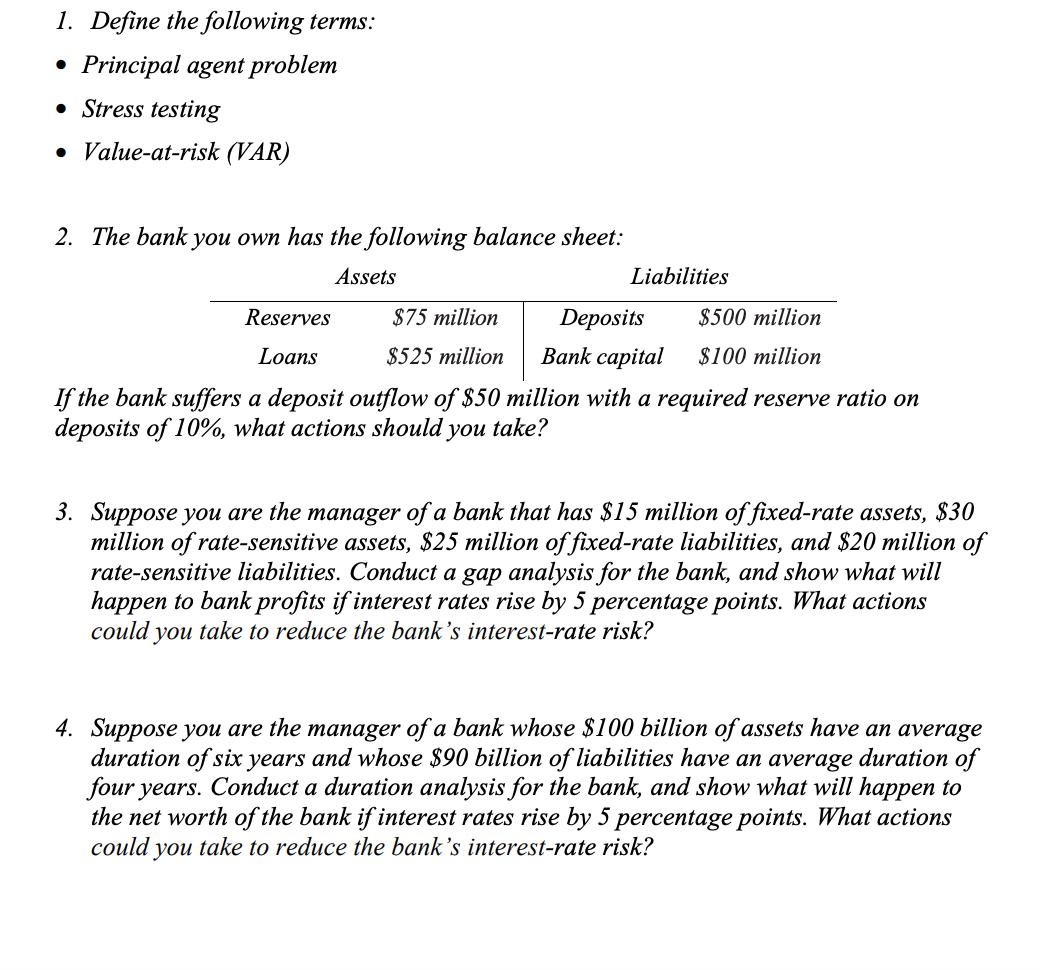

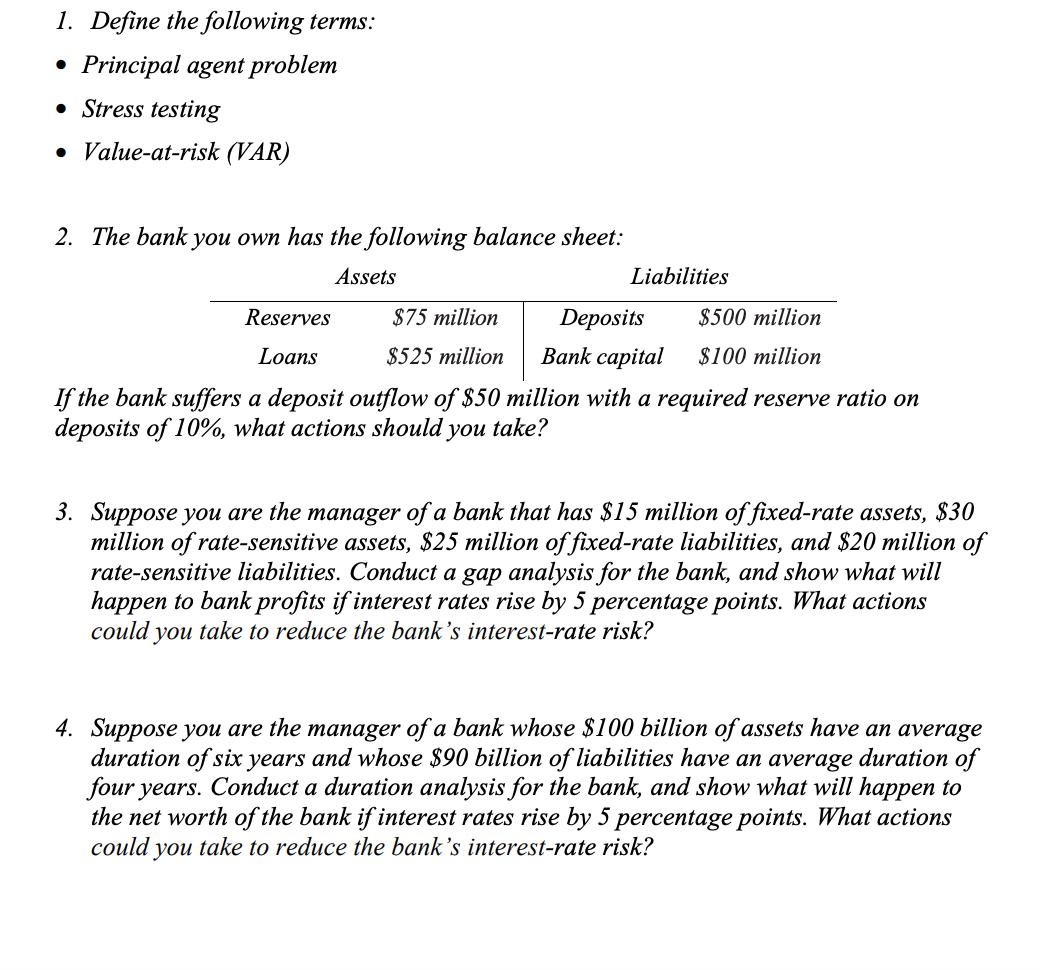

1. Define the following terms: Principal agent problem Stress testing Value-at-risk (VAR) 2. The bank you own has the following balance sheet: Assets Liabilities Reserves $75 million Deposits $500 million Loans $525 million Bank capital $100 million If the bank suffers a deposit outflow of $50 million with a required reserve ratio on deposits of 10%, what actions should you take? 3. Suppose you are the manager of a bank that has $15 million of fixed-rate assets, $30 million of rate-sensitive assets, $25 million of fixed-rate liabilities, and $20 million of rate-sensitive liabilities. Conduct a gap analysis for the bank, and show what will happen to bank profits if interest rates rise by 5 percentage points. What actions could you take to reduce the bank's interest-rate risk? 4. Suppose you are the manager of a bank whose $100 billion of assets have an average duration of six years and whose $90 billion of liabilities have an average duration of four years. Conduct a duration analysis for the bank, and show what will happen to the net worth of the bank if interest rates rise by 5 percentage points. What actions 5 could you take to reduce the bank's interest-rate risk? a 1. Define the following terms: Principal agent problem Stress testing Value-at-risk (VAR) 2. The bank you own has the following balance sheet: Assets Liabilities Reserves $75 million Deposits $500 million Loans $525 million Bank capital $100 million If the bank suffers a deposit outflow of $50 million with a required reserve ratio on deposits of 10%, what actions should you take? 3. Suppose you are the manager of a bank that has $15 million of fixed-rate assets, $30 million of rate-sensitive assets, $25 million of fixed-rate liabilities, and $20 million of rate-sensitive liabilities. Conduct a gap analysis for the bank, and show what will happen to bank profits if interest rates rise by 5 percentage points. What actions could you take to reduce the bank's interest-rate risk? 4. Suppose you are the manager of a bank whose $100 billion of assets have an average duration of six years and whose $90 billion of liabilities have an average duration of four years. Conduct a duration analysis for the bank, and show what will happen to the net worth of the bank if interest rates rise by 5 percentage points. What actions 5 could you take to reduce the bank's interest-rate risk? a