Answered step by step

Verified Expert Solution

Question

1 Approved Answer

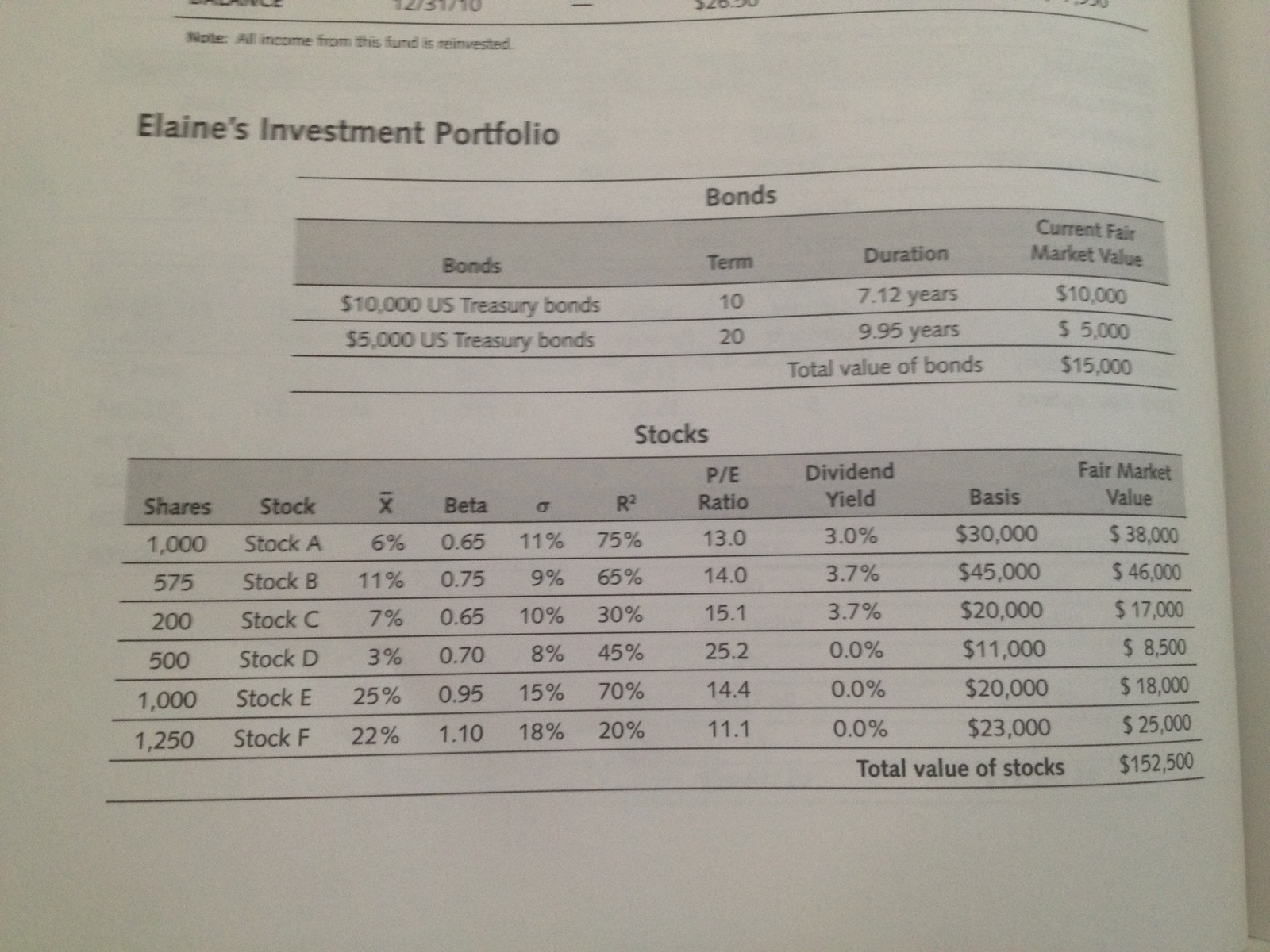

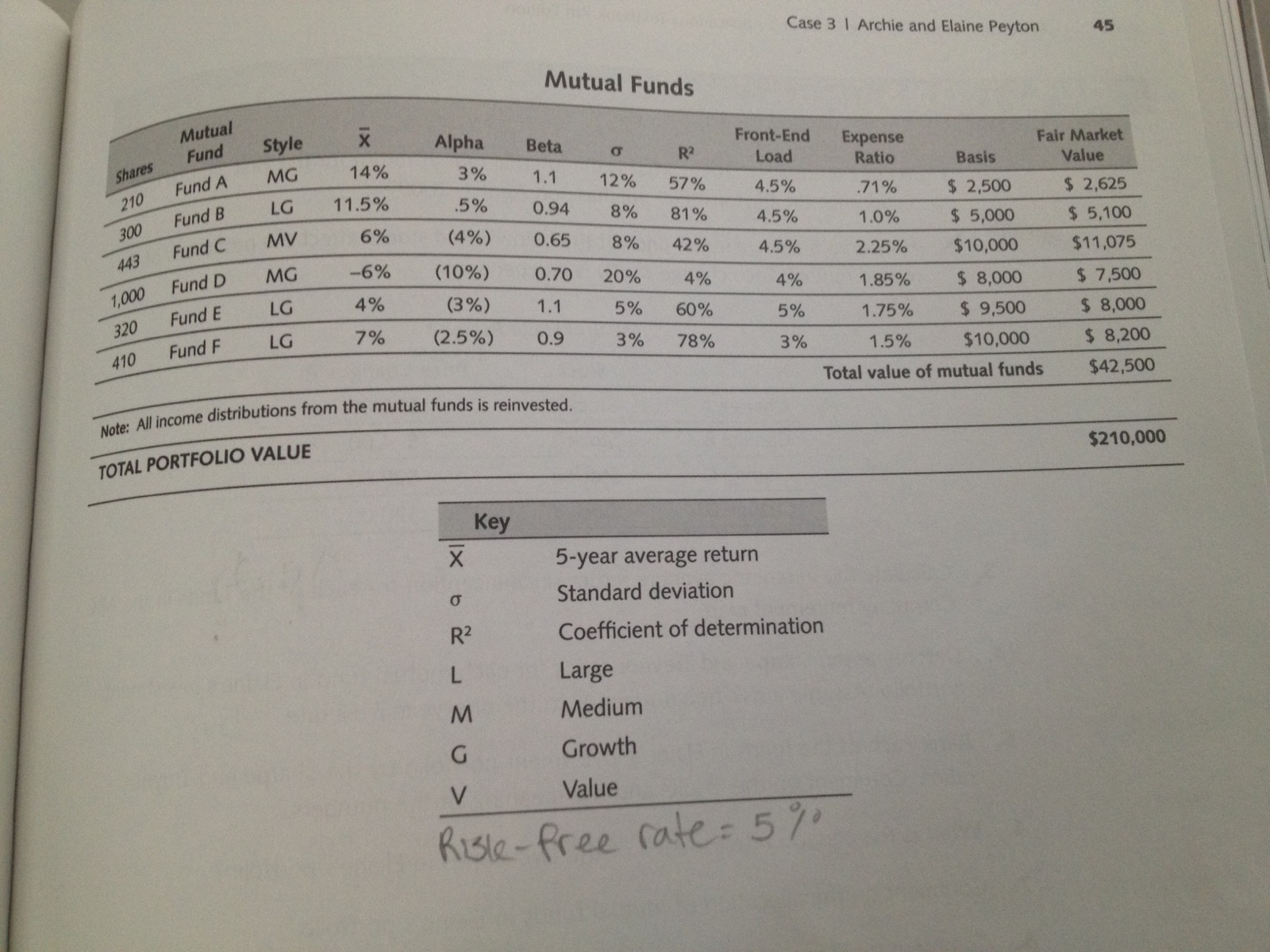

1. Determine the Sharpe and Trainor ratio for each mutual fund in Elaine's investment portfolio. The risk-free rate is 5%. Note: All income from this

1. Determine the Sharpe and Trainor ratio for each mutual fund in Elaine's investment portfolio. The risk-free rate is 5%.

Note: All income from this fund is reinvested Elaine's Investment Portfolio Bonds Current Fair Duration Market Value $10,000 US Treasury bonds $5,000 US Treasury bonds 7.12 years $10,000 9.95 years S 5,000 Total value of bonds $15,000 Stocks PIE Dividend Shares Stock Beta Ratio Yield Basis Fair Market Value 1,000 Stock A 6% 0.65 11 % 75% 13.0 3.0% $30,000 $38,000 575 Stock B 11% 0.75 9% 65% 14.0 3.7% $45,000 $ 46000 200 Stock C70.65 10% 30% 15.1 3.7% $20,000 $ 17,000 500 Stock D 3% 0.70 8% 45% 25.2 0.0% $11,000 $ 8,500 1,000 Stock E25% 0.95 15% 70% 14.4 0.0% $20,000 $ 18,000 1,250 Stock F 22% 1.10 18% 20% 11.1 0.0% $23,000 $ 25,000 Total value of stocks $152500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started