Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Does the financial plan seem realistic? Explain (20) 2. Indicate whether you will approve the business and write a report as to motivate your

1. Does the financial plan seem realistic? Explain (20)

2. Indicate whether you will approve the business and write a report as to motivate your decision (30)

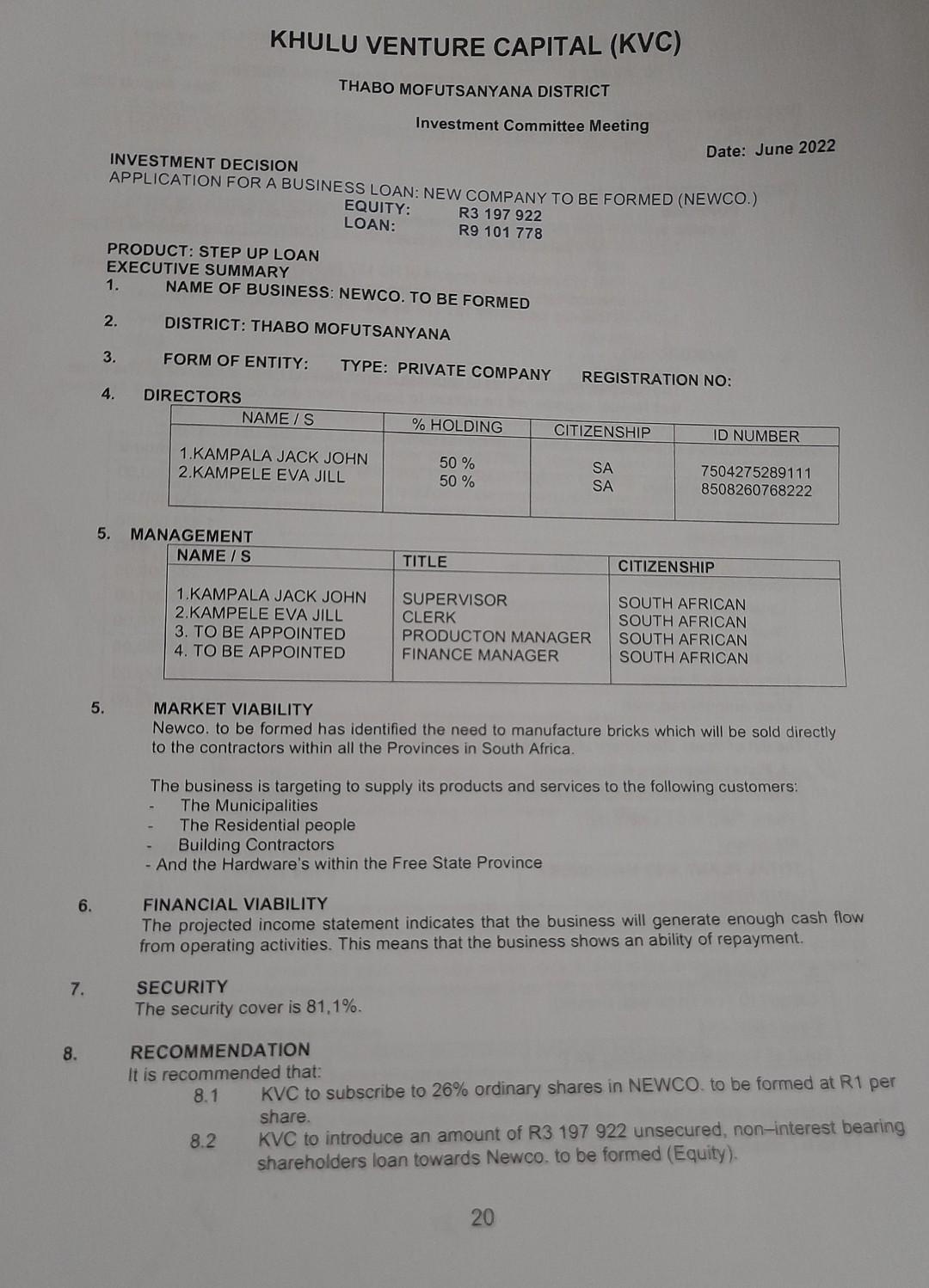

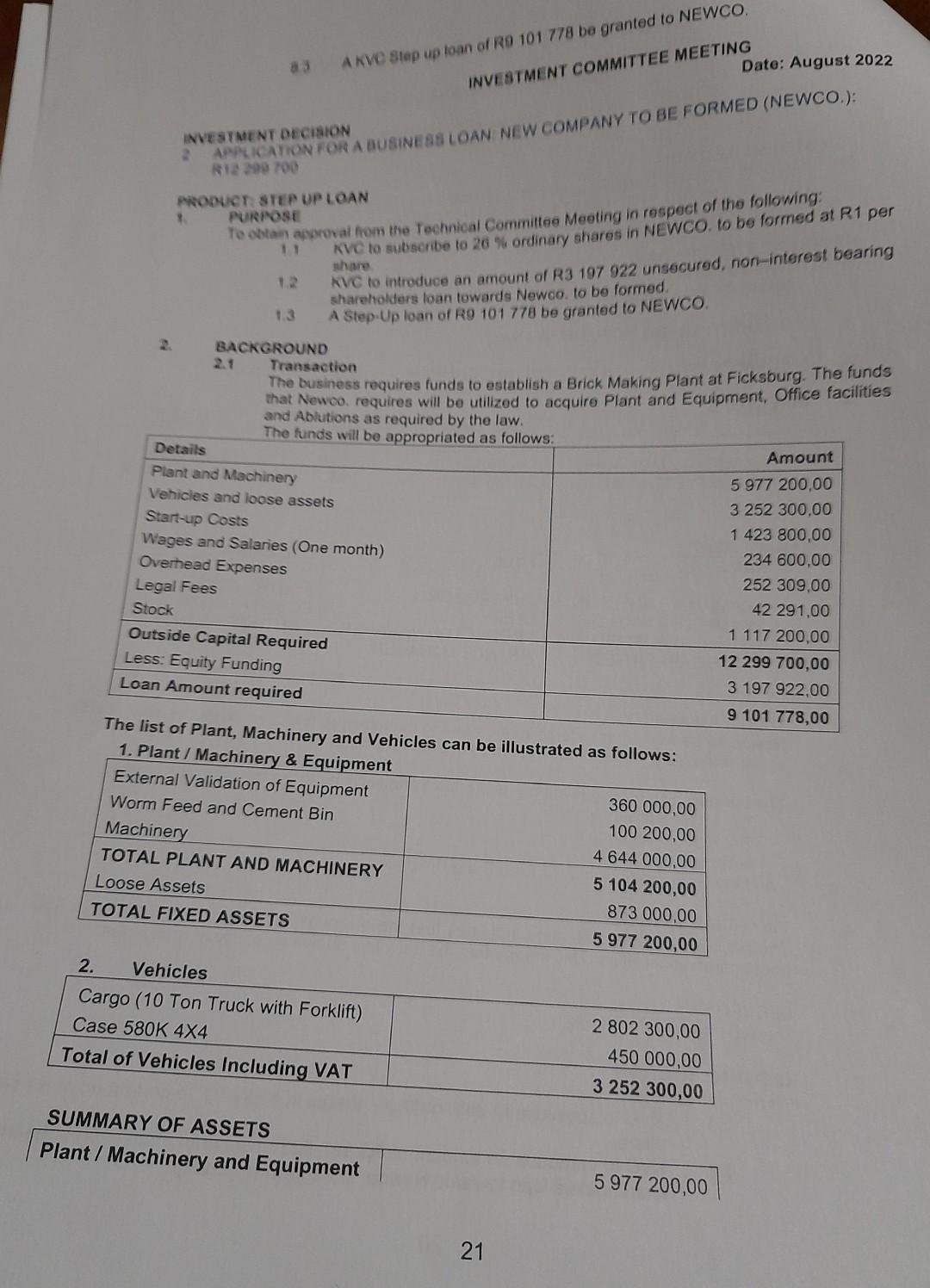

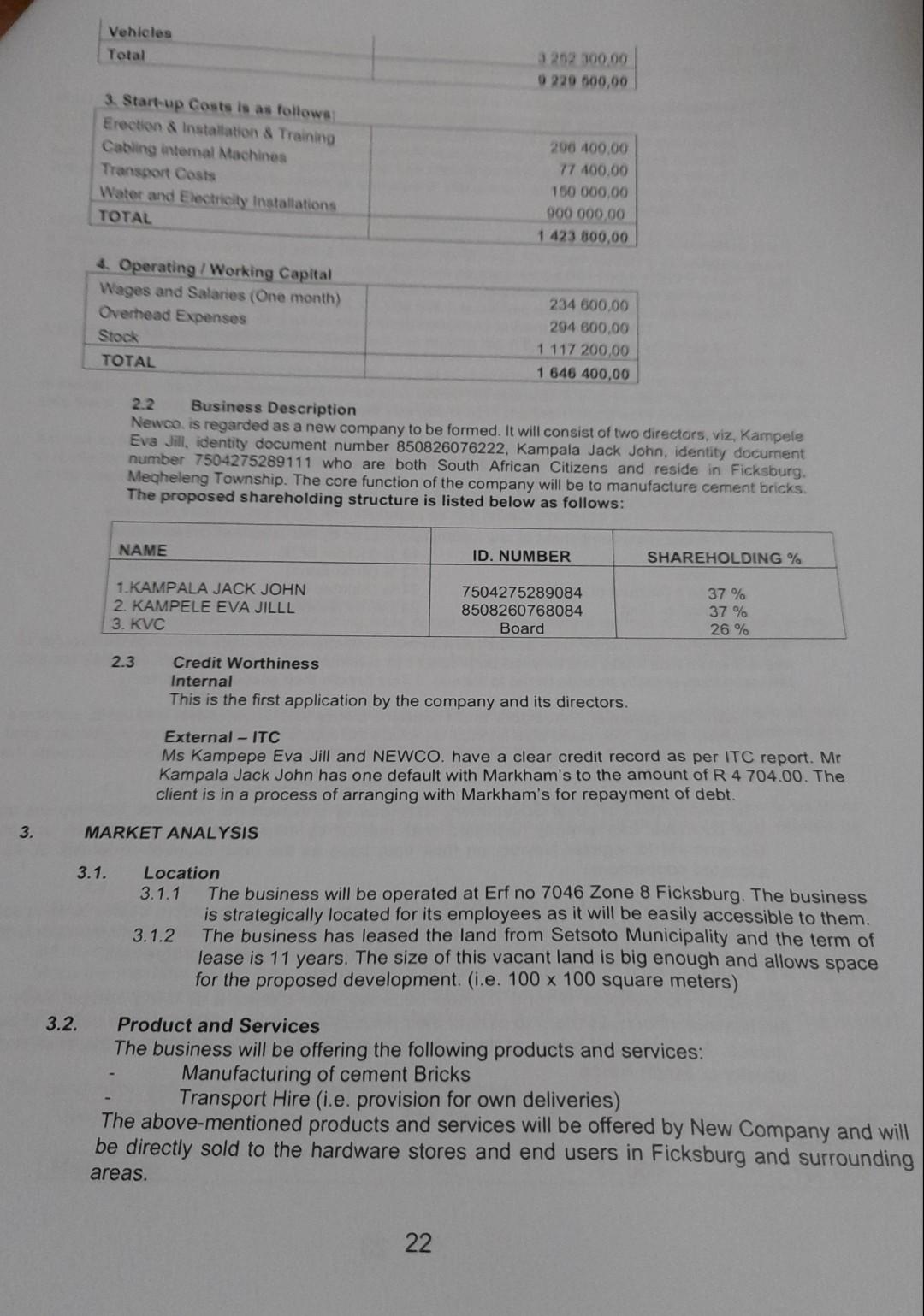

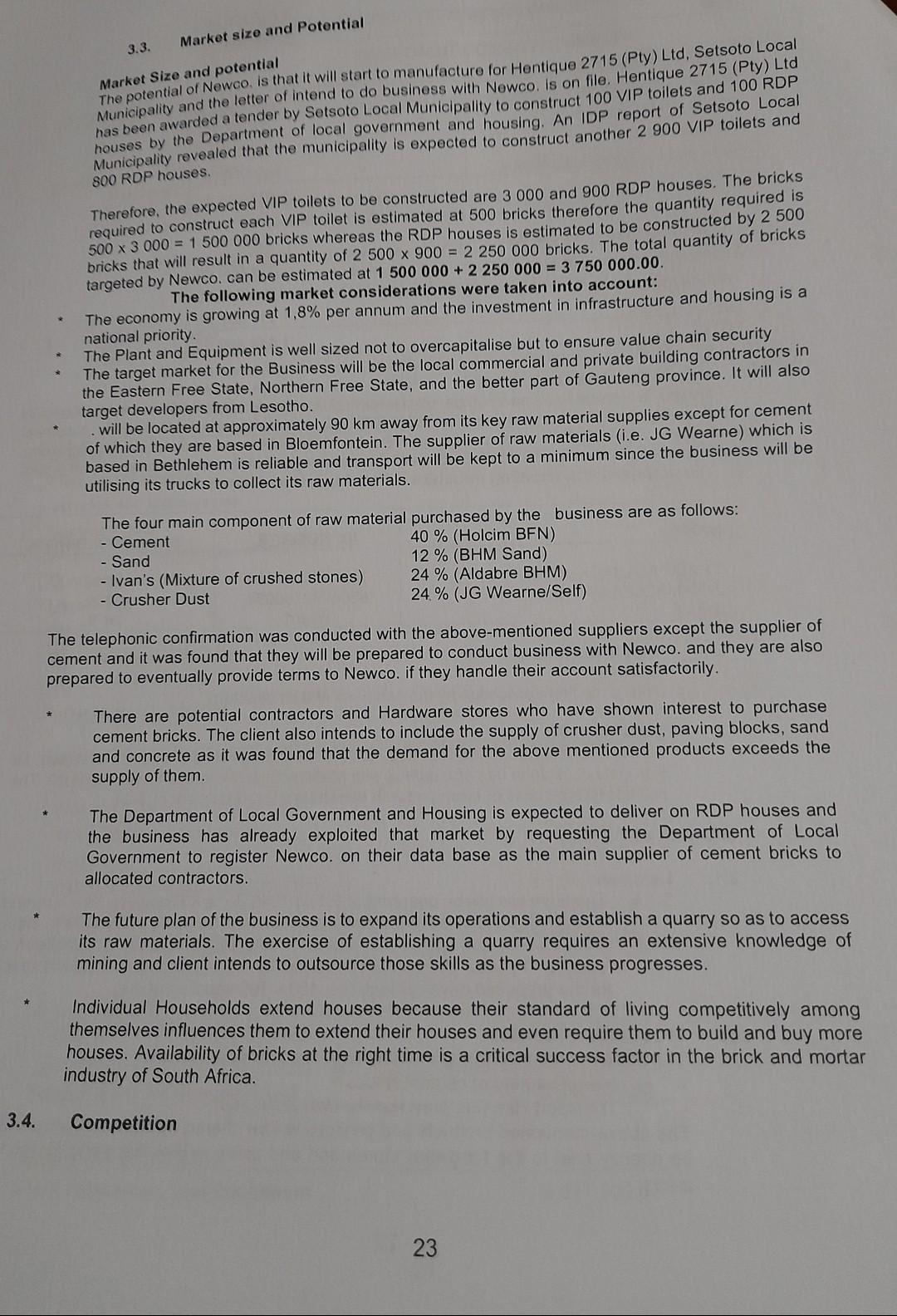

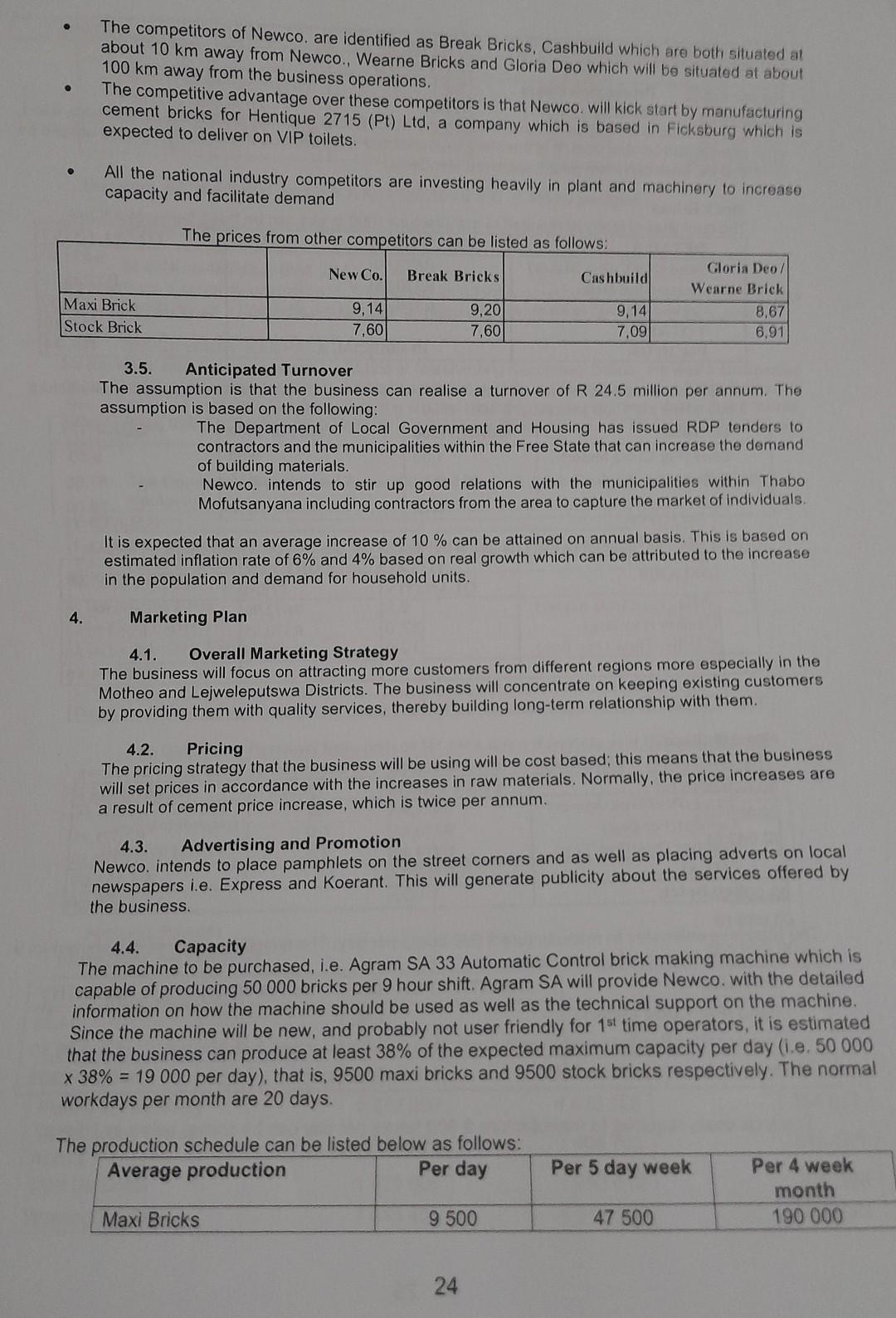

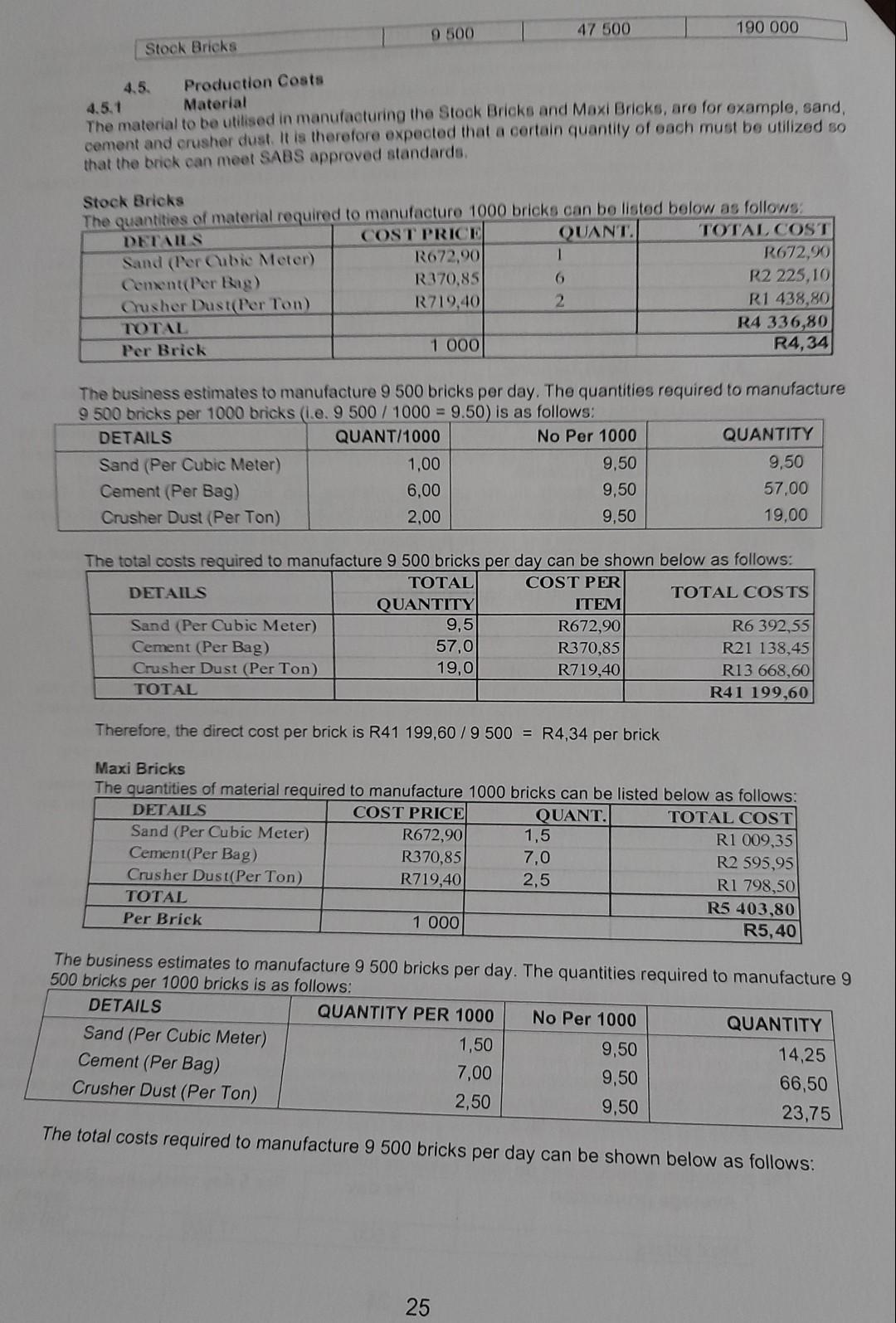

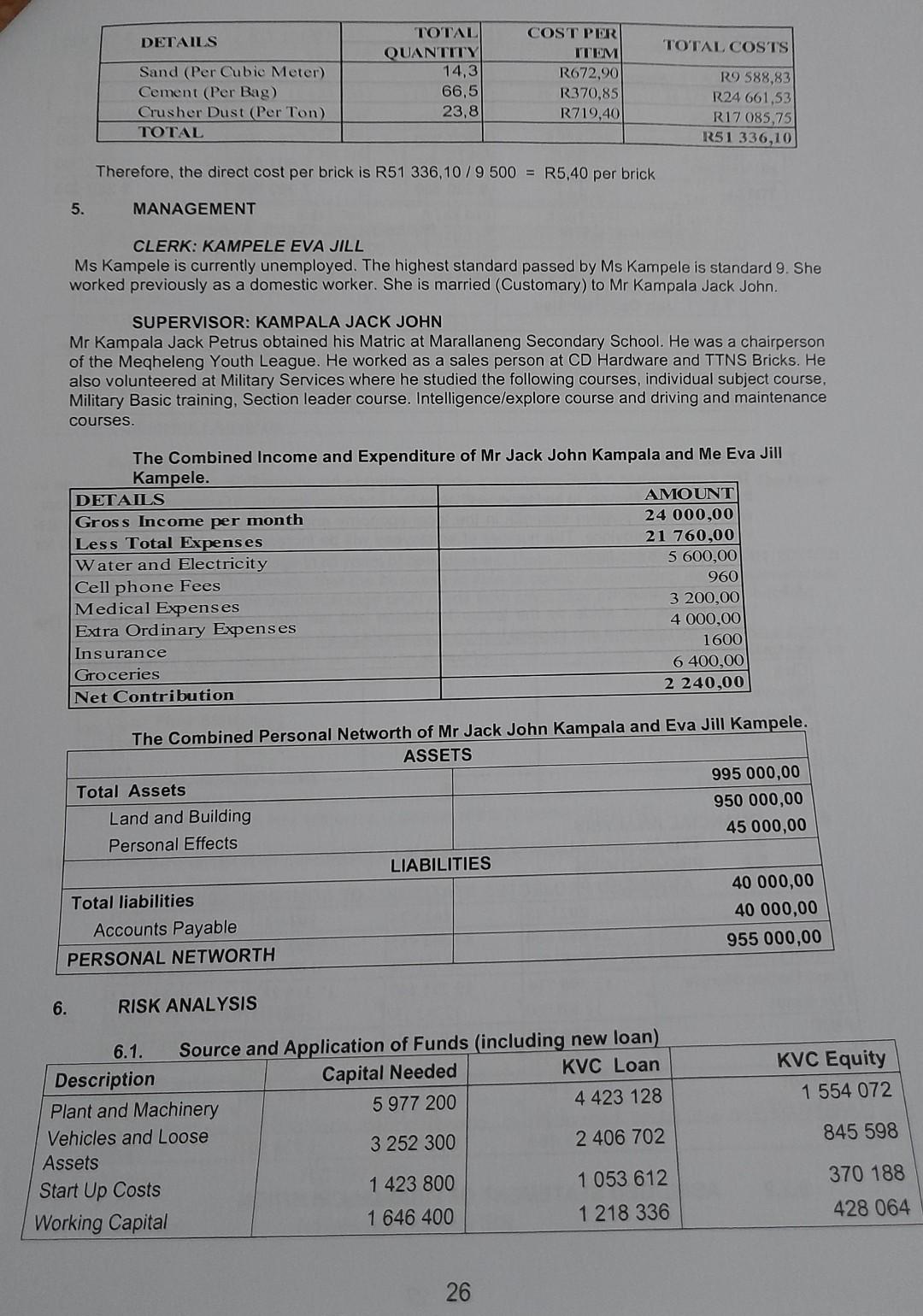

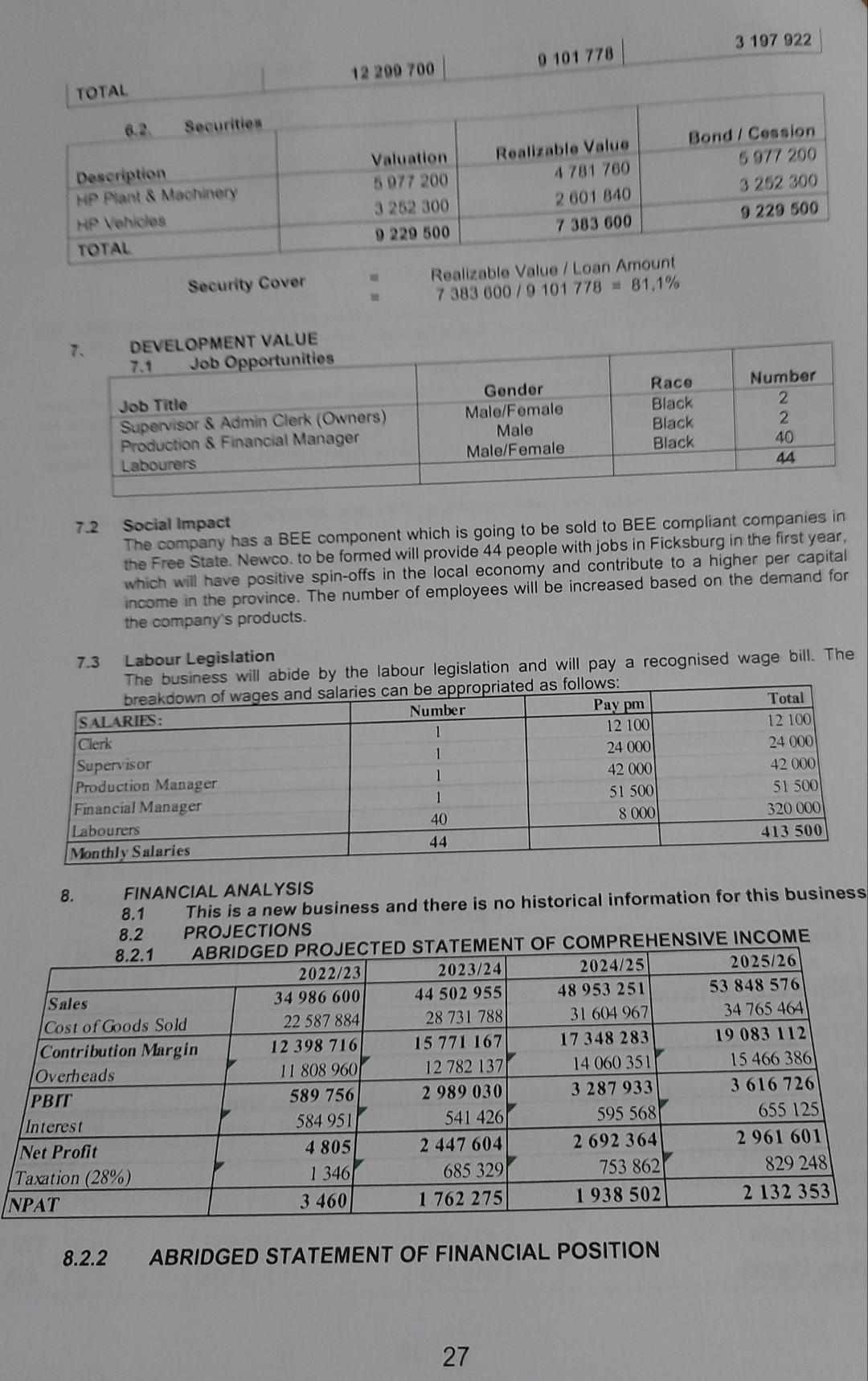

Date: June 2022 INVESTMENT DECISION PRODUCT : STEP UP LOAN EXECUTIVE SUMMARY 1. NAME OF BUSINESS: NEWCO. TO BE FORMED 2. DISTRICT: THABO MOFUTSANYANA 3. FORM OF ENTITY: TYPE: PRIVATE COMPANY REGISTRATION NO: 4. Pidentann 5. M 5. MARKET VIABILITY Newco. to be formed has identified the need to manufacture bricks which will be sold directly to the contractors within all the Provinces in South Africa. The business is targeting to supply its products and services to the following customers: The Municipalities The Residential people Building Contractors - And the Hardware's within the Free State Province 6. FINANCIAL VIABILITY The projected income statement indicates that the business will generate enough cash flow from operating activities. This means that the business shows an ability of repayment. 7. SECURITY The security cover is 81,1%. 8. RECOMMENDATION It is recommended that: 8.1 KVC to subscribe to 26% ordinary shares in NEWCO. to be formed at R1 per share. 8.2 KVC to introduce an amount of R3 197922 unsecured, non-interest bearing shareholders loan towards Newco, to be formed (Equity). a 3 AKV Step up toan of R 101778 bo framicu INVI STMENT COMMITTEE MEETING Date: August 2022 INVESYMENT DECISKN PiAOMUCT STEPUPLCAN PURNOSE To oviain aporocal from the Technical Commiltee Meeting in rospect of the following: 1. KVretal fhow the fechinical Commitee to 26 \% ordinary shares in NEWCO. to be formed at R1 per 12. Khare to introduce an amount of R3 197922 unsecured, non-interest bearing 1.3. A Step.Up loan of R9 101778 be granted to NEWCO. 2. BACKGROUND 2.1 Transaction The business requires funds to establish a Brick Making Plant at Ficksburg. The funds that Newco. requires will be utilized to acquire Plant and Equipment, Office facilities and Ablutions as required by the law. 2.2 Business Description Newco, is regarded as a new company to be formed. It will consist of two directors, viz, Kampele Eva Jill, identity document number 850826076222, Kampala Jack John, identity document number 7504275289111 who are both South African Citizens and reside in Ficksburg. Meaheleng Township. The core function of the company will be to manufacture cement bricks. The proposed shareholding structure is listed below as follows: 2.3 Credit Worthiness Internal This is the first application by the company and its directors. External - ITC Ms Kampepe Eva Jill and NEWCO. have a clear credit record as per ITC report. Mr Kampala Jack John has one default with Markham's to the amount of R4704.00. The client is in a process of arranging with Markham's for repayment of debt. MARKET ANALYSIS 3.1. Location 3.1.1 The business will be operated at Erf no 7046 Zone 8 Ficksburg. The business is strategically located for its employees as it will be easily accessible to them. 3.1.2 The business has leased the land from Setsoto Municipality and the term of lease is 11 years. The size of this vacant land is big enough and allows space for the proposed development. (i.e. 100100 square meters) 3.2. Product and Services The business will be offering the following products and services: Manufacturing of cement Bricks Transport Hire (i.e. provision for own deliveries) The above-mentioned products and services will be offered by New Company and will be directly sold to the hardware stores and end users in Ficksburg and surrounding areas. 3.3. Market size and Potential Market Size and potential The potential of Newco, is that it will start to manufacture for Hentique 2715 (Pty) Ltd, Setsoto Local Municipality and the letter of intend to do business with Newco. Is on file. Hentique 2715 (Pty) Ltd nas been awarded a tender by Setsoto Local Municipality to construct 100 VIP toilets and 100 RDP houses by the Department of local government and housing. An IDP report of Setsoto Local Municipality revealed that the municipality is expected to construct another 2900VIP toilets and 800RDP houses. Therefore, the expected VIP toilets to be constructed are 3000 and 900 RDP houses. The bricks required to construct each VIP toilet is estimated at 500 bricks therefore the quantity required is 5003000=1500000 bricks whereas the RDP houses