Answered step by step

Verified Expert Solution

Question

1 Approved Answer

.1 Dunbar is a public limited company operating in the manufacturing sector. On 1 January 2020, Dunbar took out a 7% loan specifically to fund

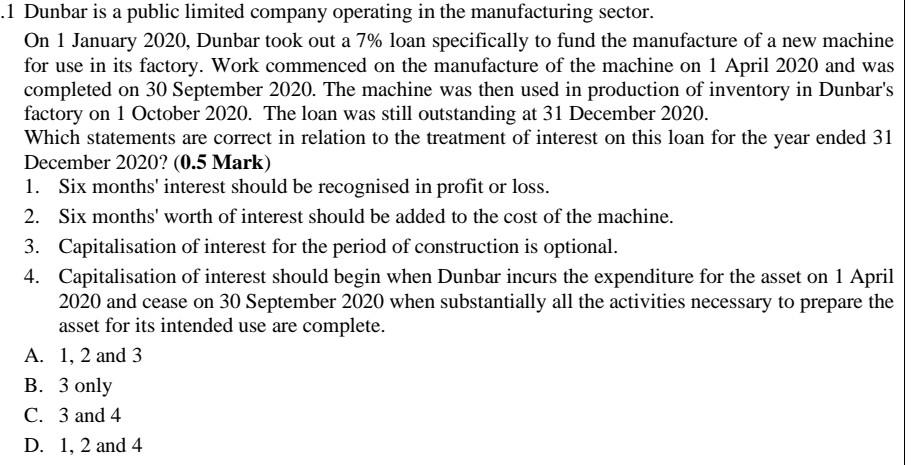

.1 Dunbar is a public limited company operating in the manufacturing sector. On 1 January 2020, Dunbar took out a 7% loan specifically to fund the manufacture of a new machine for use in its factory. Work commenced on the manufacture of the machine on 1 April 2020 and was completed on 30 September 2020. The machine was then used in production of inventory in Dunbar's factory on 1 October 2020. The loan was still outstanding at 31 December 2020. Which statements are correct in relation to the treatment of interest on this loan for the year ended 31 December 2020? (0.5 Mark) 1. Six months' interest should be recognised in profit or loss. 2. Six months' worth of interest should be added to the cost of the machine. 3. Capitalisation of interest for the period of construction is optional. 4. Capitalisation of interest should begin when Dunbar incurs the expenditure for the asset on 1 April 2020 and cease on 30 September 2020 when substantially all the activities necessary to prepare the asset for its intended use are complete. A. 1, 2 and 3 B. 3 only C. 3 and 4 D. 1, 2 and 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started