1/

each financial question needs to be solved completely and also writes the how to reach the answer with it

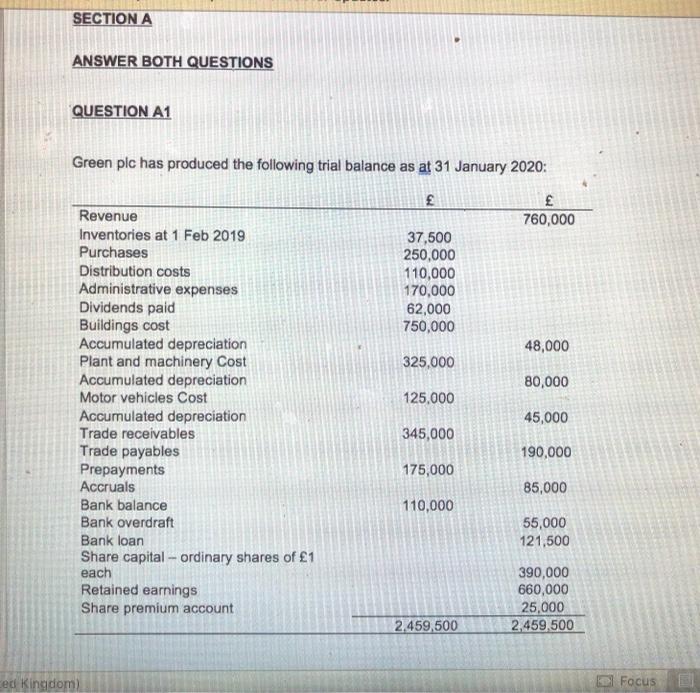

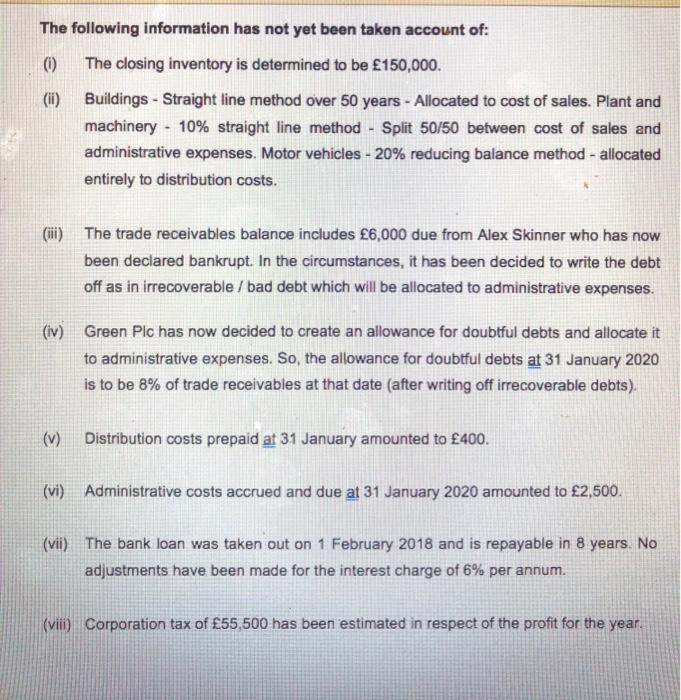

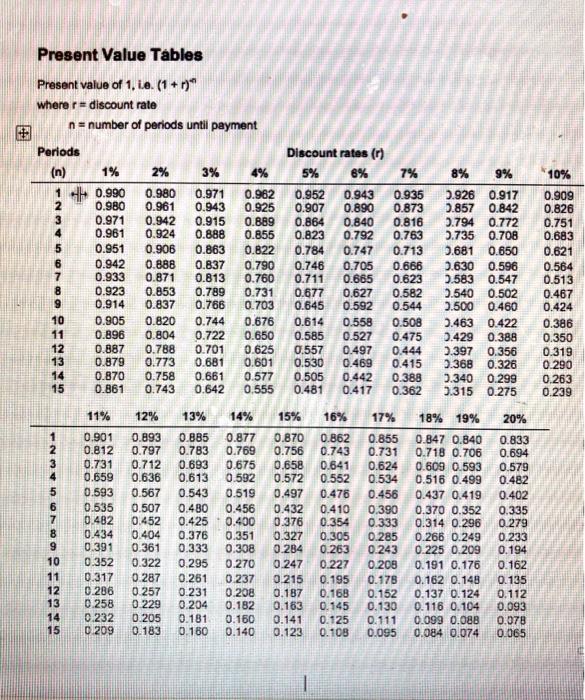

SECTION A ANSWER BOTH QUESTIONS QUESTION A1 Green plc has produced the following trial balance as at 31 January 2020: 760,000 37,500 250,000 110,000 170,000 62,000 750,000 48,000 325,000 80,000 125,000 Revenue Inventories at 1 Feb 2019 Purchases Distribution costs Administrative expenses Dividends paid Buildings cost Accumulated depreciation Plant and machinery Cost Accumulated depreciation Motor vehicles Cost Accumulated depreciation Trade receivables Trade payables Prepayments Accruals Bank balance Bank overdraft Bank loan Share capital - ordinary shares of 1 each Retained earnings Share premium account 45,000 345,000 190,000 175,000 85,000 110,000 55,000 121,500 390,000 660,000 25,000 2,459,500 2,459,500 ed Kingdom) Focus EN The following information has not yet been taken account of: (0) The closing inventory is determined to be 150,000. (ii) Buildings - Straight line method over 50 years - Allocated to cost of sales. Plant and machinery - 10% straight line method - Split 50/50 between cost of sales and administrative expenses. Motor vehicles - 20% reducing balance method - allocated entirely to distribution costs. (ii) The trade receivables balance includes 6,000 due from Alex Skinner who has now been declared bankrupt. In the circumstances, it has been decided to write the debt off as in irrecoverable / bad debt which will be allocated to administrative expenses. (iv) Green Plc has now decided to create an allowance for doubtful debts and allocate it to administrative expenses. So, the allowance for doubtful debts at 31 January 2020 is to be 8% of