Answered step by step

Verified Expert Solution

Question

1 Approved Answer

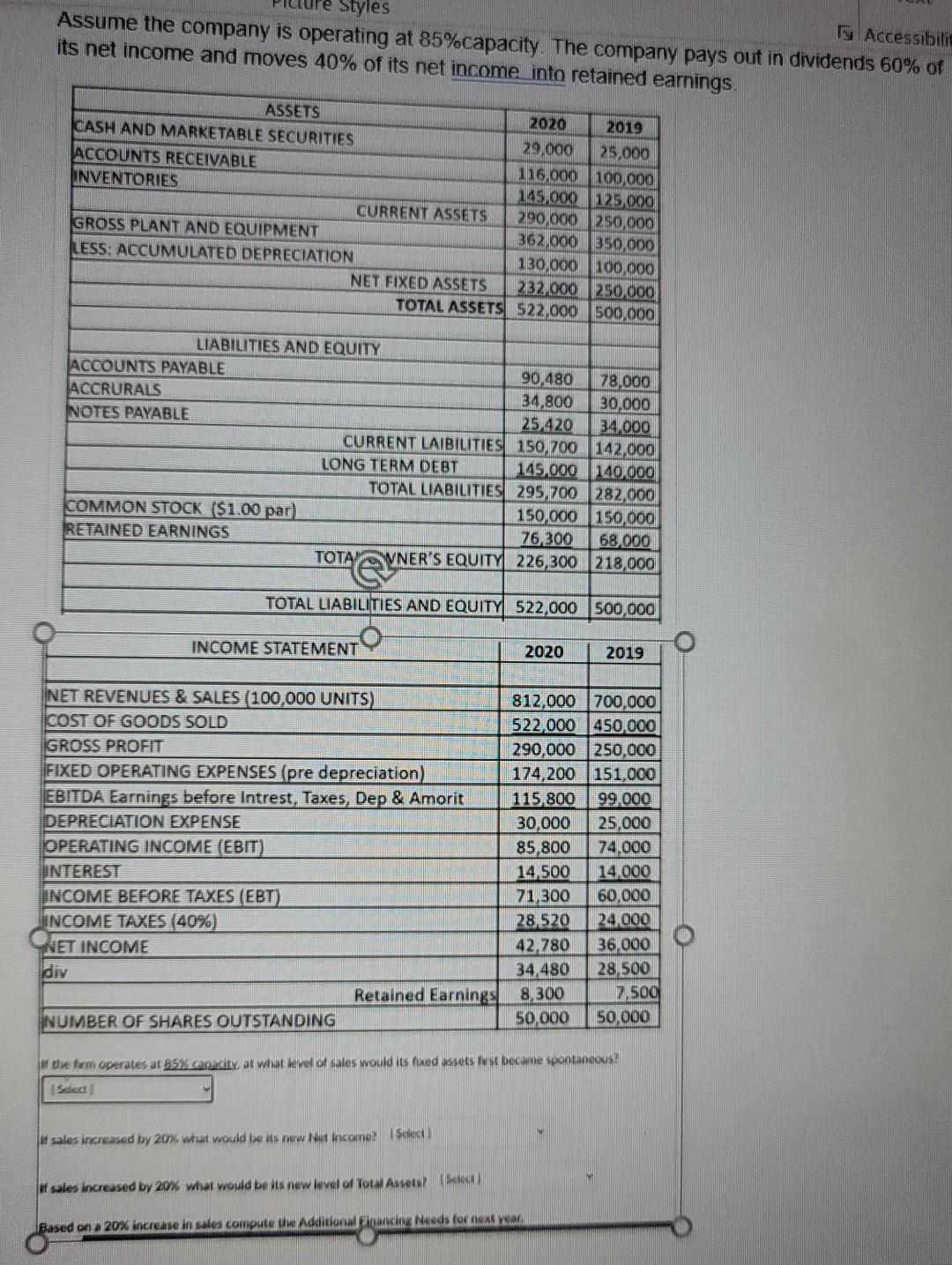

Choices: question 1 - *933,800*955,294*959,851*942,685 question 2 - *77,580*81,500*71,872*88,293 question 3 - *626,438*580,000*576,400*620,700 question 4 - *1,912*48,114*11,450*2,178 Styles Accessibilit Assume the company is operating at

Choices:

question 1 - *933,800*955,294*959,851*942,685

question 2 - *77,580*81,500*71,872*88,293

question 3 - *626,438*580,000*576,400*620,700

question 4 - *1,912*48,114*11,450*2,178

Styles Accessibilit Assume the company is operating at 85%capacity. The company pays out in dividends 60% of its net income and moves 40% of its net income into retained earnings. ASSETS 2020 2019 CASH AND MARKETABLE SECURITIES 29,000 25,000 ACCOUNTS RECEIVABLE 116.000 100.000 INVENTORIES 145.000 125.000 CURRENT ASSETS 290,000 250.000 GROSS PLANT AND EQUIPMENT 362,000 350,000 LESS: ACCUMULATED DEPRECIATION 130,000 100.000 NET FIXED ASSETS 232 000 250.000 TOTAL ASSETS 522,000 500.000 LIABILITIES AND EQUITY ACCOUNTS PAYABLE 90,480 78,000 ACCRURALS 34,800 30,000 NOTES PAYABLE 25420 34.000 CURRENT LAIBILITIES 150,700 142,000 LONG TERM DEBT 145,000 140,000 TOTAL LIABILITIES 295,700 282,000 COMMON STOCK ($1.00 par) 150,000 150,000 RETAINED EARNINGS 76 300 68,000 TOTA WNER'S EQUITY 226,300 218,000 TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 2020 2019 AMA NET REVENUES & SALES 100,000 UNITS COST OF GOODS SOLD GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation) EBITDA Earnings before Intrest, Taxes, Dep & Amorit DEPRECIATION EXPENSE OPERATING INCOME (EBIT) INTEREST INCOME BEFORE TAXES (EBT) INCOME TAXES (40%) NET INCOME div Retained Earnings NUMBER OF SHARES OUTSTANDING 812,000 700,000 522,000 450.000 290,000 250.000 174,200 151,000 115,800 99.000 30,000 25,000 85,800 74,000 14 500 14,000 71 300 60.000 28.520 24.000 42.780 36.000 34,480 28,500 8,300 7.500 50,000 50,000 if the form operates at 85% commity at what level of sales would its fixed assets it became spontaneous! Select sales increased by 20% what would be its new Nut income? Sched of sales increased by 20% what would be its new level of Total Assets? Bakal Based on a 20% increase in sales compute the Additional Financing Needs for a Styles Accessibilit Assume the company is operating at 85%capacity. The company pays out in dividends 60% of its net income and moves 40% of its net income into retained earnings. ASSETS 2020 2019 CASH AND MARKETABLE SECURITIES 29,000 25,000 ACCOUNTS RECEIVABLE 116.000 100.000 INVENTORIES 145.000 125.000 CURRENT ASSETS 290,000 250.000 GROSS PLANT AND EQUIPMENT 362,000 350,000 LESS: ACCUMULATED DEPRECIATION 130,000 100.000 NET FIXED ASSETS 232 000 250.000 TOTAL ASSETS 522,000 500.000 LIABILITIES AND EQUITY ACCOUNTS PAYABLE 90,480 78,000 ACCRURALS 34,800 30,000 NOTES PAYABLE 25420 34.000 CURRENT LAIBILITIES 150,700 142,000 LONG TERM DEBT 145,000 140,000 TOTAL LIABILITIES 295,700 282,000 COMMON STOCK ($1.00 par) 150,000 150,000 RETAINED EARNINGS 76 300 68,000 TOTA WNER'S EQUITY 226,300 218,000 TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 2020 2019 AMA NET REVENUES & SALES 100,000 UNITS COST OF GOODS SOLD GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation) EBITDA Earnings before Intrest, Taxes, Dep & Amorit DEPRECIATION EXPENSE OPERATING INCOME (EBIT) INTEREST INCOME BEFORE TAXES (EBT) INCOME TAXES (40%) NET INCOME div Retained Earnings NUMBER OF SHARES OUTSTANDING 812,000 700,000 522,000 450.000 290,000 250.000 174,200 151,000 115,800 99.000 30,000 25,000 85,800 74,000 14 500 14,000 71 300 60.000 28.520 24.000 42.780 36.000 34,480 28,500 8,300 7.500 50,000 50,000 if the form operates at 85% commity at what level of sales would its fixed assets it became spontaneous! Select sales increased by 20% what would be its new Nut income? Sched of sales increased by 20% what would be its new level of Total Assets? Bakal Based on a 20% increase in sales compute the Additional Financing Needs for aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started