Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Define the problem 2. Frame them in financial theory 20 Divisional Costs of Capital We Are Not All Alike! Pamela Sanderson was at it

1. Define the problem

2. Frame them in financial theory

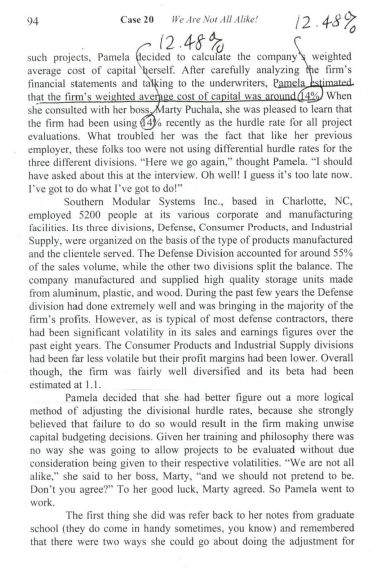

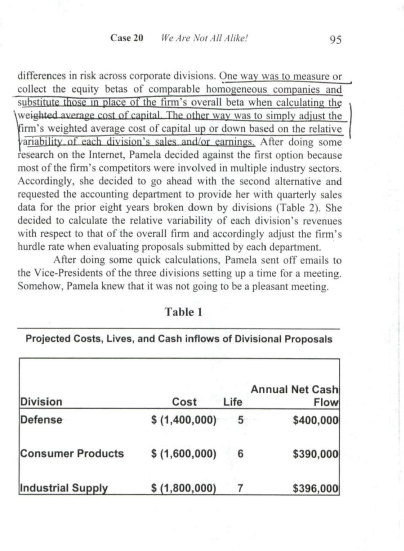

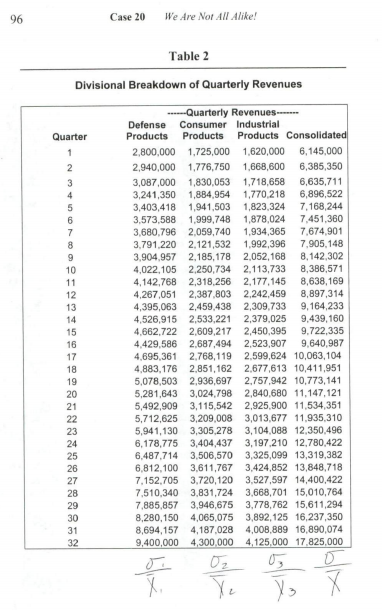

20 Divisional Costs of Capital We Are Not All Alike! Pamela Sanderson was at it again! It seemed like she made waves wherever she went. At her previous job, which incidentally was also with a Fortune 500 company, Pamela had successfully implemented a system of evaluating projects based on differential (risk-adiusted) hurdle rates. However, the change caused so much uproar and unpleasantness among divisional heads that Pamela knew her days at the job were numbered. Eventually she quit and given her sound credentials had no trouble finding another job. At her current job as Vice President of Finance for Southern Modular Systems, Pamela had to evaluate proposals that came in for funding from the firm's three product divisions: Defense, Consumer Products, and Industrial Supply. During her very first month at the job, she was presented with three funding requests, one from each department (see Table 1 for project cost and cash flow projections). Being unclear as to what the policy was regarding the hurdle rate to be used in evaluating 94 Case 20 We Are Not All like! 12.48% 12.484 TO ) such projects, Pamela decided to calculate the company weighted average cost of capital berself. After carefully analyzing the firm's financial statements and talking to the underwriters, Pamela stimated. that the firm's weighted average cost of capital was around 14 When she consulted with her boss, Marty Puchala, she was pleased to learn that the firm had been using 4) recently as the hurdle rate for all project evaluations. What troubled her was the fact that like her previous employer, these folks too were not using differential hurdle rates for the three different divisions. "Here we go again, thought Pamela. "I should have asked about this at the interview. Oh well! I guess it's too late now. I've got to do what I've got to do!" Southern Modular Systems Inc., based in Charlotte, NC, employed 5200 people at its various corporate and manufacturing facilities. Its three divisions, Defense, Consumer Products, and Industrial Supply, were organized on the basis of the type of products manufactured and the clientele served. The Defense Division accounted for around 55% of the sales volume, while the other two divisions split the balance. The company manufactured and supplied high quality storage units made from aluminum, plastic, and wood. During the past few years the Defense division had done extremely well and was bringing in the majority of the firm's profits. However, as is typical of most defense contractors, there had been significant volatility in its sales and earnings figures over the past eight years. The Consumer Products and Industrial Supply divisions had been far less volatile but their profit margins had been lower. Overall though, the firm was fairly well diversified and its beta had been estimated at 1.1 Pamela decided that she had better figure out a more logical method of adjusting the divisional hurdle rates, because she strongly believed that failure to do so would result in the firm making unwise capital budgeting decisions. Given her training and philosophy there was no way she was going to allow projects to be evaluated without due consideration being given to their respective volatilities. We are not all alike," she said to her boss, Marty, and we should not pretend to be. Don't you agree? To her good luck, Marty agreed. So Pamela went to work The first thing she did was refer back to her notes from graduate school (they do come in handy sometimes, you know) and remembered that there were two ways she could go about doing the adjustment for Case 20 We Are Nor All Alike! differences in risk across corporate divisions. One way was to measure or collect the equity betas of comparable homogeneous companies and substitute those in place of the firm's overall beta when calculating the weighted average cost of capital. The other way was to simply adjust the firm's weighted average cost of capital up or down based on the relative Variability of each division's sales and/or camings. After doing some research on the Internet, Pamela decided against the first option because