Answered step by step

Verified Expert Solution

Question

1 Approved Answer

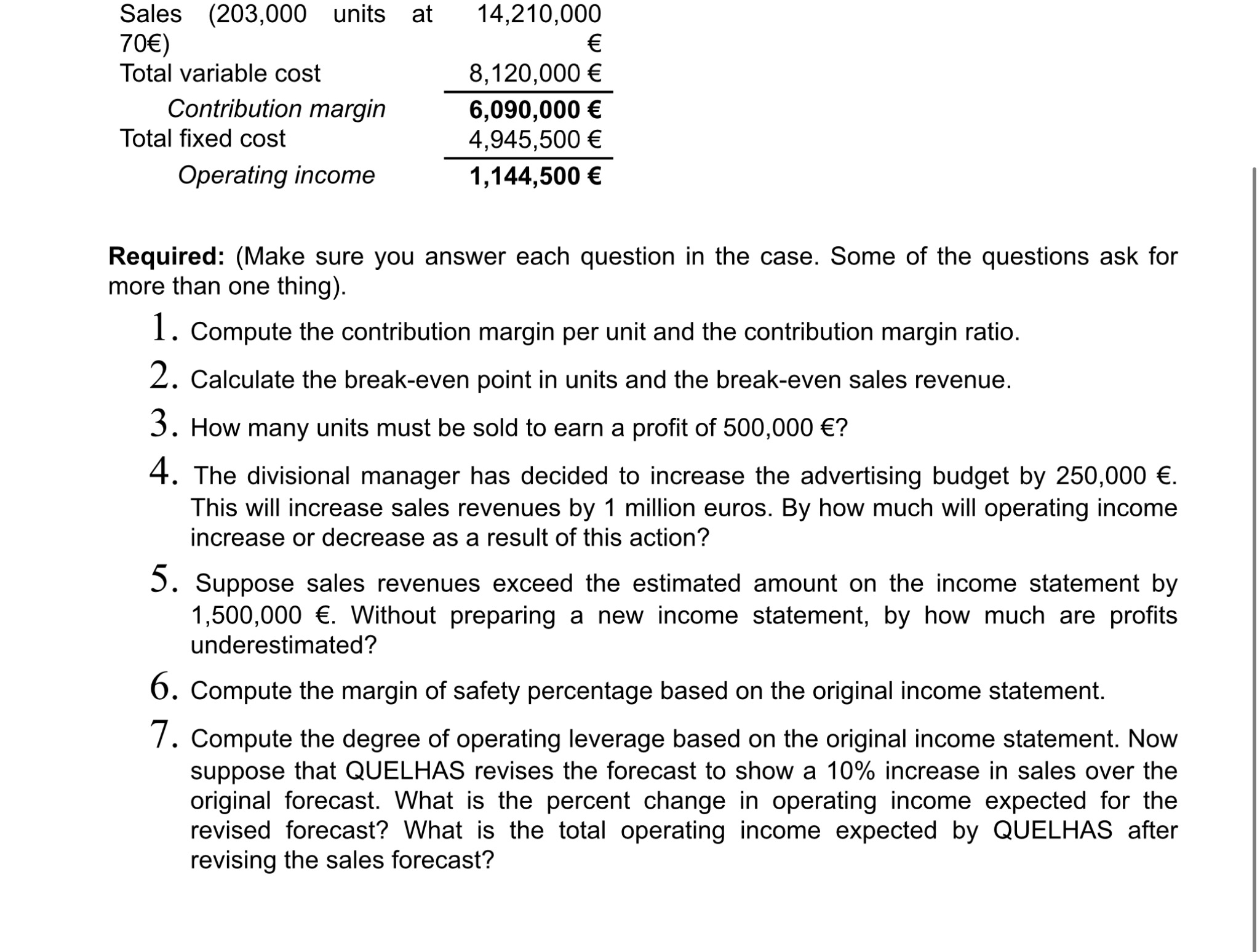

Sales (203,000 units at 14,210,000 70) Total variable cost 8,120,000 Contribution margin 6,090,000 Total fixed cost 4,945,500 Operating income 1,144,500 Required: (Make sure you

Sales (203,000 units at 14,210,000 70) Total variable cost 8,120,000 Contribution margin 6,090,000 Total fixed cost 4,945,500 Operating income 1,144,500 Required: (Make sure you answer each question in the case. Some of the questions ask for more than one thing). 1. Compute the contribution margin per unit and the contribution margin ratio. 2. Calculate the break-even point in units and the break-even sales revenue. 3. How many units must be sold to earn a profit of 500,000 ? 4. The divisional manager has decided to increase the advertising budget by 250,000 . This will increase sales revenues by 1 million euros. By how much will operating income increase or decrease as a result of this action? 5. Suppose sales revenues exceed the estimated amount on the income statement by 1,500,000 . Without preparing a new income statement, by how much are profits underestimated? 6. Compute the margin of safety percentage based on the original income statement. 7. Compute the degree of operating leverage based on the original income statement. Now suppose that QUELHAS revises the forecast to show a 10% increase in sales over the original forecast. What is the percent change in operating income expected for the revised forecast? What is the total operating income expected by QUELHAS after revising the sales forecast?

Step by Step Solution

★★★★★

3.68 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Contribution Margin per unit Contribution Margin per unit Sales Price per unit Variable Cost per unit Contribution Margin per unit 14210000 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started