A partnership begins its first year of operations with the following capital balances: Allegan, Capital Berrien, Capital $ 50,000 40,000 50,000 Kent, Capital According

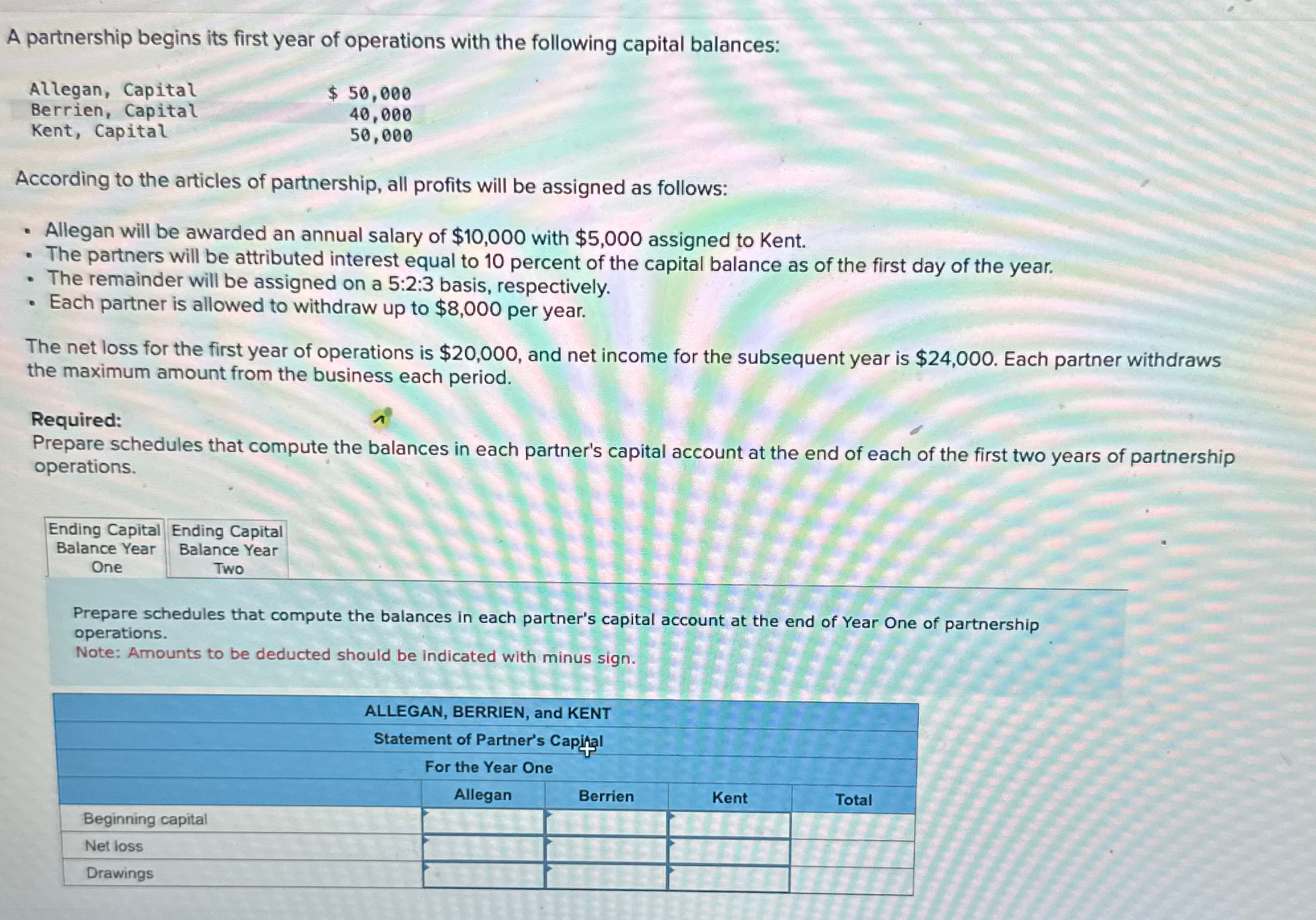

A partnership begins its first year of operations with the following capital balances: Allegan, Capital Berrien, Capital $ 50,000 40,000 50,000 Kent, Capital According to the articles of partnership, all profits will be assigned as follows: B Allegan will be awarded an annual salary of $10,000 with $5,000 assigned to Kent. The partners will be attributed interest equal to 10 percent of the capital balance as of the first day of the year. The remainder will be assigned on a 5:2:3 basis, respectively. Each partner is allowed to withdraw up to $8,000 per year. The net loss for the first year of operations is $20,000, and net income for the subsequent year is $24,000. Each partner withdraws the maximum amount from the business each period. Required: Prepare schedules that compute the balances in each partner's capital account at the end of each of the first two years of partnership operations. Ending Capital Ending Capital Balance Year One Balance Year Two Prepare schedules that compute the balances in each partner's capital account at the end of Year One of partnership operations. Note: Amounts to be deducted should be indicated with minus sign. ALLEGAN, BERRIEN, and KENT Statement of Partner's Capital For the Year One Allegan Berrien Kent Total Beginning capital Net loss Drawings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the ending capital balances for each partner at the end of the first two years of operations in this partnership well follow the instructions given and use the specified profitsharing rules ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards