Question

1. E13-1 Laurent Company entered into this transaction during 2014. (a) Issued CHF 50,000 worth of ordinary shares for cash. (b) Purchased a machine for

1. E13-1 Laurent Company entered into this transaction during 2014.

(a) Issued CHF 50,000 worth of ordinary shares for cash.

(b) Purchased a machine for CHF30,000, providing a long-term note in exchange.

(c) Issued ordinary shares of CHF 200,000 on the conversion of the double bonds

value of CHF200,000.

(d) Declare and pay a cash dividend of CHF 18,000.

(e) Sell the long-term investment at a cost of CHF15,000 for cash of CHF15,000.

(f) Collect CHF16,000 from accounts receivable.

(g) Paid CHF 18,000 on accounts payable.

Analyze transactions and show whether each transaction generates cash flow

from operating activities, investing activities, financing activities, or non-cash investing

and funding activities.

2. E13-8 The following is a comparison report on the financial position of the Scarf Company.

Additional information:1. Net income for 2014 is $ 103,000.2. Depreciation expense is $ 32,000.

Additional information:1. Net income for 2014 is $ 103,000.2. Depreciation expense is $ 32,000.

3. A cash dividend of $ 45,000 is declared and paid.

4. The $ 50,000 bond payable has been redeemed for $ 50,000 in cash.

5. Common stock was issued for $ 42,000 in cash.

6. No equipment was sold during 2014.

7. The land sold for a book value of $ 27,000.

Instruction:

Prepare a 2014 cash flow statement using the indirect method.

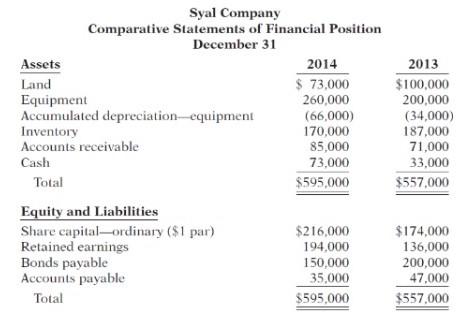

Syal Company Comparative Statements of Financial Position December 31 Assets 2014 2013 Land $ 73,000 $100,000 Equipment Accumulated depreciation-equipment Inventory Accounts receivable 260,000 200,000 (66,000) 170,000 85,000 73,000 (34,000) 187,000 71,000 33,000 Cash $557,000 Total $595,000 Equity and Liabilities $216,000 Share capital-ordinary ($1 par) Retained earnings Bonds payable Accounts payable $174,000 194,000 136,000 150,000 35,000 200,000 47,000 Total $595,000 $557,000

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Ans1 Operating activity refers to day to day business operations in cash which helps to generate revenue and income Investing activity refers to a business activity associated with purchase and sale o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started