1. Describe the key elements of Disney's corporate strategy.

2. Identify four (4) different lines of business that Disney has diversified into during the period 2000 - 2018.

3. What evidence is there that Disney's diversification strategy is actually building shareholder value? Give evidence from the Case to support your answer.

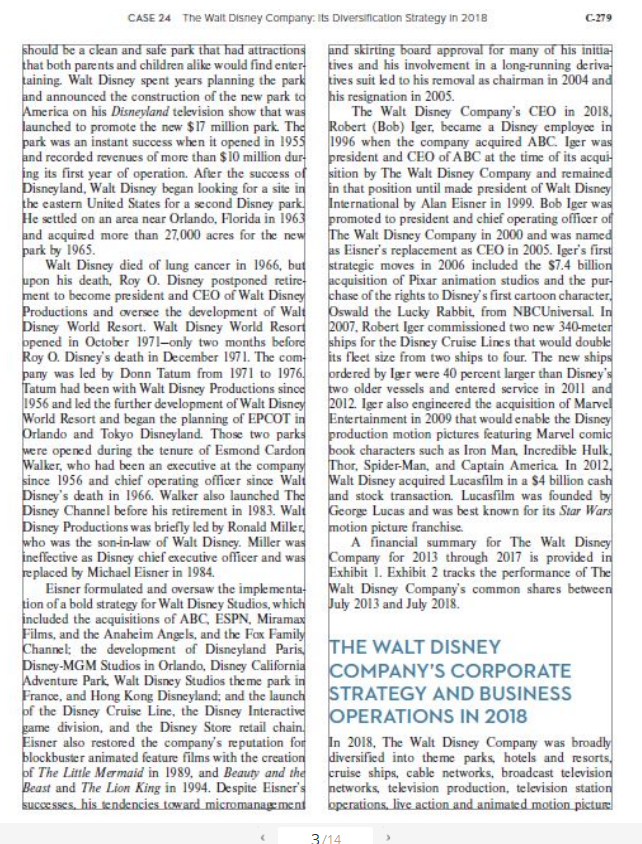

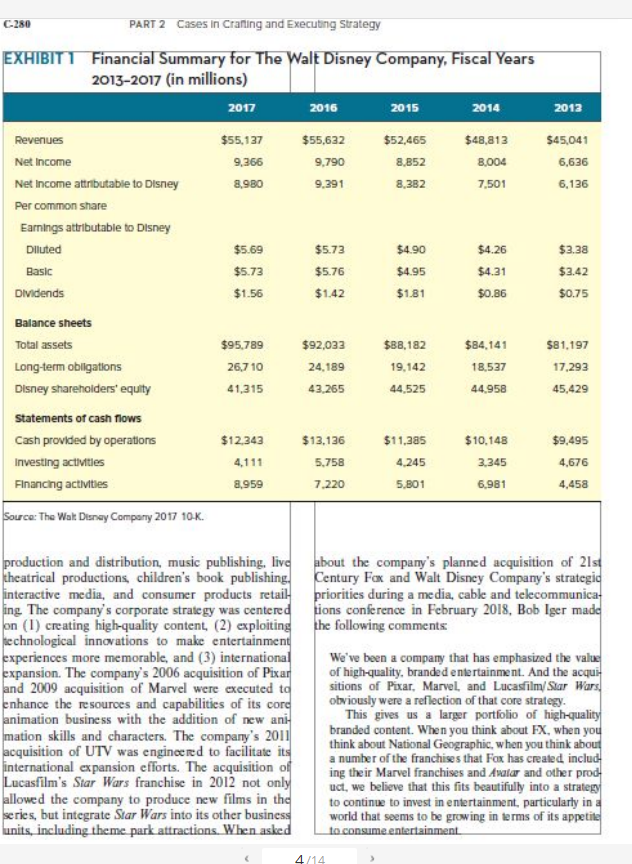

CASE 24 The Walt Disney Company: Its Diversification Strategy in 2018 connect John E. Gamble Texas A&M University-Corpus Christi he Walt Disney Company was a broadly diver- Disney CEO Robert Iger commented on the sified media and entertainment company with ability of the acquisition to further boost shareholder a business lineup that included theme parks value during an investor's conference shortly after and resorts, motion picture production and distribu- the DOJ consent decree announcement in June 2018. tion, cable television networks, the ABC broadcast television network, eight local television stations, and The acquisition of 21st Century Fox will bring signifi cant financial value to Disney and the shareholders of a variety of other businesses that exploited the com- both companies, and after six months of integration pany's intellectual property. The company's revenues planning we're even more enthusiastic and confident in had increased from $45 billion in fiscal year 2013 to the strategic fit of these complementary assets and the $55 billion in fiscal 2017 and its share price had regu- talent at Fox. larly outperformed the S&P 500. While struggling Just to remind you of the incredibly valuable assets somewhat in the mid-1980s, the company's perfor- that we're acquiring-our deal includes such premier mance had been commendable in almost every year entertainment properties as Twentieth Century Fox since Walt Disney created Mickey Mouse in 1928. Film and Twentieth Century Fox Television, FX and The company ended 2017 with a modest one National Geographic, Fox's regional sports networks percent increase in revenues and four percent Fox Networks Group International, and Star India, as increase in net income over the year prior However. well as Fox's interests in Hulu and Sky. Since we first its announcement in December 2017 that it would announced our deal in December, the intrinsic value of these assets has increased-thanks, in part to the ben acquire 21st Century Fox for $71.3 billion in cash efits of tax reform and certain operating improvements and stock had the potential to radically improve its As we've said before, the combination of Disney and future financial performance. The transaction was 21st Century Fox is an extremely compelling proposi- approved by the U.S. Department of Justice (DOJ) tion for consumers It will allow us to create even more Antitrust Division in June 2018 and was expected to appealing high-quality content, expand our direct-to be finalized by year-end 2018. The acquisition of 21st consumer offerings and international presence, and Century Fox would extend Disney's impressive col- deliver more exciting and personalized entertainment lection of media franchises to include Fox, FX, Fox experiences to meet the growing demands of consum News Channel, Fox Business Network, Fox Sports ers worldwide. Network, National Geographic Channel, Star India As the company entered the third quarter of 28 local television stations in the United States and 2018, it was coming off an impressive second quarter. more than 350 international channels, Twentieth but faced several strategic issues. The company's core Century Fox Film, and Twentieth Century Fox tele- Parks and