is estimated to be constructed by 2500 bricks that will result in a quantity of 2500900=2250000 bricks. The total quantity of bricks targeted by Newco. can be estimated at 1500000+2250000=3750000.00. The following market considerations were taken into account: The economy is growing at 1,8% per annum and the investment in infrastructure and housing is a national priority. The Plant and Equipment is well sized not to overcapitalise but to ensure value chain security The target market for the Business will be the local commercial and private building contractors in the Eastern Free State, Northern Free State, and the better part of Gauteng province. It will also target developers from Lesotho. . will be located at approximately 90km away from its key raw material supplies except for cement of which they are based in Bloemfontein. The supplier of raw materials (i.e. JG Wearne) which is based in Bethlehem is reliable and transport will be kept to a minimum since the business will be utilising its trucks to collect its raw materials. The four main component of raw material purchased by the business are as follows: - Cement 40% (Holcim BFN) - Sand 12% (BHM Sand) -Ivans(Mixtureofcrushedstones)-CrusherDust24%(AldabreBHM)24%(JGWearne/Self) The telephonic confirmation was conducted with the above-mentioned suppliers except the supplier of ement and it was found that they will be prepared to conduct business with Newco. and they are also repared to eventually provide terms to Newco. if they handle their account satisfactorily. There are potential contractors and Hardware stores who have shown interest to purchase cement bricks. The client also intends to include the supply of crusher dust, paving blocks, sand and concrete as it was found that the demand for the above mentioned products exceeds the supply of them. The Department of Local Government and Housing is expected to deliver on RDP houses and the business has already exploited that market by requesting the Department of Local Government to register Newco. on their data base as the main supplier of cement bricks to allocated contractors. The future plan of the business is to expand its operations and establish a quarry so as to access its raw materials. The exercise of establishing a quarry requires an extensive knowledge o mining and client intends to outsource those skills as the business progresses. Individual Households extend houses because their standard of living competitively amor themselves influences them to extend their houses and even require them to build and buy mo houses. Availability of bricks at the right time is a critical success factor in the brick and mor industry of South Africa. Competition - The competitors of Newco. are identified as Break Bricks, Cashbuild which are both situated at about 10km away from Newco., Wearne Bricks and Gloria Deo which will bo situated at about 100km away from the business operations. The competitive advantage over these competitors is that Newco. will kick start by manufacluring cement bricks for Hentique 2715 (Pt) Ltd, a company which is based in Ficksburg which is expected to deliver on VIP toilets. - All the national industry competitors are investing heavily in plant and machinery to increase capacity and facilitate demand The prices from other competitors can be listad ac follnwe: 3.5. Anticipated Turnover The assumption is that the business can realise a turnover of R 24.5 million per annum. The assumption is based on the following: The Department of Local Government and Housing has issued RDP tenders to contractors and the municipalities within the Free State that can increase the demand of building materials. Newco. intends to stir up good relations with the municipalities within Thabo Mofutsanyana including contractors from the area to capture the market of individuals. It is expected that an average increase of 10% can be attained on annual basis. This is based on estimated inflation rate of 6% and 4% based on real growth which can be attributed to the increase in the population and demand for household units. 4. Marketing Plan 4.1. Overall Marketing Strategy The business will focus on attracting more customers from different regions more especially in the Motheo and Lejweleputswa Districts. The business will concentrate on keeping existing customers by providing them with quality services, thereby building long-term relationship with them. 4.2. Pricing The pricing strategy that the business will be using will be cost based; this means that the business will set prices in accordance with the increases in raw materials. Normally, the price increases are a result of cement price increase, which is twice per annum. 4.3. Advertising and Promotion Newco. intends to place pamphlets on the street corners and as well as placing adverts on local newspapers i.e. Express and Koerant. This will generate publicity about the services offered by the business. 