Answered step by step

Verified Expert Solution

Question

1 Approved Answer

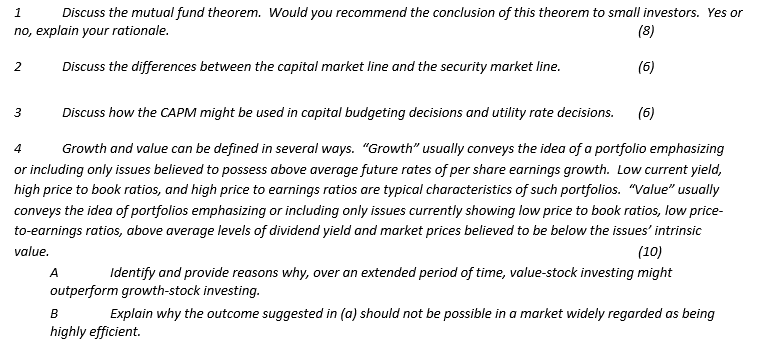

1 Discuss the mutual fund theorem. Would you recommend the conclusion of this theorem to small investors. Yes or no , explain your rationale. 2

Discuss the mutual fund theorem. Would you recommend the conclusion of this theorem to small investors. Yes or

no explain your rationale.

Discuss the differences between the capital market line and the security market line.

Discuss how the CAPM might be used in capital budgeting decisions and utility rate decisions.

Growth and value can be defined in several ways. "Growth" usually conveys the idea of a portfolio emphasizing

or including only issues believed to possess above average future rates of per share earnings growth. Low current yield,

high price to book ratios, and high price to earnings ratios are typical characteristics of such portfolios. "Value" usually

conveys the idea of portfolios emphasizing or including only issues currently showing low price to book ratios, low price

toearnings ratios, above average levels of dividend yield and market prices believed to be below the issues' intrinsic

value.

A Identify and provide reasons why, over an extended period of time, valuestock investing might

outperform growthstock investing.

Explain why the outcome suggested in a should not be possible in a market widely regarded as being

highly efficient.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started