Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) DEFINE PORTER'S FIVE FORCES WITH EXPLANATION FOR OTC MEDICINE AND CITE EVIDENCE FROM THE CASE STUDY 2) DEFINE KEY SUCCESS FACTORS AND CITE THE

1) DEFINE PORTER'S FIVE FORCES WITH EXPLANATION FOR OTC MEDICINE AND CITE EVIDENCE FROM THE CASE STUDY

2) DEFINE KEY SUCCESS FACTORS AND CITE THE EVIDENCE FROM THE CASE STUDY

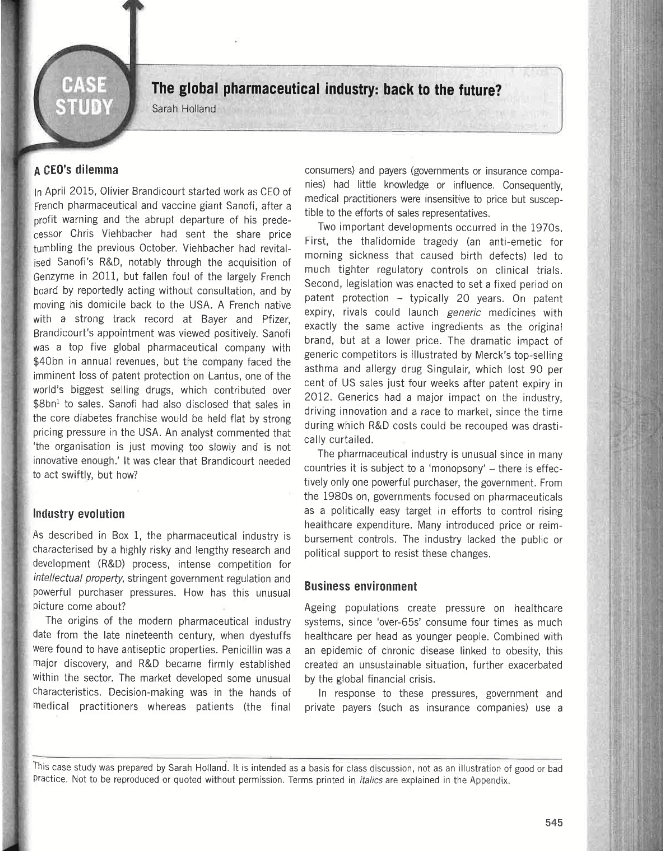

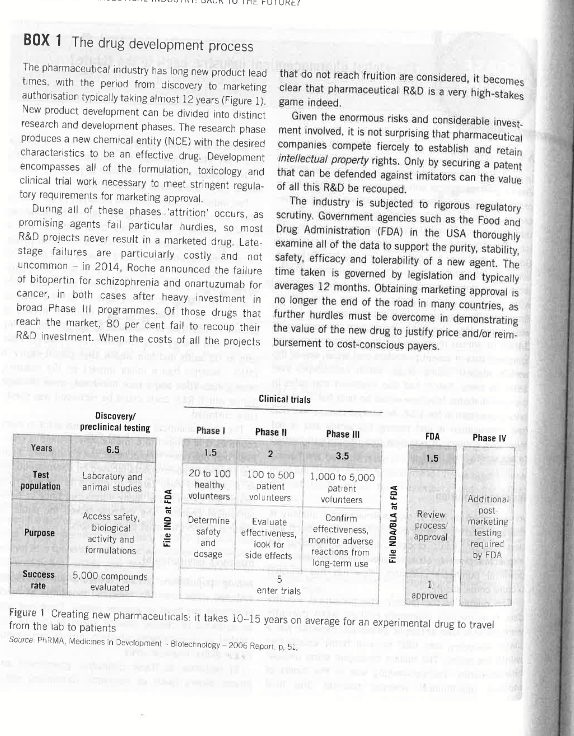

GASE The global pharmaceutical industry: back to the future? Sarah Holland A CEO's dilemma consumers) and payers (gowernments insurance compa- In April 2015, Olivier Brandicourt started work as CFO of nies) had little knowledge or influence. Consequently, French pharmaceutical and vaccine giant Sanofi, atter a medical practitioners were insensitive to price but suscepprofit warning and the abrupt departure of his prede- tible to the efforts of sales representatives. cessor Chris Viehbacher had sent the share price Two important developments occurred in the 1970s. tumbling the previous October. Viehbacher had revital- First, the thalidomide tragedy (an anti-emetic for ised Sanofi's R\&D, notably through the acquisition of morning sickness that caused birth defects) led to Genzyme in 2011, but fallen foul of the largely French much tighter regulatory controls on clinical trials. bcard by reportedly acting withoLt consultation, and by Second, legislation was enacted to set a fixed periad on moving his domicile back to the USA. A French native patent protection - typically 20 years. On patent with a strong track record at Bayer and Pfizer, expiry, rivals could launch generic medicines with Brandiccurt's appointment was viewed positively. Sanofi exactly the same active ingredients as the original was a top five global pharmaceutical company with brand, but at a lower price. The dramatic impact of $40on in annual revenues, but the company faced the generic competitors is illustrated by Merck's top-selling imminent loss of patent protection on Lantus, one of the asthma and allergy drug Singulair, which lost 90 per world's biggest selling drugs, which contributed over cent of US sales just four weeks after patent expiry in $8 bn 2 to sales. Sanvof had also disclosed that sales in 2012. Generics had a major impact on the industry, the core diabetes franchise would be held flat by strong driving innovation and a race to market, since the time pricing pressure in the USA. An analyst commented that during which R\&D costs could be recouped was drasti'the organisation is just moving too slowiy and is not cally curtailed. innovative enough.' It was clear that Brandicourt needed The pharrmaceutical industry is unusual since in many to act swiftly, but how? countries it is subject to a 'monopsory' - there is effectively only one powerful purchaser, the government. From the 1980 s on, governments focused on pharmaceuticals Industry evolution as a politically easy target in efforts to control rising characterised by a highly risky and lengthy research and political support to resist these changes. development (R\&D) process, intense competition for intellectual property, stringent government regulation and powerful purchaser pressures. How has this unusual Business environment picture come about? Ageing populations create pressure on healthcare The origins of the modern pharmaceutical industry systems, since 'over-65s' consume four times as much date from the late nineteenth century, when dyestuffs healthcare per head as younger people. Combined with were found to have antiseptic properties. Penicillin was a an epidemic of chronic disease linked to obesity, this major discovery, and R\&D became firmly established created an unsustainable situation, further exacerbated within the sector, The market developed some unusual by the giobal financial crisis. characteristics. Decision-making was in the hands of In response to these pressures, government and medical practitioners whereas patients (the final private payers (such as insurance companies) use a This case study was prepared by Sarah Holland. It is intended as a basis for class discussion, not as an illustration of good or bad practice. Not to be reproduced or quoted without permission. Terms printed in italics are explained in the Appendix. BOX 1 The drug development process The pharmaceutical indiustry has long new product lead that do not reach fruition are considered, it becomes tmes, with the period from discovery to marketing clear that pharmaceutical R&D is a very high-stakes autharisation typically taking almost 12 years (Figure 1). game indeed. New product develaprnent can be divided into distinct Given the enormous risks and considerable investresearch and development phases. The research phase ment involved, it is not surprising that pharmaceutical produces a new chemical entity (NCE) with the desired companies compete fiercely to establish and retain charactaristics to be an effective drug. Development intellectual property rights. Only by securing a patent, encompasses all