1.  Debit:

Debit:

Credit:

2.  Debit:

Debit:

Credit:

3.

4.

5.

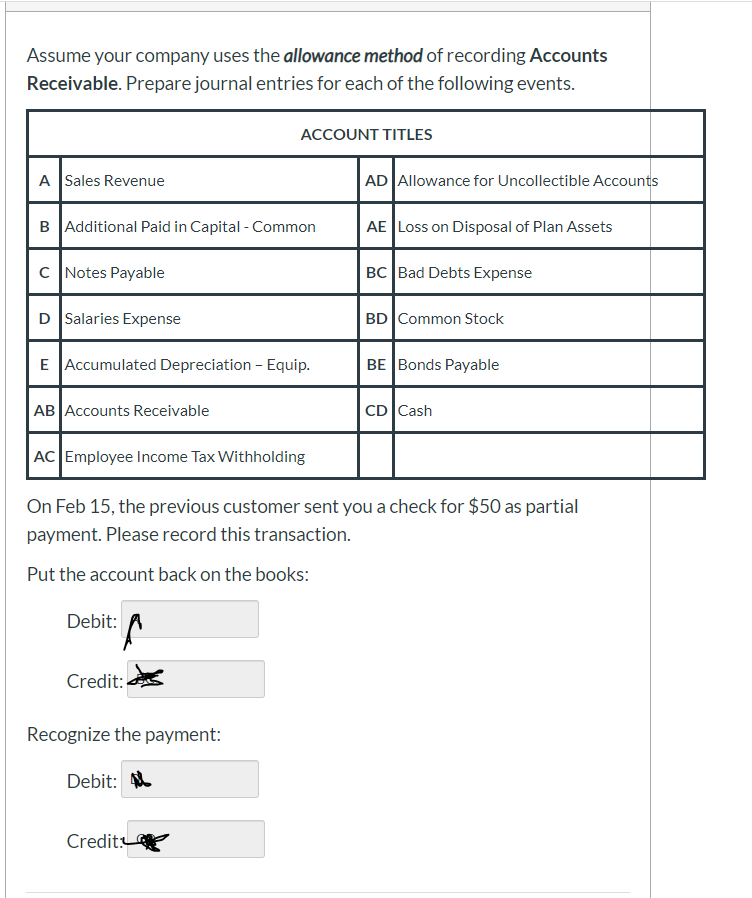

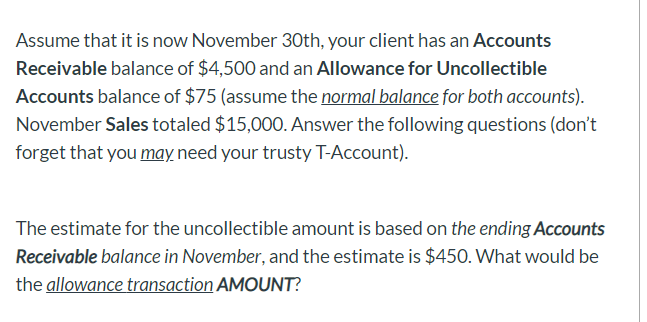

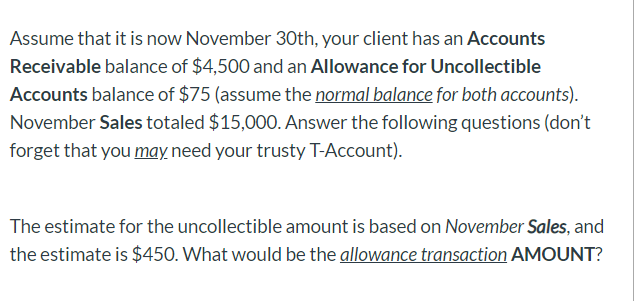

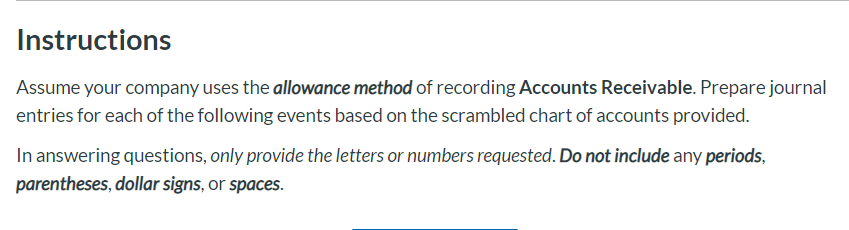

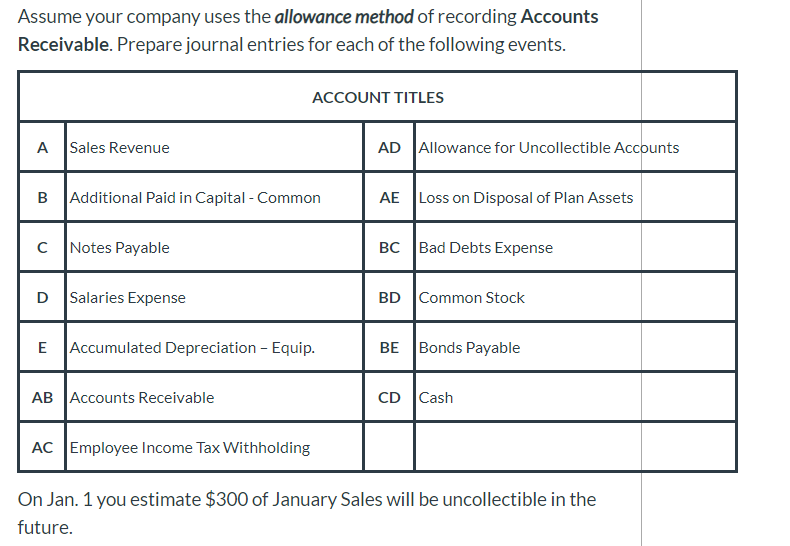

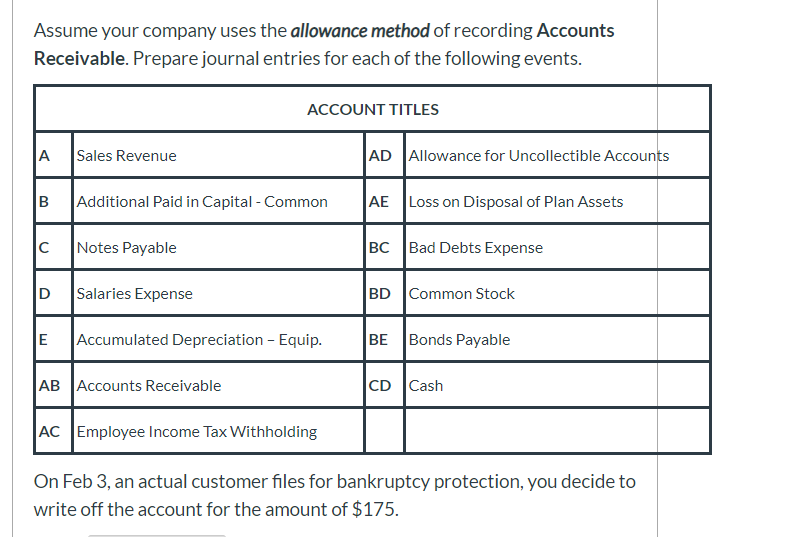

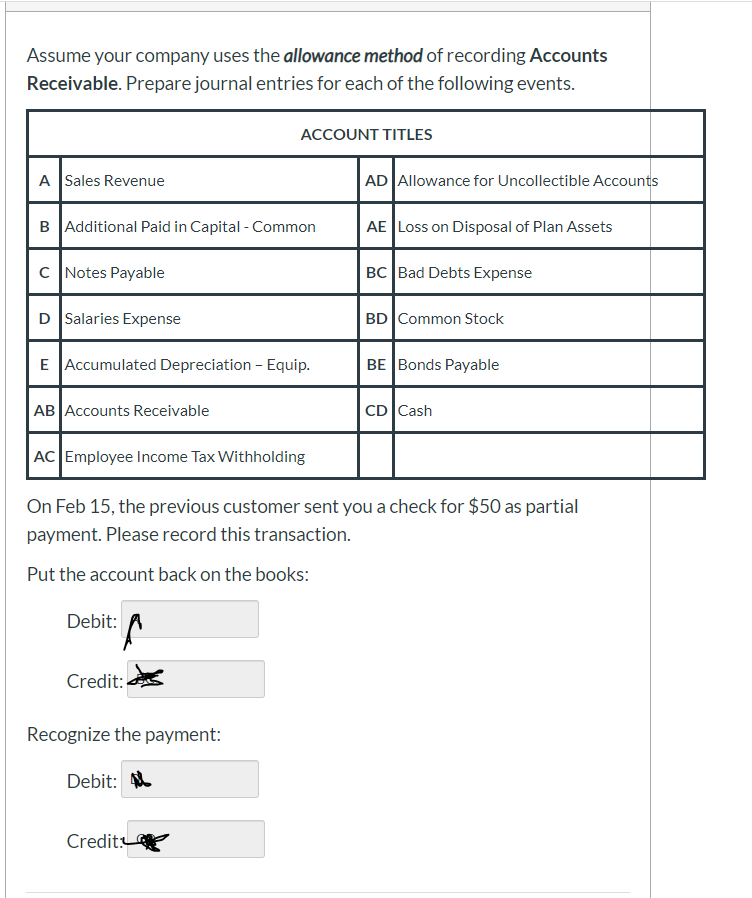

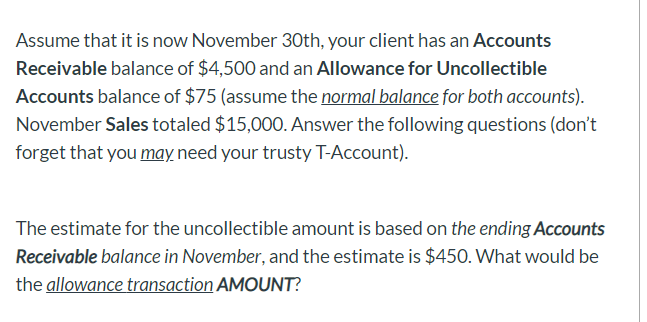

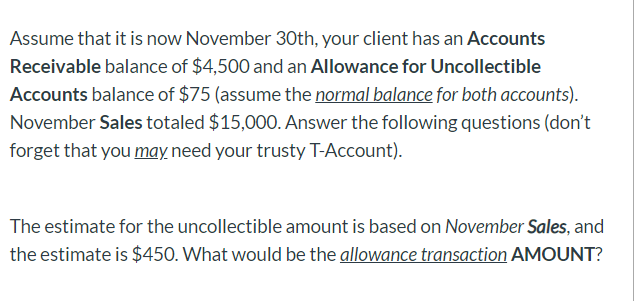

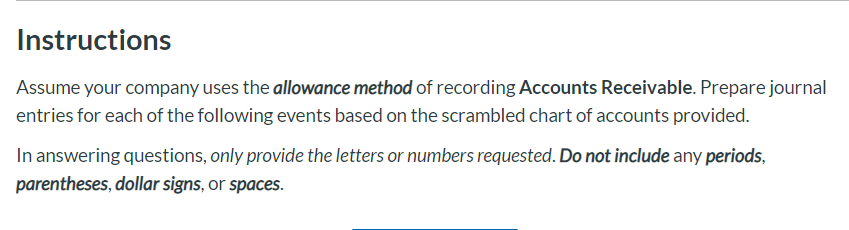

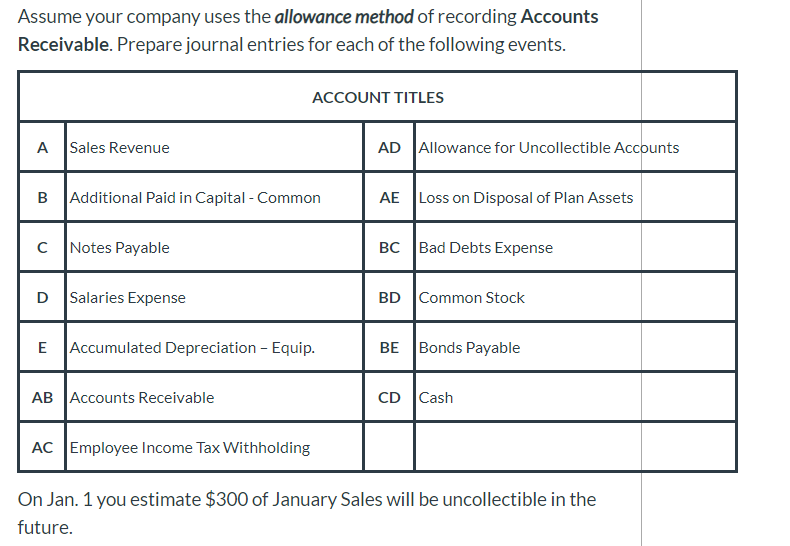

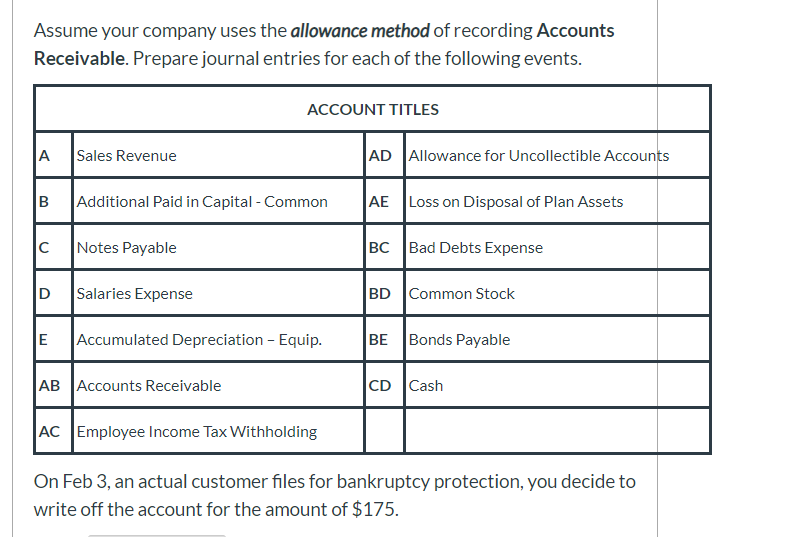

Instructions Assume your company uses the allowance method of recording Accounts Receivable. Prepare journal entries for each of the following events based on the scrambled chart of accounts provided. In answering questions, only provide the letters or numbers requested. Do not include any periods, parentheses, dollar signs, or spaces. Assume your company