Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 (East), 2 (South), 3 (West), and 4 (North). This type of analysis is somewhat similar to absorp- tion of manufacturing overheads to cost units.

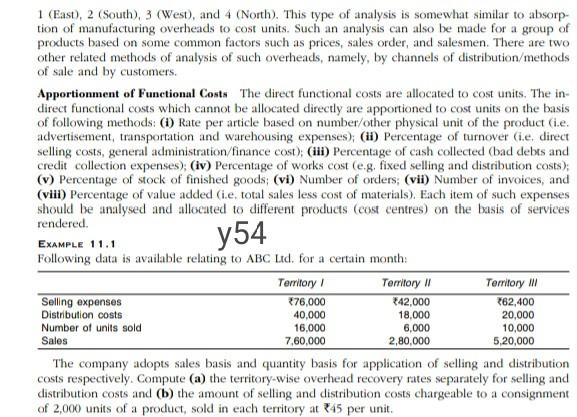

1 (East), 2 (South), 3 (West), and 4 (North). This type of analysis is somewhat similar to absorp- tion of manufacturing overheads to cost units. Such an analysis can also be made for a group of products based on some common factors such as prices, sales order, and salesmen. There are two other related methods of analysis of such overheads, namely, by channels of distribution/methods of sale and by customers. Apportionment of Functional Costs The direct functional costs are allocated to cost units. The in- direct functional costs which cannot be allocated directly are apportioned to cost units on the basis of following methods: (1) Rate per article based on number/other physical unit of the product (i.e. advertisement, transportation and warehousing expenses); (11) Percentage of turnover (i.e direct selling costs, general administration/finance cost); (iii) Percentage of cash collected (bad debts and credit collection expenses); (iv) Percentage of works cost (e.g. fixed selling and distribution costs); (v) Percentage of stock of finished goods; (vi) Number of orders; (vii) Number of invoices, and (viii) Percentage of value added (i.e. total sales less cost of materials). Each item of such expenses should be analysed and allocated to different products (cost centres) on the basis of services rendered. EXAMPLE 11.1 Following data is available relating to ABC Ltd. for a certain month: Territory Territory Territory III Selling expenses 876,000 42,000 262,400 Distribution costs 40,000 18,000 20,000 Number of units sold 16.000 6,000 10,000 Sales 7,60,000 2,80,000 5,20,000 The company adopts sales basis and quantity basis for application of selling and distribution costs respectively. Compute (a) the territory-wise overhead recovery rates separately for selling and distribution costs and (b) the amount of selling and distribution costs chargeable to a consignment of 2,000 units of a product, sold in each territory at 45 per unit. y54

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started