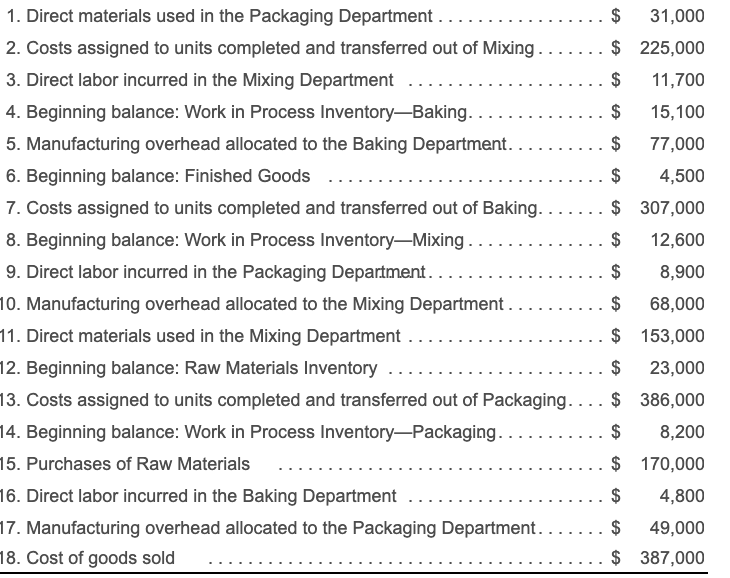

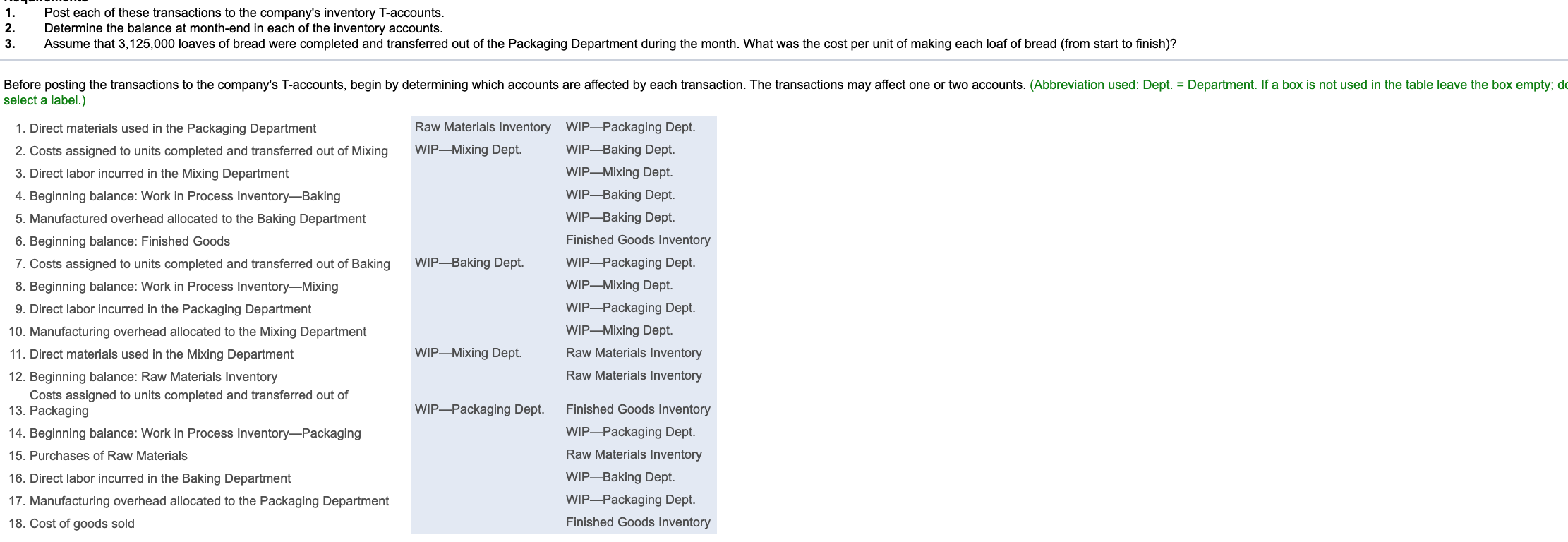

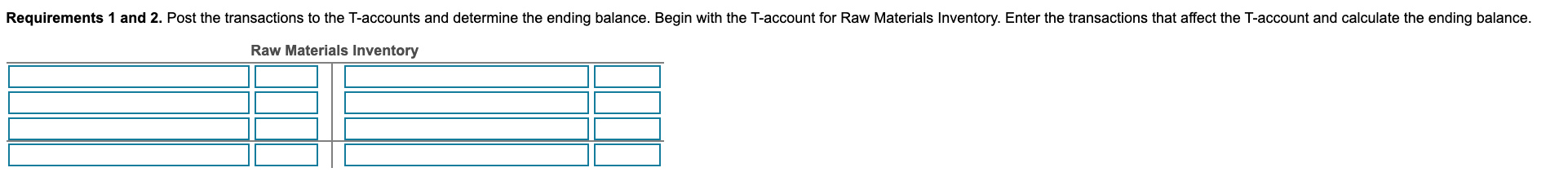

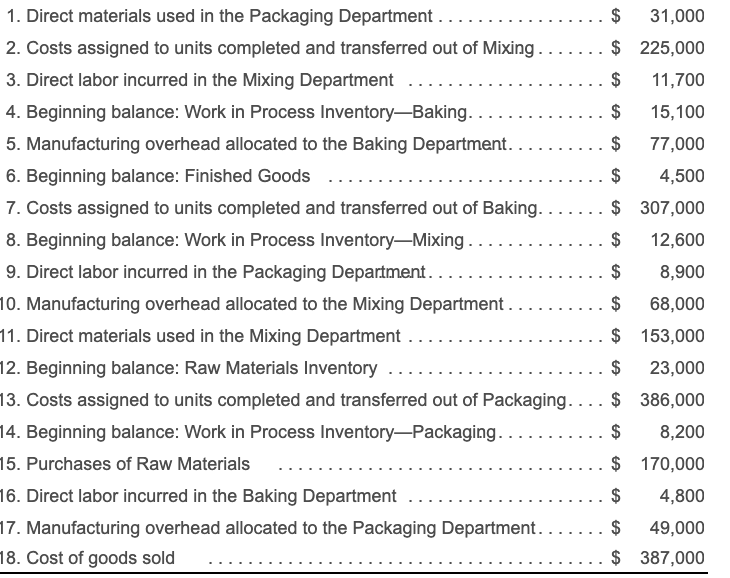

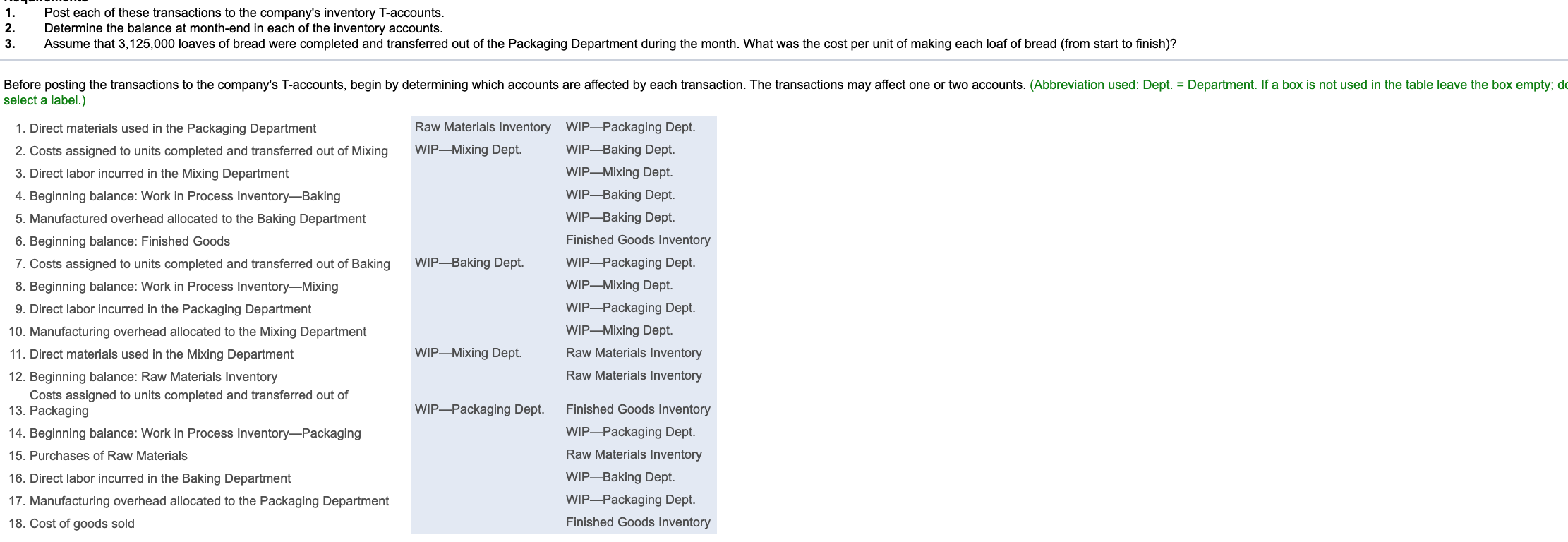

1. Direct materials used in the Packaging Department ................. $ 31,000 2. Costs assigned to units completed and transferred out of Mixing ....... $ 225,000 3. Direct labor incurred in the Mixing Department .................... $ 11,700 4. Beginning balance: Work in Process InventoryBaking..............$ 15,100 5. Manufacturing overhead allocated to the Baking Department. .........$ 77,000 6. Beginning balance: Finished Goods ... .........$ 4,500 7. Costs assigned to units completed and transferred out of Baking....... $ 307,000 8. Beginning balance: Work in Process InventoryMixing ..............$ 12,600 9. Direct labor incurred in the Packaging Department. .................$ 8,900 10. Manufacturing overhead allocated to the Mixing Department.......... $ 68,000 11. Direct materials used in the Mixing Department ......... used in the Mixing Department ....................$ 153.000 12. Beginning balance: Raw Materials Inventory ......................$ 23,000 13. Costs assigned to units completed and transferred out of Packaging.... $ 386,000 14. Beginning balance: Work in Process InventoryPackaging...........