Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer in Excel and show formulas. A-Holden wants to start saving for his 3 year old sister, Phoebe, to attend his alma mater, UA.

Please answer in Excel and show formulas.

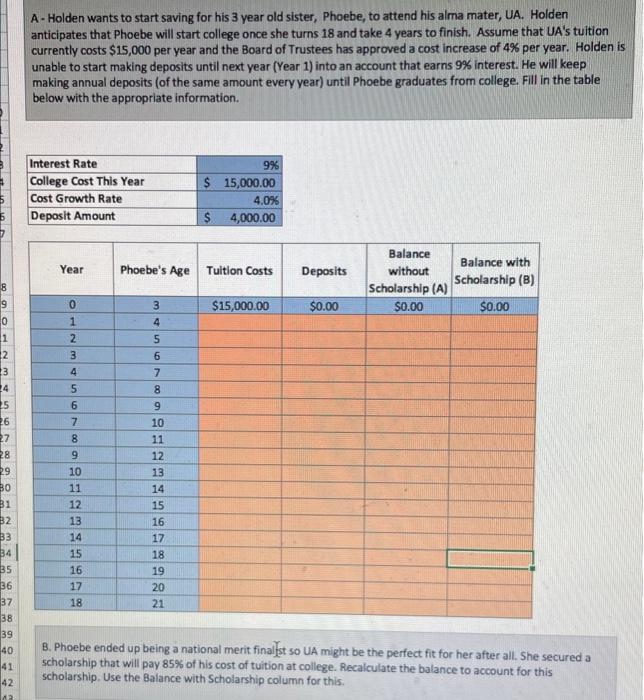

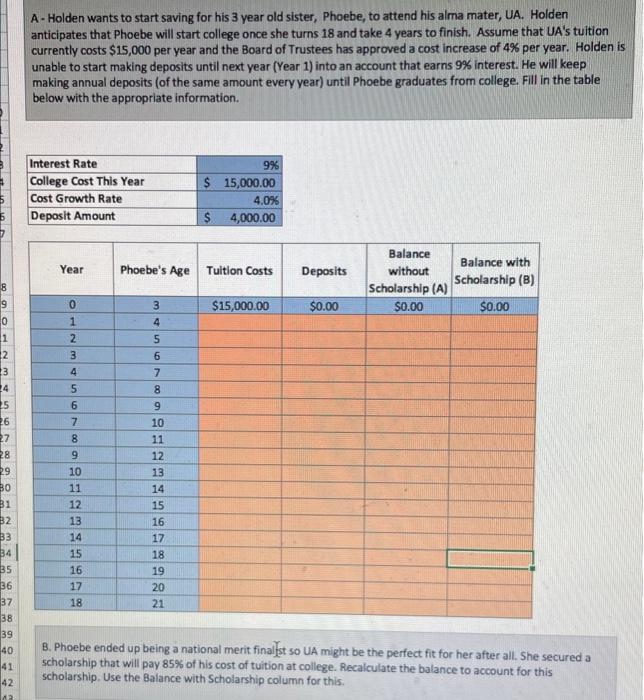

A-Holden wants to start saving for his 3 year old sister, Phoebe, to attend his alma mater, UA. Holden anticipates that Phoebe will start college once she turns 18 and take 4 years to finish. Assume that UA's tuition currently costs $15,000 per year and the Board of Trustees has approved a cost increase of 4% per year. Holden is unable to start making deposits until next year (Year 1) into an account that earns 9% interest. He will keep making annual deposits (of the same amount every year) until Phoebe graduates from college. Fill in the table below with the appropriate information. Interest Rate 9% College Cost This Year $ 15,000.00 Cost Growth Rate 4.0% Deposit Amount $ 4,000.00 Year Tuition Costs Deposits Balance without Scholarship (A) $0.00 Balance with Scholarship (B) $0.00 0 $15,000.00 $0.00 8 9 10 13 11 14 12 15 13 16 33 14 17 34 15 18 35 16 19 36 17 20 37 18 21 38 39 40 B. Phoebe ended up being a national merit finalist so UA might be the perfect fit for her after all. She secured a scholarship that will pay 85% of his cost of tuition at college. Recalculate the balance to account for this scholarship. Use the Balance with Scholarship column for this. 41 42 4 8 0 1 12 3 24 25 26 27 28 29 30 31 32 1 2 3 4 5 6 7 Phoebe's Age 3 4 5 6 7 8 9 10 11 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started