Question

1. Determine the total manufacturing cost and cost per unit for each of the two product lines for the quarter, using activity-based costing to

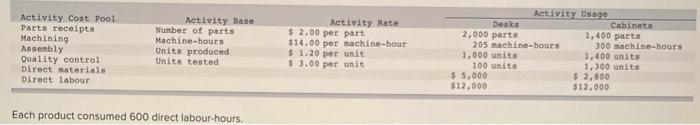

1. Determine the total manufacturing cost and cost per unit for each of the two product lines for the quarter, using activity-based costing to allocate overhead costs. 2. Redo the above using direct labour-hours as the allocation base Activity Cost Pool Parts receipts Machining Assembly Quality control Direct materials Direct labour Activity Base Number of parts Machine-hours Units produced Units tested Each product consumed 600 direct labour-hours. Activity Rate $ 2.00 per part $14.00 per machine-bour $ 1.20 per unit $ 3.00 per unit Deaks 2,000 parts 205 machine-hours 1,000 units 100 units Activity Usage $5,000 $12,000 Cabinets 1,400 parts 300 machine-hours 1,400 units 1,300 units $ 2,800 $12,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Managerial Accounting

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan

5th Canadian edition

77429494, 1259105709, 1260480798, 978-1259105708

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App