Question

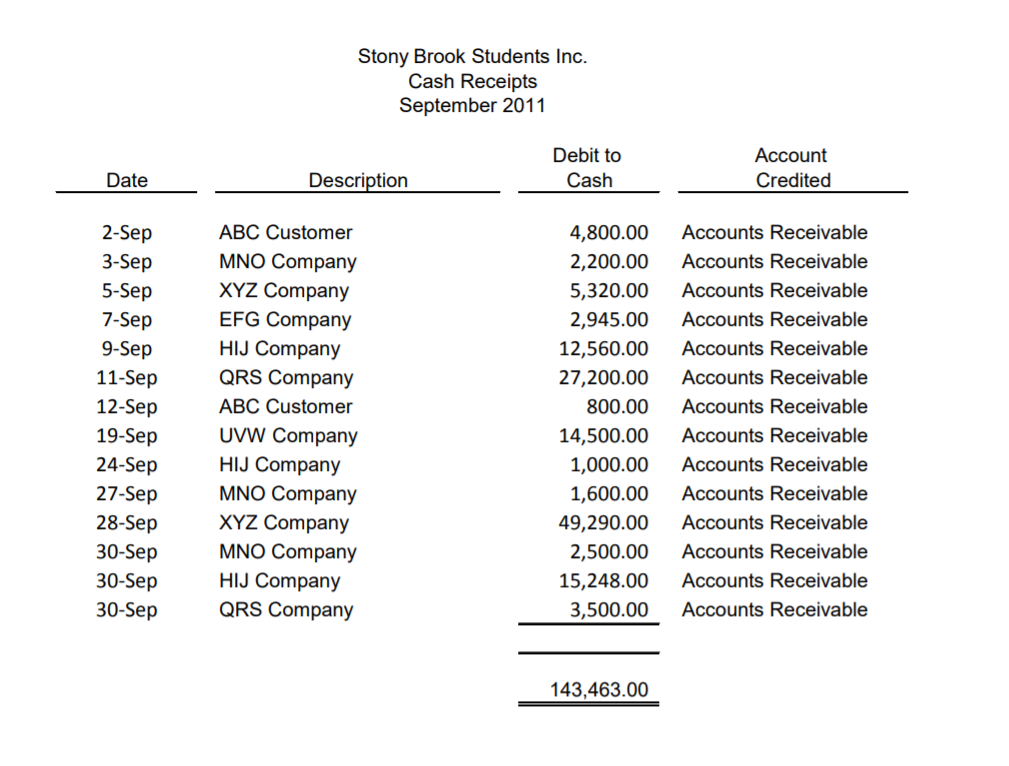

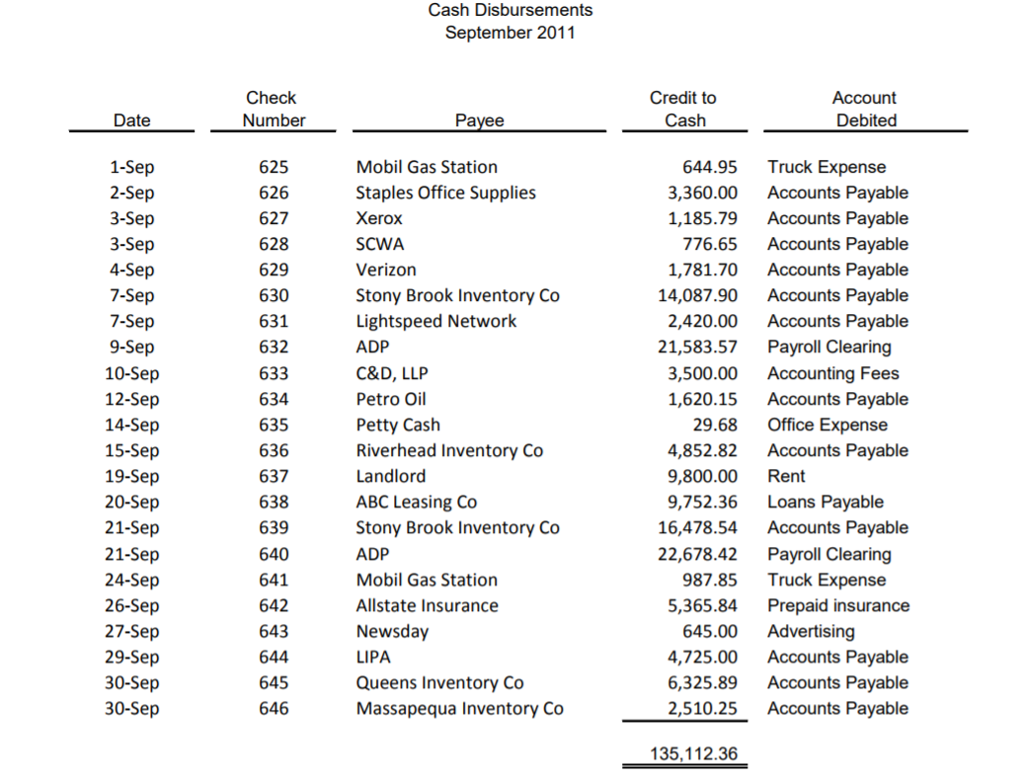

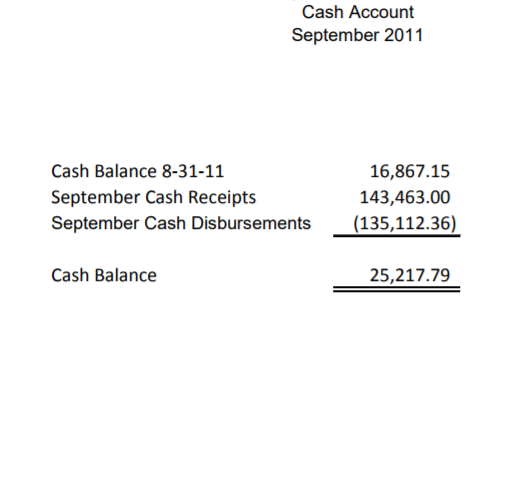

