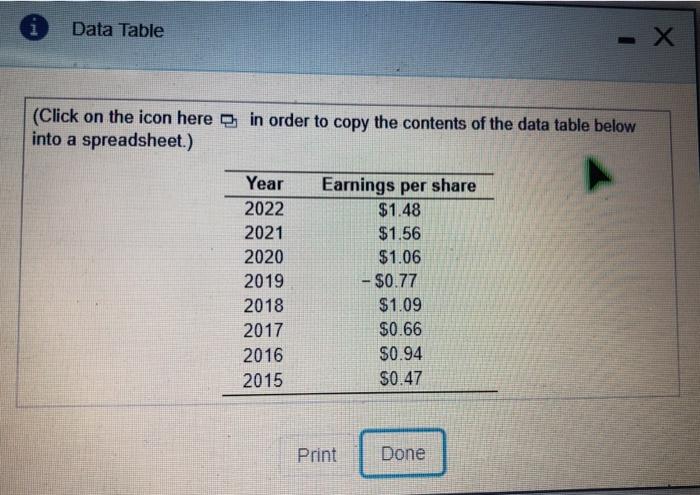

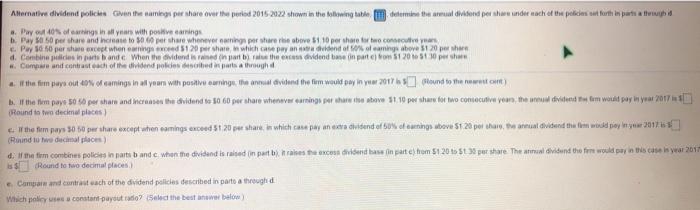

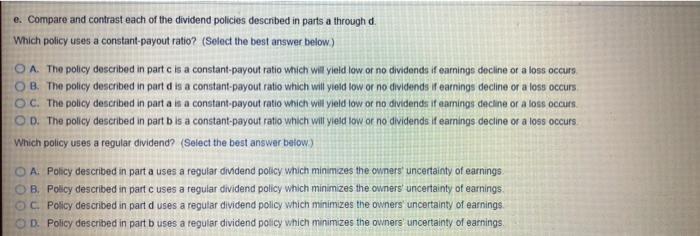

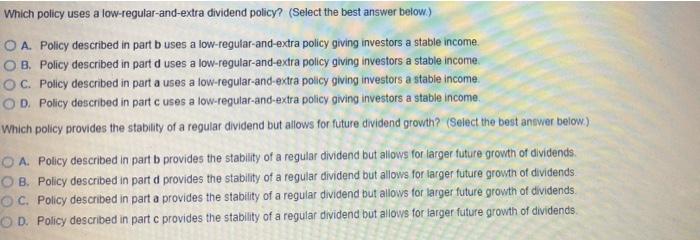

1 Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year 2022 2021 2020 2019 2018 2017 2016 2015 Earnings per share $1.48 $1.56 $1.06 - $0.77 $1.09 $0.66 $0.94 $0.47 Print Done Alternative dividend police caven the samiegi per share over the period 2015 2022 shown in the following table, determine the real dividend per shendee machof the policies at forth in partea lui # Payout 40% of earnings in all years with positive carings b. Pay suso per share and here to so o per share whenever nating per sharehe above 51 10 per share for two consecutive years Pay 56 60 per share except when coming od 120 pshare, in which the pay an end of soleaming above 51 20 per d. Combine policies in the bande When the dividend is and in part by the dividend be in parte from 5120 51 30 perche Compare and contrast each of the dividend processes through the firm pays out o camings in all year with positive ning team vided the firm would pay in year 2017 Bond to the wont b. the tom prve sospechors and increases the dividend to 30 60 per shoro whenever earnings per than the stove 31.10 per here for two consecutive years, the divided to world pay in year 2017 Round to two decimal places) che ti pas 30 80 per share except when comings exceed 51.20 per share, in which can extra dividendel so cleanings abovu 51.20 per te armul dividend thu tiem wnikl poyler 2017 Rund to we decimal places) de tem combines policies in parte band when the dividend is raised in parties to exceededood base in parte) hom $120 5 $per share the annual dividund the fee would pay in acelar 2017 Round to two decimal places Compare and contrastach of the dividend policies described in partea through d Which pois constant you to select the best weblow e. Compare and contrast each of the dividend policies described in parts a through d. Which policy uses a constant-payout ratio? (Select the best answer below) O A The policy described in part c is a constant-payout ratio which will yield low or no dividends if earnings decline or a loss occurs OB. The policy described in part d is a constant-payout ratio which will yield low or no dividends I earnings decline or a loss occurs OC. The policy described in part as a constant-payout ratio which will yield low or no dividends. If earnings decline or a loss occurs. OD. The policy described in part b is a constant-payout ratio which will yield low or no dividends If earnings decline or a loss occurs. Which policy uses a regular dividend? (Select the best answer below) O A Policy described in part a uses a regular dividend policy which minimizes the owners uncertainty of earrings OB. Policy described in part c uses a regular dividend policy which minimizes the owners uncertainty of earnings OC Policy described in part d uses a regular dividend policy which minimizes the owners uncertainty of earnings OD Policy described in part b uses a regular dividend policy which minimizes the owners uncertainty of earnings Which policy uses a low-regular-and-extra dividend policy? (Select the best answer below) O A. Policy described in part b uses a low-regular-and-extra policy giving investors a stable income. O. B. Policy described in part d uses a low-regular-and-extra policy giving investors a stable income OC. Policy described in part a uses a low-regular-and-extra policy giving investors a stable income OD Policy described in part c uses a low-regular-and-extra policy giving investors a stable income Which policy provides the stability of a regular dividend but allows for future dividend growth? (Select the best answer below) O A Policy described in part b provides the stability of a regular dividend but allows for larger future growth of dividends. O B. Policy described in part d provides the stability of a regular dividend but allows for larger tuture growth of dividends. OC. Policy described in part a provides the stability of a regular dividend but allows for larger future growth of dividends OD Policy described in partc provides the stability of a regular dividend but allows for larger future growth of dividends