Answered step by step

Verified Expert Solution

Question

1 Approved Answer

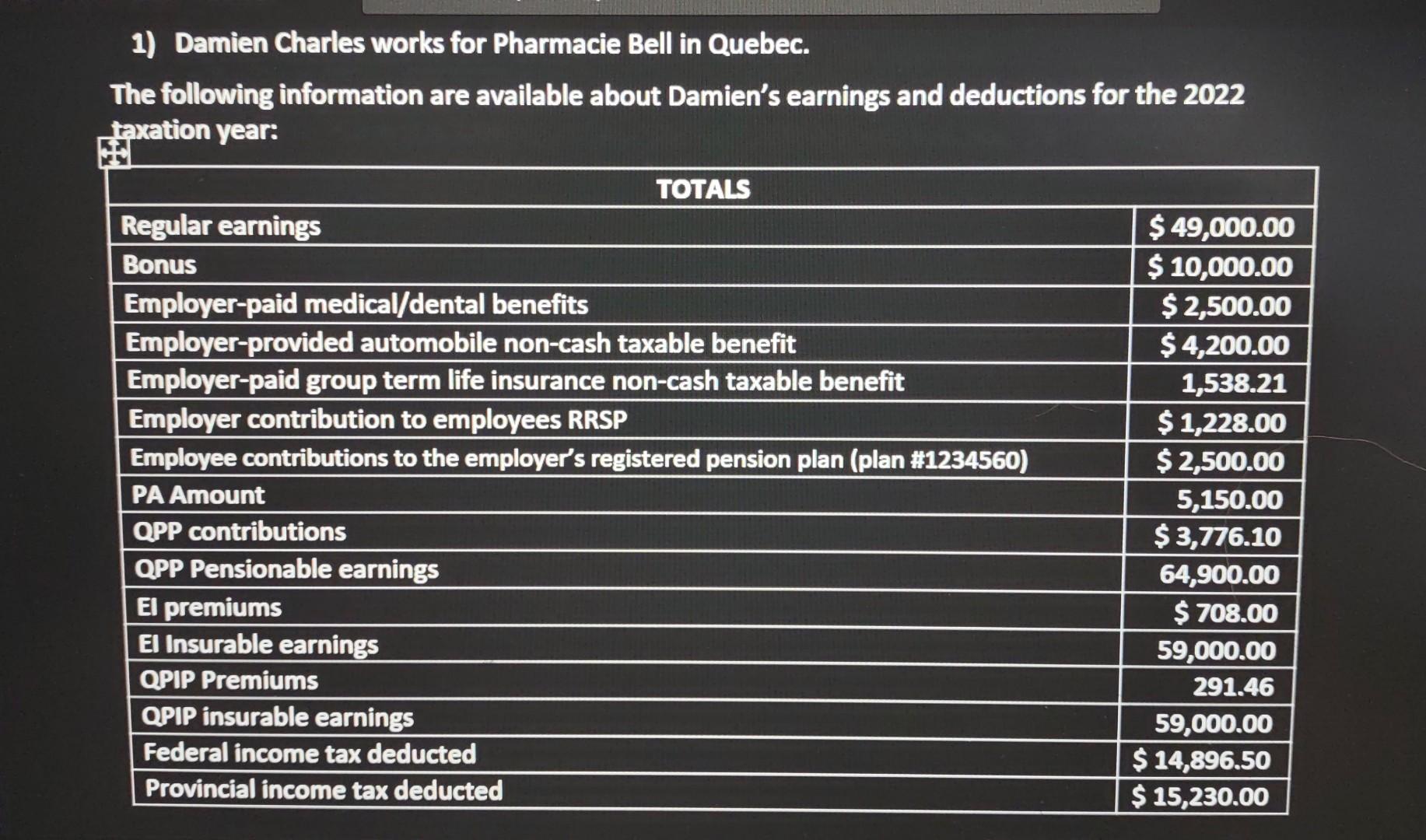

1) Damien Charles works for Pharmacie Bell in Quebec. The following information are available about Damien's earnings and deductions for the 2022 taxation year:

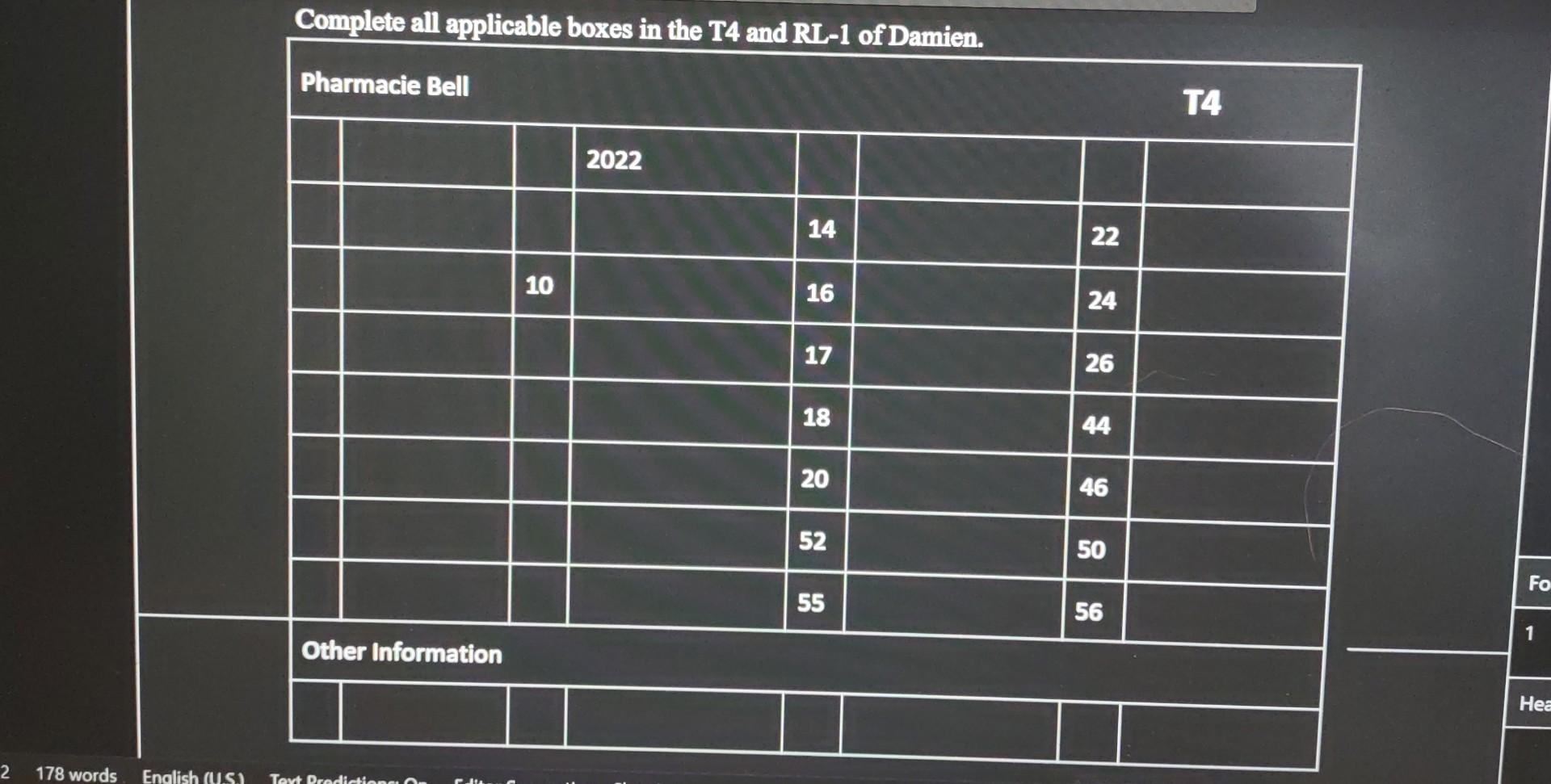

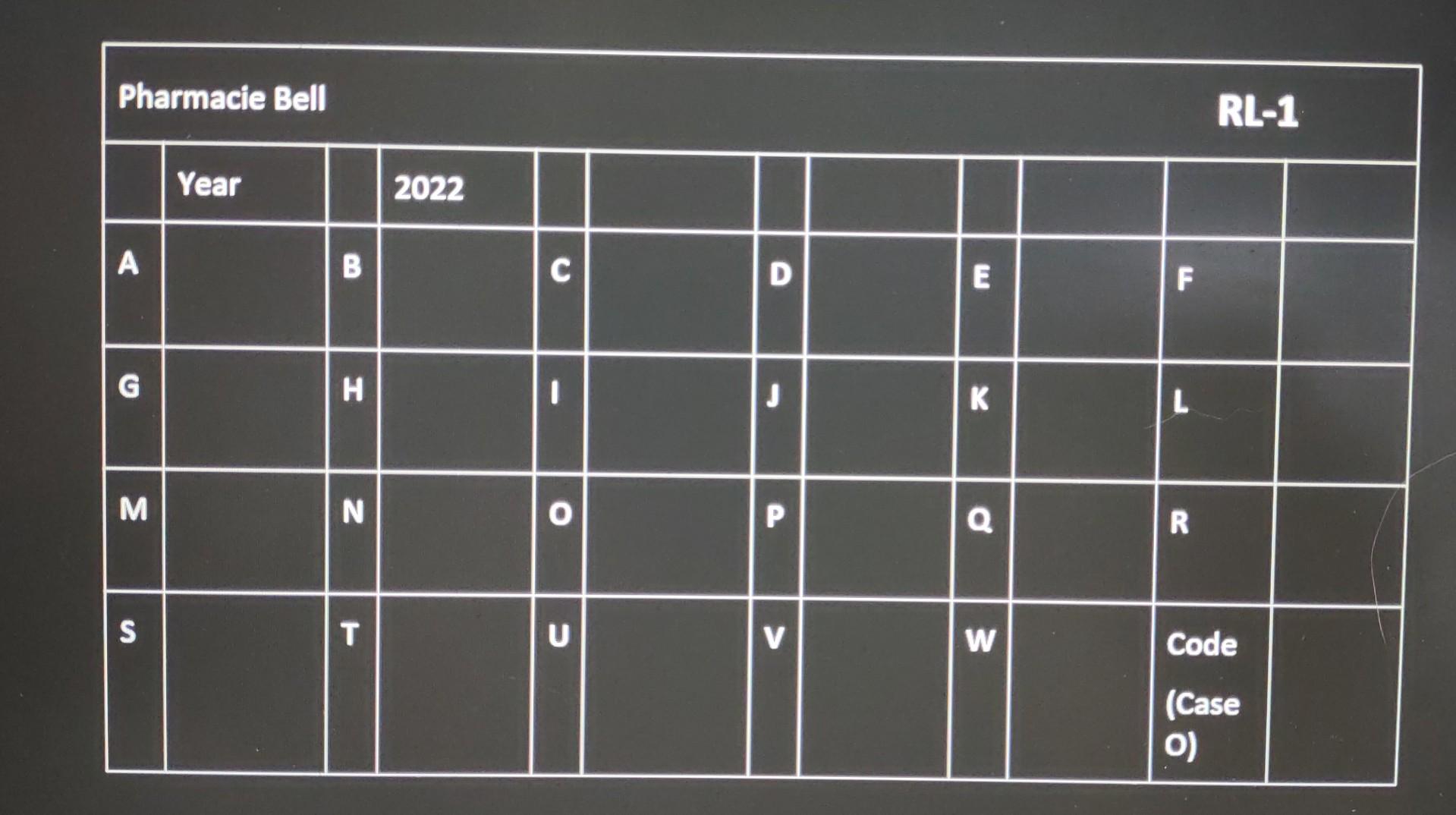

1) Damien Charles works for Pharmacie Bell in Quebec. The following information are available about Damien's earnings and deductions for the 2022 taxation year: Regular earnings Bonus Employer-paid medical/dental benefits Employer-provided automobile non-cash taxable benefit Employer-paid group term life insurance non-cash taxable benefit TOTALS Employer contribution to employees RRSP Employee contributions to the employer's registered pension plan (plan #1234560) PA Amount QPP contributions QPP Pensionable earnings El premiums El Insurable earnings QPIP Premiums QPIP insurable earnings Federal income tax deducted Provincial income tax deducted $ 49,000.00 $ 10,000.00 $2,500.00 $4,200.00 1,538.21 $ 1,228.00 $ 2,500.00 5,150.00 $3,776.10 64,900.00 $ 708.00 59,000.00 291.46 59,000.00 $14,896.50 $ 15,230.00 2 Complete all applicable boxes in the T4 and RL-1 of Damien. Pharmacie Bell Other Information 178 words English (US) Text Predictions: On 10 2022 14 16 17 18 20 52 55 22 24 26 44 46 50 56 T4 Fo 1 Hea Pharmacie Bell A G M S Year B H N T 2022 C I O U D J P V E K Q W F L R RL-1 Code (Case O)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 To calculate Damiens net income for the 2022 taxation year we need to first calculate his t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started