Answered step by step

Verified Expert Solution

Question

1 Approved Answer

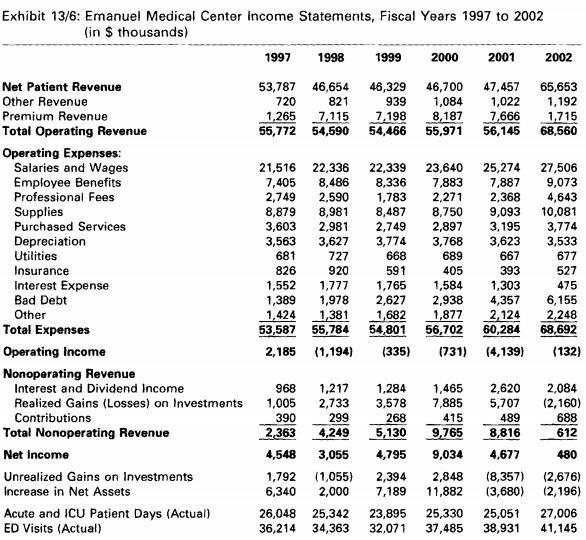

1. Create a common size income statement trend using those given in the EMC case above. a. Analyze and report the findings b. Is your

1. Create a common size income statement trend using those given in the EMC case above.

a. Analyze and report the findings

b. Is your strategy the same or different having seen the results? Why?

Exhibit 13/6: Emanuel Medical Center income Statements, Fiscal Years 1997 to 2002 (in S thousands) 1997 1998 999 2000 2001 2 2001 2002 Net Patient Revenue Other Revenue Premium Revenue Total Operating Revenue Operating Expenses: 53,787 46,654 46,329 46,700 47,457 65,653 939 1,084 1,022 1,192 1,265 7,115 7,198 8,187 ,6661.715 55,772 54,590 54,466 55,971 56,145 68,560 720 821 Salaries and Wages Employee Benefits Professional Fees Supplies Purchased Services Depreciation Utilities nsurance Interest Expense Bad Debt Other 21,516 22,336 22,339 23,640 25,274 27,506 7,405 8,486 8,336 7,883 7,887 9,073 2,749 2,590 1,783 2,271 2,368 4,643 8,879 8,981 8,487 8,750 9,093 10,081 3,603 2,981 2,749 2,897 3,1953,774 3,563 3,627 3,774 3,768 3,623 3,533 677 527 475 1,389 1,978 2,627 2,938 4,357 6,155 1,424 1381 1682 1,877 2,124 2,.248 53,587 55,784 54,801 56,702 60,284 68,692 668 591 1,552 ,777 ,765 1,584 1,303 681 826 727 920 689 405 667 393 Total Expenses Operating income Nonoperating Revenue 2,185 1,194 (335) (4,139 132) Interest and Dividend Income 9681,217 1,284 1465 2,620 2,084 Realized Gains (Losses) on Investments 1,005 2,733 3,578 7,885 5,707 (2,160) 390_299_268_415 489688 2.363 4,249 5,130 9,765 8,816 612 480 Contributions Total Nonoperating Revenue Net income Unrealized Gains on Investments Increase in Net Assets Acute and ICU Patient Days (Actual) ED Visits (Actual) 4,548 3,055 4,795 9,034 4,677 1,792 1,055) 2,394 2,848 (8,357) (2,676) 6,340 2,000 7,189 11,882 (3,680) (2,196) 26,048 25,342 23,895 25,330 25,051 27,006 36,214 34,363 32,07 37,485 38,931 41,145Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started