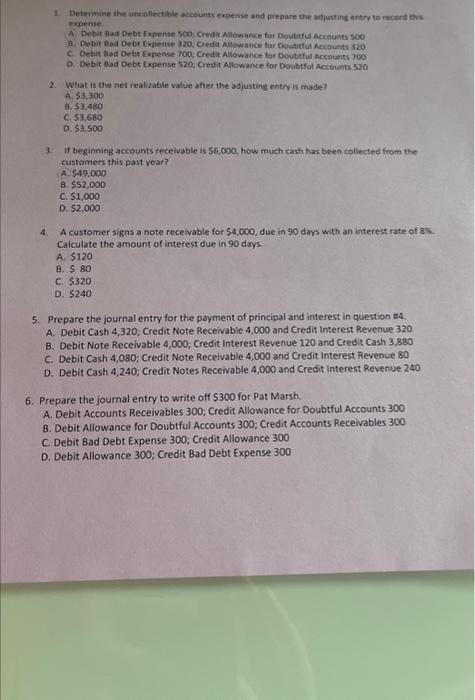

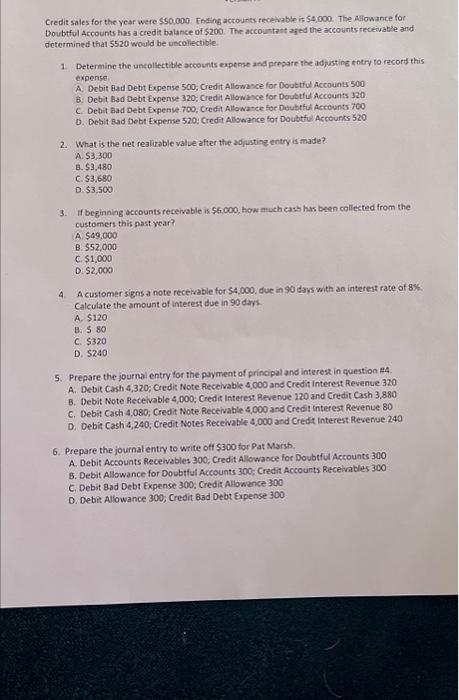

1. Determine ahe uncalliectible acceunts expense and prepare the adjunting entry to recond ths expense A Debit aad Debt Fxpense soo, Credit Allowance for Doubthis Accounts 500 In Debit inad Debt ropense 320, Credit Allowance for Doubtiul Accounts 320 c. Debit Bad Detat \&xpense 700, Credit Alowance for boutithul Accounts 700 0. Debit Bad Debt Erpense 520; Credit Allowance for Doubtfut Accounts 520 2. What is the nel realiable value after the adjusting entry is made? A. 53,300 8. $3,480 C. $3,680 D. 53.500 3. If beginning accounts tecieivable is 56,000 , how much cash hat been coliected from the customers this past year? A. 549,000 B. $52,000 C. 51,000 D. 52,000 4. A customer signs a note receivable for 54,000 , due in 90 days with an interest rate of 83 . Calculate the amount of interest due in 90 days: A. 5120 B. $80 C. $320 D. $240 5. Prepare the journal entry for the payment of principal and interest in question \#4. A. Debit Cash 4,320; Credit Note Receivable 4,000 and Credit interest Revenue 320 B. Debit Note Receivable 4,000; Credit Interest Revenue 120 and Credit Cash 3,880 C. Debit Cash 4,080; Credit Note Receivable 4,000 and Credit interest Revenve 80 D. Debit Cash 4,240; Credit Notes Recelvable 4,000 and Credit Interest Revenue 240 6. Prepare the journal entry to write off $300 for Pat Marsh. A. Debit Accounts Receivables 300; Credit Allowance for Doubtful Accounts 300 B. Debit Allowance for Doubtful Accounts 300; Credit Accounts Recelvables 300 C. Debit Bad Debt Expense 300; Credit Allowance 300 D. Debit Allowance 300; Credit Bad Debt Expense 300 Credit sales for the year were $50,000. Fnding accounts recolvable it 54,000 . The Allowance for Doubtful Accounts has a credit balance of $200. The accountant ased the accounts rectivable and determined that $520 would be uncollectible. 1 Determine the uncoliectible accounts expense and prepare the adjusting entry to record this expense. A. Debit Badd Debt Expense 500, Credit Allowance for Doubtful Accounts 500 6. Debit Bad Debt Expense 320; Credil Allowance for Doutthl Accounts 320 C. Debit aad Debt Expense 700; Credit Allowatce for Doubetul Accounts 700 D. Debit Rad Debt Expense 520; Credit Allowance for Doubtful Accounts 520 2. What is the net realirable value after the adyusting entiry is mhade? A. 53,300 B. 53,480 C. 53,680 D. $3,500 3. If beginning accounts receivable is 56,000 , how much cast has been collected from the customers this nast vear? A. $49,000 B. 552,000 C. 51,000 D. 52,000 4. A customer signs a note receivable for 54,000 , doe in 90 das with an intereit rate of 8%. Calculate the amount of interest due in 90 days. A. 5120 B. $80 C. $320 D. 5240 5. Prepare the journal entry for the payment of principal and interest in question A4. A. Debit Cash 4,320; Credis Note Receivabie 4,000 and Credit interest Resenue 320 B. Debit Note Receivable 4,000; Credir Interest Revenue 120 and Credit Cash 3,880 C. Debit Cash 4,080; Credit Note Receivable 4,000 and Credit interest Revenue 80 D. Debit Cash 4, 240; Credit Notes Receivable 4,000 and Credit interest Revenue 240 6. Prepare the journal entry to Write off $300 for Pat Marsh. A. Debit Accounts Recelvables 300; Credit Allowance for Doubtul Accounts 300 B. Debit Allowance for Doubtful Accounts 300: Credit Accounts Receivables 300 C. Debit Bad Debt Expense 300, Credit Allowance 300 D. Debit Allowance 300; Credit Bad Debt Expense 300