Resorts business continued to grow and vision production studios. Twenty-First Century record healthy profit margins, but its larger Media Fox also held a 39.1 percent stake in Sky, Europe's leading entertainment company that served nearly 23 million households in five countries. Capricht 62018 by John E. Gamble. All rights reserved.Networks business had seen minimal revenue growth action motion picture photography. Disney brought in recent years and was experiencing declining oper. Ub Iwerks from Kansas City to Hollywood to work ating profits as media consumers turned from cable with Disney Brothers Studio (later to be named Walt to direct-to-consumer (DTC) programming. The Disney Productions) to produce the Alice Comedies company's Studio Entertainment business unit had series that would number 50-plus films by the series also struggled to develop stable revenue and earn end in 1927. Disney followed the Alice Comedies ings growth and its Consumer Products & Interactive series with a new animated cartoon for Universal Media business unit had seen a decline in revenues Studios. After Disney's Oswald the Lucky Rabbit car- and operating profits in the past year. Going into toons quickly became a hit. Universal terminated 2019, Iger and Disney's management team would Disney Brothers Studio and hired most of Disney's have to evaluate the corporation's strategy to bolster animators to continue producing the cartoon. the performance of its existing business units and In 1928, Disney and Iwerks created Mickey develop new media delivery capabilities while prepar- Mouse to replace Oswald as the feature character in ing for the integration of the probable acquisition of Walt Disney Studios cartoons. Unlike with Oswald, 2Ist Century Fox. Disney retained all rights over Mickey Mouse and all subsequent Disney characters. Mickey Mouse and COMPANY HISTORY his girlfriend, Minnie Mouse, made their cartoon debuts later in 1928 in the cartoons, Plane Crazy, The Walt Disney's venture into animation began in 1919 Gallopin' Gaucho, and Steamboat Willie. Steamboat when he returned to the United States from France, Willie was the first cartoon with synchronized sound where he had volunteered to be an ambulance driver and became one of the most famous short films of for the American Red Cross during World War L all time. The animated film's historical importance Disney volunteered for the American Red Cross only was recognized in 1998 when it was added to the after being told he was too young to enlist for the National Film Registry by the United States Library United States Army. Upon returning after the war. of Congress. Mickey Mouse's popularity exploded Disney settled in Kansas City, Missouri, and found over the next few decades with a Mickey Mouse Club work as an animator for Pesman Art Studio. Disney. being created in 1929, new accompanying characters and fellow Pesman animator, Ub Iwerks, soon left the such as Pluto, Goofy, Donald Duck, and Daisy Duck company to found Iwerks-Disney Commercial Artists being added to Mickey Mouse cartoon storylines. in 1920. The company lasted only briefly, but Iwerks and Mickey Mouse appearing in Walt Disney's 1940 and Disney were both able to find employment with a feature length film, Fantasia Mickey Mouse's univer- Kansas City company that produced short animated sal appeal reversed Walt Disney's series of failures in advertisements for local movie theaters. Disney the animated film industry and became known as the left his job again in 1922 to found Laugh-O-Grams. mascot of Disney Studios, Walt Disney Productions. where he employed Iwerks and three other animators and The Walt