$ 8,200 15. Purchases of Raw Materials ................. $ 170,000 16. Direct labor incurred in the Baking Department ....... .........$ 4,800 17. Manufacturing overhead allocated to the Packaging Department....... $ 49,000 18. Cost of goods sold ............$ 387,000 Post each of these transactions to the company's inventory T-accounts. Determine the balance at month-end in each of the inventory accounts. Assume that 3,125,000 loaves of bread were completed and transferred out of the Packaging Department during the month. What was the cost per unit of making each loaf of bread (from start to finish)? Before posting the transactions to the company's T-accounts, begin by determining which accounts are affected by each transaction. The transactions may affect one or two accounts. (Abbreviation used: Dept. = Department. If a box is not used in the table leave the box empty; do select a label.) Raw Materials Inventory WIPMixing Dept. 1. Direct materials used in the Packaging Department 2. Costs assigned to units completed and transferred out of Mixing 3. Direct labor incurred in the Mixing Department 4. Beginning balance: Work in Process Inventory-Baking 5. Manufactured overhead allocated to the Baking Department 6. Beginning balance: Finished Goods 7. Costs assigned to units completed and transferred out of Baking transferred out of Baking 8. Beginning balance: Work in Process Inventory-Mixing 9. Direct labor incurred in the Packaging Department 10. Manufacturing overhead allocated to the Mixing Department 11. Direct materials used in the Mixing Department 12. Beginning balance: Raw Materials Inventory Costs assigned to units completed and transferred out of 13. Packaging 14. Beginning balance: Work in Process Inventory-Packaging 15. Purchases of Raw Materials 16. Direct labor incurred in the Baking Department 17. Manufacturing overhead allocated to the Packaging Department 18. Cost of goods sold WIPPackaging Dept. WIPBaking Dept. WIPMixing Dept. WIPBaking Dept. WIPBaking Dept. Finished Goods Inventory WIPPackaging Dept. WIPMixing Dept. WIPPackaging Dept. WIPMixing Dept. Raw Materials Inventory Raw Materials Inventory WIPBaking Dept. WIPMixing Dept. WIPPackaging Dept. Finished Goods Inventory WIPPackaging Dept. Raw Materials Inventory WIPBaking Dept. WIPPackaging Dept. Finished Goods Inventory Requirements 1 and 2. Post the transactions to the T-accounts and determine the ending balance. Begin with the T-account for Raw Materials Inventory. Enter the transactions that affect the T-account and calculate the ending balance. Raw Materials Inventory