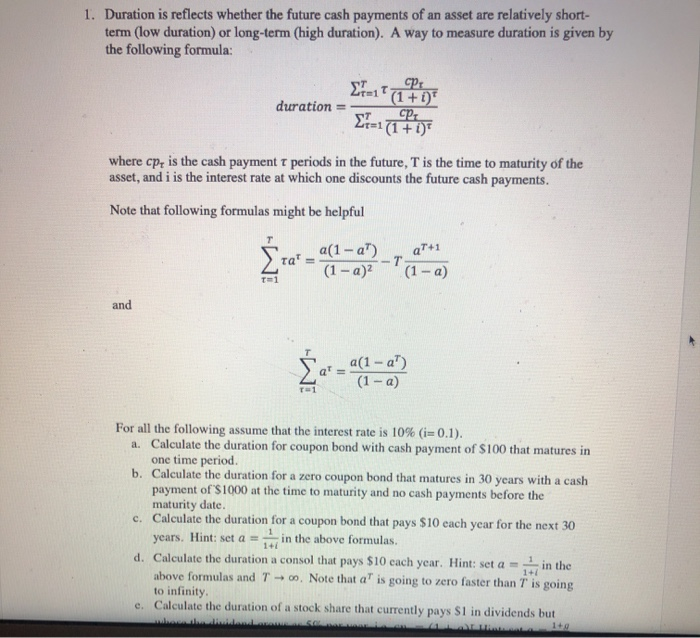

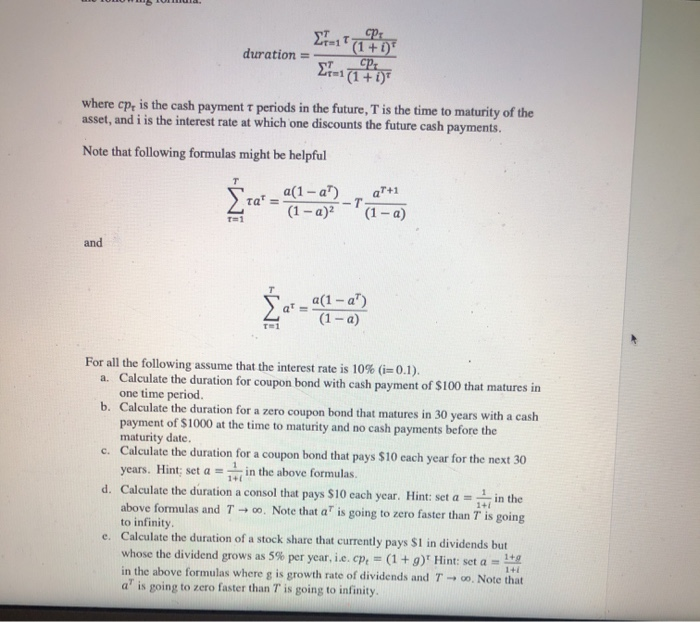

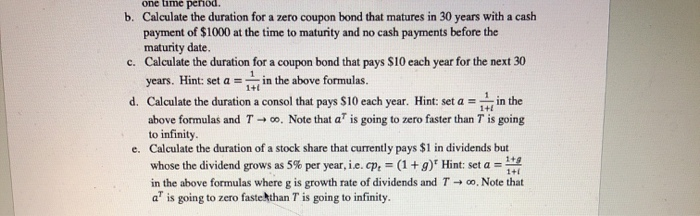

1. Duration is reflects whether the future cash payments of an asset are relatively short- term (low duration) or long-term (high duration). A way to measure duration is given by the following formula: duration = ?t=1(1+1) where cpt is the cash payment t periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful and a(1-a") (1 -a) For all the following assume that the interest rate is 10% (i=0.1). a. Calculate the duration for coupon bond with cash payment of $100 that matures in one time period. b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of S1000 at the time to maturity and no cash payments before the maturity date. c. Calculate the duration for a coupon bond that pays $10 each year for the next 30 years. Hint: set a = in the above formulas. d. Calculate the duration a consol that pays $10 cach year. Hint: set a - in the above formulas and T 00. Note that a" is going to zero faster than T is going to infinity. e Calculate the duration of a stock share that currently pays Sl in dividends but CP duration = CPE 171 +1) where cp, is the cash payment periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful Sa=1-a) _a(1 - a") For all the following assume that the interest rate is 10% (i=0.1). a. Calculate the duration for coupon bond with cash payment of $100 that matures in one time period. b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of $1000 at the time to maturity and no cash payments before the maturity date. C. Calculate the duration for a coupon bond that pays $10 cach year for the next 30 years. Hint: set a = in the above formulas. d. Calculate the duration a consol that pays $10 each year. Hint: set a = in the above formulas and T-00. Note that aT is going to zero faster than ' is going to infinity. Calculate the duration of a stock share that currently pays $1 in dividends but whose the dividend grows as 5% per year, i.e. cp = (1 + 9) Hint: set a - * in the above formulas where g is growth rate of dividends and T - 00. Note that a' is going to zero faster than T is going to infinity. one Lime period. b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of $1000 at the time to maturity and no cash payments before the maturity date. c. Calculate the duration for a coupon bond that pays $10 each year for the next 30 years. Hint: set a = in the above formulas. d. Calculate the duration a consol that pays $10 each year. Hint: set a = in the above formulas and T 00. Note that at is going to zero faster than T is going to infinity. e. Calculate the duration of a stock share that currently pays $1 in dividends but whose the dividend grows as 5% per year, i.e. cp,= (1 + g)' Hint: set a = 119 in the above formulas where g is growth rate of dividends and T . Note that a" is going to zero faste.than T is going to infinity. 