of the formulation, toxicology and that can be defended against imitators can the value clinical trial wark necessary to reet stringent regula- of all this R\&D be recouped. tory requirements for marketing approval. The industry is subjected to rigorous regulatory During all of these phases : 'attrition' occurs, as scrutiny. Government agencies such as the Food and promising agents fail particular hurdies, so most Drug Administration (FDA) in the USA thoroughly R\&D projects never result in a marketed drug. Late- examine all of the data to support the purity, stability, stage failures are particularly costly and nat safety, efficacy and tolerability of a new agent. The uncommon - in 2014, Roche announced the failure time taken is governed by legislation and typically of bitopertin for schizophrenia and onartuzumab for averages 12 months. Obtaining marketing approval is cancer, in both cases after heavy investment in no longer the end of the road in many countries, as broac Phase III programmes. Of those drugs that further hurdles must be overcome in demonstrating reach the market, 80 per cent fail to recoup their the value of the new drug to justify price and/or reimR\&D investment. When the costs of all the projects bursement to cost-conscious payers. Figure 1 Creating new pharmaceuticals: it takes 10-15 years on average for an experimental drug to travel from the lab to patients Source PhRMA, Medieines in Development - Biolechndogy - 2006 Repart. D. Si. THE GLOBAL PHARMACEUTICAL INDUSTRY; BACK TO THE FUTURE? Table 1 Methods used to control pharmaceutical spending Where the pattent pays somene dif the drug cost. variety of methods to control pharmaceutical spending cost of diabetes - the fastest-growing chronic disease in (see Table 1). Some put the emphasis on the manufac the world - found that 60 per cent was driven by hospiturer and distributor, others on the prescriber and patient. talisations, which could often be avoided by correct Controls are designed to reward genuine advances - price outpatient use of medicines. Companies have introduced andior reimoursement levels are based on perceived inno- disease management initiatives, which focus on the goals vation and superior effectiveness. of the healthcare system for a specific disease. Firms In countries with supply-side controls, negotiating then offer a broad-based service to improve disease orice or reimbursement can take up to a year. In those outcomes, positioning their products as part of the soluwith demand-side controls, market penetration is delayed tion. Another approach is the "pay for performance" deal; while negotiating with bodies such as the National for example, UK reimburserrent of the cancer drug institute for Clinical Excellence (NICE) in the UK. NICE Velcade was linked to disease response. An innovative typifies a general trend towards evidence-based medi- deal was struck in Italy, where Roche agreed to be paid cine, where payers expect objective evidence of effec- different amounts for the cancer drug Avastin depending tiveness to justify funding new therapies. The impact of on the type of cancer for which it was prescribed, based NICE decisions reverberates beyand the UK, as coun- on its varying cost-effectiveress. tries collaborate internationally on value assessments. Payers value 'real-world evidence', i.e. how drugs Where new drugs are approved for funding, this is perform in real populations rather than the artificial increasingly in the context of formal patient selection populations studied in trials. One challenge in demonand treatment guidelines, so their use is carefully strating real-world drug performance is that countercontrolled and individual prescribers have limited feit products are a growing problem, putting patient decision-making power. safety and lives at risk. In 2012, tainted stercids Switching to generics is one way to cut drug expendi- kilied 11 people near Boston and sickened another ture. Countries are experimenting with 'e-prescribing' 100..2 More than 27 million counterfeit mecicine artiwhere physicians are presented with recommended cles were seized at EU borders in 2011, and at least options. Payers are increasingy effective in establishing one to two per cent of global sales, or cver $100bn generic drugs as first-line treatment for chronic diseases were estimated to be counterfeits by 2012." Drug such as osteoporosis, asthma and depression, with manufacturers and distributors are forced to invest in patented drugs only used if generics fail to work. In countermeasures, such as traceability and authenticavolume terms, generic drugs are growing and patented tion technologies. drugs are in decline - falling from 50 per cent of US Government price contro's create another chaflenge prescriptions in 2005 to barey over 12 per cent by 2014 for the industry in the form of 'parallel trade'. The prin- so sales growth for patented drugs relies on securing ciple of free movement of goods across the EU mean ever higher prices for innowation. that distributors are free to source