4.4. Capacity The machine to be purchased, i.e. Agram SA 33 Automatic Control brick making machine which is capable of producing 50000 bricks per 9 hour shift. Agram SA will provide Newco. with the detailed information on how the machine should be used as well as the technical support on the machine. Since the machine will be new, and probably not user friendly for 1st time operators, it is estimated that the business can produce at least 38% of the expected maximum capacity per day (i.e. 50000 38%=19000 per day), that is, 9500 maxi bricks and 9500 stock bricks respectively. The normal workdays per month are 20 days. 24 4.5. Production Costs 4.5.1 Material The material to be utilised in manufacturing the Stock Bricks and Maxi Bricks, are for example, sand, cement and crusher dust. It is therefore expected that a certain quantity of each must be utilized so that the brick can meet SABS approved standards. Stock Bricks The business estimates to manufacture 9500 bricks per day. The quantities required to manufacture o. 50n hnicks ner 1000 bricks (i.e. 9500/1000=9.50 ) is as follows: The total costs required to manufacture 9500 bricks per day can be shown below as follows: Therefore, the direct cost per brick is R41199,60/9500=R4,34 per brick Maxi Bricks 500 bricks per 1000 bricks is as follows: The total costs required to manufacture 9500 bricks per day can be shown below as follows: Therefore, the direct cost per brick is R51336,10/9500=R5,40 per brick 5. MANAGEMENT CLERK: KAMPELE EVA JILL Ms Kampele is currently unemployed. The highest standard passed by Ms Kampele is standard 9 . She worked previously as a domestic worker. She is married (Customary) to Mr Kampala Jack John. SUPERVISOR: KAMPALA JACK JOHN Mr Kampala Jack Petrus obtained his Matric at Marallaneng Secondary School. He was a chairperson of the Meqheleng Youth League. He worked as a sales person at CD Hardware and TTNS Bricks. He also volunteered at Military Services where he studied the following courses, individual subject course, Military Basic training, Section leader course. Intelligence/explore course and driving and maintenance courses. The Combined Income and Expenditure of Mr Jack John Kampala and Me Eva Jill 6. RISK ANALYSIS 7.2 Social lmpact The company has a BEE component which is going to be sold to BEE compliant companies in the Free State. Newco. to be formed will provide 44 people with jobs in Ficksburg in the first year, which will have positive spin-offs in the local economy and contribute to a higher per capital income in the province. The number of employees will be increased based on the demand for the company's products. 7.3 Labour Legislation The business will abide by the labour legislation and will pay a recognised wage bill. The by andrise nan he anoropriated as follows: 8. FINANCIAL ANALYSIS 8.1 This is a new business and there is no historical information for this business 8.2 PROJECTIONS 8.2.2 ABRIDGED STATEMENT OF FINANCIAL POSITION Comments / Analysis Profit Margin The projected contribution percentage of the company for the next four years is 41,8%. The higher the percentage, the higher are the chances for this business to grow and survive. Net Profit Margin The net profit percentage in all years of operation is 0,1% in 2022/23 and 5,5% in 2023/24, 2024/25 and 2025/26. This means that the business is able to control its operating expenses/overheads and it also indicates the percentage profit made from sales after all costs have been deducted. With the financial year-end results as projected, the business has the potential to realise a positive net profit after interest and tax. The projected performance indicates that this business can be profitable for all financial years under review. Cash Flow Statement The business has the potential to maintain a positive cash flow from year one to year four. 9. LEGAL IMPLICATIONS National Credit Act - The transaction falls within the provision of the National Credit Act. 10. RECOMMENDATIONS It is recommended that: 10.1 KVC to subscribe 26% shareholding at R1 per share in Newco. 10 KVC introduce shareholder's loan in Newco. to be formed under the following terms and 10.3 An interest-bearing step-up loan of R 9101778 be granted to Newco. for the purpose of establishing a brick manufacturing plant under the following terms and conditions: 10.3.1 Loan Amount: R 9101778 10.3.2 Loan Term: 72 months 10.3.3 Interest rate: PBR (Fluctuating) 10% 10.3.4 Monthly instalment - only interest: R75 848 10.3.5 Initiation Fee: R 2850.00 (VAT inc.) be paid before disbursement 10.4 Loan Agreement to be concluded and monthly instalments be paid by Debit Order. 10.5 Instalment Sale Agreement on New Equipment and Vehicle be registered for the loan amount. 