Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Country A and B each have 2000 units of labour. In Country A, one unit of labour can produce 7 kilograms of cheese

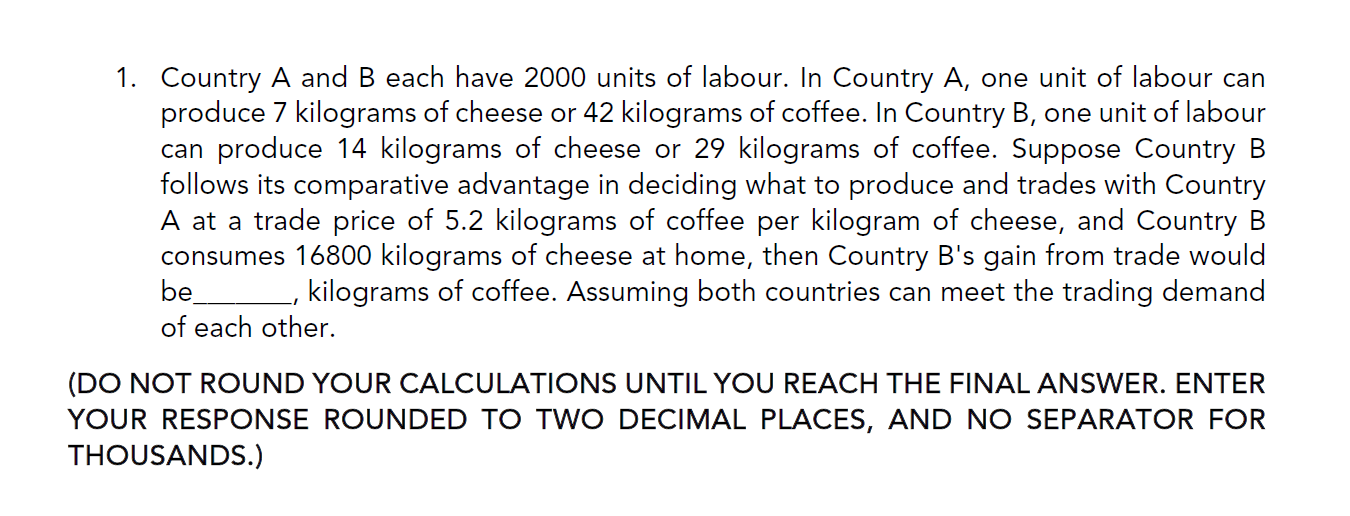

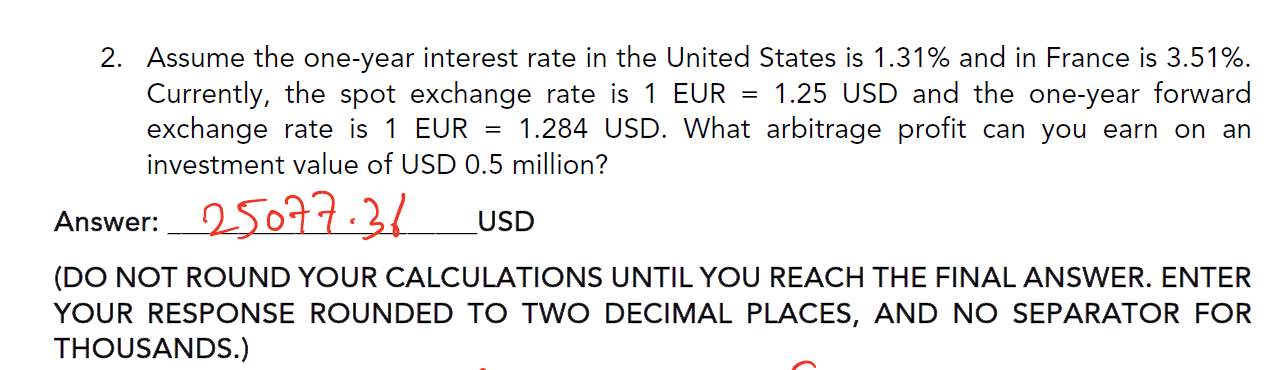

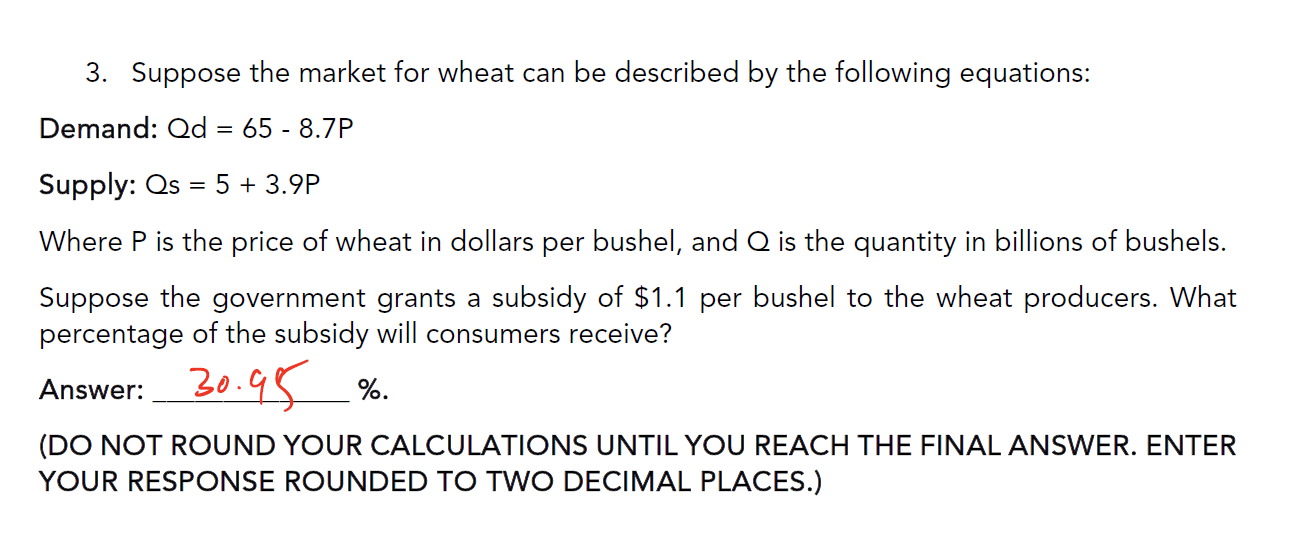

1. Country A and B each have 2000 units of labour. In Country A, one unit of labour can produce 7 kilograms of cheese or 42 kilograms of coffee. In Country B, one unit of labour can produce 14 kilograms of cheese or 29 kilograms of coffee. Suppose Country B follows its comparative advantage in deciding what to produce and trades with Country A at a trade price of 5.2 kilograms of coffee per kilogram of cheese, and Country B consumes 16800 kilograms of cheese at home, then Country B's gain from trade would be kilograms of coffee. Assuming both countries can meet the trading demand of each other. (DO NOT ROUND YOUR CALCULATIONS UNTIL YOU REACH THE FINAL ANSWER. ENTER YOUR RESPONSE ROUNDED TO TWO DECIMAL PLACES, AND NO SEPARATOR FOR THOUSANDS.) = 2. Assume the one-year interest rate in the United States is 1.31% and in France is 3.51%. Currently, the spot exchange rate is 1 EUR 1.25 USD and the one-year forward exchange rate is 1 EUR 1.284 USD. What arbitrage profit can you earn on an investment value of USD 0.5 million? Answer: 25077.31 = USD (DO NOT ROUND YOUR CALCULATIONS UNTIL YOU REACH THE FINAL ANSWER. ENTER YOUR RESPONSE ROUNDED TO TWO DECIMAL PLACES, AND NO SEPARATOR FOR THOUSANDS.) 3. Suppose the market for wheat can be described by the following equations: Demand: Qd = 65 -8.7P Supply: Qs5 + 3.9P Where P is the price of wheat in dollars per bushel, and Q is the quantity in billions of bushels. Suppose the government grants a subsidy of $1.1 per bushel to the wheat producers. What percentage of the subsidy will consumers receive? Answer: 30.95 %. (DO NOT ROUND YOUR CALCULATIONS UNTIL YOU REACH THE FINAL ANSWER. ENTER YOUR RESPONSE ROUNDED TO TWO DECIMAL PLACES.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started