drugs in low price The industry has adopted a number of strategic markets and ship them to high price markets, pocketing responses to these challenges. Pharmacoeconomic eval- the diiference. EU parallei trade was estimated at: uations are conducted to demonstrate the added value 5.4bn in 2013, with the highest penetration in offered by a new drug due to improved efficacy, safety. Denmark where it accounted for nearly a quarter of phartolerability or ease of use. For example, a study of the macy sales, Industry sectors 1990s, US generics prices collapsed, accompanied by a Prescription-only or ethical drugs contrioute about shakeout to determine cost leadership. The speed and 85 per cent ($865bn) of the $1 trn giobal pharmaceutical aggression of generic attacks on branded products market by value and 50 per cent by volume. Ethical increased sharply. Econcmies of scale, including finance products divide into conventional pharmaceuticais and to support complex patent disputes, proved decisive and mare complex biophamaceutical agents and vaccines the sector consolidated, with only four companies (see Box 2). The other 15 per cent of the market holding nearly half the global market by 2014, Given the comprises over the counter (OTC) medicines, which may number of blockbusters undergoing patent expiry and be purchased without prescription. Both ethical and OTC markets with still untapped potential (e.g. Spain, France, medicines may be patented or generic. Japan), not surprisingly growth in generics outstrips the The typical cost structure of ethical pharmaceutical overall market. The global market for generics is projected companies comprises manufacturing of goods 25 per to increase from $260bn in 2012 to over $400 bn by cent), research and development (16-24 per cent), 2017, with a compound annual growth rate of 11 per administration (10 per cent), and medical education, cent, contributing half of absolute market growth. marketing and sales (25 per cent). The key strategic A new type of industry player appeared in the 1980 s capabilities of these companies are R\&D and medical small biotechnology start-ups backed by venture capitai education, marketing and sales. Pressure on margins to exoloit the opportunities created by molecuiar created an incentive to restructure manufacturing, ration- biology and genetic engineering. Initially, bjotechs were alising and relocating production sites and outsourcing to associated with biologics (see Box 2). Biotechs now contract manulacturing organisations (CMOs). pursue a huge variety of core capabilities, creating an Manufacturing and distribution efficiency is key for extraordinarily diverse and innovative sector. Because of generics manufacturers, whose operating margins are the long product development cycie, most biotechs take typicaily less than half that of ethical companies. In the years to reach profitability, if at all, and revenues are BOX 2 Biologics - the industry saviour Biopharmaceuticals or 'bioiogics' are large molecules Olivier Brandicourt arrived as CEO. The marketed drugs that behave like natural substances, such as proteins Zaltrap and Praluent, as well as a number of late-stage and monocional antibodies. The discovery and design assets, were fruits of this deal, and Sanofi hoped that of biologics entails optimising specificity and affinity the latest agreement would catapult the company into and making the molecules as close to human a competitive position in the exciting field of immunosubstances as possible to avoid provoking an immune oncology. response. Produced through large-scale fermentation In adolition to lower attrition and superior pricing, in costly plants, biologics are given by injection and biologics are at less risk from gerieric threat. The used to treat specialist conditions such as cancer and sophisticated capabilities required to develcp and rheumatoid arthritis. Biologics are much more specific manufacture a complex biosimilar product take in their action than small molecules; this avoids unex- substantial investment. Furthermore, regulators were pected 'off target' side-effects and increases success slow to clarity requirements for approval. However, rate from Phase I to launch from 7 per cent to top generics companies clearly saw the potentia!. 12 per cent. Because of their benefits and use in Sandoz led the way with human growth hormone and high-unmet-need diseases, biologics generaily secure erythropoietin in the EU, and scored the first US righer prices than small molecules. approval of a biosimilar in 2015. The lure of stealing Initialiy associated with biotechs, biologics became sales from biockbuster biologics attracted nan-. mainstream - contributing $230bn in 2014 -and were traditional players into the fieid, such as GE expected to provide six of the top ten brands by 2020 . Heaitheare, Celltrion and Samsung. Even sc, sericus Companies that invested early benefited from this rapid biosimilar competition was nct expected before 2018 growth. Others noted their success and many acquired and