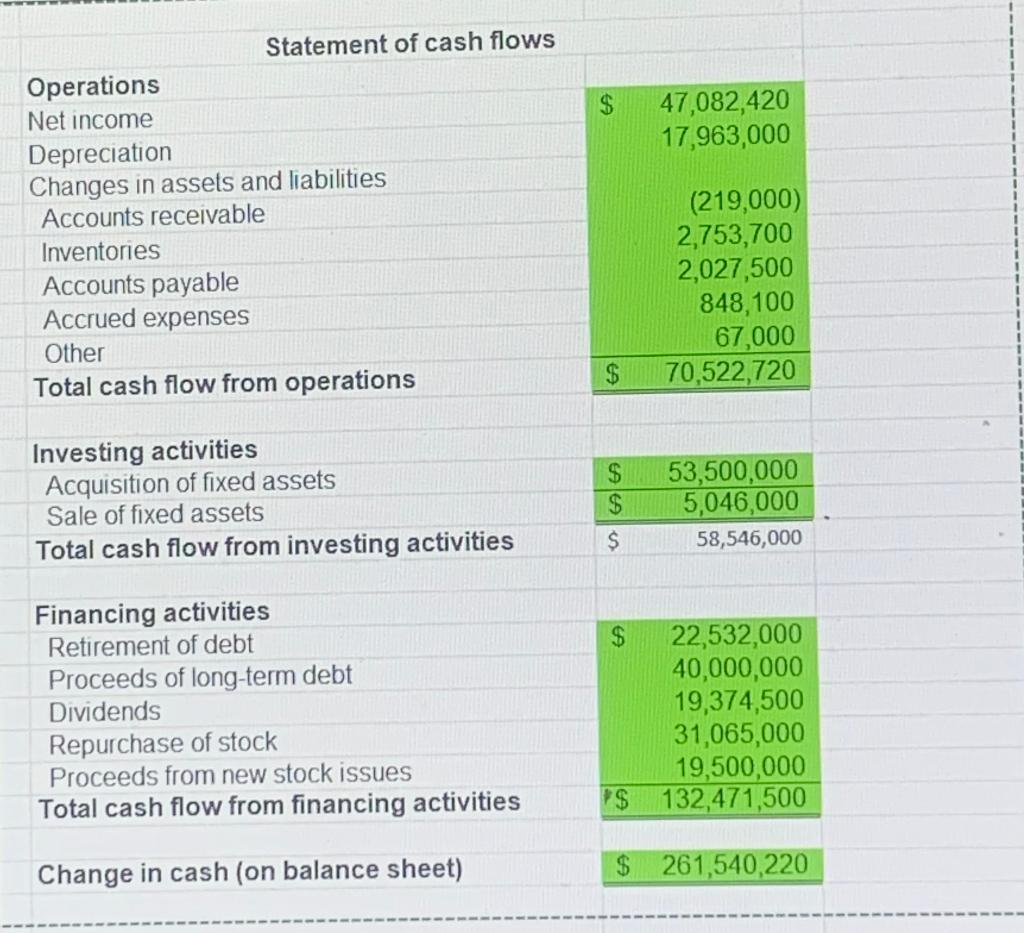

1) Correct the calculations in green as needed. 2) Reconcile your ending figure for the statement of cash flows. 3) Comment on the strengths and

1) Correct the calculations in green as needed.

2) Reconcile your ending figure for the statement of cash flows.

3) Comment on the strengths and weaknesses of the company's cash flow situation. Include in this discussion a comparison of the Statement of Cash Flows and the other cash flow calculations. Mainly, do the two sets of cash flow calculations lead to the same conclusion regarding the company's cash flow situation? Why or why not? Which set of cash flows is more important to the value of the company? Why?

4) Based on your findings, would you recommend the company pursue a planned expansion? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started