10.6 Tax Clearance Certificate be submitted before implementation of loan. 10.7 Shareholders Agreements be concluded adequately safeguarding the interests of KVC and inter alia addressing the following: i. That all decisions by Shareholders and the Directors have to be sanctioned by KVC or its delegate. ii. That expenditure incurred by Management be sanctioned by KVC and a delegate who may be elected by KVC to participate in Management. iii. That the Company commits itself to the development and transfer of skills to its employees in accordance with an appropriate plan approved by the Board of the Company. iv. That all other shareholders loans will be non-interest bearing and only repayable once both KVC loans have been fully settled. v. That dividend will only be declared and payable to other shareholders once the KVCs. Shareholders loan has been repaid and provided that the propeller loan repayments remain up to date. vi.That the share certificates and loan accounts of other shareholders be ceded to KVC. vii. That the other shareholders bind themselves as Sureties in respect of both KVC loans. 10.8 Legal Services to verify that the Company and all other participants in the transactions are authorized to do so in accordance with relevant founding documentation. 10.10 The Company to provide KVC with appropriate resolution(s) authorizing the conclusion of relevant transactions. 10.11 Keyman Insurance be taken out before implementation of loan and be ceded to KVC. 10.12 Comprehensive Insurance on New Vehicles be taken out before disbursement on Vehicles and be ceded to KVC. 10.13 Comprehensive Insurance on New Equipment be taken out after disbursement on Equipment and be ceded to KVC. 10.14 The copy of pro-forma lease agreement be submitted before disbursement. 10.15 The shelf company be acquired by Newco. to be formed. 10.16 All legal costs incurred be debited to the Step-Up Loan account. 10.17 Disbursement to be done as follows: i.After conclusion of all relevant Contractual and related documentation and ii. After registration of securities and iii.Payment of loan be made as per requisitions to be drawn and submitted by client. 10.18 The application be approved subject to the compliance of the provision of the NCA. 10.19 The funds will be appropriated as follows: \begin{tabular}{|l|r|} \hline Details & Amount \\ \hline Plant and Machinery & 5977200,00 \\ Vehicles and loose assets & 3252300,00 \\ Start-up Costs & 1423800,00 \\ Wages/Salaries (1 month) & 234600,00 \\ Overhead Expenses & 252309,00 \\ Legal Fees & 42291,00 \\ Stock & 1117200,00 \\ \hline Outside Capital Required & 12299700,00 \\ Less: Equity Funding & 3197922,00 \\ \hline Loan Amount required & 9101778,00 \\ \hline \end{tabular} Date: June 2022 INVESTMENT DECISION PRODUCT : STEP UP LOAN EXECUTIVE SUMMARY 1. NAME OF BUSINESS: NEWCO. TO BE FORMED 2. DISTRICT: THABO MOFUTSANYANA 3. FORM OF ENTITY: TYPE: PRIVATE COMPANY REGISTRATION NO: 4. Pidentann 5. M 5. MARKET VIABILITY Newco. to be formed has identified the need to manufacture bricks which will be sold directly to the contractors within all the Provinces in South Africa. The business is targeting to supply its products and services to the following customers: The Municipalities The Residential people Building Contractors - And the Hardware's within the Free State Province 6. FINANCIAL VIABILITY The projected income statement indicates that the business will generate enough cash flow from operating activities. This means that the business shows an ability of repayment. 7. SECURITY The security cover is 81,1%. 8. RECOMMENDATION It is recommended that: 8.1 KVC to subscribe to 26% ordinary shares in NEWCO. to be formed at R1 per share. 8.2 KVC to introduce an amount of R3 197922 unsecured, non-interest bearing shareholders loan towards Newco, to be formed (Equity). a 3 AKV Step up toan of R 101778 bo framicu INVI STMENT COMMITTEE MEETING Date: August 2022 INVESYMENT DECISKN PiAOMUCT STEPUPLCAN PURNOSE To oviain aporocal from the Technical Commiltee Meeting in rospect of the following: 1. KVretal fhow the fechinical Commitee to 26 \% ordinary shares in NEWCO. to be formed at R1 per 12. Khare to introduce an amount of R3 197922 unsecured, non-interest bearing 1.3. A Step.Up loan of R9 101778 be granted to NEWCO. 