although markets with tender systems saw rapic biologics capabilitios. Sanofi entered into a strategic penetration, price erosion was likely to be more partnership with US biotech Regeneron in 20C, gradual and less severe than with smiall molecule extended in 2009 and further built on in 2015 after generic.5. concentrated in a tiny subgroup of highly profitable Another important category of medicine is vaccines, a firms. During the giobal credit squeeze biotech IPOs key industry growth driver. Prophylactic vaccines provide became very rare and, as access to venture and debt life-long protection against serious diseases, preventing funding dried up, corporate venture funds of big pharma at least three million deaths annually worldwide and companies became an important source of start-up saving an estimated $720 healtheare dollars per dollar funding. Investment pickod up in 2011, as scientific spent on vaccines. This nearly $30 bn market is highly breakthroughs reignited belief in the sector, and reached concentrated: just five global players account for nearly record levels by 2014. An amazing 41 FDA approvals of 80 per cent. Global vaccine sales tripied between 2005 novel drugs in 2014 encouraged an IPO boom: 50 and 2013 with launches of high-priced vaceines for new companies raised over $50bn in the first half of 2015 , applications such as human papilloma virus (HPV). Entry leading to fears of a 'biotech bubble'. barriers are high, with specialised skills required in OTC medicines are bought by consumers without a manufacturing, conducting large and complex clinical prescription. The global OTC market was estimated at trials and managing surveillance programmes. Vaccines $120bn in 2014, with the top ten manufacturers have higher development success rates and a lower risk accounting for more than half. Consumer brand loyalty of generic entry than conventional medicines, while provides defence against generic competition and offeringblockbuster sales potential. Novartis, AstraZeneca prolongs the product life cycle. Consistertly outper- and Pfizer ail entered the sector through acquisitions, forming the ethical sector globally, OTC sales are boosted while Brandicourt benefited from an enviable heritage by innovation, promotion of self-medication and expan- through Sanofi Pasteur. sion of distribution channels. Sales have accelerated in emerging markets, providing global players with a rare Key markets 5ource of growth and a quick way to gain presence in these key markets. Consumer marketing skiils are key, The majority of pharmaceutical saies originate in the especially with new competition from companies such as USA, Japan, China, the EU and Brazil, with ten key counDanone and Nestl, who are capitalising on consumer tries contributing 75 per cent of the global market. interest in personal welibeing by making health claims Pharmaceutical market growth is strongly aligned with for so-called nutracouticais. GDP growth. The USA is by far the largest market by BOX 3 US dominance under threat? A number of factors contributed to industry globalisa- domestic beginnings, Once again, the USA domition, Chief is the international convergence of medical nated: publicly-traded biotechs employed over four science and practice under the infiuence of modern times more people in the USA than in the EU, with a communications technology and increased travel and similar ratio for R\&D spend. US biotechs secured the information exchange. Well-funded US universities majority of venture capitai investment. and hospitals generally led their fields, while US in the longer term, US pre-eminence in biornedscientific congresses provided the most prestigious ical research could be under threat from Asia. platforms for new discoveries. Global companies were opening R\&D sites in Asia, Leading corporations globalised, with presence in while closing them in the USA and EU. The Chinese all significant markets. Production sites had a global government declared its intention to become a mandate and were selected by wcrldwide screening. leader in the fieid and poured money into new R\&D was sourced from best place worldwide, which universities and science parks, with the result that often meant the USA. Strong US market growth gave the number of Chinese graduates in natural US companies a springboard in achieving global ambi- sciences avertook the USA by 2004. Routine tions, and in 2014 they occupied six of the top ten chemistry and toxicology were already often slots isee Table 2 below). outsourced to China, but as US returnees and Biotechnology companies were 'born global'; from home-grawn talent sought more innovative projects, their incestion they drew upon a global pool af collab- a fully integrated life science innovation ecosystem orators and investors, rather than growing from smail began to emerge. THE GI OBAL PHARMACEUTICAL INDUSTRY: BACK TO THE FUTURE? findings into proven innovative treatments that are for example, Novartis and GlaxoSmithKline swapped widely available and accessibie.? Companies