Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Define ex ante and ex post returns. Why do investors have the need for both ex ante and ex post measures of asset performance?

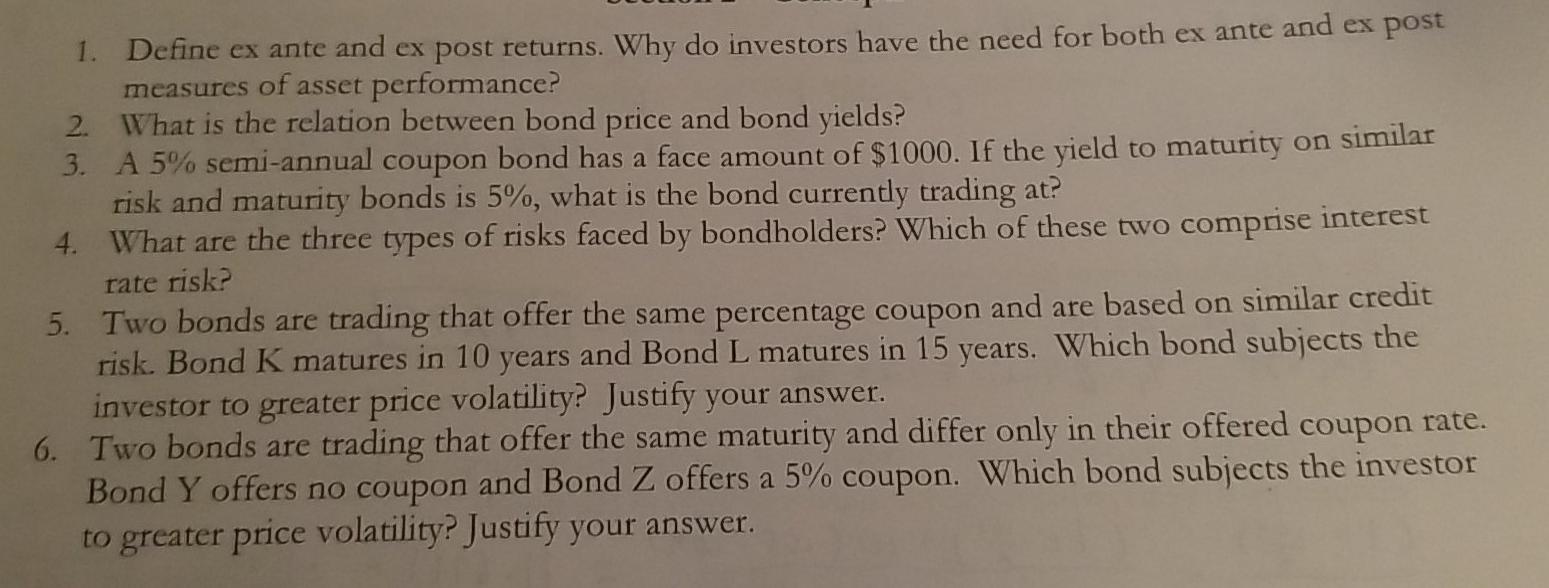

1. Define ex ante and ex post returns. Why do investors have the need for both ex ante and ex post measures of asset performance? 2. What is the relation between bond price and bond yields? 3. A 5% semi-annual coupon bond has a face amount of $1000. If the yield to maturity on similar risk and maturity bonds is 5%, what is the bond currently trading at? 4. What are the three types of risks faced by bondholders? Which of these two comprise interest rate risk? 5. Two bonds are trading that offer the same percentage coupon and are based on similar credit risk. Bond K matures in 10 years and Bond L matures in 15 years. Which bond subjects the investor to greater price volatility? Justify your answer. 6. Two bonds are trading that offer the same maturity and differ only in their offered coupon rate. Bond Y offers no coupon and Bond Z offers a 5% coupon. Which bond subjects the investor to greater price volatility? Justify your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started