Answered step by step

Verified Expert Solution

Question

1 Approved Answer

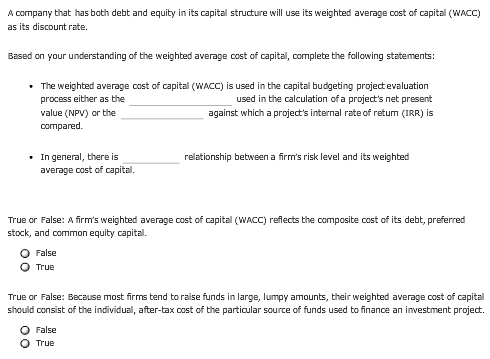

1. Discount rat/ internal rate of return. 2.Maximum return/hurdle rate 3.An inverse/ a direct. Answer all questions or i will downvote. A company that has

1. Discount rat/ internal rate of return.

2.Maximum return/hurdle rate

3.An inverse/ a direct.

Answer all questions or i will downvote.

A company that has bath debt and equity in its capital structure will use its weighbed average cost of capital (WACC) as its discount rate. Based on your understanding of the weighted average cost of capital, complebe the following statements: . The weighted average cost of capital (WACc) is used in the capital budgeting project evaluation used in the calculation ofa projedt's net present against which a project's internal rate of retum (IRR) is process either as the value (NPV) or the compared. In general, there is relationship between a firm's risk level and its weighted average cost of capital. True or False:A firm's weighted average cost of capital (WACc) reflects the composite cost of its debt, preferred stock, and common equity capital. O False O True True or False: Because most firms tend to raise funds in large, lumpy amounts, their weighted average cost of capital should consist of the individual, after-tax cost of the particular source of funds used to finance an investment project O False O TrueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started