Disney Company. to produce short animated cartoons. Laugh-O-Grams The success of The Walt Disney Company was was able to sell its short cartoons to local Kansas sparked by Mickey Mouse, but Disney Studios also City movie theaters, but its costs far exceeded its produced several other highly successful animated fea- revenues-forcing Disney to declare bankruptcy in ture films including Snow White and the Seven Dwarfs 1923. Having exhausted his savings, Disney had only in 1937, Pinocchio in 1940, Dumbo in 1941, Bambi in enough cash to purchase a one-way train ticket to 1942, Song of the South in 1946, Cinderella in 1950 Hollywood, California, where his brother, Roy, had Treasure Island in 1950. Peter Pan in 1953, Sleeping offered a temporary room. Once in California, Roy Beauty in 1959, and One Hundred-One Dalmatians began to look for buyers for a finished animated-live in 1961. What would prove to be Disney's greatest action film he retained from Laugh-O-Grams. The achievement began to emerge in 1954 when con- film was never distributed, but New York distributors struction began on his Disneyland Park in Anaheim, Margaret Winkler and Charles Mintz were impressed California. Walt Disney's Disneyland resulted from enough with the short film that they granted Disney an idea that Disney had many years earlier while a contract in October 1923 to produce a series of sitting on an amusement park bench watching his khort films that hlanded cartoon animation with live wrung danightare nav Walt Disney thought that thamCASE 24 The Walt Disney Company: Its Diversification Strategy In 2018 C-279 should be a clean and safe park that had attractions and skirting board approval for many of his initia that both parents and children alike would find enter Lives and his involvement in a long-running deriva taining. Walt Disney spent years planning the park Lives suit led to his removal as chairman in 2004 and and announced the construction of the new park to his resignation in 2005. America on his Disneyland television show that was The Walt Disney Company's CEO in 2018, launched to promote the new $17 million park. The Robert (Bob) Iger, became a Disney employee in park was an instant success when it opened in 1955 1996 when the company acquired ABC. Iger was and recorded revenues of more than $10 million dur president and CEO of ABC at the time of its acqui- ing its first year of operation. After the success of sition by The Walt Disney Company and remained Disneyland, Walt Disney began looking for a site in in that position until made president of Walt Disney the eastern United States for a second Disney park. International by Alan Eisner in 1999. Bob Iger was He settled on an area near Orlando, Florida in 1963 promoted to president and chief operating officer of and acquired more than 27,000 acres for the new The Walt Disney Company in 2000 and was named park by 1965. as Eisner's replacement as CEO in 2005. Iger's first Walt Disney died of lung cancer in 1966, but strategic moves in 2006 included the $7.4 billion upon his death, Roy O. Disney postponed retire acquisition of Pixar animation studios and the pur- ment to become president and CEO of Walt Disney chase of the rights to Disney's first cartoon character. Productions and oversee the development of Walt Oswald the Lucky Rabbit, from NBCUniversal. In Disney World Resort. Walt Disney World Resort 2007, Robert Iger commissioned two new 340-meter opened in October 1971-only two months before ships for the Disney Cruise Lines that would double Roy O. Disney's death in December 1971. The come its fleet size from two ships to four. The new ships pany was led