trade receivables at that date (after writing off irrecoverable debts). (v) Distribution costs prepaid at 31 January amounted to 400. (vi) Administrative costs accrued and due at 31 January 2020 amounted to 2,500. (vii) The bank loan was taken out on 1 February 2018 and is repayable in 8 years. No adjustments have been made for the interest charge of 6% per annum. (vii) Corporation tax of 55,500 has been estimated in respect of the profit for the year. Required: a) Prepare a statement of profit or loss for Green plc for the year ended 31 January 2020. b) Prepare a statement of financial position for Green plc as at 31 January 2020. Present Value Tables Present value of 1. ie. (1+0) where r = discount rate n=number of periods untill payment Discount rates (0) 5% 6% 3% 7% Periods (n) 1% 10.990 2 0.980 0.971 0.961 5 0.951 6 0.942 7 0.933 0.923 9 0.914 10 0.905 11 0.896 12 0.887 13 0.879 14 0.870 15 0.861 COU AUNE 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.845 0.614 0.585 0.557 0.530 0.505 0.481 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 8% 9% 2.926 0.917 0.857 0.842 5.794 0.772 2.735 0.708 9.681 0.650 0.630 0.596 0.583 0.547 2.540 0.502 0.500 0.460 2.463 0.422 0.429 0.388 0.397 0.356 2.368 0.326 9.340 0.299 1.315 0.275 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 11% 12% 13% 14% 15% 16% 17% 20% 5 6 7 8 9 10 11 12 13 14 15 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0 209 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0237 0.208 0.182 0.150 0.140 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0.095 18% 19% 0.847 0.840 0.718 0.706 0.609 0.593 0.516 0.499 0.437 0.419 0.370 0.352 0.314 0.296 0.266 0.249 0.225 0.209 0.191 0.176 0.162 0.148 0.137 0.124 0.116 0.104 0.099 0.088 0.084 0.074 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065