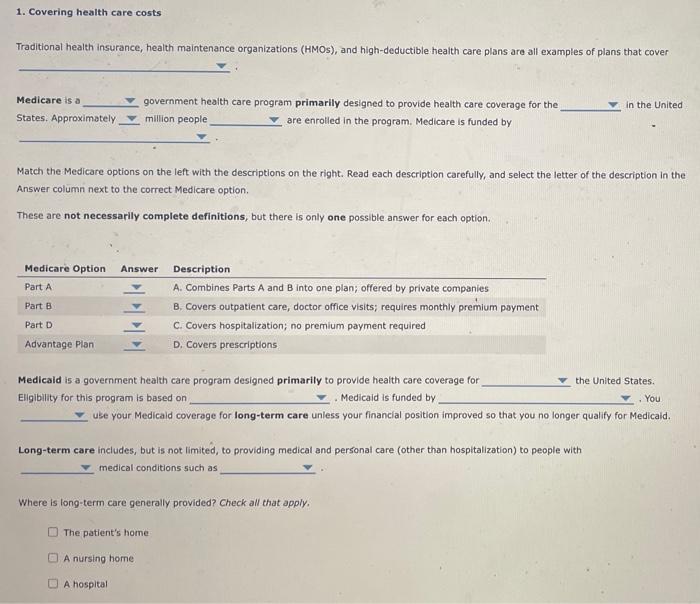

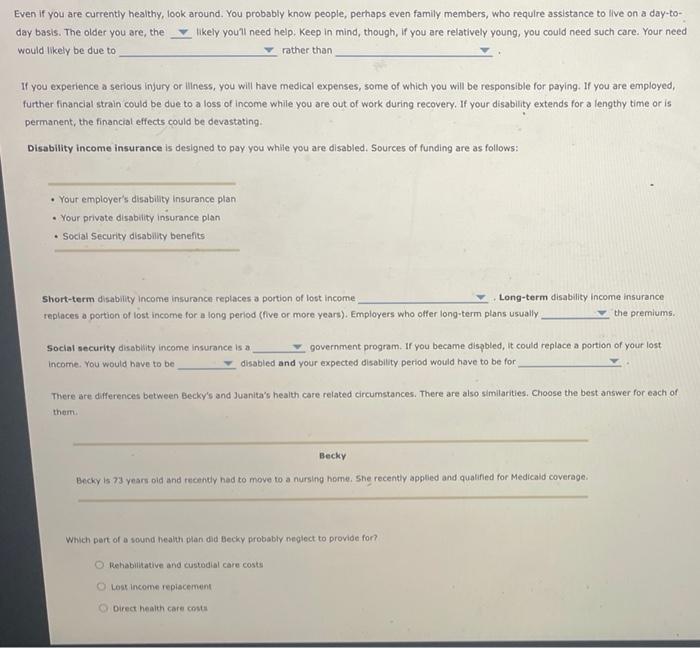

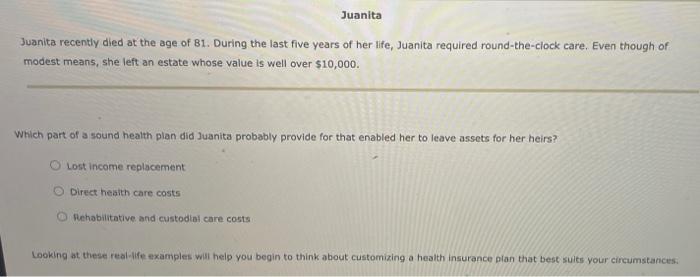

1. Covering health care costs Traditional health insurance, health maintenance organizations (HMOs), and high-deductible health care plans are all examples of plans that cover Match the Medicare options on the left with the descriptions on the right. Read each description carefully, and select the letter of the description in the Answer column next to the correct Medicare option. These are not necessarily complete definitions, but there is only one possible answer for each option. Medicald is a government health care program designed primarily to provide health care coverage for Eligibility for this program is based on use your Medicaid coverage for long-term care unless your financial position improved so that you no longer qualify for Medicaid. Long-term care includes, but is not limited, to providing medical and personal care (other than hospitalization) to people with medical conditions 5 uch as Where is long-term care generally provided? Check all that apply, The patient's home A nursing home A hospita! Even if you are currently healthy, look around. You probably know people, perhaps even family members, who require assistance to live on a day-today basis. The older you are, the likely you?l need help. Keep in mind, though, If you are relatively young, you could need such care. Your need would likely be due to rather than If you experience a serious Injury or liness, you will have medical expenses, some of which you will be responsible for paying. If you are employed, further financial strain could be due to a loss of income while you are out of work during recovery. If your disability extends for a lengthy time or is permanent, the financial effects could be devastating. Disability income insurance is designed to pay you whlle you are disabled. Sources of funding are as follows: - Your employer's disability insurance plan - Your private disabuity insurance plan - Social Security disability benefits Short-term disability income insurance-repiaces a portion of lost income teplaces a partion of lost income for a long period (flive or more years). Employers who olfer long-term plans usually Social security disablity income insurance is a disability income insurance income. You would have to be povernment program. If you became dispbled, it could reploce a portion of your lost There are differences between Becky's and Juanita's health care related circumstances. There are also similarities. Choose the best answer for each of them. Becky Becky is 73 years old and reconty had to move to a nursing home. She recently applied and quatified for Medicald coverage. Which part of a sound healuh plan did becky probably neglect to provide for? Rehabiliative and custodial care costs Losk income repiacement. Direct health care coste Juanita recently died at the age of 81 . During the last five years of her life, Juanita required round-the-clock care. Even though of modest means, she left an estate whose value is well over $10,000. Which part of a sound health plan did Juanita probably provide for that enabled her to leave assets for her heirs? Lost income replacement Direct heaith care costs Rehabilitative and custodial care costs Looking at these real-Alfe examples wisl help you begin to think about customizing a health insurance plan that best sults your circumstances. 