Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 Cost Analysis of Job - Order Sheets Completing this activity will help you learn to: 2 1 . build calculations to find cumulative costs

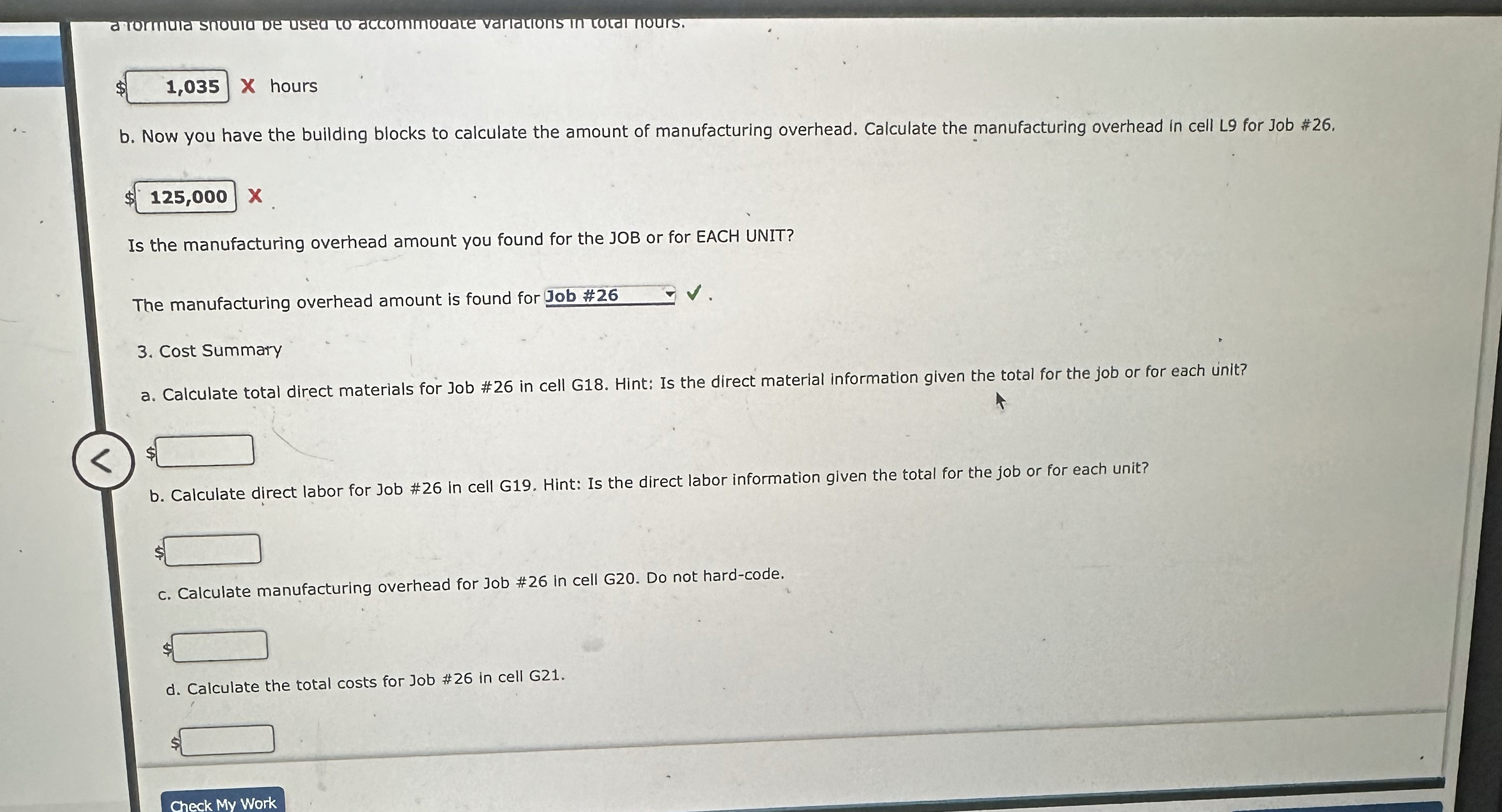

Cost Analysis of JobOrder Sheets Completing this activity will help you learn to: build calculations to find cumulative costs and unit costs for a manufacturing job understand and utilize a manufacturing overhead rate understand what variable the direct labor, direct materials and manufacturing overhead costs depend on hours units, etc. reflect and utilize the helpful information you created in the joborder sheet.Case scenario: You are working at a manufacturing plant. You do not have the specific identification of the good sold. You are given the building blocks of cost labor materials, etc. for Job # which your plant completed. Your company accumulates cost per job on a JobOrder Sheet. Required: Download spreadsheet JobOrderCaseDatadbbexlsxBuild a spreadsheet to calculate a manufacturing job's total cost and unit product cost. This lab uses "Job # information.HINT: STEPBYSTEP WALKTHROUGH To help you get started, the file already has a job order costs sheet populated with information. To complete the task, complete the following steps: Naming Cells: Individual cells, cell ranges, and tables can be named within Excel for formula ease. For example, the Total Material Subtotal cell E can be named "TotalMaterialSubtotal." Going forward, cells can be referenced using words instead of the Excel coordinates. Label the completed units cell G "Units." Manufacturing Overhead: Review the manufacturing overhead rate in cell K of the joborder spreadsheet and observe how the manufacturing overhead is allocated for Job #Hint: DLH stands for Direct Labor Hours a Calculate the total hours for Job # in cell J Remember, your goal is to create a reusable spreadsheet. Total labor hours should NOT be hardcoded or typed in but a formula should be used to accommodate variations in total hours.fill in the blank of $ hoursb. Now you have the building blocks to calculate the amount of manufacturing overhead. Calculate the manufacturing overhead in cell L for Job #fill in the blank of $ Is the manufacturing overhead amount you found for the JOB or for EACH UNIT?The manufacturing overhead amount is found for each unitJob # Cost Summarya. Calculate total direct materials for Job # in cell G Hint: Is the direct material information given the total for the job or for each unit?fill in the blank of $ b Calculate direct