most of the firm's competitors were involved in multiple industry sectors. Accordingly, she decided to go ahead with the second alternative and requested the accounting department to provide her with quarterly sales data for the prior eight years broken down by divisions (Table 2). She decided to calculate the relative variability of each division's revenues with respect to that of the overall firm and accordingly adjust the firm's hurdle rate when evaluating proposals submitted by each department After doing some quick calculations, Pamela sent off emails to the Vice-Presidents of the three divisions setting up a time for a meeting, Somehow, Pamela knew that it was not going to be a pleasant meeting. Table 1 Projected Costs, Lives, and Cash inflows of Divisional Proposals Division Defense Cost S (1,400,000) Annual Net Cash Life Flow 5 $400,000 Consumer Products $ (1,600,000) 6 $390,000 Industrial Supply S (1,800,000) 7 $396,000 Case 20 We Are Not All Alike! Table 2 Divisional Breakdown of Quarterly Revenues Quarter Quarterly Revenues- Defense Consumer Industrial Products Products Products Consolidated 2,800,000 1,725,000 1.620,000 6,145,000 2,940,000 1,776,750 1,668,600 6,385,350 3,087,000 1,830,053 1,718,658 6,635,711 3,241,350 1,884,954 1,770,218 6,896,522 3,403,418 1,941,503 1,823,324 7,168,244 3,573,588 1.999,748 1,878,024 7.451,360 3,680.796 2,059,740 1.934,365 7,674,901 3.791.220 2.121,532 1.992,396 7.905,148 3,904,957 2.185,178 2,052,168 8,142,302 4,022,105 2,250,734 2,113,733 8,386,571 4.142.768 2,318,256 2,177,145 8,638,169 4,267,051 2,387,803 2.242,459 8,897,314 4,395,063 2,459.438 2,309,733 9,164,233 4,526,915 2,533,221 2,379,025 9,439,160 4,662,722 2,609,217 2,450,395 9.722,335 4,429,586 2,687,494 2,523,907 9,640,987 4,695,361 2,768,119 2,599,624 10,063,104 4,883,176 2.851,162 2,677,613 10,411,951 5,078,503 2,936,697 2.757,942 10,773,141 5,281,643 3,024,798 2,840,680 11,147,121 5,492,909 3,115,542 2.925,900 11,534,351 5,712,625 3,209,008 3,013,677 11,935,310 5,941,130 3,305,278 3,104,088 12,350,496 6,178,775 3,404,437 3,197.210 12,780.422 6,487,714 3,506,570 3,325,099 13,319,382 6,812,100 3,611,767 3.424,852 13,848,718 7.152,705 3,720,120 3,527,597 14,400,422 7.510,340 3.831,724 3,668,701 15,010,764 7,885,857 3,946,675 3,778,762 15,611,294 8,280,150 4,065,075 3,892,125 16,237,350 8,694,157 4,187,028 4,008,889 16,890,074 9,400,000 4,300,000 4,125,000 17.825,000 20 Divisional Costs of Capital We Are Not All Alike! Pamela Sanderson was at it again! It seemed like she made waves wherever she went. At her previous job, which incidentally was also with a Fortune 500 company, Pamela had successfully implemented a system of evaluating projects based on differential (risk-adiusted) hurdle rates. However, the change caused so much uproar and unpleasantness among divisional heads that Pamela knew her days at the job were numbered. Eventually she quit and given her sound credentials had no trouble finding another job. At her current job as Vice President of Finance for Southern Modular Systems, Pamela had to evaluate proposals that came in for funding from the firm's three product divisions: Defense, Consumer Products, and Industrial Supply. During her very first month at the job, she was presented with three funding requests, one from each department (see Table 1 for project cost and cash flow projections). Being unclear as to what the policy was regarding the hurdle rate to be used in evaluating 94 Case 20 We Are Not All like! 12.48% 12.484 TO ) such projects, Pamela decided to calculate the company weighted average cost of capital berself. After carefully analyzing the firm's financial statements and talking to the underwriters, Pamela stimated. that the firm's weighted average cost of capital was around 14 When she consulted with her boss, Marty Puchala, she was pleased to learn that the firm had been using 4) recently as the hurdle rate for all project evaluations. What troubled her was the fact that like her previous employer, these folks too were not using differential hurdle rates for the three different divisions. "Here we go again, thought Pamela. "I should have asked about this at the interview. Oh well! I guess it's too late now. I've got to do what I've got to do!" Southern Modular Systems Inc., based in Charlotte, NC, employed 5200 people at its various corporate and manufacturing facilities. Its three divisions, Defense, Consumer Products, and Industrial Supply, were organized on the basis of the type of products