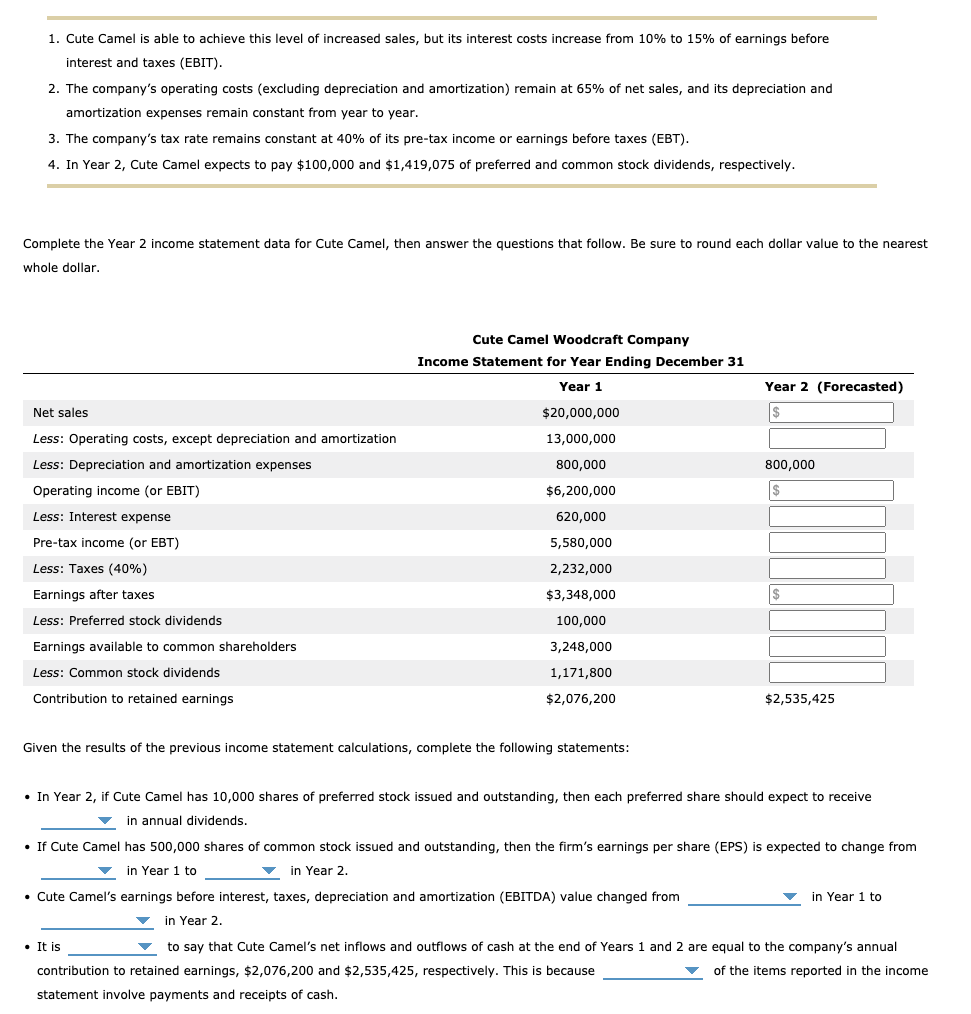

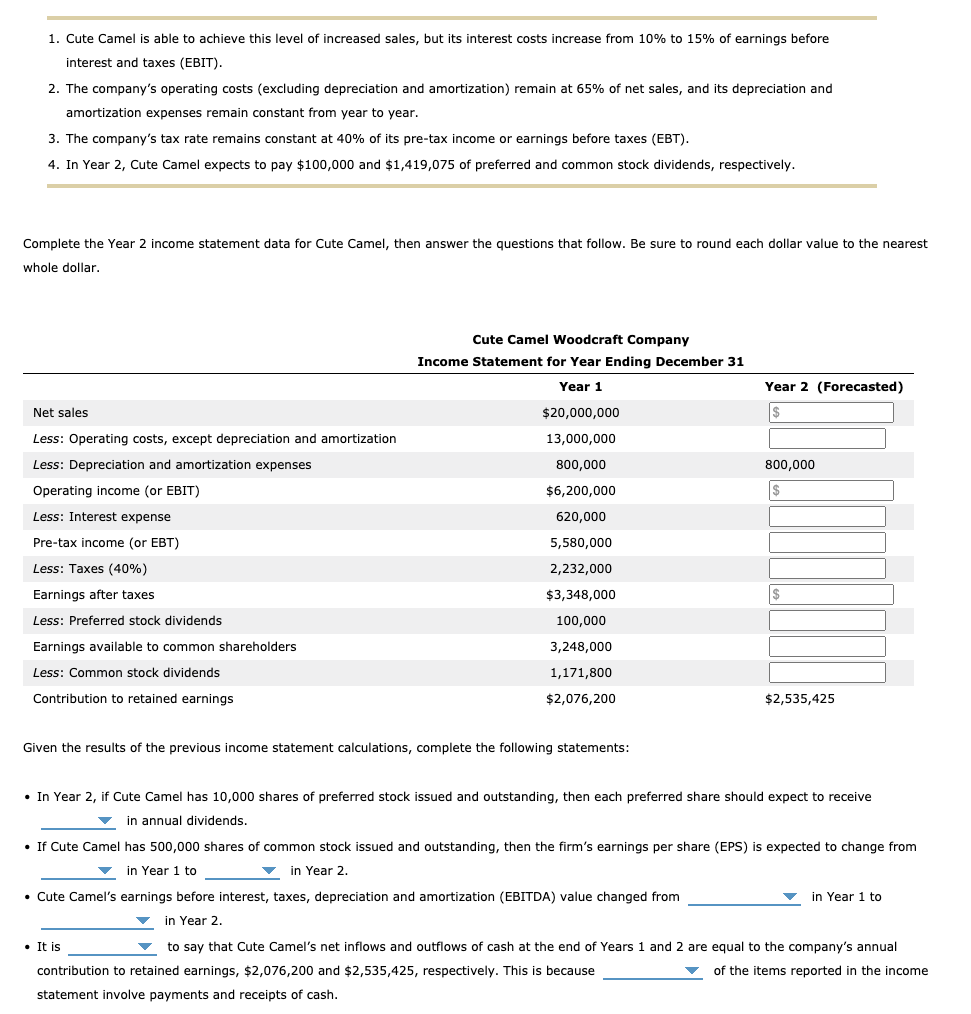

1. Cute Camel is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company's operating costs (excluding depreciation and amortization) remain at 65% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company's tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Cute Camel expects to pay $100,000 and $1,419,075 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Cute Camel, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar. Cute Camel Woodcraft Company Income Statement for Year Ending December 31 Year 1 Year 2 (Forecasted) $ Net sales $20,000,000 13,000,000 Less: Operating costs, except depreciation and amortization Less: Depreciation and amortization expenses Operating income (or EBIT) 800,000 800,000 $ $6,200,000 Less: Interest expense 620,000 Pre-tax income (or EBT) 5,580,000 Less: Taxes (40%) 2,232,000 $ Earnings after taxes Less: Preferred stock dividends Earnings available to common shareholders $3,348,000 100,000 3,248,000 Less: Common stock dividends 1,171,800 Contribution to retained earnings $2,076,200 $2,535,425 Given the results of the previous income statement calculations, complete the following statements: In Year 2, if Cute Camel has 10,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive in annual dividends. If Cute Camel has 500,000 shares of common stock issued and outstanding, then the firm's earnings per share (EPS) is expected to change from in Year 1 to in Year 2 in Year 1 to Cute Camel's earnings before interest, taxes, depreciation and amortization (EBITDA) value changed from in Year 2 It is to say that Cute Camel's net inflows and outflows of cash at the end of Years 1 and 2 are equal to the company's annual contribution to retained earnings, $2,076,200 and $2,535,425, respectively. This is because of the items reported in the income statement involve payments and receipts of cash