2. BACKGROUND 2.1 Transaction The business requires funds to establish a Brick Making Plant at Ficksburg. The funds that Newco. requires will be utilized to acquire Plant and Equipment, Office facilities and Ablutions as required by the law. 2.2 Business Description Newco, is regarded as a new company to be formed. It will consist of two directors, viz, Kampele Eva Jill, identity document number 850826076222, Kampala Jack John, identity document number 7504275289111 who are both South African Citizens and reside in Ficksburg. Meaheleng Township. The core function of the company will be to manufacture cement bricks. The proposed shareholding structure is listed below as follows: 2.3 Credit Worthiness Internal This is the first application by the company and its directors. External - ITC Ms Kampepe Eva Jill and NEWCO. have a clear credit record as per ITC report. Mr Kampala Jack John has one default with Markham's to the amount of R4704.00. The client is in a process of arranging with Markham's for repayment of debt. MARKET ANALYSIS 3.1. Location 3.1.1 The business will be operated at Erf no 7046 Zone 8 Ficksburg. The business is strategically located for its employees as it will be easily accessible to them. 3.1.2 The business has leased the land from Setsoto Municipality and the term of lease is 11 years. The size of this vacant land is big enough and allows space for the proposed development. (i.e. 100100 square meters) 3.2. Product and Services The business will be offering the following products and services: Manufacturing of cement Bricks Transport Hire (i.e. provision for own deliveries) The above-mentioned products and services will be offered by New Company and will be directly sold to the hardware stores and end users in Ficksburg and surrounding areas. 3.3. Market size and Potential Market Size and potential The potential of Newco, is that it will start to manufacture for Hentique 2715 (Pty) Ltd, Setsoto Local Municipality and the letter of intend to do business with Newco. Is on file. Hentique 2715 (Pty) Ltd nas been awarded a tender by Setsoto Local Municipality to construct 100 VIP toilets and 100 RDP houses by the Department of local government and housing. An IDP report of Setsoto Local Municipality revealed that the municipality is expected to construct another 2900VIP toilets and 800RDP houses. Therefore, the expected VIP toilets to be constructed are 3000 and 900 RDP houses. The bricks required to construct each VIP toilet is estimated at 500 bricks therefore the quantity required is 5003000=1500000 bricks whereas the RDP houses is estimated to be constructed by 2500 bricks that will result in a quantity of 2500900=2250000 bricks. The total quantity of bricks targeted by Newco. can be estimated at 1500000+2250000=3750000.00. The following market considerations were taken into account: The economy is growing at 1,8% per annum and the investment in infrastructure and housing is a national priority. The Plant and Equipment is well sized not to overcapitalise but to ensure value chain security The target market for the Business will be the local commercial and private building contractors in the Eastern Free State, Northern Free State, and the better part of Gauteng province. It will also target developers from Lesotho. . will be located at approximately 90km away from its key raw material supplies except for cement of which they are based in Bloemfontein. The supplier of raw materials (i.e. JG Wearne) which is based in Bethlehem is reliable and transport will be kept to a minimum since the business will be utilising its trucks to collect its raw materials. The four main component of raw material purchased by the business are as follows: - Cement 40% (Holcim BFN) - Sand 12% (BHM Sand) -Ivans(Mixtureofcrushedstones)-CrusherDust24%(AldabreBHM)24%(JGWearne/Self) The telephonic confirmation was conducted with the above-mentioned suppliers except the supplier of ement and it was found that they will be prepared to conduct business with Newco. and they are also repared to eventually provide terms to Newco. if they handle their account satisfactorily. There are potential contractors and Hardware stores who have shown interest to purchase cement bricks. The client also intends to include the supply of crusher dust, paving blocks, sand and concrete as it was found that the demand for the above mentioned products exceeds the supply of them. The Department of Local Government and Housing is expected to deliver on RDP houses and the business has already exploited that market by requesting the Department of Local Government to register Newco. on their data base as the main supplier of cement bricks to allocated contractors. The future plan of the business is to expand its operations and establish a quarry so as to access its raw materials. The exercise of establishing a quarry requires an extensive knowledge o mining and client intends to outsource those skills as the business progresses. Individual Households extend houses because their standard of living competitively amor themselves influences them to extend their houses and even require them to build and buy mo houses. Availability of bricks at the right time is a critical success factor in the brick and mor industry of South Africa. Competition - The competitors of Newco. are identified as Break Bricks, Cashbuild