Answered step by step

Verified Expert Solution

Question

1 Approved Answer

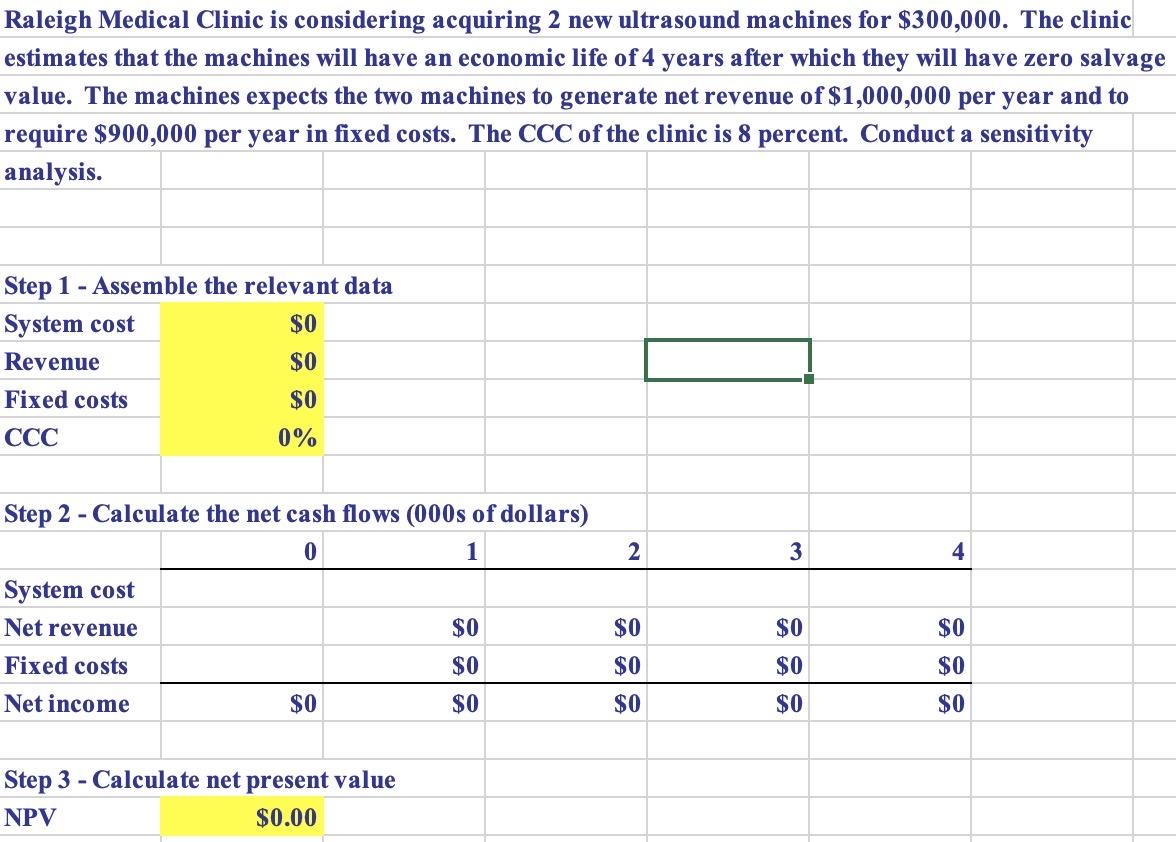

Raleigh Medical Clinic is considering acquiring 2 new ultrasound machines for $300,000. The clinic estimates that the machines will have an economic life of

