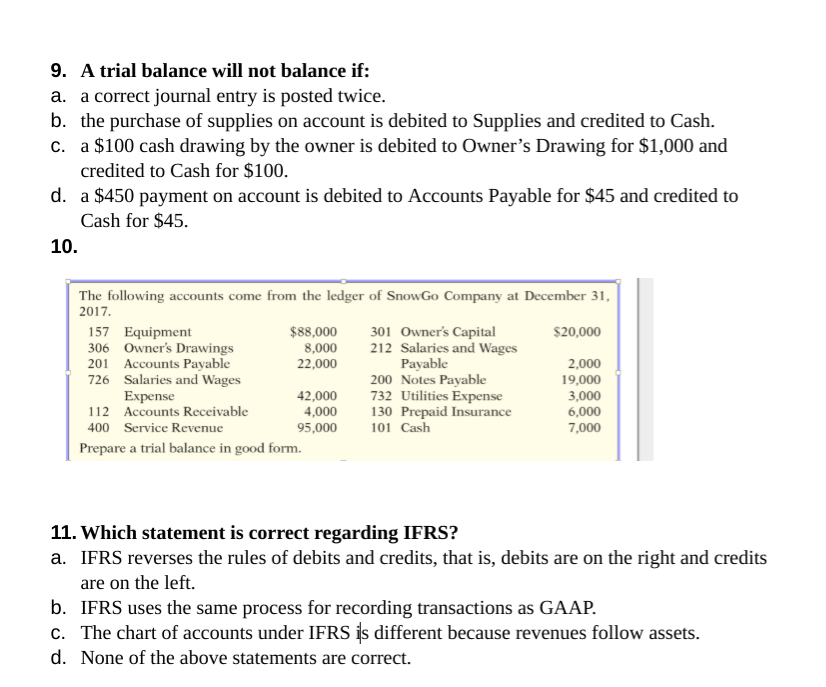

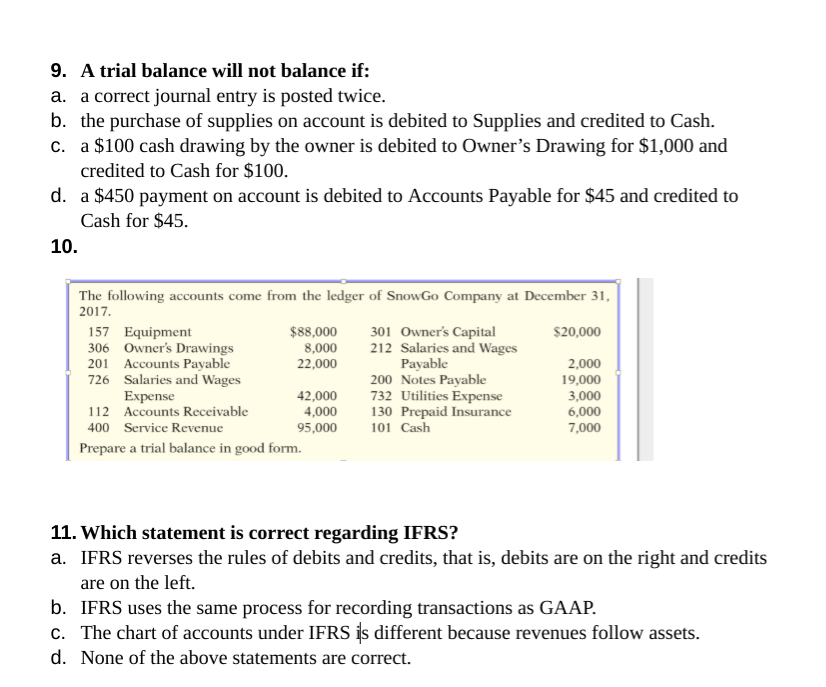

1. Debits: a. increase both assets and liabilities. b. decrease both assets and liabilities C. increase assets and decrease liabilities. d. decrease assets and increase liabilities 2. Accounts that normally have debit balances are: a. assets, expenses, and revenues. b. assets, expenses, and equity c. assets, liabilities, and owner's drawing. d. assets, owner's drawing, and expenses 3. Kate Browne has just rented space in a shopping mall. In this space, she will open a hair salon to be called "Hair It Is." A friend has advised Kate to set up a double-entry set of accounting records in which to record all of her business transactions. Identify the balance sheet accounts that Kate will likely need to record the transactions needed to open her business. Indicate whether the normal balance of each account is a debit or a credit. 4. On July 1, Butler Company purchases a delivery truck costing $14,000. It pays $8,000 cash now and agrees to pay the remaining $6,000 on account. 5. On September 1, Ray Neal invested $15,000 cash in the business, and Softbyte purchased computer equipment for $7,000 cash. 9. A trial balance will not balance if: a. a correct journal entry is posted twice. b. the purchase of supplies on account is debited to Supplies and credited to Cash. c. a $100 cash drawing by the owner is debited to Owner's Drawing for $1,000 and credited to Cash for $100 a $450 payment on account is debited to Accounts Payable for $45 and credited to Cash for $45 d. 10. The following accounts come from the ledger of SnowGo Company at December 31 2017 $88,000 301 Owners Capital $20,000 57 Equipment 306 Owner's Drawings 201 Accounts Payable 726 Salaries and Wages 8,000 212 Salaries and Wages 22,000 42,000 95,000 Payable 2,000 19,000 3,000 6,000 7,000 200 Notes Payable 732 Utilities Expense Expense 112 Accounts Receivable 400 Service Revenue ,000 130 Prepaid Insurance 101 Cash Prepare a trial balance in good form. 11. Which statement is correct regarding IFRS? a. IFRS reverses the rules of debits and credits, that is, debits are on the right and credits are on the left. b. IFRS uses the same process for recording transactions as GAAP. C. The chart of accounts under IFRS is different because revenues follow assets d. None of the above statements are correct. 12. A trial balance: a. is the same under IFRS and GAA. b. proves that transactions are recorded correctly. c. proves that all transactions have been recorded. d. will not balance if a cormrect journal entry is posted twice. 13. Which statement is correct regarding IFRS? a. IFRS reverses the rules of debits and credits, that is, debits are on the right and credits are on the left. b. IFRS uses the same process for recording transactions as GAAP. C. The chart of accounts under IFRS is different because revenues follow assets. d. None of the above statements are correct. 14. One difference between IFRS and GAAP is that: a. GAAP uses accrual-accounting concepts and IFRS uses primarily the cash basis of b. C. d. accounting. IFRS uses a different posting process than GAAP. IFRS uses more fair value measurements than GAAP the limitations of a trial balance are different between IFRS and GAAP