which are both situated at about 10km away from Newco., Wearne Bricks and Gloria Deo which will bo situated at about 100km away from the business operations. The competitive advantage over these competitors is that Newco. will kick start by manufacluring cement bricks for Hentique 2715 (Pt) Ltd, a company which is based in Ficksburg which is expected to deliver on VIP toilets. - All the national industry competitors are investing heavily in plant and machinery to increase capacity and facilitate demand The prices from other competitors can be listad ac follnwe: 3.5. Anticipated Turnover The assumption is that the business can realise a turnover of R 24.5 million per annum. The assumption is based on the following: The Department of Local Government and Housing has issued RDP tenders to contractors and the municipalities within the Free State that can increase the demand of building materials. Newco. intends to stir up good relations with the municipalities within Thabo Mofutsanyana including contractors from the area to capture the market of individuals. It is expected that an average increase of 10% can be attained on annual basis. This is based on estimated inflation rate of 6% and 4% based on real growth which can be attributed to the increase in the population and demand for household units. 4. Marketing Plan 4.1. Overall Marketing Strategy The business will focus on attracting more customers from different regions more especially in the Motheo and Lejweleputswa Districts. The business will concentrate on keeping existing customers by providing them with quality services, thereby building long-term relationship with them. 4.2. Pricing The pricing strategy that the business will be using will be cost based; this means that the business will set prices in accordance with the increases in raw materials. Normally, the price increases are a result of cement price increase, which is twice per annum. 4.3. Advertising and Promotion Newco. intends to place pamphlets on the street corners and as well as placing adverts on local newspapers i.e. Express and Koerant. This will generate publicity about the services offered by the business. 4.4. Capacity The machine to be purchased, i.e. Agram SA 33 Automatic Control brick making machine which is capable of producing 50000 bricks per 9 hour shift. Agram SA will provide Newco. with the detailed information on how the machine should be used as well as the technical support on the machine. Since the machine will be new, and probably not user friendly for 1st time operators, it is estimated that the business can produce at least 38% of the expected maximum capacity per day (i.e. 50000 38%=19000 per day), that is, 9500 maxi bricks and 9500 stock bricks respectively. The normal workdays per month are 20 days. 24 4.5. Production Costs 4.5.1 Material The material to be utilised in manufacturing the Stock Bricks and Maxi Bricks, are for example, sand, cement and crusher dust. It is therefore expected that a certain quantity of each must be utilized so that the brick can meet SABS approved standards. Stock Bricks The business estimates to manufacture 9500 bricks per day. The quantities required to manufacture o. 50n hnicks ner 1000 bricks (i.e. 9500/1000=9.50 ) is as follows: The total costs required to manufacture 9500 bricks per day can be shown below as follows: Therefore, the direct cost per brick is R41199,60/9500=R4,34 per brick Maxi Bricks 500 bricks per 1000 bricks is as follows: The total costs required to manufacture 9500 bricks per day can be shown below as follows: Therefore, the direct cost per brick is R51336,10/9500=R5,40 per brick 5. MANAGEMENT CLERK: KAMPELE EVA JILL Ms Kampele is currently unemployed. The highest standard passed by Ms Kampele is standard 9 . She worked previously as a domestic worker. She is married (Customary) to Mr Kampala Jack John. SUPERVISOR: KAMPALA JACK JOHN Mr Kampala Jack Petrus obtained his Matric at Marallaneng Secondary School. He was a chairperson of the Meqheleng Youth League. He worked as a sales person at CD Hardware and TTNS Bricks. He also volunteered at Military Services where he studied the following courses, individual subject course, Military Basic training, Section leader course. Intelligence/explore course and driving and maintenance courses. The Combined Income and Expenditure of Mr Jack John Kampala and Me Eva Jill 6. RISK ANALYSIS 7.2 Social lmpact The company has a BEE component which is going to be sold to BEE compliant companies in the Free State. Newco. to be formed will provide 44 people with jobs in Ficksburg in the first year, which will have positive spin-offs in the local economy and contribute to a higher per capital income in the province. The number of employees will be increased based on the demand for the company's products. 