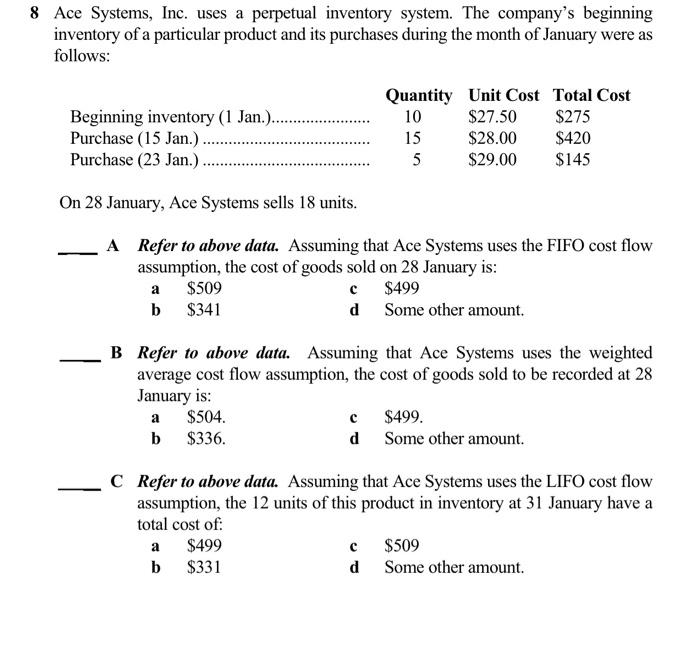

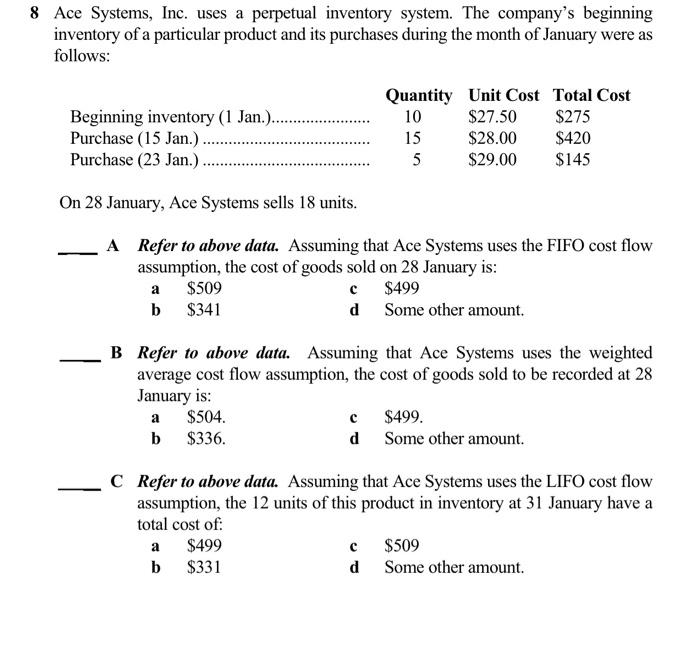

1 Easy Software uses a periodic inventory system. Its inventory was $36,000 at the beginning of the year and $48,000 at the end. During the year, Easy Software made purchases of merchandise totaling $99,000. (Identify the two correct answers). a To use this system, Easy must take a complete physical inventory count twice each year. b Prior to making adjusting and closing entries at year-end, the balance in Easy's Inventory account is $48,000. c The cost of goods sold for the year is $87,000. d As sales transactions occur during the year, Best makes no entries update its inventory records or to record the cost of goods sold. 2 Which of the following statements about perpetual merchandising activities is true? (Identify the two correct answers.) a As inventory is purchased, the Purchase account is Debited and |Cash (or Accounts Payable) is credited. bInventory is recorded as an asset when it is first purchased. c As inventory is sold, its cost is transferred from the income statement to the balance sheet d As inventory is sold, its cost is transferred from the balance sheet to the income statement. 3 Which one of the following accounts would never appear in the after-closing trial balance? (One correct answer). a Unearned Revenue b Dividends c Accumulated Depreciation d Prepaid Insurance 4 Big Brother, a retail store, purchased 100 television sets from Krueger Electronics on account at a cost of $200 each. Krueger offers credit terms of 3/10,n33. Big brother uses a perpetual inventory system and records purchases at net cost. Big Brother pays Krueger 12 days after the purchase. In recording the payment Big Brother will: a Debit Purchase discounts lost $600 b Debit Purchase discounts taken S600 c Credit Purchase discounts taken S600 d Debit Purchase discounts lost $60 5. On June 1, 2020, East Financial loaned Blurr corporation $500,000, receiving in exchange a one-year, 12 percent per year note receivable. East ends its fiscal year on December 31 and makes adjusting entries to accrue interest eamed on all notes receivable. The interest earned on the note receivable from Blurr Corporation during 2020 will amount to: a $35,000 b $30,000 c $60,000 d $20,000 Ace Systems, Inc. uses a perpetual inventory system. The company's beginning inventory of a particular product and its purchases during the month of January were as follows: On 28 January, Ace Systems sells 18 units. A Refer to above data. Assuming that Ace Systems uses the FIFO cost flow assumption, the cost of goods sold on 28 January is: ab$509$341cd$499Someotheramount. B Refer to above data. Assuming that Ace Systems uses the weighted average cost flow assumption, the cost of goods sold to be recorded at 28 January is: ab$504.$336.cd$499.Someotheramount. C Refer to above data. Assuming that Ace Systems uses the LIFO cost flow assumption, the 12 units of this product in inventory at 31 January have a total cost of: a $499 c $509 b $331 d Some other amount