1. Duration is reflects whether the future cash payments of an asset are relatively short- term (low duration) or long-term (high duration). A way to measure duration is given by the following formula: duration = ?t=1(1+1) where cpt is the cash payment t periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful and a(1-a") (1 -a) For all the following assume that the interest rate is 10% (i=0.1). a. Calculate the duration for coupon bond with cash payment of $100 that matures in one time period. b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of S1000 at the time to maturity and no cash payments before the maturity date. c. Calculate the duration for a coupon bond that pays $10 each year for the next 30 years. Hint: set a = in the above formulas. d. Calculate the duration a consol that pays $10 cach year. Hint: set a - in the above formulas and T 00. Note that a" is going to zero faster than T is going to infinity. e Calculate the duration of a stock share that currently pays Sl in dividends but CP duration = CPE 171 +1) where cp, is the cash payment periods in the future, T is the time to maturity of the asset, and i is the interest rate at which one discounts the future cash payments. Note that following formulas might be helpful Sa=1-a) _a(1 - a") For all the following assume that the interest rate is 10% (i=0.1). a. Calculate the duration for coupon bond with cash payment of $100 that matures in one time period. b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of $1000 at the time to maturity and no cash payments before the maturity date. C. Calculate the duration for a coupon bond that pays $10 cach year for the next 30 years. Hint: set a = in the above formulas. d. Calculate the duration a consol that pays $10 each year. Hint: set a = in the above formulas and T-00. Note that aT is going to zero faster than ' is going to infinity. Calculate the duration of a stock share that currently pays $1 in dividends but whose the dividend grows as 5% per year, i.e. cp = (1 + 9) Hint: set a - * in the above formulas where g is growth rate of dividends and T - 00. Note that a' is going to zero faster than T is going to infinity. one Lime period. b. Calculate the duration for a zero coupon bond that matures in 30 years with a cash payment of $1000 at the time to maturity and no cash payments before the maturity date. c. Calculate the duration for a coupon bond that pays $10 each year for the next 30 years. Hint: set a = in the above formulas. d. Calculate the duration a consol that pays $10 each year. Hint: set a = in the above formulas and T 00. Note that at is going to zero faster than T is going to infinity. e. Calculate the duration of a stock share that currently pays $1 in dividends but whose the dividend grows as 5% per year, i.e. cp,= (1 + g)' Hint: set a = 119 in the above formulas where g is growth rate of dividends and T . Note that a" is going to zero faste.than T is going to infinity