Answered step by step

Verified Expert Solution

Question

1 Approved Answer

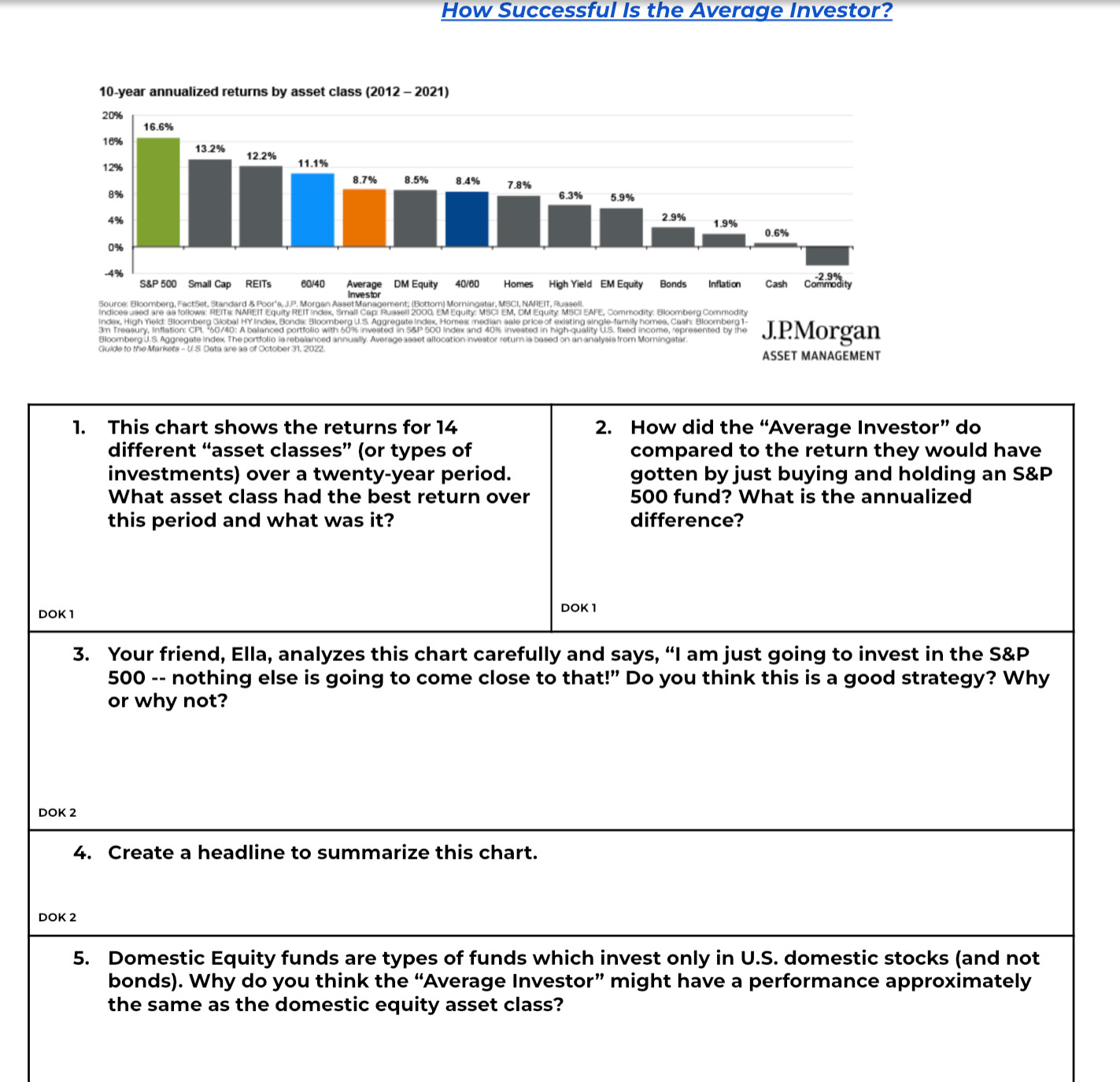

1. DOK 1 DOK 2 10-year annualized returns by asset class (2012-2021) 20% 16% DOK 2 12% 8% 4% 0% -4% 16.6% 13.2% 12.2%

1. DOK 1 DOK 2 10-year annualized returns by asset class (2012-2021) 20% 16% DOK 2 12% 8% 4% 0% -4% 16.6% 13.2% 12.2% 11.1% 8.7% 8.5% How Successful Is the Average Investor? Average DM Equity Investor 8.4% 7.8% This chart shows the returns for 14 different "asset classes" (or types of investments) over a twenty-year period. What asset class had the best return over this period and what was it? 6.3% 4. Create a headline to summarize this chart. S&P 500 Small Cap REITS 60/40 40/60 Homes High Yield EM Equity Bonds Inflation Source: Bloomberg, FactSet, Standard & Poor's, J.P. Morgan Asset Management: (Bottom) Morningstar, MSCI, NAREIT, Russell. Indices used are as follows: REITS NAREIT Equity REIT index, Small Cap: Russell 2000, EM Equity: MSCI EM, DM Equity MSCI EAFE, Commodity: Bloomberg Commodity Index, High Yield: Bloomberg Global HY Index, Bonds: Bloomberg U.S. Aggregate Index, Homes median sale price of existing single-family homes, Cash: Bloomberg 1- 3m Treasury, Inflation: CPL 60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in high-quality U.S. fixed income, represented by the Bloomberg U.S. Aggregate Index The portfolio ia rebalanced annually. Average asset allocation investor return is based on an analysis from Morningstar. Guide to the Markets-US Data are as of October 31, 2022 5.9% 2.9% DOK 1 1.9% 0.6% -2.9% Cash Commodity 3. Your friend, Ella, analyzes this chart carefully and says, I am just going to invest in the S&P 500 -- nothing else is going to come close to that!" Do you think this is a good strategy? Why or why not? J.P.Morgan ASSET MANAGEMENT 2. How did the "Average Investor" do compared to the return they would have gotten by just buying and holding an S&P 500 fund? What is the annualized difference? 5. Domestic Equity funds are types of funds which invest only in U.S. domestic stocks (and not bonds). Why do you think the "Average Investor" might have a performance approximately the same as the domestic equity asset class?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started