labor for Job # in cell G Hint: Is the direct labor information given the total for the job or for each unit?fill in the blank of $ c Calculate manufacturing overhead for Job # in cell G Do not hardcode.fill in the blank of $ d Calculate the total costs for Job # in cell Gfill in the blank of $ e Calculate the unit product cost for Job # in cell G fill in the blank of $ Reflect on your calculation process to further understand cost concepts.a How does manufacturing overhead differ from direct materials and direct labor? Manufacturing overhead is fill in the blank of a directan indirectcost, not fill in the blank of directindirectcosts, associated with manufacturing. It requires analyzation of total fill in the blank of directindirectcosts, a rational method of allocating the cost, and a rate. This differs from direct material and labor because those costs fill in the blank of areare nottraceable outright to producing a unit.b What variables does direct labor depend onDirect labor depends on material costs.Direct labor depends on units.Direct labor depends on a variety of variables including units, hours, jobs, etc.What variables do direct materials depend onDirect materials depends on labor hours spent.Direct materials depends on units.Direct materials depends on a variety of variables including units, hours, jobs, etc.What variables does manufacturing overhead depend onManufacturing overhead depends on material costs.Manufacturing overhead depends on units.Manufacturing overhead depends on a variety of variables including units, hours, jobs, etc.c What information can you gleam from the jobcost spreadsheet? What is the most expensive part of the job? least expensive? Direct laborDirect materialsManufacturing overheadis the most expensive part of manufacturing this job. It accounts for about fill in the blank of of the job's cost. The least expensive part of this manufacturing job is direct labordirect materialsmanufacturing overhead. It is about fill in the blank of of the job's cost. Explain how job cost sheets are used to evaluate and control costs.The input in the box below will not be graded, but may be reviewed and considered by your instructor.

HINT: STEPBYSTEP WALKTHROUGH

To help you get started, the file already has a job order costs sheet populated with information. To complete the task, complete the following steps:

Naming Cells: Individual cells, cell ranges, and tables can be named within Excel for formula ease. For example, the Total Mate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started