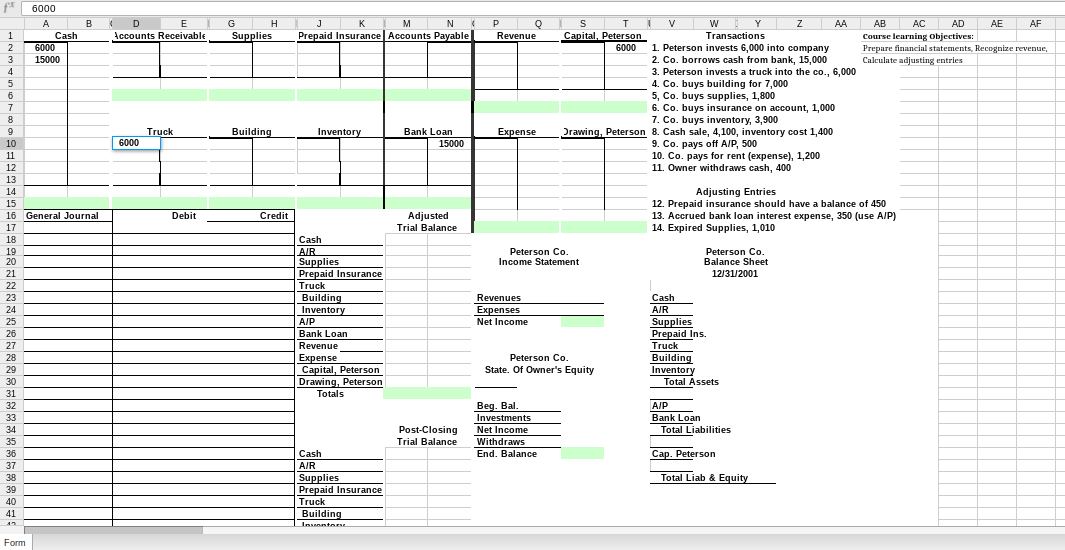

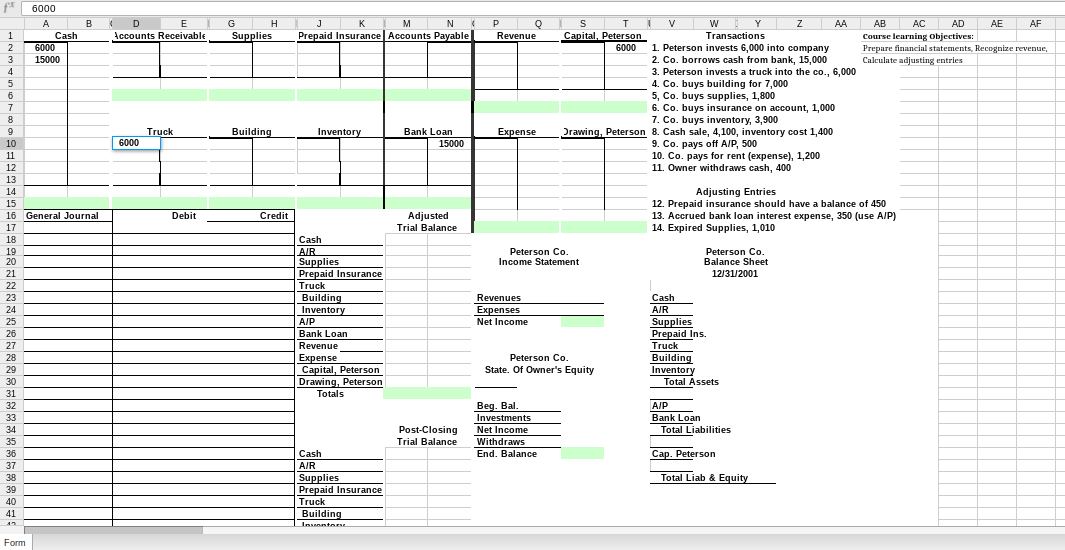

1 D E Accounts Receivable G H Supplies J K M N Prepaid Insurance Accounts Payable P O Revenue 1 2 AB AC AD AE AF Course learning Objectives: Prepare financial statements. Recognize revenue, Calculate adjusting entries S T V w MY Z AA Capital, Peterson Transactions 6000 1. Peterson invests 6,000 into company 2. Co. borrows cash from bank, 15,000 3. Peterson invests a truck into the co., 6,000 4. Co. buys building for 7,000 5, Co. buys supplies, 1,800 6. Co. buys insurance on account, 1,000 7. Co. buys inventory, 3,900 Drawing, Peterson 8. Cash sale, 4,100, inventory cost 1,400 9. Co. pays off AIP, 500 10. Co. pays for rent (expense), 1,200 11. Owner withdraws cash, 400 Truck Building Inventory Bank Loan 15000 Expense 6000 ournal Adjusting Entries 12. Prepaid insurance should have a balance of 450 13. Accrued bank loan interest expense, 350 (use AIP) 14. Expired Supplies, 1,010 Debit Credit Adjusted Trial Balance * 6000 A B Cash 6000 3 15000 4 5 6 7 8 9 10 11 12 13 14 15 16 General Journal 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 33 34 35 36 37 Peterson Co. Income Statement Peterson Co. Balance Sheet 12/31/2001 Cash AIR Supplies Prepaid Insurance Truck Building Inventory AIP Bank Loan Revenue Expense Capital, Peterson Drawing, Peterson Totals Revenues Expenses Net Income Cash AIR Supplies Peterson Co. State. Of Owner's Equity Prepaid Ins. Truck Building Inventory Total Assets Beg. Bal. Investments Net Income Withdraws End. Balance AIP Bank Loan Total Liabilities Post-Closing Trial Balance Cap. Peterson Total Liab & Equity 39 10 40 41 4 Cash AIR Supplies