Answered step by step

Verified Expert Solution

Question

1 Approved Answer

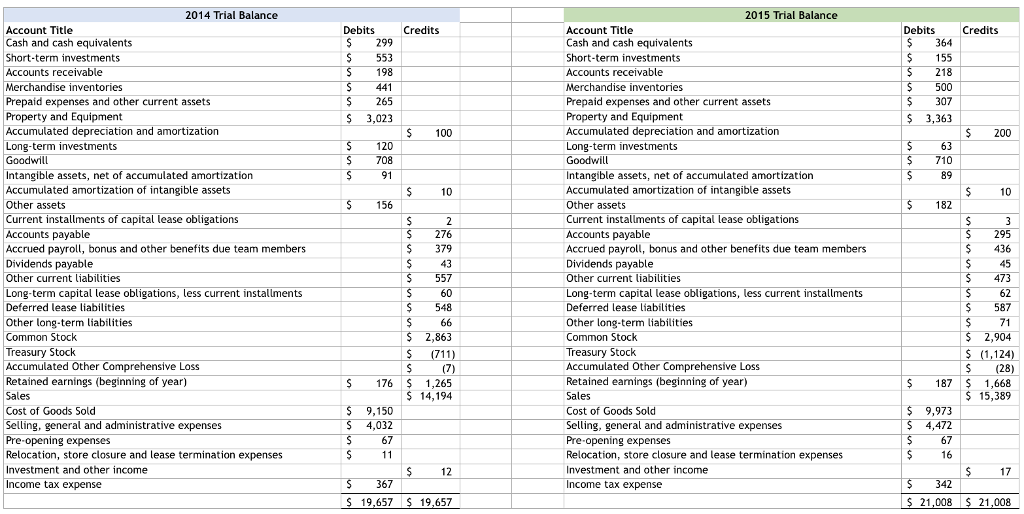

1. Create ONE Excel Workbook with the following tabs: a. Tab 1: Trial Balance for 2014 and 2015 provided b. Tab 2: Closing Entries for

1. Create ONE Excel Workbook with the following tabs:

a. Tab 1: Trial Balance for 2014 and 2015 provided

b. Tab 2: Closing Entries for 2014 Income Statement

c. Tab 3: 2015 Income Statement

d. Tab 4: Closing entries for 2015

e. Tab 5: 2015 Balance Sheet post-closing entries (Use the 2014 Retained Earnings balance as your beginning 2015 balance)

f. Tab 6: Cash Flow Statement

2. Formulas:

a. Use Excel to setup the financial statements by linking the values from the trial balance.

b. Use Excel formulas to calculate all totals and sub-totals.

2014 Trial Balance Account Title Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation and amortization Long-term investments Goodwill Intangible assets, net of accumulated amortization Accumulated amortization of intangible assets Other assets Current installments of capital ease obligations Accounts payable Accrued payroll, bonus and other benefits due team members Dividends payable Other current lia bilities Long-term capital ease obligations ess current installments Deferred lease liabilities Other long-term liabilities Common Stock Treasury Stock Accumulated other Comprehensive Loss Retained earnings (beginning of year) Sales Cost of Goods So Selling, general and administrative expenses Pre-opening expenses Relocation, store closure and lease termination expenses Investment and other income Income tax expense Debits Cred 299 553 198 441 265 S 3,023 100 120 708 91 10 156 276 1557 60 S 548 66 2,863 IS 9.150 IS 4,032 67 11 12 367 S 19,657 19 657 2015 Trial Balance Account Title Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation and amortization Long-term investments Goodwi ntangible assets, net of accumulated amortization Accumulated amortization of intangible assets Other assets Current installments of capital lease obligations Accounts payable Accrued payroll, bonus and other benefits due team members Dividends payable Other current liabilities Long-term capital lease obligations, less current nstallments. Deferred lease liabilities other long-term ab es Common Stock Treasury Stock Accumulated other Comprehensive Loss Retained earnings (beginning of year Sales Cost of Goods Sold Selling, general and administrative expenses Pre-opening expense Relocation, store closure and lease termination expenses Investment and other income ncome tax expense Debits Credits 364 55 IS 218 500 307 3,363 200 63 IS 710 89 182 3 295 473 62 587 71 2,904 1,124) 28) 87 1 668 15,389 9,973 IS 4,472 67 16 17 342 21,0088 21,008Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started