with oncology and vaccine portfolios, whife Brandicourt consistently high levels of R\&D spending and produc- streamlined Sanofi's R\&D. They invested in alliances tivity became industry leaders. For this reason, stock with academic institutions, seeking depth of expertise. market valuations place as much importance on the Strategic out-sourcing to contract research organisations R\&D pipeline (i.e. the products in development) as on (CROs) reduced fixed costs and leveraged lower cost marketed products. geographies. Lilly created a special urit to conduct small The holy grail of pharmaceutical R\&D was the block- clinical tests to quickly and cheaply shake out molecules buster. Blockbuster drugs are genuine advances that that were not going to make it. Recognising that biopharachieve rapid, deep market penetration. Because of their maceuticals had a lower attrition rate, companies superlative market performance, blockbusters determine acquired biologics capabilities - Sanofi through a crucial the fortunes of individual companies. Gilead leapt into strategic partnership with Regeneron. Some reorganised the top rank of global pharma companies thanks to their R\&D to create smaller and more rimble units: Sovaldi, which beat all records by selling $2.30 n in its GlaxoSmithKline's research centres competed for first quarter. While blockbusters make immense contri- funding like internal biotechs. Many opened R\&D sites in butions to company fortunes, they are few and far innovation 'hotspots', such as the US West coast, between. Andrew Witty, the CEO of GlaxoSmithKline, Boston and Asia. All sought external innovation through likened the hunt to 'finding a needle in a haystack right licensing deal 5 and acquisitions, although with few real when you nead it". jewels available the cost of deals spiralled. Focusing on blockbusters exposed an already high- To better manage some of the tremendous risks stakes industry to even greater levels of risk. This was inwolved, companies moved towards a more networkdramatically brought home in September 2004 when the based approach to innovation. For diseases that were just cardiovascular safety risks of Vioxx emerged, and Merck too tough to tackle alone, 'pre-competitive' collaboration withdrew the brand from the market. Merck lost $2.5bn allows costs and insights to be shared. Companies, founin sales, a quarter of its stock market value, and faced dations and regulators working on Alzheimer's disease the prospect of numerous liability suits. Blockbusters pooled data and resources to create shared underalso exaceroate the impact of patent expiries, creating a standing. Where large, long-term outcome studies were so-called 'patent cliff'. Companies were projected to lose needed, companios pooled assets, moving only the best nearly $100bn in sales due to generic erosion on small forvard. In diabetes, AstraZeneca and BMS paired up to molecule drugs alone up to 2018, when the impact of develop drugs together, sharing cost, risk and reward, as biosimilars would also start to bite. Witty argued that the did Lilly and Bcehringer Ingelheim. industry must move from being 'blockbuster dependent' There are encouraging signs that industry's focus on to 'blockbuster capable's - i.e, able to develop and meaningful clinical benefit, together with the FDA's commercialise blockbusters, but also efficient at devel- explicit support for drugs designated as 'breakthroughs', oping and commercialising a steady stream of drugs in is finally delivering improved R\&D productivity and the \$50-500m range. desperately needed revenue. The FDA approved 41 Unforturately, R\&D productivity has declined and NMEs in 2014, of which eight were expected to sell over development times lengthened. The average cost to $1bn within five years of launch. develop a new orug is estimated at $1.4bn9 and has grown at doubie the rate of inflation for 20 years. Despite increasing R\&D spend from 11 per cent of annual sales Sales and marketing to 20 per cent or more, the industry struggles to replace Historically, sales and marketing capability was importhe value lost through patent expiries. Attrition increased tant to competitive advantage. A company that ceveloped as companies put higher hurdies in place to address a strong globai franchise with its customers could payer needs for meaningful clinical benefit. Employing maximise return on its products and was in a good posithousands of in-house scientists to develop drug candi- tion to attract the best in-licensing candidates. dates from scratch became a billion dollar gamble that The traditional focus of drug marketing was the simply wasn't delivering. From 2008 omwards, industry personal detail in which a sales representative (rep) R\&D spencing growth slowed rapidly, and actually discussed the merits of a drug in a face-to-face meeting declined in 2012 . with a doctor and provided free samples. Promotion is Companies endeavoured to become both creative and subject to industry self-regulation. For example, in the efficient. They narrowed their areas of therapeutic focus: UK, reps have to pass an examination testing medical THE GLOBAL PHARIAACEU TICAL INDUSTRY: BACK TO THE FUTURE? kncwledge. in some countries, government regulatory employment. 