Question

1. Discount Banners pays $220,000 cash for a group purchase of land, building, and equipment. At the time of acquisition, the land has a

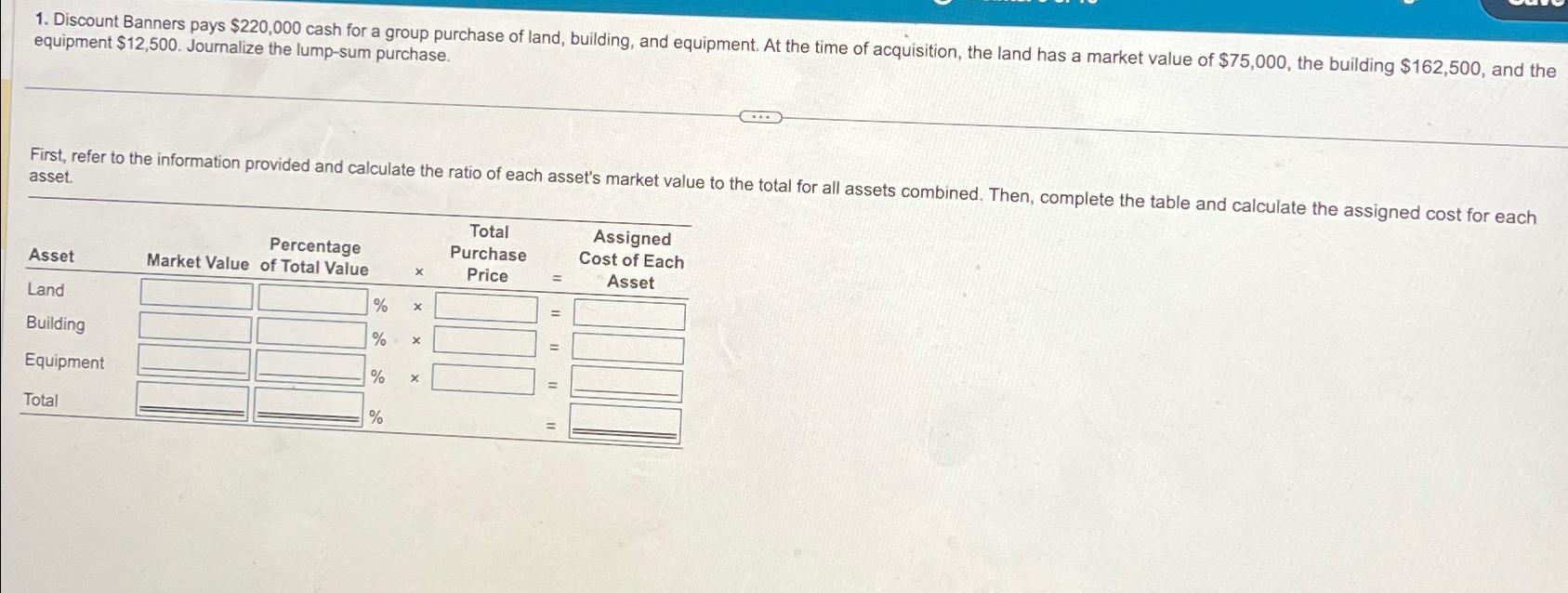

1. Discount Banners pays $220,000 cash for a group purchase of land, building, and equipment. At the time of acquisition, the land has a market value of $75,000, the building $162,500, and the equipment $12,500. Journalize the lump-sum purchase. First, refer to the information provided and calculate the ratio of each asset's market value to the total for all assets combined. Then, complete the table and calculate the assigned cost for each asset. Percentage x Total Purchase Price = Assigned Cost of Each Asset Asset Market Value of Total Value Land Building % x % x Equipment % x Total %

Step by Step Solution

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

In this problem we have to prepare the schedule showing the allocation of the purchase price of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial accounting

Authors: Walter T. Harrison, Charles T. Horngren, William Bill Thomas

8th Edition

9780135114933, 136108865, 978-0136108863

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App