7.3 Labour Legislation The business will abide by the labour legislation and will pay a recognised wage bill. The by andrise nan he anoropriated as follows: 8. FINANCIAL ANALYSIS 8.1 This is a new business and there is no historical information for this business 8.2 PROJECTIONS 8.2.2 ABRIDGED STATEMENT OF FINANCIAL POSITION Comments / Analysis Profit Margin The projected contribution percentage of the company for the next four years is 41,8%. The higher the percentage, the higher are the chances for this business to grow and survive. Net Profit Margin The net profit percentage in all years of operation is 0,1% in 2022/23 and 5,5% in 2023/24, 2024/25 and 2025/26. This means that the business is able to control its operating expenses/overheads and it also indicates the percentage profit made from sales after all costs have been deducted. With the financial year-end results as projected, the business has the potential to realise a positive net profit after interest and tax. The projected performance indicates that this business can be profitable for all financial years under review. Cash Flow Statement The business has the potential to maintain a positive cash flow from year one to year four. 9. LEGAL IMPLICATIONS National Credit Act - The transaction falls within the provision of the National Credit Act. 10. RECOMMENDATIONS It is recommended that: 10.1 KVC to subscribe 26% shareholding at R1 per share in Newco. 10 KVC introduce shareholder's loan in Newco. to be formed under the following terms and 10.3 An interest-bearing step-up loan of R 9101778 be granted to Newco. for the purpose of establishing a brick manufacturing plant under the following terms and conditions: 10.3.1 Loan Amount: R 9101778 10.3.2 Loan Term: 72 months 10.3.3 Interest rate: PBR (Fluctuating) 10% 10.3.4 Monthly instalment - only interest: R75 848 10.3.5 Initiation Fee: R 2850.00 (VAT inc.) be paid before disbursement 10.4 Loan Agreement to be concluded and monthly instalments be paid by Debit Order. 10.5 Instalment Sale Agreement on New Equipment and Vehicle be registered for the loan amount. 10.6 Tax Clearance Certificate be submitted before implementation of loan. 10.7 Shareholders Agreements be concluded adequately safeguarding the interests of KVC and inter alia addressing the following: i. That all decisions by Shareholders and the Directors have to be sanctioned by KVC or its delegate. ii. That expenditure incurred by Management be sanctioned by KVC and a delegate who may be elected by KVC to participate in Management. iii. That the Company commits itself to the development and transfer of skills to its employees in accordance with an appropriate plan approved by the Board of the Company. iv. That all other shareholders loans will be non-interest bearing and only repayable once both KVC loans have been fully settled. v. That dividend will only be declared and payable to other shareholders once the KVCs. Shareholders loan has been repaid and provided that the propeller loan repayments remain up to date. vi.That the share certificates and loan accounts of other shareholders be ceded to KVC. vii. That the other shareholders bind themselves as Sureties in respect of both KVC loans. 10.8 Legal Services to verify that the Company and all other participants in the transactions are authorized to do so in accordance with relevant founding documentation. 10.10 The Company to provide KVC with appropriate resolution(s) authorizing the conclusion of relevant transactions. 10.11 Keyman Insurance be taken out before implementation of loan and be ceded to KVC. 10.12 Comprehensive Insurance on New Vehicles be taken out before disbursement on Vehicles and be ceded to KVC. 10.13 Comprehensive Insurance on New Equipment be taken out after disbursement on Equipment and be ceded to KVC. 10.14 The copy of pro-forma lease agreement be submitted before disbursement. 10.15 The shelf company be acquired by Newco. to be formed. 10.16 All legal costs incurred be debited to the Step-Up Loan account. 10.17 Disbursement to be done as follows: i.After conclusion of all relevant Contractual and related documentation and ii. After registration of securities and iii.Payment of loan be made as per requisitions to be drawn and submitted by client. 10.18 The application be approved subject to the compliance of the provision of the NCA. 10.19 The funds will be appropriated as follows: \begin{tabular}{|l|r|} \hline Details & Amount \\ \hline Plant and Machinery & 5977200,00 \\ Vehicles and loose assets & 3252300,00 \\ Start-up Costs & 1423800,00 \\ Wages/Salaries (1 month) & 234600,00 \\ Overhead Expenses & 252309,00 \\ Legal Fees & 42291,00 \\ Stock & 1117200,00 \\ \hline Outside Capital Required & 12299700,00 \\ Less: Equity Funding & 3197922,00 \\ \hline Loan Amount required & 9101778,00 \\ \hline \end{tabular}Step by Step Solution

