Answered step by step

Verified Expert Solution

Question

1 Approved Answer

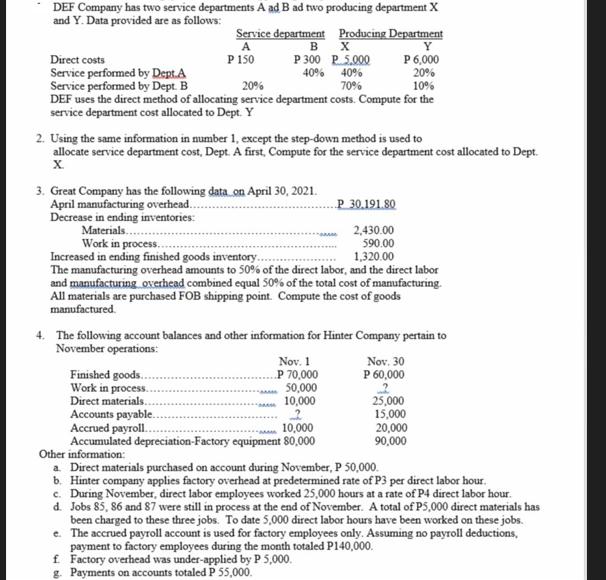

DEF Company has two service departments A ad B ad two producing department X and Y. Data provided are as follows: Service department Producing

DEF Company has two service departments A ad B ad two producing department X and Y. Data provided are as follows: Service department Producing Department A P 150 Direct costs Service performed by Dept.A Service performed by Dept. B 20% DEF uses the direct method of allocating service department costs. Compute for the service department cost allocated to Dept. Y BX P 300 P 5.000 40% 40% 70% 2. Using the same information in number 1, except the step-down method is used to allocate service department cost, Dept. A first, Compute for the service department cost allocated to Dept. X 3. Great Company has the following data on April 30, 2021. April manufacturing overhead.... ..P. 30.191.80 Decrease in ending inventories: Materials... 2,430.00 Work in process. 590.00 Increased in ending finished goods inventory. 1,320.00 The manufacturing overhead amounts to 50% of the direct labor, and the direct labor and manufacturing overhead combined equal 50% of the total cost of manufacturing. All materials are purchased FOB shipping point. Compute the cost of goods manufactured. Finished goods.. Work in process. Direct materials. Y P 6,000 20% 10% 4. The following account balances and other information for Hinter Company pertain to November operations: Nov. 1 P 70,000 50,000 10,000 2 10,000 Accumulated depreciation-Factory equipment 80,000 Accounts payable. Accrued payroll.. Other information: Nov. 30 P 60,000 2 25,000 15,000 20,000 90,000 a. Direct materials purchased on account during November, P 50,000. b. Hinter company applies factory overhead at predetermined rate of P3 per direct labor hour. c. During November, direct labor employees worked 25,000 hours at a rate of P4 direct labor hour. d. Jobs 85, 86 and 87 were still in process at the end of November. A total of P5,000 direct materials has been charged to these three jobs. To date 5,000 direct labor hours have been worked on these jobs. e. The accrued payroll account is used for factory employees only. Assuming no payroll deductions, payment to factory employees during the month totaled P140,000. f. Factory overhead was under-applied by P 5,000. g. Payments on accounts totaled P 55,000. Compute for the work in process on November 30. 5. Using the data in no. 4, compute for the cost of goods manufactured. 6. Using the same data in no. 4, compute for the cost of goods sold.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Lets solve each problem step by step 1 Calculation of service department cost allocated to Dept Y using the direct method Service performed b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started