Answered step by step

Verified Expert Solution

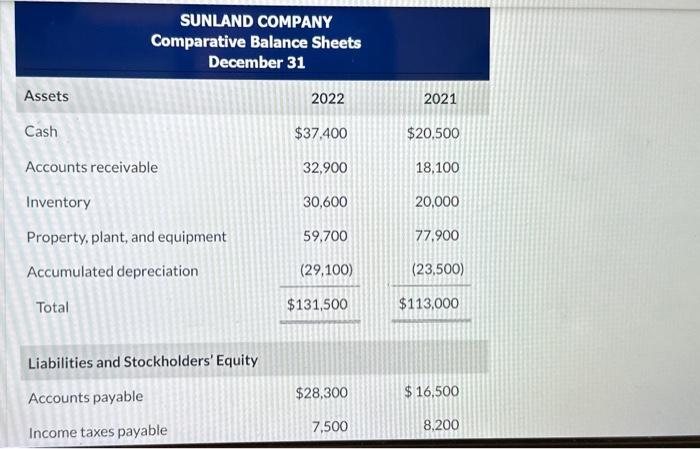

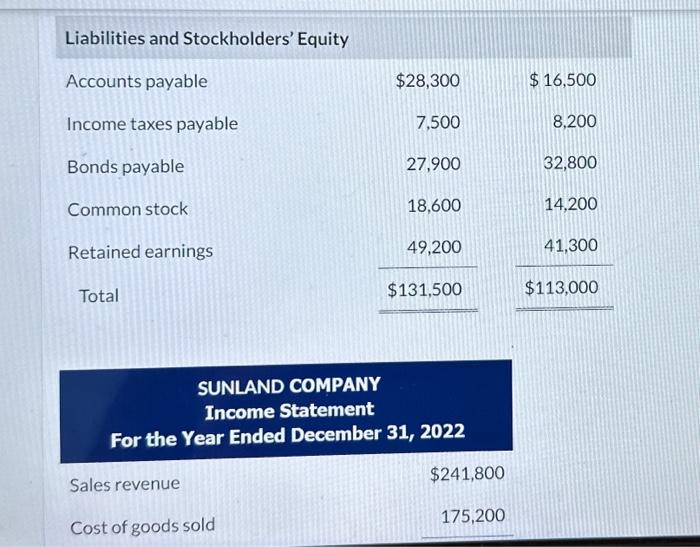

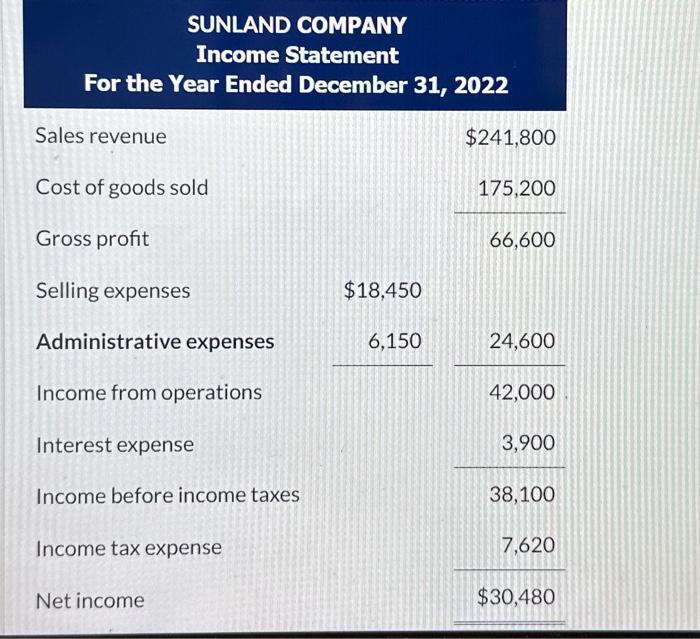

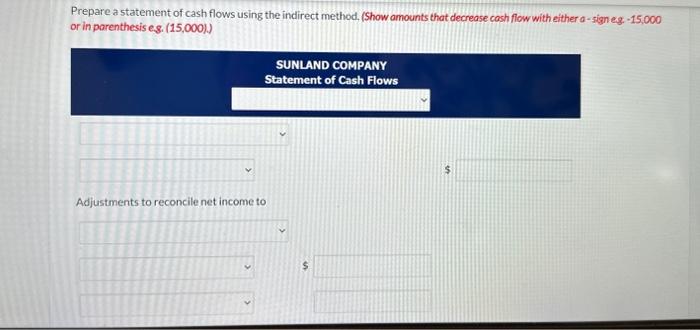

Question

1 Approved Answer

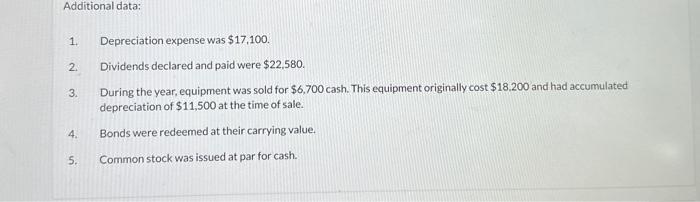

1. Depreciation expense was $17,100. 2. Dividends declared and paid were $22,580. 3. During the year, equipment was sold for $6,700 cash. This equipment originally

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started