Question

1. Dividend Discount Model Valuation for Kraft Heinz Company- Using the constant growth dividend discount model formula, give a valuation estimate of the common stock

1. Dividend Discount Model Valuation for Kraft Heinz Company- Using the constant growth dividend discount model formula, give a valuation estimate of the common stock of Kraft Heinz's company. What are your findings?

All the data should be calculated, including Expected Growth Rate (Dividends&Stock Repurchase) over the last 4 years, terminal value, Required Rate of Return (CAPM), Required Rate of Return (DIvidend Discount Model), Required Rate of Return (Average of CAPM and Dividend Discount Model), Sustainable Rate of Growth, as well as Stock Value (Constant Growth Model), Stock Value (Variable Growth Model)

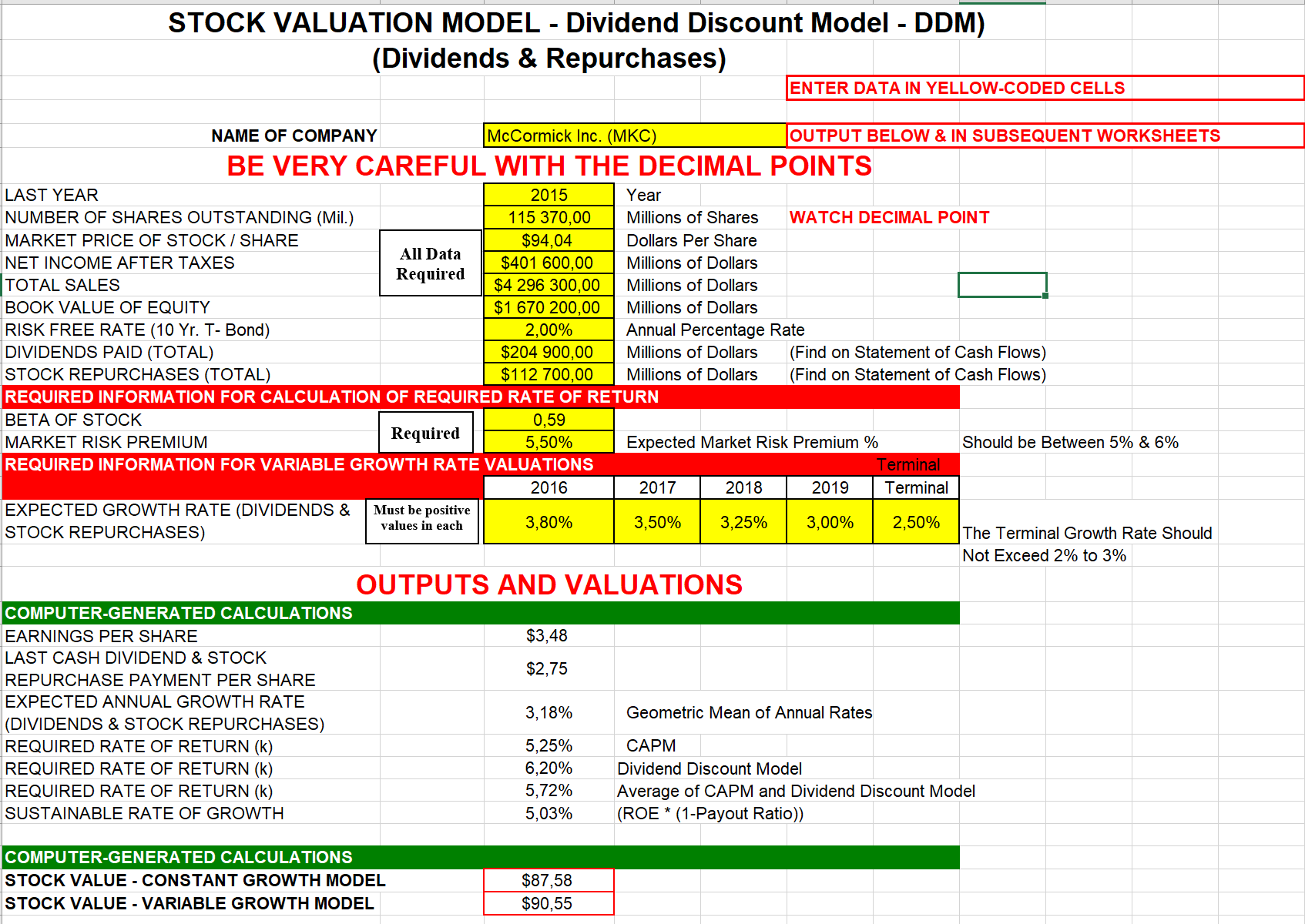

Please refer to the Excel model below.

STOCK VALUATION MODEL - Dividend Discount Model - DDM) (Dividends & Repurchases) NAME OF COMPANY McCormick Inc. (MKC) BE VERY CAREFUL WITH THE DECIMAL POINTS LAST YEAR NUMBER OF SHARES OUTSTANDING (Mil.) MARKET PRICE OF STOCK / SHARE NET INCOME AFTER TAXES TOTAL SALES BOOK VALUE OF EQUITY RISK FREE RATE (10 Yr. T- Bond) DIVIDENDS PAID (TOTAL) 2015 115 370,00 $94,04 $401 600,00 $4 296 300,00 $1 670 200,00 2,00% $204 900,00 $112 700,00 STOCK REPURCHASES (TOTAL) REQUIRED INFORMATION FOR CALCULATION OF REQUIRED RATE OF RETURN BETA OF STOCK 0,59 5,50% MARKET RISK PREMIUM REQUIRED INFORMATION FOR VARIABLE GROWTH RATE VALUATIONS 2016 3,80% EXPECTED GROWTH RATE (DIVIDENDS & STOCK REPURCHASES) COMPUTER-GENERATED CALCULATIONS EARNINGS PER SHARE LAST CASH DIVIDEND & STOCK REPURCHASE PAYMENT PER SHARE EXPECTED ANNUAL GROWTH RATE (DIVIDENDS & STOCK REPURCHASES) REQUIRED RATE OF RETURN (K) REQUIRED RATE OF RETURN (K) REQUIRED RATE OF RETURN (K) SUSTAINABLE RATE OF GROWTH All Data Required Required Must be positive values in each COMPUTER-GENERATED CALCULATIONS STOCK VALUE - CONSTANT GROWTH MODEL STOCK VALUE - VARIABLE GROWTH MODEL OUTPUTS AND VALUATIONS $3,48 $2,75 3,18% 5,25% 6,20% 5,72% 5,03% ENTER DATA IN YELLOW-CODED CELLS $87,58 $90,55 OUTPUT BELOW & IN SUBSEQUENT WORKSHEETS Year Millions of Shares Dollars Per Share Millions of Dollars Millions of Dollars Millions of Dollars Annual Percentage Rate Millions of Dollars Millions of Dollars WATCH DECIMAL POINT (Find on Statement of Cash Flows) (Find on Statement of Cash Flows) Expected Market Risk Premium % 2017 2018 3,50% 3,25% 2019 3,00% Terminal Terminal 2,50% Should be Between 5% & 6% The Terminal Growth Rate Should Not Exceed 2% to 3% Geometric Mean of Annual Rates CAPM Dividend Discount Model Average of CAPM and Dividend Discount Model (ROE* (1-Payout Ratio))

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Here are the results of the dividend discount model valuation for Kraft Heinz Company with stepbyste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started