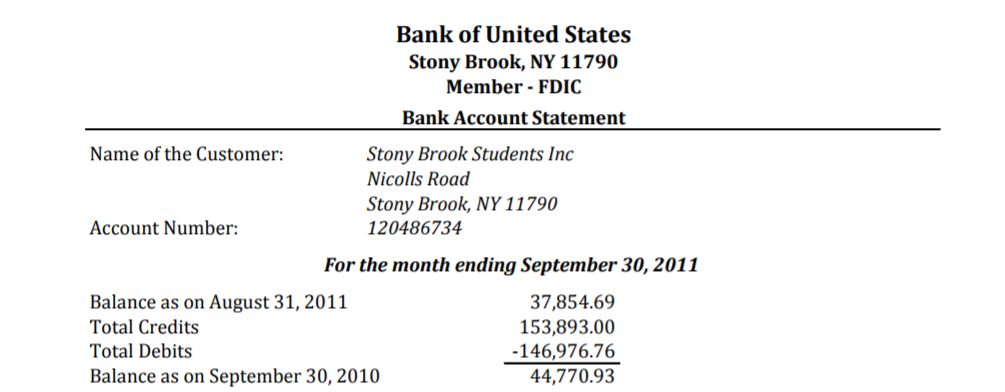

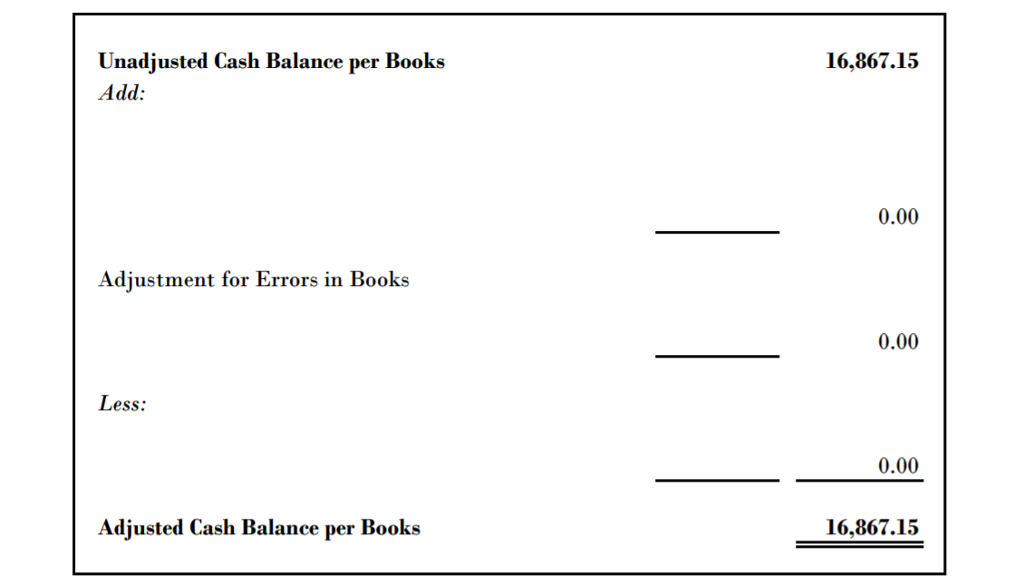

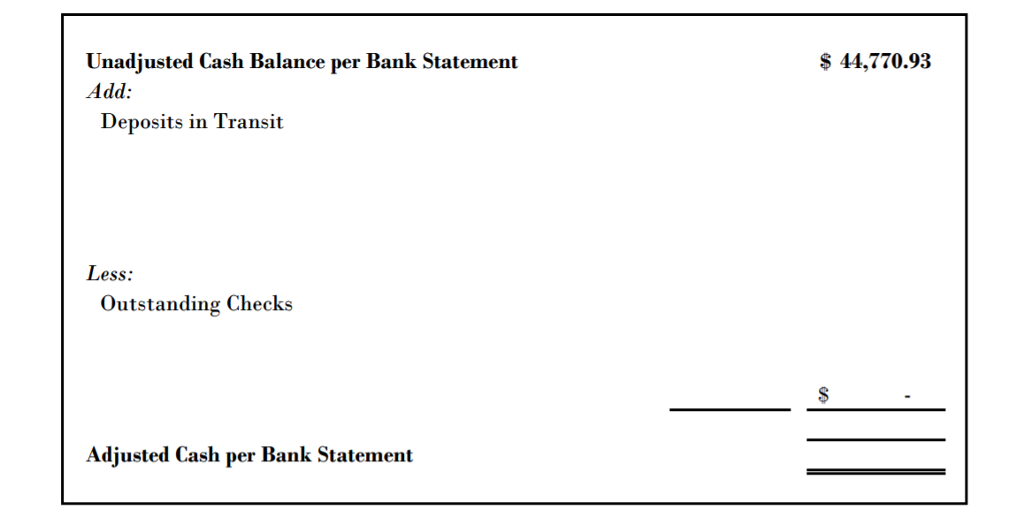