manufactured and the clientele served. The Defense Division accounted for around 55% of the sales volume, while the other two divisions split the balance. The company manufactured and supplied high quality storage units made from aluminum, plastic, and wood. During the past few years the Defense division had done extremely well and was bringing in the majority of the firm's profits. However, as is typical of most defense contractors, there had been significant volatility in its sales and earnings figures over the past eight years. The Consumer Products and Industrial Supply divisions had been far less volatile but their profit margins had been lower. Overall though, the firm was fairly well diversified and its beta had been estimated at 1.1 Pamela decided that she had better figure out a more logical method of adjusting the divisional hurdle rates, because she strongly believed that failure to do so would result in the firm making unwise capital budgeting decisions. Given her training and philosophy there was no way she was going to allow projects to be evaluated without due consideration being given to their respective volatilities. We are not all alike," she said to her boss, Marty, and we should not pretend to be. Don't you agree? To her good luck, Marty agreed. So Pamela went to work The first thing she did was refer back to her notes from graduate school (they do come in handy sometimes, you know) and remembered that there were two ways she could go about doing the adjustment for Case 20 We Are Nor All Alike! differences in risk across corporate divisions. One way was to measure or collect the equity betas of comparable homogeneous companies and substitute those in place of the firm's overall beta when calculating the weighted average cost of capital. The other way was to simply adjust the firm's weighted average cost of capital up or down based on the relative Variability of each division's sales and/or camings. After doing some research on the Internet, Pamela decided against the first option because most of the firm's competitors were involved in multiple industry sectors. Accordingly, she decided to go ahead with the second alternative and requested the accounting department to provide her with quarterly sales data for the prior eight years broken down by divisions (Table 2). She decided to calculate the relative variability of each division's revenues with respect to that of the overall firm and accordingly adjust the firm's hurdle rate when evaluating proposals submitted by each department After doing some quick calculations, Pamela sent off emails to the Vice-Presidents of the three divisions setting up a time for a meeting, Somehow, Pamela knew that it was not going to be a pleasant meeting. Table 1 Projected Costs, Lives, and Cash inflows of Divisional Proposals Division Defense Cost S (1,400,000) Annual Net Cash Life Flow 5 $400,000 Consumer Products $ (1,600,000) 6 $390,000 Industrial Supply S (1,800,000) 7 $396,000 Case 20 We Are Not All Alike! Table 2 Divisional Breakdown of Quarterly Revenues Quarter Quarterly Revenues- Defense Consumer Industrial Products Products Products Consolidated 2,800,000 1,725,000 1.620,000 6,145,000 2,940,000 1,776,750 1,668,600 6,385,350 3,087,000 1,830,053 1,718,658 6,635,711 3,241,350 1,884,954 1,770,218 6,896,522 3,403,418 1,941,503 1,823,324 7,168,244 3,573,588 1.999,748 1,878,024 7.451,360 3,680.796 2,059,740 1.934,365 7,674,901 3.791.220 2.121,532 1.992,396 7.905,148 3,904,957 2.185,178 2,052,168 8,142,302 4,022,105 2,250,734 2,113,733 8,386,571 4.142.768 2,318,256 2,177,145 8,638,169 4,267,051 2,387,803 2.242,459 8,897,314 4,395,063 2,459.438 2,309,733 9,164,233 4,526,915 2,533,221 2,379,025 9,439,160 4,662,722 2,609,217 2,450,395 9.722,335 4,429,586 2,687,494 2,523,907 9,640,987 4,695,361 2,768,119 2,599,624 10,063,104 4,883,176 2.851,162 2,677,613 10,411,951 5,078,503 2,936,697 2.757,942 10,773,141 5,281,643 3,024,798 2,840,680 11,147,121 5,492,909 3,115,542 2.925,900 11,534,351 5,712,625 3,209,008 3,013,677 11,935,310 5,941,130 3,305,278 3,104,088 12,350,496 6,178,775 3,404,437 3,197.210 12,780.422 6,487,714 3,506,570 3,325,099 13,319,382 6,812,100 3,611,767 3.424,852 13,848,718 7.152,705 3,720,120 3,527,597 14,400,422 7.510,340 3.831,724 3,668,701 15,010,764 7,885,857 3,946,675 3,778,762 15,611,294 8,280,150 4,065,075 3,892,125 16,237,350 8,694,157 4,187,028 4,008,889 16,890,074 9,400,000 4,300,000 4,125,000 17.825,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started