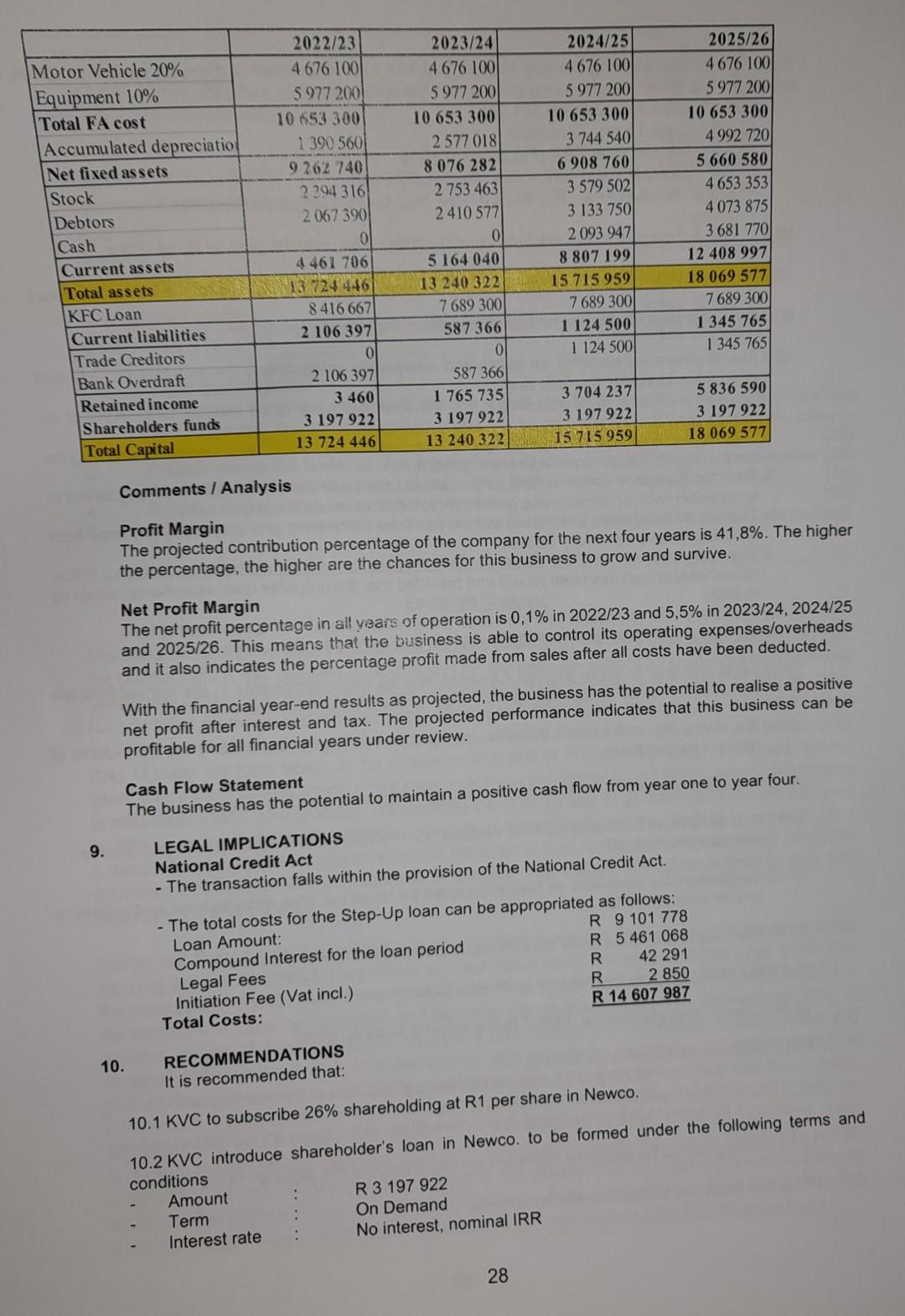

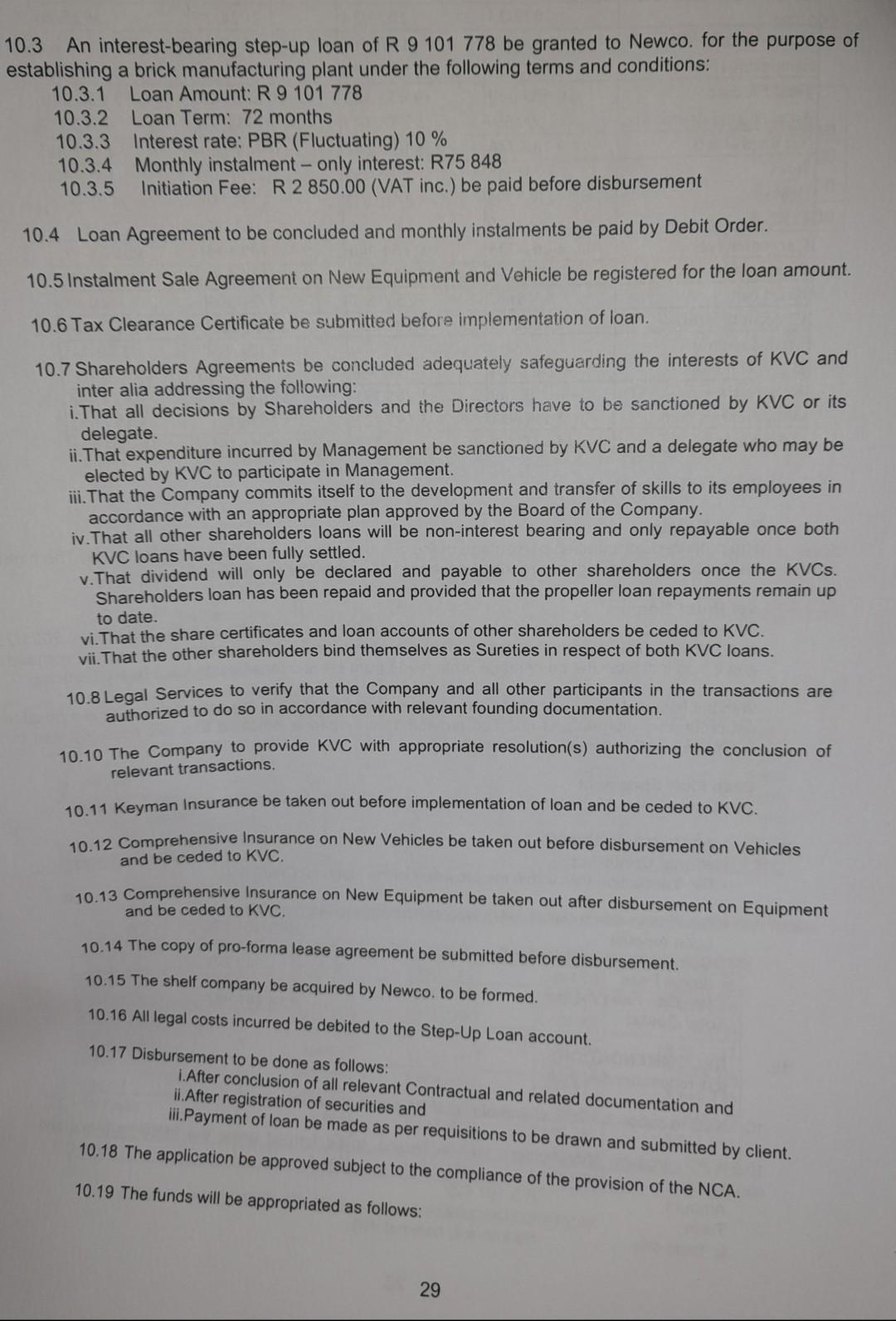

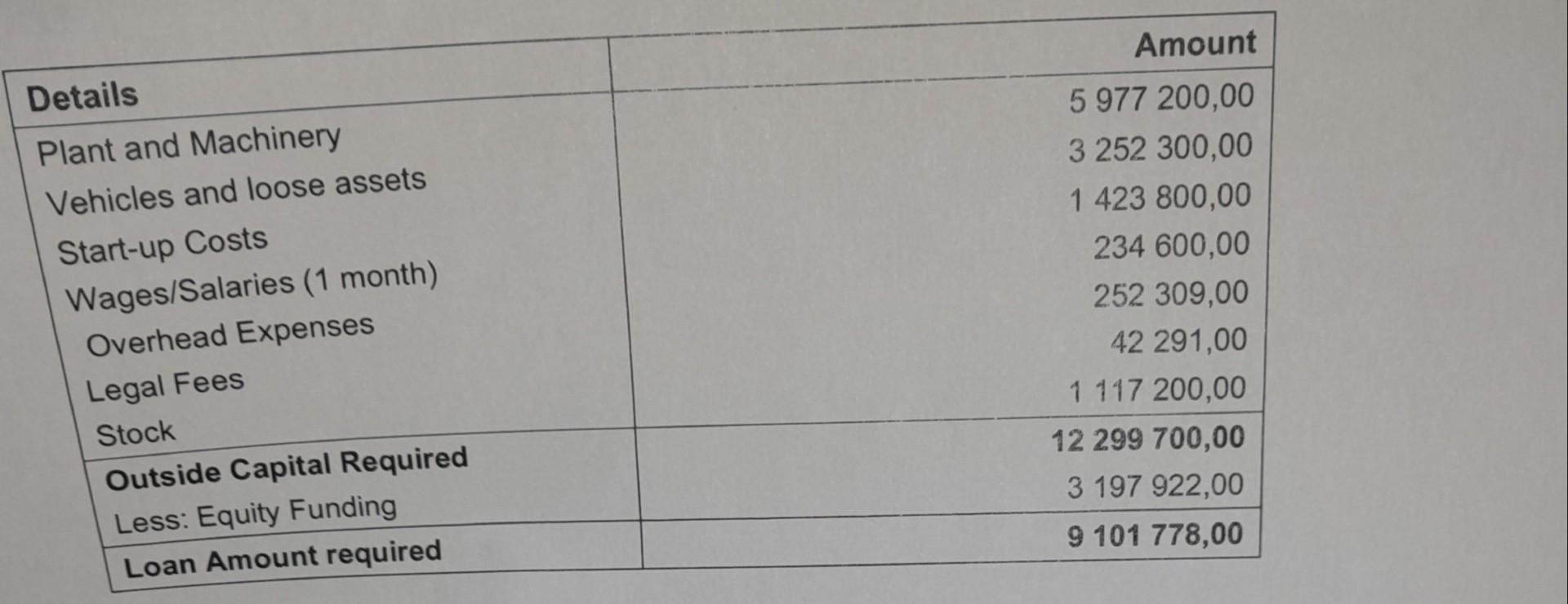

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started