by Donn Tatum from 1971 to 1976. ordered by Iger were 40 percent larger than Disney's Tatum had been with Walt Disney Productions since two older vessels and entered service in 2011 and 1956 and led the further development of Walt Disney 2012. Iger also engineered the acquisition of Marvel World Resort and began the planning of EPCOT in Entertainment in 2009 that would enable the Disney Orlando and Tokyo Disneyland. Those two parks production motion pictures featuring Marvel comic we're opened during the tenure of Esmond Cardon book characters such as Iron Man, Incredible Hulk Walker, who had been an executive at the company Thor, Spider-Man, and Captain America In 2012, since 1956 and chief operating officer since Walt Walt Disney acquired Lucasfilm in a $4 billion cash Disney's death in 1966. Walker also launched The and stock transaction. Lucasfilm was founded by Disney Channel before his retirement in 1983. Walt George Lucas and was best known for its Star Wars Disney Productions was briefly led by Ronald Miller motion picture franchise. who was the son-in-law of Walt Disney. Miller was A financial summary for The Walt Disney ineffective as Disney chief executive officer and was Company for 2013 through 2017 is provided in replaced by Michael Eisner in 1984. Exhibit 1. Exhibit 2 tracks the performance of The Eisner formulated and oversaw the implementa- Walt Disney Company's common shares between tion of a bold strategy for Walt Disney Studios, which July 2013 and July 2018. included the acquisitions of ABC, ESPN, Miramax Films, and the Anaheim Angels, and the Fox Family Channel; the development of Disneyland Paris THE WALT DISNEY Disney-MGM Studios in Orlando, Disney California Adventure Park, Walt Disney Studios theme park in COMPANY'S CORPORATE France, and Hong Kong Disneyland; and the launch STRATEGY AND BUSINESS of the Disney Cruise Line, the Disney Interactive OPERATIONS IN 2018 game division, and the Disney Store retail chain. Eisner also restored the company's reputation for In 2018, The Walt Disney Company was broadly blockbuster animated feature films with the creation diversified into theme parks, hotels and resorts. of The Little Mermaid in 1989, and Beauty and the cruise ships, cable networks, broadcast television Beast and The Lion King in 1994. Despite Eisner's networks, television production, television station successes. his tendencies toward micromanagement operations, live action and animated motion picture 3/14C-280 PART 2 Cases In Crafting and Executing Strategy EXHIBIT 1 Financial Summary for The Walt Disney Company, Fiscal Years 2013-2017 (in millions) 2017 2016 2015 2014 2013 Revenues $55,137 $55,632 $52,465 $48,813 $45,041 Net Income 9,366 9.790 8.852 B.004 6.636 Net Income attributable to Disney 8,980 9.391 8.382 7.501 6.136 Per common share Earnings attributable to Disney Diluted $5.69 $5.73 $4.90 $4.26 $3.38 Basic $5.73 $5.76 $4.95 $4.31 $3.42 Dividends $1.56 $1.42 $1.81 $0.86 $0.75 Balance sheets Total assets $95.789 EEO'Z6$ $88, 182 $84.141 581.197 Long-term obligations 26,710 24.189 19,142 18.537 17.293 Disney shareholders' equity 41,315 43.265 44.525 44.958 45.429 Statements of cash flows Cash provided by operations $12,343 $13,136 $11,385 $10.148 $9.495 Investing activities 4,111 5.758 4.245 3.345 4.676 Financing activities 8,959 7.220 5,801 6.981 4.458 Source: The Walt Disney Company 2017 10-K. production and distribution, music publishing, live about the company's planned acquisition of 21s theatrical productions, children's book publishing. Century Fox and Walt Disney Company's strategic interactive media, and consumer products retail- priorities during a