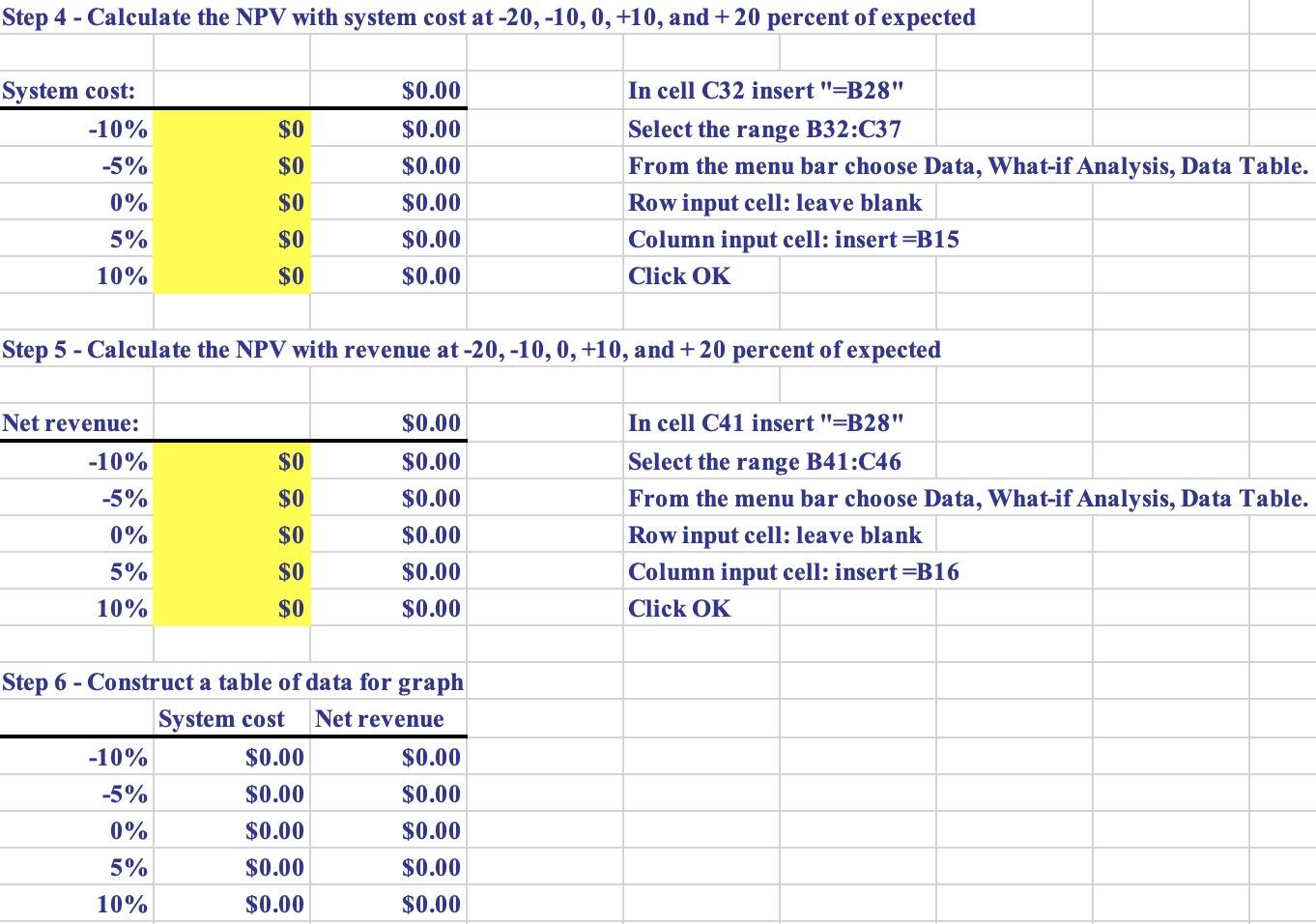

Raleigh Medical Clinic is considering acquiring 2 new ultrasound machines for $300,000. The clinic estimates that the machines will have an economic life of 4 years after which they will have zero salvage value. The machines expects the two machines to generate net revenue of $1,000,000 per year and to require $900,000 per year in fixed costs. The CCC of the clinic is 8 percent. Conduct a sensitivity analysis. Step 1 - Assemble the relevant data System cost $0 Revenue $0 $0 Fixed costs CCC 0% Step 2 -Calculate the net cash flows (000s of dollars) 0 1 System cost Net revenue Fixed costs Net income $0 Step 3 - Calculate net present value NPV $0.00 $0 $0 $0 2 $0 $0 $0 3 $0 $0 $0 4 $0 $0 $0 Step 4 - Calculate the NPV with system cost at -20, -10, 0, +10, and +20 percent of expected System cost: -10% -5% 0% 5% 10% Net revenue: -10% -5% 0% 5% 10% $0 $0 $0 $0 $0 Step 5 - Calculate the NPV with revenue at -20, -10, 0, +10, and +20 percent of expected -10% -5% 0% 5% 10% $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0 $0 $0 $0 $0 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Step 6 - Construct a table of data for graph System cost Net revenue $0.00 $0.00 $0.00 $0.00 $0.00 In cell C32 insert "=B28" Select the range B32:C37 From the menu bar choose Data, What-if Analysis, Data Table. Row input cell: leave blank Column input cell: insert =B15 Click OK $0.00 $0.00 $0.00 $0.00 $0.00 In cell C41 insert "=B28" Select the range B41:C46 From the menu bar choose Data, What-if Analysis, Data Table. Row input cell: leave blank Column input cell: insert =B16 Click OK Step 7 - Create graph Step 7 - Interpret graph

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

It seems there is a sensitivity analysis exercise that you need to complete for the Raleigh Medical Clinic which is considering acquiring new ultrasou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started