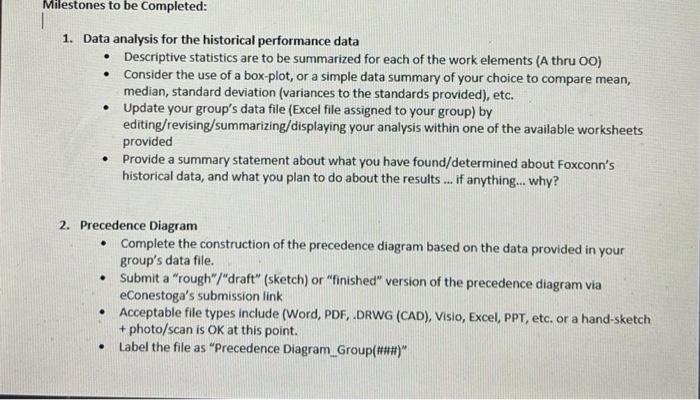

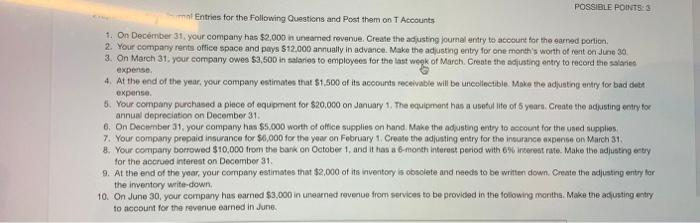

1. Data analysis for the historical performance data - Descriptive statistics are to be summarized for each of the work elements (A thru OO) - Consider the use of a box-plot, or a simple data summary of your choice to compare mean, median, standard deviation (variances to the standards provided), etc. - Update your group's data file (Excel file assigned to your group) by editing/revising/summarizing/displaying your analysis within one of the available worksheets provided - Provide a summary statement about what you have found/determined about Foxconn's historical data, and what you plan to do about the results ... if anything... why? 2. Precedence Diagram - Complete the construction of the precedence diagram based on the data provided in your group's data file. - Submit a "rough"/"draft" (sketch) or "finished" version of the precedence diagram via econestoga's submission link - Acceptable file types include (Word, PDF, .DRWG (CAD), Visio, Excel, PPT, etc. or a hand-sketch + photo/scan is OK at this point. - Label the file as "Precedence Diagram_Group(\#\#\#)" Entries for the Following Queations and Post them on T Accounts 1. On Decermber 31, your company has, $2,000 in uneamed revenue. Create the adjusting journal antry te acoount for the earned portion. 2. Your company rents office space and poys $12,000 annually in advance. Make the adjusting entry for one month's worth of rest cn Jine 30 . 3. On Merch 31, your company owes $3,500 in salaries to employees for the last wepk of March. Create the sdiusting entry to record the salaries expense. 4. At the end of the year, your company estimanes that 51,500 of its acoounts receivable will be uncellectible. Moke the adjusting entry for bad dete expense. 5. Your company purchased a plece of equpment for $20,000 on January 1 , The equipment has a useful life of 5 years. Create the adjusting entry for annual deprociation on December 31. 6. On Deoember 31 , your compary has $5,000 worth of offlee supplies on hand. Make the adusting entry to account for the used aupplies 7. Your company prepaid insurance tor $0,000 for the year on February 1, Create the adjusting entry for the insurance axpense on March 31. 8. Your compary borfowed $10,000 from the bark on October 1, and it has a 6-month interest period with 6% inkerest rate. Mahe the adjusting estry for the accrued interest on December 31. 9. At the end of the yoar, your company estimates that $2,000 of its inventory is obsolete and needs to be written down. Create the adjusting entry for the imentory write-down. 10. On June 30 , your company has earned $3,000 in urteaned revenue from services to be provided in the foliowing montha, Make the adusting entry to account for the revenue earned in June. 1. Data analysis for the historical performance data - Descriptive statistics are to be summarized for each of the work elements (A thru OO) - Consider the use of a box-plot, or a simple data summary of your choice to compare mean, median, standard deviation (variances to the standards provided), etc. - Update your group's data file (Excel file assigned to your group) by editing/revising/summarizing/displaying your analysis within one of the available worksheets provided - Provide a summary statement about what you have found/determined about Foxconn's historical data, and what you plan to do about the results ... if anything... why? 2. Precedence Diagram - Complete the construction of the precedence diagram based on the data provided in your group's data file. - Submit a "rough"/"draft" (sketch) or "finished" version of the precedence diagram via econestoga's submission link - Acceptable file types include (Word, PDF, .DRWG (CAD), Visio, Excel, PPT, etc. or a hand-sketch + photo/scan is OK at this point. - Label the file as "Precedence Diagram_Group(\#\#\#)" Entries for the Following Queations and Post them on T Accounts 1. On Decermber 31, your company has, $2,000 in uneamed revenue. Create the adjusting journal antry te acoount for the earned portion. 2. Your company rents office space and poys $12,000 annually in advance. Make the adjusting entry for one month's worth of rest cn Jine 30 . 3. On Merch 31, your company owes $3,500 in salaries to employees for the last wepk of March. Create the sdiusting entry to record the salaries expense. 4. At the end of the year, your company estimanes that 51,500 of its acoounts receivable will be uncellectible. Moke the adjusting entry for bad dete expense. 5. Your company purchased a plece of equpment for $20,000 on January 1 , The equipment has a useful life of 5 years. Create the adjusting entry for annual deprociation on December 31. 6. On Deoember 31 , your compary has $5,000 worth of offlee supplies on hand. Make the adusting entry to account for the used aupplies 7. Your company prepaid insurance tor $0,000 for the year on February 1, Create the adjusting entry for the insurance axpense on March 31. 8. Your compary borfowed $10,000 from the bark on October 1, and it has a 6-month interest period with 6% inkerest rate. Mahe the adjusting estry for the accrued interest on December 31. 9. At the end of the yoar, your company estimates that $2,000 of its inventory is obsolete and needs to be written down. Create the adjusting entry for the imentory write-down. 10. On June 30 , your company has earned $3,000 in urteaned revenue from services to be provided in the foliowing montha, Make the adusting entry to account for the revenue earned in June