10 So how has an industry that delivers all agencies check that promotional ciaims are consistent these benefits acquired such a tarnished image and with the data. become an easy target for government intervention? There were important differences in the marketing of Pharmaceuticals have the characteristics of a 'public 'primary care' and 'specialist' products. Office-based good' - i.e. expensive to produce but inexpensive to practitioners generaly prescribe primary care products, reproduce. The manufacturing cost of drugs is often tiny whereas treatment with specialist products is typically compared with the cost of R\&D that led to the discovery. initiated in hospitals. Sales volume, marketing spend and Setting prices that attempt to recoup R\&D therefore look skills required differed for the two segments. Product-led like corporate greed in comparison with the very low muscle marketing was key in the primary care sector, prices charged for generics. This was exacerbated as while specialist products involved more cost-effective sales volumes dwindled and prices spiralled. targeted relationship marketing. Some companies damage the industry's overall repuThe term 'high compression marketing' was coined to tation. In July 2012, GSK paid $3bn in the largest describe global launches of prima'y care brands. This healthcare fraud settlement in US history, having pleaded involved near-simuitaneous worldwide launches, global guilty to promoting two drugs for unapproved uses. The branding and heavy investment in promotion. The airn Deputy US Attorney General declared the settlement was to create a rapid take-off curve that maxirrised 'unprecedented in both size and scope'. Even more serireturn by creating higher peak year sales earlier in the ously, companies were accused of putting profits before product life cycle. A typical example was the launch of patient safety. After the withdrawal of Vioxx, Merck was Celebrex in 1999, which netted $1 bn sales in the first accused of ignoring problems during product developnine months. In the USA, an important marketing tool ment, and publishing misleading scientific resuits. As a was DTC advertising. where spending peaked at $5.4bn consequence, the FDA was empowered to demand risk in 2006. DTC was costly because of the vast target audi- evaluation and mitigation strategies (REMS) - costly ence and expensive television advertising, but profitable. additional programmes to monitor and ensure drug safety Well-informed patients asked for crugs by brand name, after product approval. Soon one third of nev drug creating a powerfu' 'pull' strategy. Sales force size was a key competitive attribute. The industry also faces condemnation of its response However, as primary care blockbusters dried up, sales to the enormous unmet need in developing countries. force productivity declined sharply. Over 500,000 saies Although effective drugs and vaccines exist for many reps were made redundant between 2006 and 2008 , diseases affecting millions, often their cost is beyond the while use of contract sales forces and digital channels means of the people who need them. It is argued that increased. As pipelines shifted to high-unmet-need companies could realocate R\&D efforts in favour of tropdiseases treated by specialists, the era of lavish launches ical diseases, sell low-priced essential drugs and provide and massive sales forces was over. Selling became a technology transfer. In response, most global players more complex process with muitiple stakeholders inter- donate medicines for neglected diseases, and a few go ested in cost-effectiveness as well as clinical arguments, further, for example making molecules and patents freely requiring new skills. Crucially for bg pharma, size is no available to researchers. longer a critical advantage: in fact, the fastest growing companies are specialty players such as Gilead, Biogen and Celgene. Industry mergers and acquisitions The pharmaceutical market is fragmented, with very Corporate social responsibility large numbers of domestic and regional piayers, but Today's EU citizens can expect to live up to 30 consolidated at the global level, with the top ten compalonger than they dis an expect to live up to 30 years nies holding 34 per cent of the market in 2014. Table 2 ment can be atribu a century ago. Much of this improve- shows how the industry responded to the patent ciff and ment can be attributed to pharmaceutical innovation. For ceclining productivity with a wave of mergers and acqui. example, EU deaths from AIDS fel, by three quarters sitions. Mergers resulted in the formation of Novartis. between 2004 and 2013. Few other industries have done Sanofi, AstraZeneca and GlaxoSmithKline, while Pfizer as much for the well-being of mankind. Furthermcre, at a acquired Warner-Lambert, Pharmacia and Wyeth. global level the industry has the highest ratio of R\&D to A striking development was the sudden appearance of net sales, funds nearly a fifth of all industr al R\&D invest- Gilead on the leader board - clear evidence that a single ment, and makes a significant contribution to skilled blockbuster can change company fortune. 