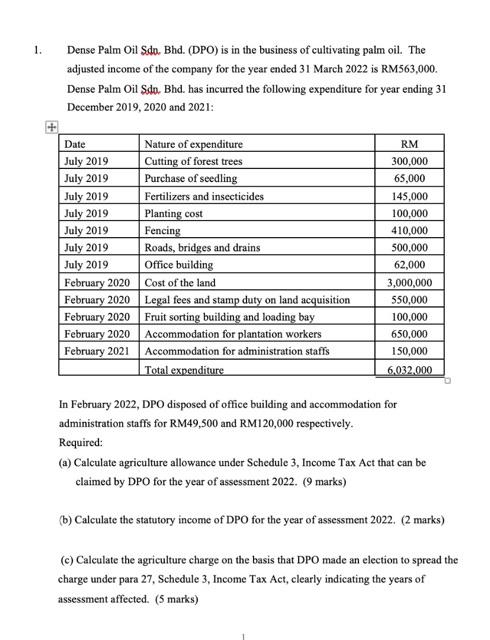

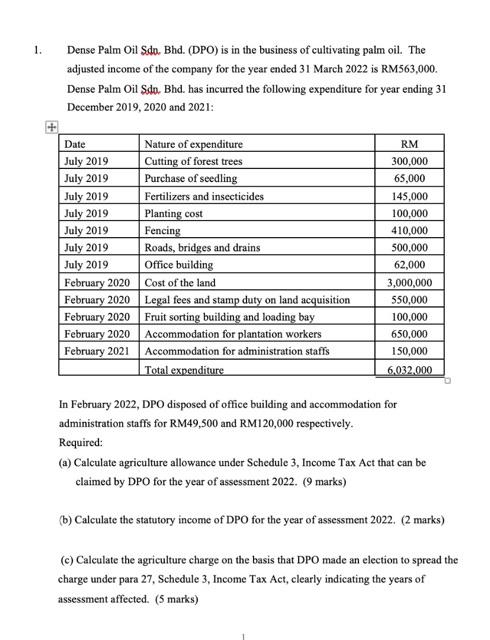

1. Dense Palm Oil Sdn. Bhd. (DPO) is in the business of cultivating palm oil. The adjusted income of the company for the year ended 31 March 2022 is RM563,000. Dense Palm Oil Sdn. Bhd. has incurred the following expenditure for year ending 31 December 2019, 2020 and 2021: Date July 2019 July 2019 July 2019 July 2019 July 2019 July 2019 July 2019 February 2020 February 2020 February 2020 February 2020 February 2021 Nature of expenditure Cutting of forest trees Purchase of seedling Fertilizers and insecticides Planting cost Fencing Roads, bridges and drains Office building Cost of the land Legal fees and stamp duty on land acquisition Fruit sorting building and loading bay Accommodation for plantation workers Accommodation for administration staffs Total expenditure RM 300,000 65,000 145,000 100,000 410,000 500,000 62,000 3,000,000 550,000 100,000 650,000 150,000 6,032,000 In February 2022, DPO disposed of office building and accommodation for administration staffs for RM49,500 and RM120,000 respectively. Required: (a) Calculate agriculture allowance under Schedule 3, Income Tax Act that can be claimed by DPO for the year of assessment 2022. (9 marks) (b) Calculate the statutory income of DPO for the year of assessment 2022. (2 marks) (c) Calculate the agriculture charge on the basis that DPO made an election to spread the charge under para 27, Schedule 3, Income Tax Act, clearly indicating the years of assessment affected. (5 marks) 1. Dense Palm Oil Sdn. Bhd. (DPO) is in the business of cultivating palm oil. The adjusted income of the company for the year ended 31 March 2022 is RM563,000. Dense Palm Oil Sdn. Bhd. has incurred the following expenditure for year ending 31 December 2019, 2020 and 2021: Date July 2019 July 2019 July 2019 July 2019 July 2019 July 2019 July 2019 February 2020 February 2020 February 2020 February 2020 February 2021 Nature of expenditure Cutting of forest trees Purchase of seedling Fertilizers and insecticides Planting cost Fencing Roads, bridges and drains Office building Cost of the land Legal fees and stamp duty on land acquisition Fruit sorting building and loading bay Accommodation for plantation workers Accommodation for administration staffs Total expenditure RM 300,000 65,000 145,000 100,000 410,000 500,000 62,000 3,000,000 550,000 100,000 650,000 150,000 6,032,000 In February 2022, DPO disposed of office building and accommodation for administration staffs for RM49,500 and RM120,000 respectively. Required: (a) Calculate agriculture allowance under Schedule 3, Income Tax Act that can be claimed by DPO for the year of assessment 2022. (9 marks) (b) Calculate the statutory income of DPO for the year of assessment 2022. (2 marks) (c) Calculate the agriculture charge on the basis that DPO made an election to spread the charge under para 27, Schedule 3, Income Tax Act, clearly indicating the years of assessment affected