Answered step by step

Verified Expert Solution

Question

1 Approved Answer

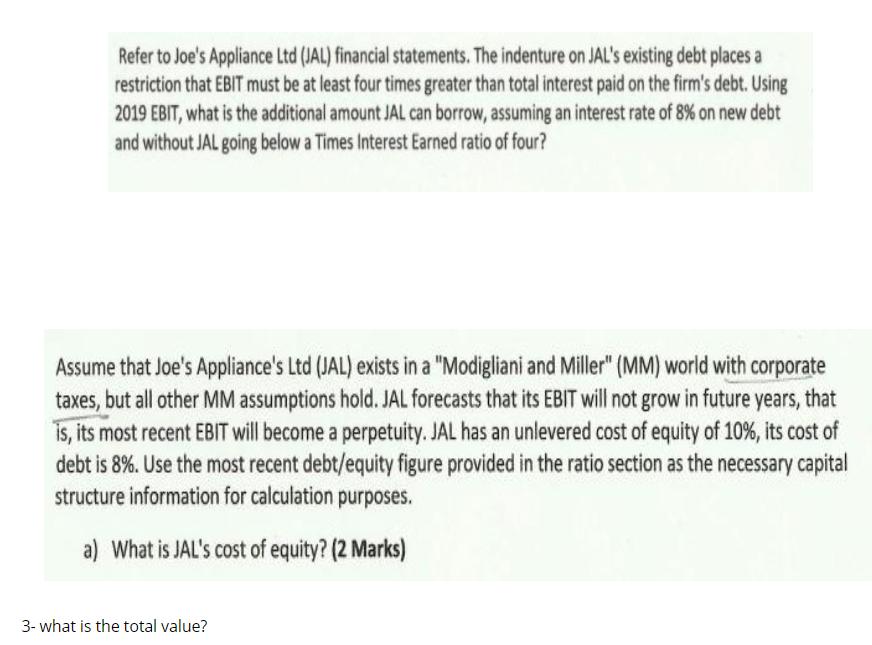

Refer to Joe's Appliance Ltd (JAL) financial statements. The indenture on JAL's existing debt places a restriction that EBIT must be at least four