1. Covering health care costs Traditional health insurance, health maintenance organizations (HMOs), and high-deductible health care plans are all examples of plans that cover Match the Medicare options on the left with the descriptions on the right. Read each description carefully, and select the letter of the description in the Answer column next to the correct Medicare option. These are not necessarily complete definitions, but there is only one possible answer for each option. Medicald is a government health care program designed primarily to provide health care coverage for Eligibility for this program is based on use your Medicaid coverage for long-term care unless your financial position improved so that you no longer qualify for Medicaid. Long-term care includes, but is not limited, to providing medical and personal care (other than hospitalization) to people with medical conditions 5 uch as Where is long-term care generally provided? Check all that apply, The patient's home A nursing home A hospita! Even if you are currently healthy, look around. You probably know people, perhaps even family members, who require assistance to live on a day-today basis. The older you are, the likely you?l need help. Keep in mind, though, If you are relatively young, you could need such care. Your need would likely be due to rather than If you experience a serious Injury or liness, you will have medical expenses, some of which you will be responsible for paying. If you are employed, further financial strain could be due to a loss of income while you are out of work during recovery. If your disability extends for a lengthy time or is permanent, the financial effects could be devastating. Disability income insurance is designed to pay you whlle you are disabled. Sources of funding are as follows: - Your employer's disability insurance plan - Your private disabuity insurance plan - Social Security disability benefits Short-term disability income insurance-repiaces a portion of lost income teplaces a partion of lost income for a long period (flive or more years). Employers who olfer long-term plans usually Social security disablity income insurance is a disability income insurance income. You would have to be povernment program. If you became dispbled, it could reploce a portion of your lost There are differences between Becky's and Juanita's health care related circumstances. There are also similarities. Choose the best answer for each of them. Becky Becky is 73 years old and reconty had to move to a nursing home. She recently applied and quatified for Medicald coverage. Which part of a sound healuh plan did becky probably neglect to provide for? Rehabiliative and custodial care costs Losk income repiacement. Direct health care coste Juanita recently died at the age of 81 . During the last five years of her life, Juanita required round-the-clock care. Even though of modest means, she left an estate whose value is well over $10,000. Which part of a sound health plan did Juanita probably provide for that enabled her to leave assets for her heirs? Lost income replacement Direct heaith care costs Rehabilitative and custodial care costs Looking at these real-Alfe examples wisl help you begin to think about customizing a health insurance plan that best sults your circumstances