1. Determine the proper tax year for gross income inclusion in each of the following cases. a. Christopher, who files his income tax return

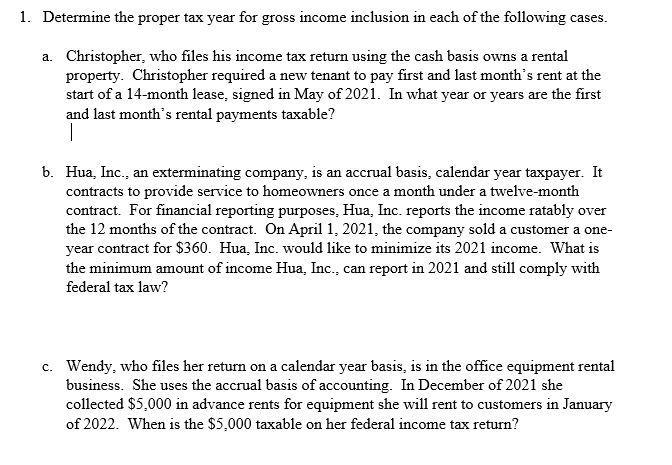

1. Determine the proper tax year for gross income inclusion in each of the following cases. a. Christopher, who files his income tax return using the cash basis owns a rental property. Christopher required a new tenant to pay first and last month's rent at the start of a 14-month lease, signed in May of 2021. In what year or years are the first and last month's rental payments taxable? b. Hua, Inc., an exterminating company, is an accrual basis, calendar year taxpayer. It contracts to provide service to homeowners once a month under a twelve-month contract. For financial reporting purposes, Hua, Inc. reports the income ratably over the 12 months of the contract. On April 1, 2021, the company sold a customer a one- year contract for $360. Hua, Inc. would like to minimize its 2021 income. What is the minimum amount of income Hua, Inc., can report in 2021 and still comply with federal tax law? c. Wendy, who files her return on a calendar year basis, is in the office equipment rental business. She uses the accrual basis of accounting. In December of 2021 she collected $5,000 in advance rents for equipment she will rent to customers in January of 2022. When is the $5,000 taxable on her federal income tax return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Its Tax year will be 2021 as Christopher is following cas...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started