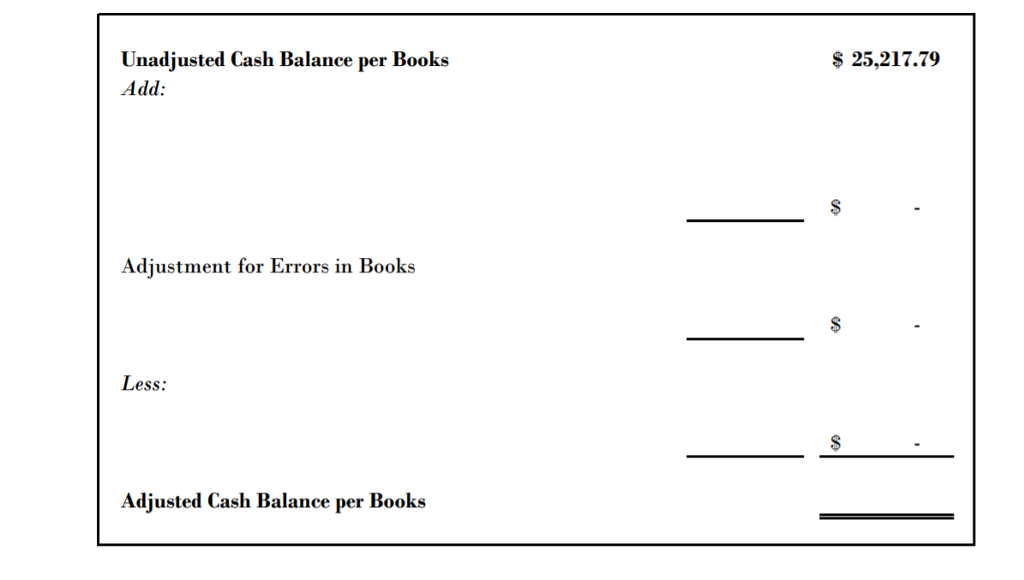

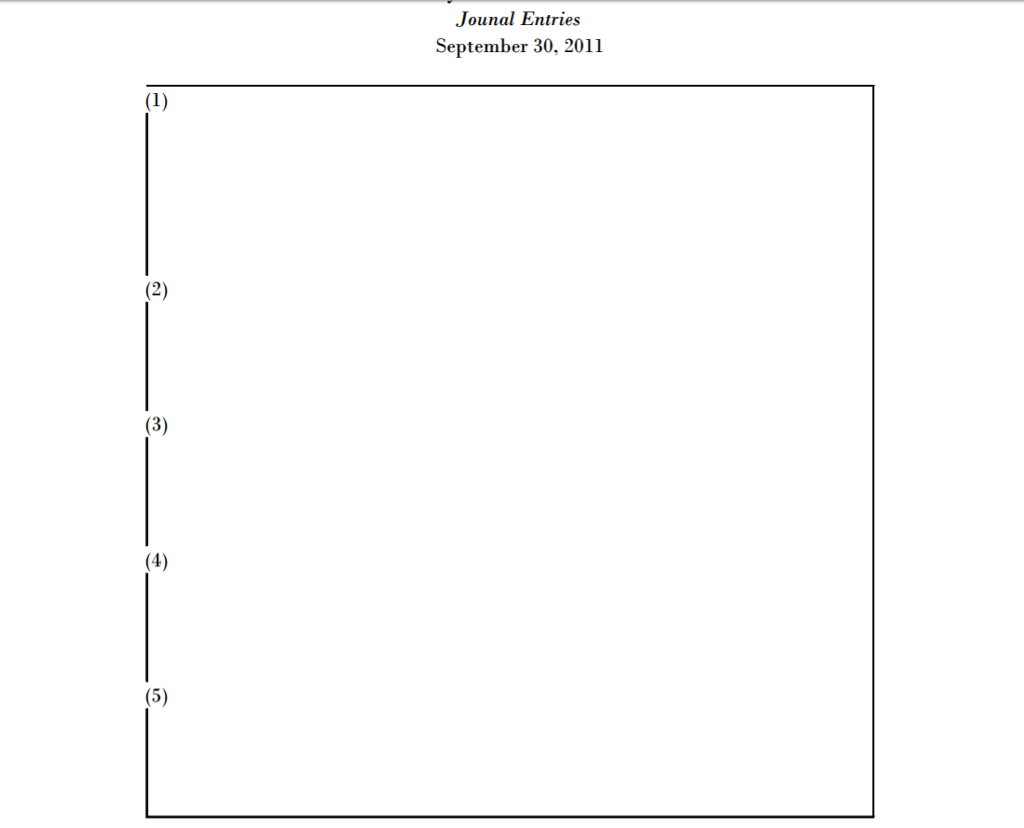

1) Do a Bank Reconciliation for September 2011 2) Do Journal Entries for adjustments to the books as determined in the Bank Rec Notes for