552 One rationale for M\&A was to acquire global commer- announced planned legislative changes that scuppered cial reach. The acquisition of Nycomed transformed the deal. Takeda from a Japanese player with limited geographic reach to a global company. Companies also used M\&A to access growth segments. In February 2011, Sanofi Where next? acquired Genzyme, the leading player in rare disease, At the start of 2016, the global pharmaceutical industry one of pharma's few growth areas. Sanofi also acquired faced its most positive outlook in decades, but also a Medley, the third largest pharmaceutical company in greater degree of turmoil than ever before. As economies Brazil, in 2009, and merged with the Chinese company of scale no longer played a critical role, and size underBMP Sunstone in 2011. Other industry acquisitions mined crucial R\&D productivity, industry giants were increased presence in vaccines, biologics, consumer supplanted by much faster growing mid-sized players. Thealth and generics. Buying exciting assets could also boost growth. through a spate of M\&A transactions. Investment in Alongside the IPO market, M\&A offered another way for biotechs had reached record levels, thanks to a combinaventure capitalists to recover the cash invested in early tion of scientific breakthroughs and regulatory support stage biotechs. Those with the best programmes could for meaningful advances. However, as innovative pharcommand remarkable prices, as desperate big pharmas, maceuticals were used in ever lower volumes at ever Japanese companies seeking to globalise and newly-rich higher prices, becoming akin to a luxury good, pharmaspecialty players all entered the fray. Public companies ceutical pricing was a focus of public debate, putting the were targets too: when Gilead placed its $11 bn bet on whole industry model at risk. what was essentially a one-drug company with its An intriguing response to environmental change was purchase of Pharmasset in late 2011, there were pioneered by Roche, who positioned themselves as operconcerns that it had massively overpaid. Gilead was the ating a 'personalised healthcare' business model. Roche world leader in combination therapies for HIV and saw was the global leader in diagnostics and their strategy the opportunity to repeat this success in HCV. This belief was to offer value through targeting treatments to was vindicated with the highest US sales of any company patients that would benefit most. This concept appealed in 2014, as well as the most valued pipeline product, and to regulators and payers, who endorsed the linkage of Gilead was forecast to capture over half the global anti- high-priced cancer drugs such as Zelboraf for melanoma viral market by 2020 . With diagnostic tests to identify suitable patients. Mergers were also strongly motivated by falling Investing in discovery and development of tests added revenue and the attraction of eliminating duplicated further to cost and complexity, but offered the chance to costs. Within a month of merging with Wryeth, Pfizer reduce attrition, build unique competencies and secure announced a 35 per cent reduction in R\&D square rapid market uptake. Most of the Roche pipeline was footage with six site ciosures. Another way to cut costs being developed with companion diagnostics. was to relocate to a more attractive tax domicile. A A related but more embryonic field was healthcare striking example was Actavis, which first built critical information technology. Other sectors were able to mass as a generics player, cost-stripping and moving to analyse huge data sets to generate and exploit highly Ireland in the process. Fuelled by very cheap debt, it personalised consumer insights, but the pharmaceutical acquired Forest Laboratories for $25bn in 2014 , along industry was slow to hamess the power of 'big data'. with CEO Brent Saunders. Shifting tax domicile for Electronic health records offered an opportunity to Forest's US income was quickly accretive to earnings. detect patterns and gain new insights. However, there Alongside smaller purchases, Actavis then acquired the were huge challonges: even simple tests were not standhighly respected California company Allergan (best- ardised between hospitals, and adoption rates were low known for Botox), for $70bn. Saunders adopted the with poor inter-operability of medical records systems. Allergan name, and promptly soid the generics business Nevertheless, visionary players were starting to tackle to Teva for $40.5bn to cement rebranding as a specialty these problems. In August 2015, Sanofi announced a 'growth' pharma. This dizzying series of deal's culminated collaboration with Google Life Science aimed at improving in November 2015 in the announcement that Allergan diabetes health outcomes. The companies planned to was to merge with venerable US giant Pfizer in a $160bn use data and miniaturised technology to give patients deal, with Saunders becoming President and Chief tools to self-manage their disease. The declared goal was Operating Officer of the new Ireland-based Pfizer Inc. At 'to strive to shift from episodic, event-driven diabetes this point, the US government lost patience and care to continuous, value-based care.'