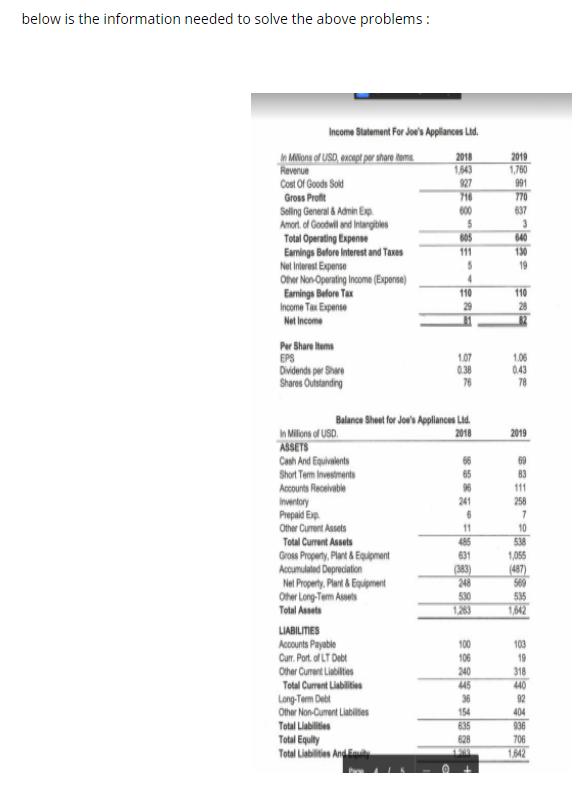

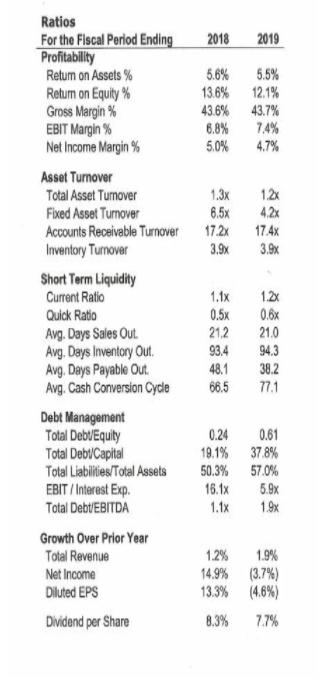

Refer to Joe's Appliance Ltd (JAL) financial statements. The indenture on JAL's existing debt places a restriction that EBIT must be at least four times greater than total interest paid on the firm's debt. Using 2019 EBIT, what is the additional amount JAL can borrow, assuming an interest rate of 8% on new debt and without JAL going below a Times Interest Earned ratio of four? Assume that Joe's Appliance's Ltd (JAL) exists in a "Modigliani and Miller" (MM) world with corporate taxes, but all other MM assumptions hold. JAL forecasts that its EBIT will not grow in future years, that is, its most recent EBIT will become a perpetuity. JAL has an unlevered cost of equity of 10%, its cost of debt is 8%. Use the most recent debt/equity figure provided in the ratio section as the necessary capital structure information for calculation purposes. a) What is JAL's cost of equity? (2 Marks) 3- what is the total value? below is the information needed to solve the above problems : Income Stutement For Joe's Applances Lid. n MNons of USD, except per thare Roms Reverue Cost Of Goods Sold Gross Profit 2018 2010 1,643 1,760 991 927 716 600 770 Seling General & Adnin Ep Amort. of Goodwil and Intargtles Total Operating Expense Eamings Bafore Interest and Taxes Net Inierest Expense Otw Non Operating Income (Exporse) Earnings Belore Tax Income Ta Expense 637 605 640 130 111 19 4. 110 110 29 28 Net Income Per Share hums EPS Divdends per Share Shares Outstandng 1.07 0.38 78 1.06 043 78 Balance Shee for Jor's Applinces Ltd. h Milons of USD. ASSETS 2018 2019 Cash And Equivalents Short Term Investments 69 83 Accourta Receivable Inventory Prepaid Exp. Other Curent Assets 96 111 241 258 11 10 Total Current Assets 485 631 538 Gross Propery, Plart & Equipnant Accumudaled Depreciation Net Property. Plart & Egipment Oher Long-Tem Ases Total Ansets (383) 248 530 1,055 (487) 569 535 1283 1,642 LIABILITIES Accounts Payabie 100 103 Cur. Port of LT Debt Other Cument Liabilties 106 240 19 318 Total Current Liabilities 445 36 440 Long-Tem Dett Other Nan-Cument Liabilles Total Liabilities 92 154 404 635 936 Total Equity Total Lisbilities Andn 828 706 1642 Ratios For the Flscal Period Ending Profitability 2018 2019 Retum on Assets % 5.6% 5.5% Retum on Equity % Gross Margin % EBIT Margin % Net Income Margin % 12.1% 43.6% 43.7% 6.8% 13.6% 7.4% 5.0% 4.7% Asset Turnover 1.2x 4,.2x Total Asset Tumover Fixed Asset Turnover Accounts Receivable Turnover Inventory Turnover 1.3x 6.5x 17.2x 17.4x 3.9x 3.9x Short Term Liquidity Current Ratio Quick Ratio 1.1x 1.2x 0.6x 21.0 Avg. Days Sales Out. Avg. Days Inventory Out. Avg. Days Payable Out. Avg. Cash Conversion Cycde 0.5x 21,2 93.4 48.1 66.5 94.3 38.2 77.1 Debt Management Total DebVEquity Total Debi/Capital Total Liabilities/Total Assets EBIT / Interest Exp. 0.61 19.1% 37.8% 0.24 50.3% 57.0% 16.1x 5.9x Total DebtEBITDA 1.1x 1.9x Growth Over Prior Year 1.9% 14.9% (3.7%) 13.3% (4.6%) Total Revenue 1.2% Net Income Diluted EPS Dividend per Share 8.3% 7.7%

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Operating expense 130 Times interest earned ratio EBIT Interest expense 59 594 19 It should not be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started