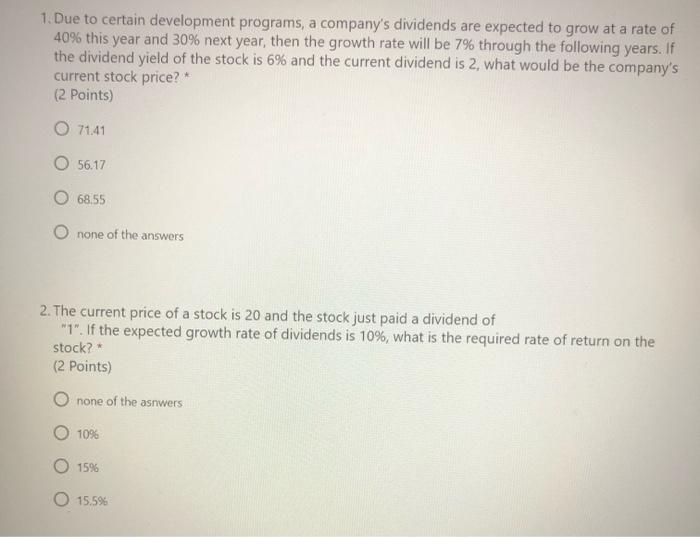

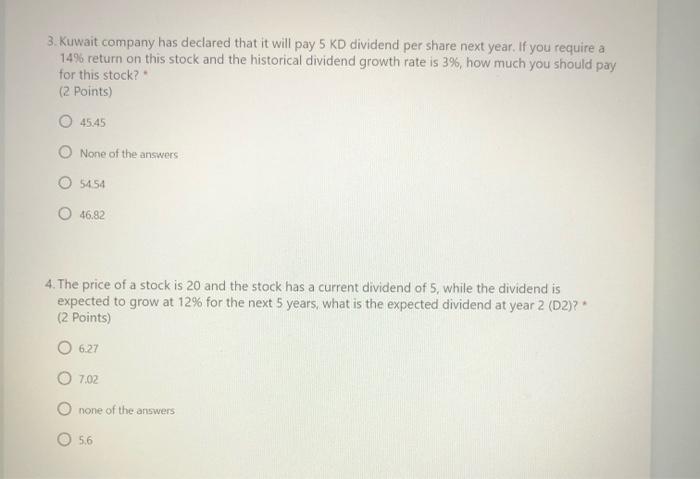

1. Due to certain development programs, a company's dividends are expected to grow at a rate of 40% this year and 30% next year, then the growth rate will be 7% through the following years. If the dividend yield of the stock is 6% and the current dividend is 2, what would be the company's current stock price? (2 points) O 71.41 O 56.17 68.55 O none of the answers 2. The current price of a stock is 20 and the stock just paid a dividend of "1". If the expected growth rate of dividends is 10%, what is the required rate of return on the stock? (2 points) O none of the asnwers O 10% 1596 O 15.5% 3.Kuwait company has declared that it will pay 5 KD dividend per share next year. If you require a 14% return on this stock and the historical dividend growth rate is 3%, how much you should pay for this stock? (2 points) 45.45 None of the answers 05454 46.82 4. The price of a stock is 20 and the stock has a current dividend of 5, while the dividend is expected to grow at 12% for the next 5 years, what is the expected dividend at year 2 (D2)? (2 points) 6.27 7.02 none of the answers 5.6 1. Due to certain development programs, a company's dividends are expected to grow at a rate of 40% this year and 30% next year, then the growth rate will be 7% through the following years. If the dividend yield of the stock is 6% and the current dividend is 2, what would be the company's current stock price? (2 points) O 71.41 O 56.17 68.55 O none of the answers 2. The current price of a stock is 20 and the stock just paid a dividend of "1". If the expected growth rate of dividends is 10%, what is the required rate of return on the stock? (2 points) O none of the asnwers O 10% 1596 O 15.5% 3.Kuwait company has declared that it will pay 5 KD dividend per share next year. If you require a 14% return on this stock and the historical dividend growth rate is 3%, how much you should pay for this stock? (2 points) 45.45 None of the answers 05454 46.82 4. The price of a stock is 20 and the stock has a current dividend of 5, while the dividend is expected to grow at 12% for the next 5 years, what is the expected dividend at year 2 (D2)? (2 points) 6.27 7.02 none of the answers 5.6