uses the allowance method of recording Accounts Receivable. Prepare journal entries for each of the following events. ACCOUNT TITLES A Sales Revenue AD Allowance for Uncollectible Accounts B Additional Paid in Capital - Common AE Loss on Disposal of Plan Assets C Notes Payable BC Bad Debts Expense D Salaries Expense BD Common Stock E Accumulated Depreciation - Equip. BE Bonds Payable AB Accounts Receivable CD Cash AC Employee Income Tax Withholding On Jan. 1 you estimate $300 of January Sales will be uncollectible in the future. Assume your company uses the allowance method of recording Accounts Receivable. Prepare journal entries for each of the following events. ACCOUNT TITLES A Sales Revenue AD Allowance for Uncollectible Accounts B Additional Paid in Capital - Common AE Loss on Disposal of Plan Assets Notes Payable BC Bad Debts Expense D Salaries Expense BD Common Stock E Accumulated Depreciation - Equip. BE Bonds Payable AB Accounts Receivable CD Cash AC Employee Income Tax Withholding On Feb 3, an actual customer files for bankruptcy protection, you decide to write off the account for the amount of $175. Assume your company uses the allowance method of recording Accounts Receivable. Prepare journal entries for each of the following events. ACCOUNT TITLES A Sales Revenue AD Allowance for Uncollectible Accounts B Additional Paid in Capital - Common AE Loss on Disposal of Plan Assets c Notes Payable BC Bad Debts Expense D Salaries Expense BD Common Stock E Accumulated Depreciation - Equip. BE Bonds Payable AB Accounts Receivable CD Cash AC Employee Income Tax Withholding On Feb 15, the previous customer sent you a check for $50 as partial payment. Please record this transaction. Put the account back on the books: Debit: Credit: Recognize the payment: Debit: AL Credit: Assume that it is now November 30th, your client has an Accounts Receivable balance of $4,500 and an Allowance for Uncollectible Accounts balance of $75 (assume the normal balance for both accounts). November Sales totaled $15,000. Answer the following questions (don't forget that you may need your trusty T-Account). The estimate for the uncollectible amount is based on the ending Accounts Receivable balance in November, and the estimate is $450. What would be the allowance transaction AMOUNT? Assume that it is now November 30th, your client has an Accounts Receivable balance of $4,500 and an Allowance for Uncollectible Accounts balance of $75 (assume the normal balance for both accounts). November Sales totaled $15,000. Answer the following questions (don't forget that you may need your trusty T-Account). The estimate for the uncollectible amount is based on November Sales, and the estimate is $450. What would be the allowance transaction AMOUNT

Debit:

Debit: Debit:

Debit: