Answered step by step

Verified Expert Solution

Question

1 Approved Answer

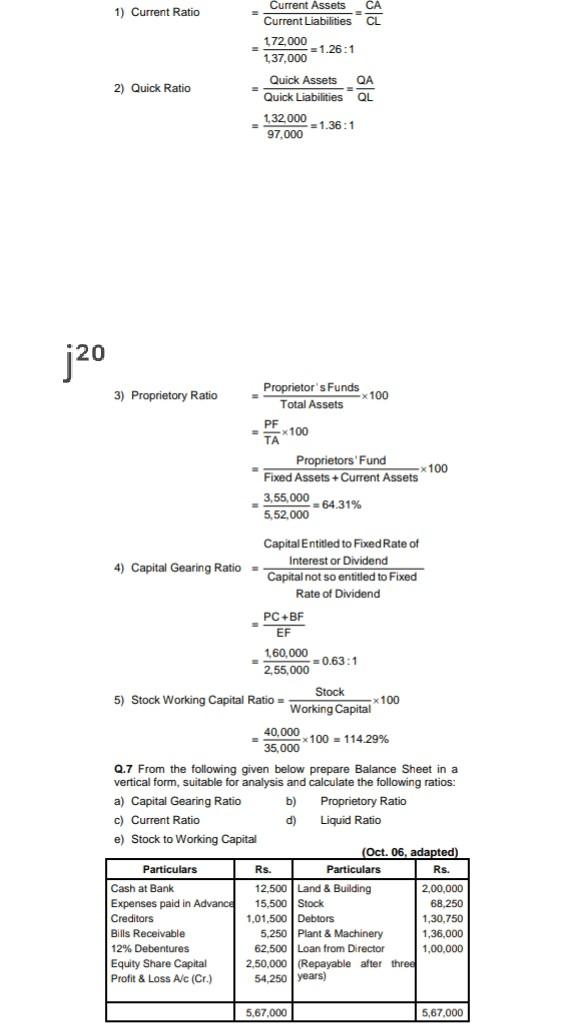

) 1) Current Ratio Current Assets CA Current Liabilities CL 172,000 = 1.26:1 1.37,000 Quick Assets QA Quick Liabilities QL 132.000 = 1.36:1 97.000 2)

) 1) Current Ratio Current Assets CA Current Liabilities CL 172,000 = 1.26:1 1.37,000 Quick Assets QA Quick Liabilities QL 132.000 = 1.36:1 97.000 2) Quick Ratio 20 3) Proprietory Ratio Proprietor's Funds -x 100 Total Assets PF x 100 TA Proprietors' Fund Fixed Assets + Current Assets * 100 3,55,000 - 64.31% 5,52,000 Capital Entitled to Fixed Rate of Interest or Dividend 4) Capital Gearing Ratio = Capital not so entitled to Fixed Rate of Dividend PC +BF EF 160,000 =0.63:1 2,55,000 Stock 5) Stock Working Capital Ratio x100 Working Capital 40,000 x 100 = 114.29% 35,000 Q.7 From the following given below prepare Balance Sheet in a vertical form, suitable for analysis and calculate the following ratios: a) Capital Gearing Ratio b) Proprietory Ratio c) Current Ratio d) Liquid Ratio e) Stock to Working Capital (Oct. 06, adapted) Particulars Rs Particulars Rs. Cash at Bank 12.500 Land & Building 2,00.000 Expenses paid in Advance 15,500 Stock 68,250 Creditors 1.01,500 Debtors 1,30.750 Bills Receivable 5,250 Plant & Machinery 1,36,000 12% Debentures 62,500 Loan from Director 1,00,000 Equity Share Capital 2.50,000 (Repayable after three Profit & Loss A/C (Cr.) 54.250 years) 5,67,000 5,67,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started