Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (Decision making) Suppose that we have three business plans: A, B and C. Profits from the plans are random and depend on economic condition:

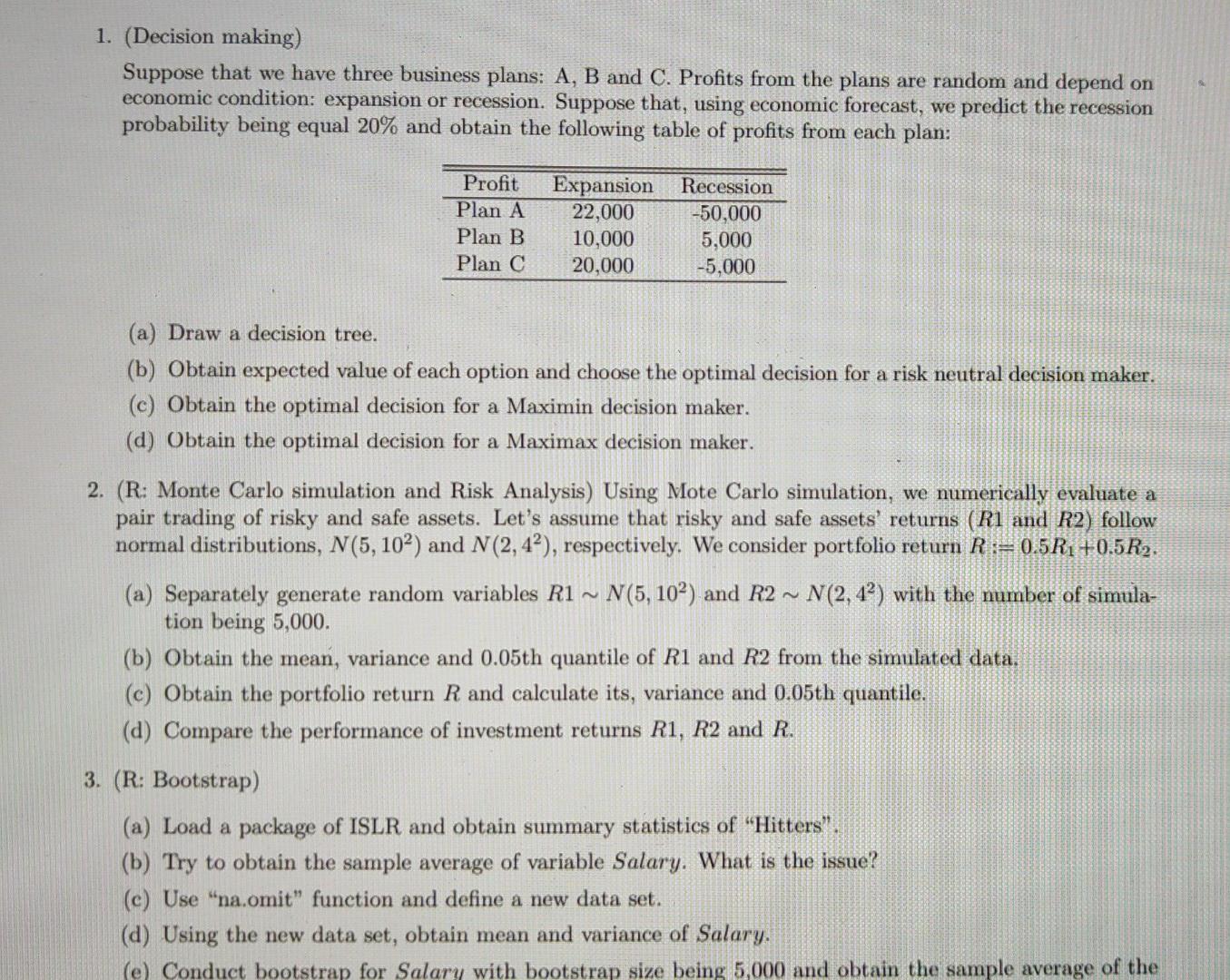

1. (Decision making) Suppose that we have three business plans: A, B and C. Profits from the plans are random and depend on economic condition: expansion or recession. Suppose that, using economic forecast, we predict the recession probability being equal 20% and obtain the following table of profits from each plan: Recession Profit Plan A Expansion 22,000 -50,000 Plan B 10,000 5,000 Plan C 20,000 -5,000 (a) Draw a decision tree. (b) Obtain expected value of each option and choose the optimal decision for a risk neutral decision maker. (c) Obtain the optimal decision for a Maximin decision maker. (d) Obtain the optimal decision for a Maximax decision maker. 2. (R: Monte Carlo simulation and Risk Analysis) Using Mote Carlo simulation, we numerically evaluate a pair trading of risky and safe assets. Let's assume that risky and safe assets' returns (R1 and R2) follow normal distributions, N(5, 102) and N(2, 42), respectively. We consider portfolio return R := 0.5R +0.5R. (a) Separately generate random variables R1~ N(5, 102) and R2 ~ N(2, 42) with the number of simula- tion being 5,000. (b) Obtain the mean, variance and 0.05th quantile of R1 and R2 from the simulated data. (c) Obtain the portfolio return R and calculate its, variance and 0.05th quantile. (d) Compare the performance of investment returns R1, R2 and R. 3. (R: Bootstrap) (a) Load a package of ISLR and obtain summary statistics of "Hitters". (b) Try to obtain the sample average of variable Salary. What is the issue? (c) Use "na.omit" function and define a new data set. (d) Using the new data set, obtain mean and variance of Salary. (e) Conduct bootstrap for Salary with bootstrap size being 5,000 and obtain the sample average of the 1. (Decision making) Suppose that we have three business plans: A, B and C. Profits from the plans are random and depend on economic condition: expansion or recession. Suppose that, using economic forecast, we predict the recession probability being equal 20% and obtain the following table of profits from each plan: Recession Profit Plan A Expansion 22,000 -50,000 Plan B 10,000 5,000 Plan C 20,000 -5,000 (a) Draw a decision tree. (b) Obtain expected value of each option and choose the optimal decision for a risk neutral decision maker. (c) Obtain the optimal decision for a Maximin decision maker. (d) Obtain the optimal decision for a Maximax decision maker. 2. (R: Monte Carlo simulation and Risk Analysis) Using Mote Carlo simulation, we numerically evaluate a pair trading of risky and safe assets. Let's assume that risky and safe assets' returns (R1 and R2) follow normal distributions, N(5, 102) and N(2, 42), respectively. We consider portfolio return R := 0.5R +0.5R. (a) Separately generate random variables R1~ N(5, 102) and R2 ~ N(2, 42) with the number of simula- tion being 5,000. (b) Obtain the mean, variance and 0.05th quantile of R1 and R2 from the simulated data. (c) Obtain the portfolio return R and calculate its, variance and 0.05th quantile. (d) Compare the performance of investment returns R1, R2 and R. 3. (R: Bootstrap) (a) Load a package of ISLR and obtain summary statistics of "Hitters". (b) Try to obtain the sample average of variable Salary. What is the issue? (c) Use "na.omit" function and define a new data set. (d) Using the new data set, obtain mean and variance of Salary. (e) Conduct bootstrap for Salary with bootstrap size being 5,000 and obtain the sample average of the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started