Prepaid Insurance Truck Building lessen Form 1 D E Accounts Receivable G H Supplies J K M N Prepaid Insurance Accounts Payable P O Revenue 1 2 AB AC AD AE AF Course learning Objectives: Prepare financial statements. Recognize revenue, Calculate adjusting entries S T V w MY Z AA Capital, Peterson Transactions 6000 1. Peterson invests 6,000 into company 2. Co. borrows cash from bank, 15,000 3. Peterson invests a truck into the co., 6,000 4. Co. buys building for 7,000 5, Co. buys supplies, 1,800 6. Co. buys insurance on account, 1,000 7. Co. buys inventory, 3,900 Drawing, Peterson 8. Cash sale, 4,100, inventory cost 1,400 9. Co. pays off AIP, 500 10. Co. pays for rent (expense), 1,200 11. Owner withdraws cash, 400 Truck Building Inventory Bank Loan 15000 Expense 6000 ournal Adjusting Entries 12. Prepaid insurance should have a balance of 450 13. Accrued bank loan interest expense, 350 (use AIP) 14. Expired Supplies, 1,010 Debit Credit Adjusted Trial Balance * 6000 A B Cash 6000 3 15000 4 5 6 7 8 9 10 11 12 13 14 15 16 General Journal 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 33 34 35 36 37 Peterson Co. Income Statement Peterson Co. Balance Sheet 12/31/2001 Cash AIR Supplies Prepaid Insurance Truck Building Inventory AIP Bank Loan Revenue Expense Capital, Peterson Drawing, Peterson Totals Revenues Expenses Net Income Cash AIR Supplies Peterson Co. State. Of Owner's Equity Prepaid Ins. Truck Building Inventory Total Assets Beg. Bal. Investments Net Income Withdraws End. Balance AIP Bank Loan Total Liabilities Post-Closing Trial Balance Cap. Peterson Total Liab & Equity 39 10 40 41 4 Cash AIR Supplies Prepaid Insurance Truck Building lessen Form