1) Do a Bank Reconciliation for September 2011

2) Do Journal Entries for adjustments to the books as determined in the Bank Rec

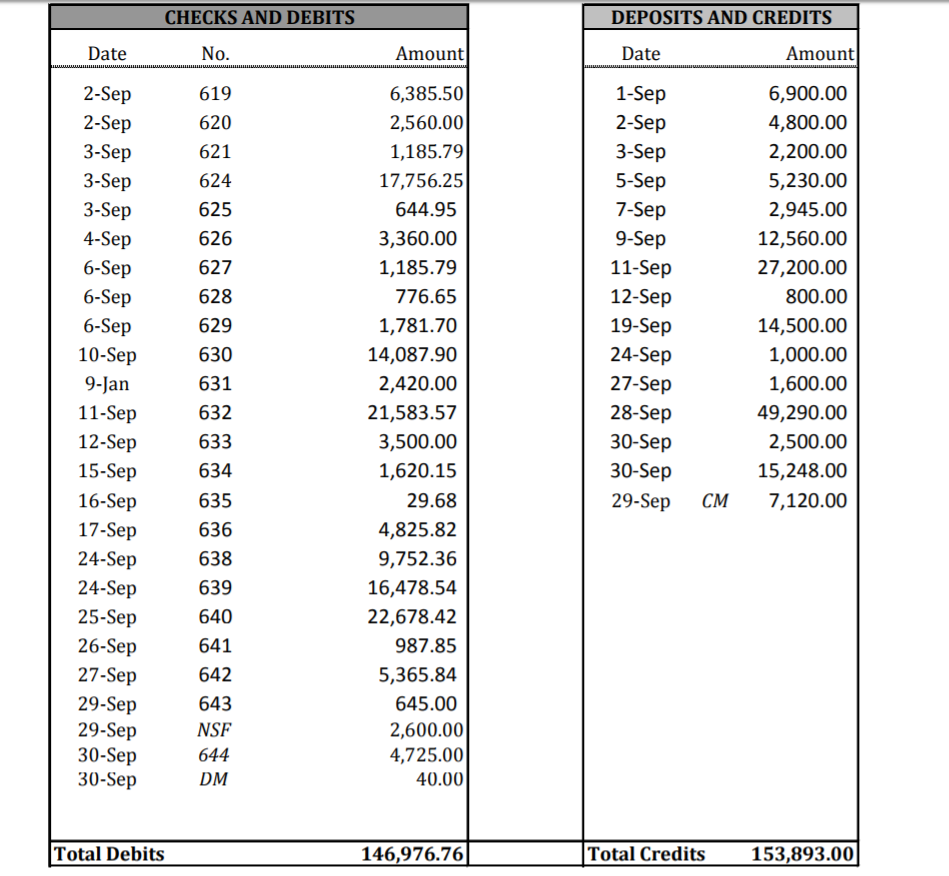

Notes for September, 2011 Bank Statement

Symbols CM Credit Memo DM Debit Memo NSF Not Sufficient Funds

1) The bank collected a Notes Receivable for the company in the amount of $7,000 plus interest of $150 and charged the company $30 for doing this

2) There was a $2,600 deposit from a customer that bounced because of NSF

3) The bank charged the company a $40 monthly bank charge

4) Errors: There were two errors made by Stony Brook Students Inc on their books (note the bank's statement is correct, two of the company's entries on its books are incorrect)

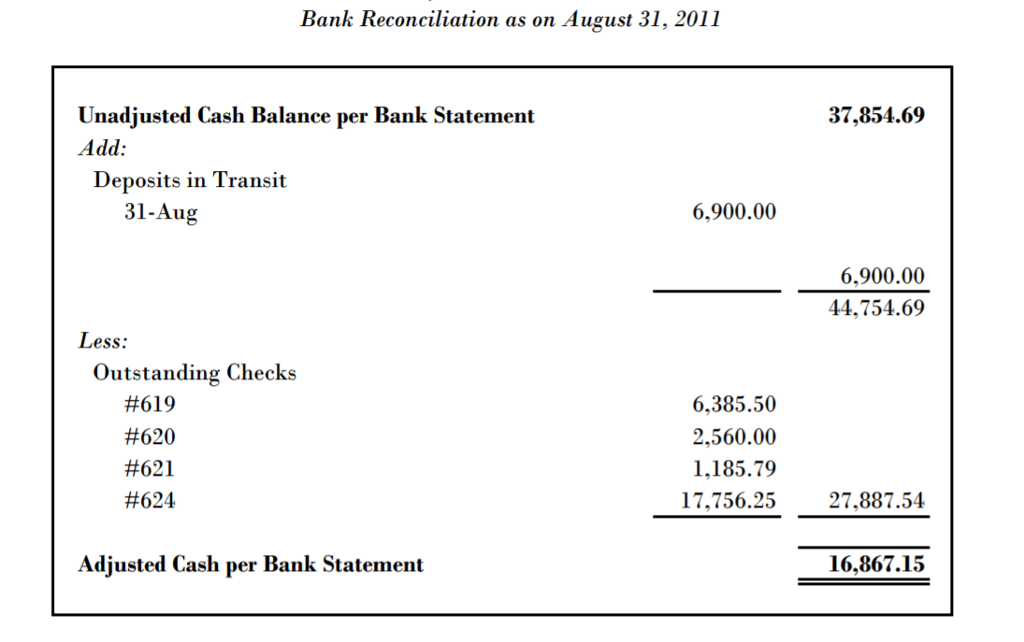

Notes for August, 2011 Bank Reconcilliation

1) There was one DIT and four OSC on the August 2011 Bank Reconciliation.

2) There were no adjustments to the books on the August, 2011 bank reconcilliation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started