. THE GL OBAL PHARMACEUTICAL INDUSTRY. BACK TO THE FUTURE? Brandicourt's first year R\&D operating model was expected to boost productivity, On 6 November 2015, Brandicourt held a press confer- together with an increased emphasis on accessing ence to reveal his new Sanofi 5trategy, comprising three external innovation. The new blueprint for Sanofi's future pillars resting on a fundamental platform. The platform had thus been laid out was the much-needed simplification of the complex and unwieldy organisation, with the creation af five global business units, comprising all activities from clinical Notes and references proof of concept through to marketing and sales. ll 2, 'Gad modcine'. The Ecamamist. 13 0ctober 201?, stipport functions, including R\&D, were to be integrated 3, UCL Sctionl of Phannacy, 'Falsii ind modicines and the glocial putbcts and globalised. After many years af an unusual regionalconventional global approach, akin to Brandicourt's 6, Healtheare costs fiar mourod American famiy foo Seok in 2012 experience at Pfizer. The three strategic pillars were to Millinan', (nsurance dasmal, 15 mas 2012 reshape the portfolio, deiver outstandirg launches and privete sector contrattians to sharmaceutical scierce'. Marhatian meant focusing on those areas where Sanofi could win: Brandicourt announced a planned strategic swap of the animal health business for Boehringher Ingelheim's win marketreg approfl for 2 nrw drug is $2,6 b liagr', 28 November deals to boost core franchises. Delivering outstanding Cuntre, Directo ate Gencroi Reseanch \& Iticonation, Eurcpean launches of the rich late-stage pipeline was clearly Commissich. crucia' to estabish his credibility as the new CEO. A new Guvele-Lfe-Sclances-tis-lrmpowe-D obetes-Heatth Outcomeres APPENDIX: Glossary big pharma A group term for large globalised pharmaneu- behalf of a pharma or biotech company; this has evolved tical companies. from a project-based model to more strategic relationbiologic or biopharmaceutical Large molecules that behave ships. like natural substances, such as therapeutic proteins and detaildetailing Detaiiing refers to a sales call in which a monocional antibodies. pharmaceutical sales representative ('rep') discusses the biosimilar Molecules designed to mirnic the therapeutic merits of a drug in a face-to-face meeting with a doctor effects of an crignal biologic agert - similar in molec- and may provide free samples, ular structure but not identical. direct-to-consumer (DTC) DTC advertising involves commubiotech Shorthand for biotechnology, biotech companies nication of promotional messages directly to consumers typically discaver and develoo products, which may be via print, radio, televisian and the internet. diagnostics, therapeutics or vaccines. However, some disease management initiatives These involve underbiotechs simply provide services to other companies. Stand ng the goals of the healthcare system in addressing blockbuster drug that is marketed globally and has annval a specific disease. The firm then aligns itse f with the salas exceeding $1bn. healthcare providers, to offer an integrated service that branded generics Branded generics are original brands that improves eventua disease outcomes, positioning its have lost patent protection. and are priced similarly to products as one part of the solution. identica' generic medicines, but offer the reassurance ethical Ethical medicines can only be obtained with a that they are produced by an established manufactura'. prescription from a qualified medical practitioner. companion diagnostic A diagnostic product to be used evidence-based medicine Basing medical decisions, and alongside a drug, to identify pat ents that are elther best decisions to fund therapy, on objective evidence of suited, or not suited, to receive the therapy. effectiveness. contract manufacturing organisation (CMO) A service organ- Food and Drug Administration (FDA) The FDA is responisation that undertakes manufacturing activities on sible for approving drugs for marketing and regulating behaif of a pharma or biotech compeny, thus avoiding the US pharmaceutical market. the need for capitai investment in manufacturing plants. generic medicine A generic medicine contains exactly the contract research organisation (CRO) A service organisation same active ingredients as the original brand, but is that undertakes laboratory or clinical reseerch activities on typically launched at less than 60 per cent of the price. 555Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started