media, cable and telecommunica ing The company's corporate strategy was centered tions conference in February 2018, Bob Iger made jon (1) creating high-quality content, (2) exploiting the following comments technological innovations to make entertainment experiences more memorable, and (3) international We've been a company that has emphasized the value expansion. The company's 2006 acquisition of Pixar of high-quality, branded entertainment. And the acqui- and 2009 acquisition of Marvel were executed to sitions of Pixar, Marvel, and Lucasfilm/Star Wars enhance the resources and capabilities of its core obviously were a reflection of that core strategy. animation business with the addition of new ani- This gives us a larger portfolio of high-quality mation skills and characters. The company's 2011 branded content. When you think about FX, when you acquisition of UTV was engineered to facilitate its think about National Geographic, when you think about international expansion efforts. The acquisition of a number of the franchises that Fox has created include ing their Marvel franchises and Avatar and other prod Lucasfilm's Star Wars franchise in 2012 not only uct, we believe that this fits beautifully into a strategy allowed the company to produce new films in the to continue to invest in entertainment, particularly in a series, but integrate Star Wars into its other business world that seems to be growing in terms of its appetite lunits, including theme park attractions. When asked to consume entertainment.EXHIBIT 2 Performance of The Walt Disney Company's Stock Price, July 2013 to July 2018 (a) Trend In The Walt Disney Company's Common Stock Price 120 110 100 90 Stock price ($ BO 70 60 2014 2015 2016 2017 2018 Year (b) Performance of The Walt Disney Company's Stock Price Vorsus the 58P 500 Index 90% The Walt Disney Company's Stock +70% Price +60% +50% +40 (July 2013 = 0) Percent change 30% 20%% SAP 500 +10% 2014 2015 2017 2018 -10% 2016 Year Source: The Walt Disney Company 2017 10-K Secondly, we've been talking a lot about using tech over the last decade deepening that penetration in nology to reach consumers in more modern, more effi markets. You mentioned Shanghai Disneyland, which cient, and effective ways. That certainly has changed would be an example of how we've done that in China. significantly. When I talk about a dynamic marketplace. This gives us the ability to have a far more global foot- I think it's most evident in how people access entertain print and to diversify the company's interest from a goo- ment how they consume entertainment, and this acquit graphic perspective. sition gives us the ability not only to have essentially more product, more intellectual property, but to bring Disney's corporate strategy also called for suf- it to the consumer in more compelling ways and ways ficient capital to be allocated to its core theme we think the consumer wants their entertainment more parks and resorts business to sustain its advantage and more. The Star and Sky assets and the Hulu assets give us an opportunity to do that in the industry. The company expanded the rang And then lastly, we've talked a lot about wanting to of attractions at its theme parks with billion-dollar grow our company globally. The Walt Disney Company plus additions such as its new Toy Story Land attract has been a global company for a long time, but in many tions opened in 2018 at Shanghai Disneyland and of the markets that we operate in our penetration was Disney's Hollywood Studios and its Star Wars Land relatively superficial We spent a fair amount of time scheduled to open in Disney's Hollywood Studios 5/14